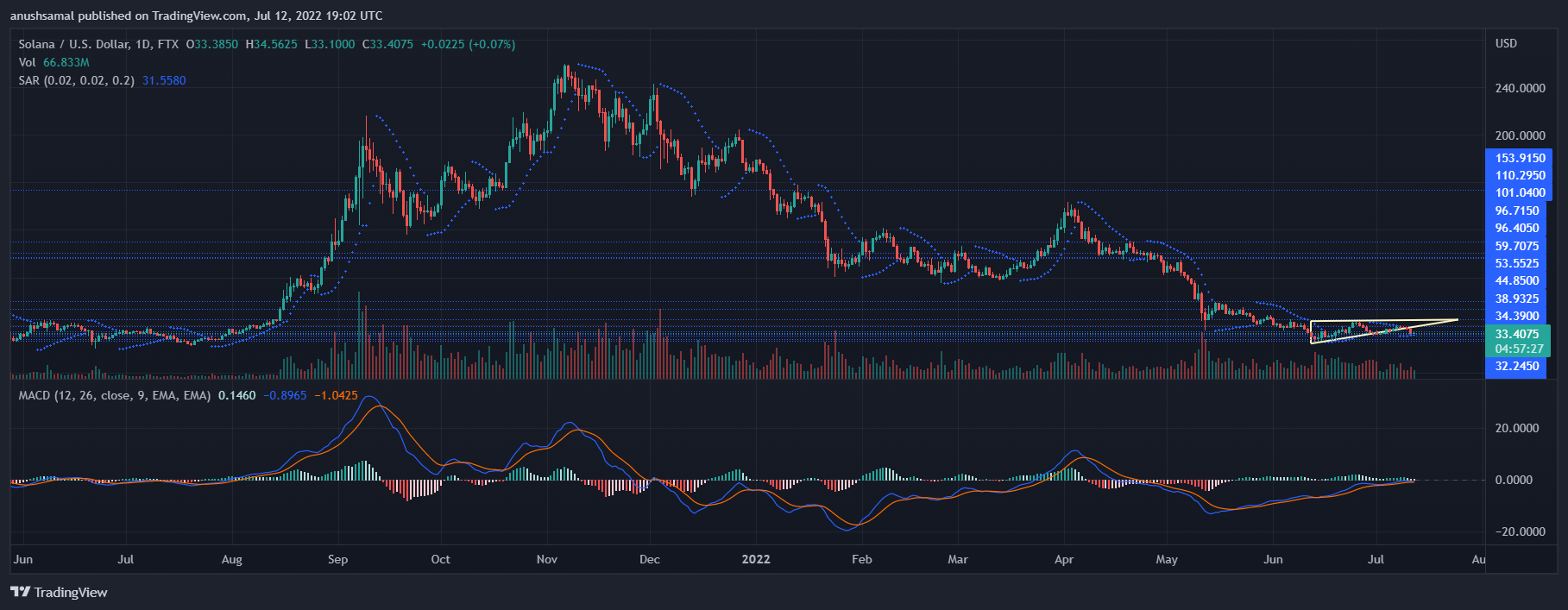

Solana was on a downtrend because the bulls have misplaced steam after SOL fell beneath the help line of $38. During the last 24 hours the coin depreciated 4% and within the final week, the coin fell by 8%. Worth of Solana was pushed to $33, nonetheless, at press time the coin was buying and selling barely above the help line.

Bitcoin too struggled beneath the $20,000 mark and the altcoins walked the identical value path. Broader market weak point continues to contribute in direction of the altcoins bearish stress. One the every day chart, Solana had shaped an ascending triangle but it surely managed to interrupt beneath the identical.

If the coin continues on the identical path then it may transfer beneath the $30 value mark. The present very important help stage for the altcoin stood at $33. Shopping for stress declined on the every day chart as SOL met with a unload. The worldwide cryptocurrency market cap in the present day is $924 Billion with a 3.1% adverse change within the final 24 hours.

Solana Worth Evaluation: One Day Chart

SOL was buying and selling at $33.40 on the time of writing. It moved precariously near the important value flooring of $33. A fall in value beneath the $33 value mark will first drag SOL to $30 after which to $27.

Because of elevated bearish energy, SOL broke beneath the ascending triangle (yellow).

Continued downward motion may cause one other 18% fall on SOL’s chart. If Solana manages to maneuver above the $34 value stage and topple the $38 value mark, the bearish thesis stood an opportunity to be invalidated.

The rapid resistance was at $34 after which at $38. Buying and selling quantity of Solana dropped barely however the bar was inexperienced which indicated that patrons nonetheless tried to face their floor on the chart.

Technical Evaluation

SOL’s shopping for energy has remained delicate with the coin witnessing common sell-offs out there. For probably the most of Might, June and July, Solana has witnessed excessive promoting stress.

In accordance with the identical, the Relative Energy Index was beneath the half-line which meant that sellers dominated the market.

Worth of SOL was seen beneath the 20-SMA, a studying that indicated sellers have been accountable in driving the value momentum out there.

Advised Studying | Solana Glints With 14% 3-Day Rally – Will SOL Preserve On Beaming?

SOL’s chart displayed blended technical indicators. The Transferring Common Convergence Divergence depicts the value momentum and potential development reversals. MACD underwent a bullish crossover and pictured inexperienced sign bars.

The inexperienced sign bars are related to purchase sign on the chart. This may very well be a constructive signal for the coin as there is perhaps an upcoming change within the value route over the subsequent buying and selling periods.

Parabolic SAR determines the value route, the dotted strains beneath the value candlesticks have been indication of an anticipated change within the present value motion.

For the coin to maneuver upwards, energy from the broader market stays very important.

Associated Studying | Glassnode: Bitcoin LTHs Who Purchased Throughout 2017-2020 Aren’t Promoting But

Featured picture from BusinessToday.in, charts from TradingView.com