The query of whether or not the bitcoin worth backside is behind us is on the minds of many buyers who’re poised with the problem: purchase the dip or look forward to a much bigger one?

Monetary predictions are seldom correct, and that actuality echoes within the bitcoin market as properly. However since BTC buying and selling usually follows four-year cycles of bull and bear markets, because the peer-to-peer foreign money navigates its method by means of its adoption cycle, many nonetheless attempt to time bitcoin tops and bottoms when making allocation choices.

With that in thoughts, buyers, merchants and analysts have tried to make the most of totally different strategies to identify the underside in worth, together with technical evaluation (TA), sentiment, hash price and even search reputation on Google. And this text will discover a extra novel worth indicator that depends on Bitcoin’s hash price and its community of miners, often known as hash ribbons.

This indicator may very well be invaluable as a result of it has confirmed dependable in recognizing opportunistic entry factors in bitcoin up to now from a threat/reward perspective, enabling buyers to enter the market and purchase low, earlier than worry of lacking out (FOMO) units in. Although whether or not this precisely predicts the bitcoin worth or not is one other query.

Miner Capitulation As A Backside Indicator

Charles Edwards, founding father of quantitative asset administration agency Capriole Investments, instructed Bitcoin Journal that, in his view, the bitcoin worth and hash price are correlated in a reflexive trigger and impact relationship.

“Hash-rate drops and subsequent recoveries have marked most, if not all, main bitcoin bottoms,” he mentioned.

The thought course of is easy: When some miners begin being pushed out of the market, proven by a major drop in Bitcoin’s hash price, additional market stress ensues as miner revenue margins are squeezed. Additionally, intense market stress was wanted to trigger that capitulation within the first place, as miners are seen as very resilient gamers within the ecosystem.

“Given the magnitude of the provision managed by miners, and the overall degree of excessive effectivity of their companies, when miners are promoting the worst has usually occurred,” Edwards defined. “Because of this, worth and hash price restoration out of this miner capitulation has traditionally marked main worth bottoms.”

Edwards defines miner capitulation as a measured decline in Bitcoin’s complete hash price, within the order of a ten% to 40% decline. To raised spot such an occasion, the quant analyst developed an indicator: hash ribbons.

Can Hash Ribbons Predict Bitcoin Value Bottoms?

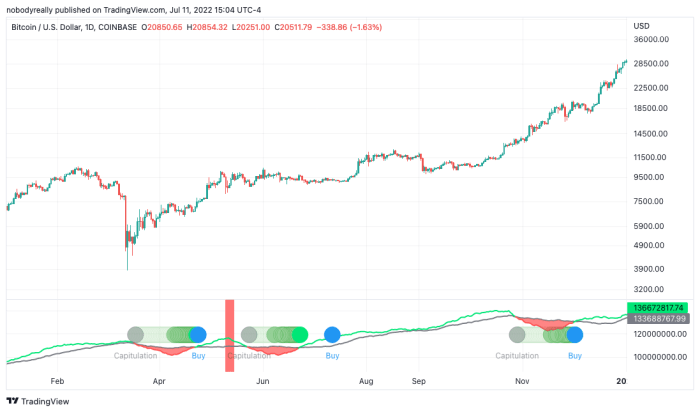

Hash ribbons, publicly out there on TradingView, is an indicator made up of two easy transferring averages (SMAs) of Bitcoin’s hash price: the 30-day and the 60-day SMA. A downward cross of the short-term MA on the long-term MA marks the start of a capitulation interval, whereas an upward cross spots its finish.

Edwards argues that purchasing bitcoin on the finish of a miner capitulation interval produces outsized returns for buyers because the worst is believed to be over and the market is starting a restoration.

“Thus far, I consider it’s the very best publicly-available, long-term purchase sign, however the reader ought to make that evaluation,” he mentioned.

In 2020, the hash ribbons indicator flashed a purchase sign on three events: April 24 ($7,505.53), July 12 ($9,306.17) and December 2 ($19,226.55). After one yr, these buys generated returns of about 567.76%, 255.73% and 194.11%, respectively.

The hash ribbons indicator flagged three shopping for alternatives in Bitcoin throughout 2020, all of which produced outsized returns in only one yr. Picture supply: TradingView.

Final yr, nevertheless, the indicator didn’t fare so properly. An investor following hash ribbons for bitcoin allocations would’ve purchased BTC at round $44,612.94 on August 7, solely to see that funding lose over half its worth till the current day because the P2P foreign money trades under $20,000.

Nevertheless, that’s after bitcoin rallied to a brand new all-time excessive worth of $69,000 in November, at which level that investor can be 54.66% within the inexperienced in solely three months. Nonetheless, it’s fairly laborious — if not inconceivable — to precisely spot a high.

Shopping for when Hash ribbons final signaled a chance would’ve yielded damaging outcomes of 55.53% so far, after being over 54% within the inexperienced on the all-time excessive of $69,000. Picture supply: TradingView.

Edwards defined to Bitcoin Journal that the hash ribbons technique is worried solely about flagging enticing entry factors, and the choice of when to promote and shut the place stays a burden the investor themself should endure.

Within the 2018 to 2019 bear market, the hash ribbons indicator flashed a purchase sign on January 10, 2019. Bitcoin closed at $3,627.51 that day — solely 16% increased than that cycle’s low of $3,122.28 seen on December 15, 2018.

This yr, miner capitulation helped spot one other opportunistic decline in worth.

“Lately we noticed robust proof for a significant miner capitulation in June as confirmed by the $30,000 to $20,000 worth drop following the hash ribbon capitulation sign, the next 30% drawdown in miner treasuries and the $4 billion of miner mortgage stress information in June 2022,” Edwards instructed Bitcoin Journal.

Certainly, hash ribbons flagged the start of a miner capitulation on June 9, indicating that additional stress might come to the market. Within the following 9 days, bitcoin dropped under the 2017 excessive, nearing $17,500 on June 18.

As it might be found in July’s public filings and manufacturing updates releases, many public bitcoin miners bought hundreds of bitcoin in June. Thus far, solely Marathon Digital and HUT 8 have continued to deposit month-to-month mined BTC into custody.

Is The Relevancy Of Miner Capitulation Lowering Every Yr?

Fred Thiel, the CEO of Nasdaq-listed bitcoin miner Marathon Digital, instructed Bitcoin Journal that methods based mostly on miner capitulation intervals assume what has been rule of thumb on the whole markets: that these deep throughout the trade have higher info than these on the surface.

“Sometimes in financial markets or monetary markets, when the individual with the very best info acts, it’s an indicator of the surest place out there,” he mentioned.

Thiel continued to clarify {that a} miner is aware of particular info akin to what their working price is, what the fee to mine one bitcoin is, and what the bitcoin worth is. They then leverage that info to determine a plan of action, together with to both liquidate their place and their bitcoin holdings, and even stop operations if it reaches a degree the place it’s too unprofitable.

“So when a miner begins promoting their bitcoin holdings, they’re at a degree the place that’s their greatest different, and so you’ll assume that will point out a backside,” Thiel mentioned.

Nevertheless, the chief government highlighted that the extent to which miner capitulation influences the market will diminish with time. Why? Whereas years in the past miners had been the largest institutional bitcoin holders, now their place sizes are being outgrown by these of firms akin to MicroStrategy, Tesla and Block.

“So the place earlier than miners had been a extremely good indicator of the underside, I believe at present they’re indicator of when the market has hit a degree the place the ache level’s actual excessive,” Thiel defined. “And if miners are promoting bitcoin it’s as a result of both they don’t have another, so that they’re pressured sellers, similar to those who get margin calls, or they’re promoting as a result of they’re getting determined, in case you would.”

Edwards acknowledges this level as properly, however doesn’t dismiss the validity of taking a look at miners’ capitulation to identify enticing bitcoin costs.

“I believe the facility of hash ribbons diminishes with time, in a step-change style each 4 years with the Bitcoin halving cycle,” the analyst instructed Bitcoin Journal. “We now have seen the entry of establishments and banks into Bitcoin over the past 18 months.”

“The present configuration of hash ribbons will most likely turn out to be noticeably much less helpful subsequent cycle, and maybe unusable within the following cycle,” Edwards added. “Nonetheless, hash ribbons has been nice this cycle to this point, and the present cycle nonetheless has two years left to run. Capriole Investments is actively watching hash ribbons and utilizing it as an enter into our funding technique.”

Is The Bitcoin Backside In?

Although hash ribbons is flagging a miner capitulation occasion has been underway for over a month now, it has not but flagged a purchase sign for bitcoin — which begs the query: Is the bitcoin backside behind us or might there be extra drawdowns?

Edwards instructed Bitcoin Journal that, usually, miner capitulation intervals final wherever from one week to 2 months, indicating that both the underside already occurred on June 18 or that it might occur within the close to future.

“We run a number of methods internally at Capriole to assist get a confluence of alerts and approaches,” Edwards mentioned. “Some methods at present counsel we have now bottomed, others counsel a backside is forming and others nonetheless say we’re in contraction and a backside isn’t but confirmed.”

Given the hardship of recognizing a bitcoin worth backside, buyers can at a minimal leverage hash ribbons to identify miner capitulation intervals — through which dollar-cost averaging might flip into an efficient technique over an extended time period. Alternatively, risk-averse buyers that consider within the reasoning behind hash ribbons can look forward to the indicator’s purchase sign, because it might spot the start of a restoration.

In any case, Edwards believes the time is prime for allocating to bitcoin.

“My normal view is that the following six to 12 months will present the very best alternative to get into bitcoin over the following five-plus years,” Edwards predicted. “That is based mostly on the info we’re quantitatively modeling, the present cycle downdraw, and timing throughout the present four-year cycle, that’s, bitcoin often bottoms within the actual six-to-12-month halving cycle time window we’re at present in. Not monetary recommendation in fact!”