The under is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Bitcoin And The S&P 500

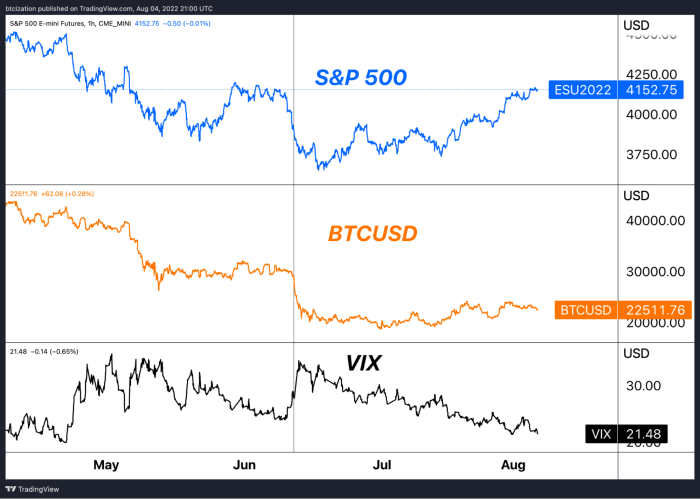

In our newest month-to-month report, which centered extensively on the evolving macroeconomic surroundings, we highlighted the robust correlation between bitcoin and equities over the course of 2020, whereas additionally referring to bitcoin as a quasi-24/7/365, inverse VIX (at the moment). Usually, which means that when equities are bidding, bitcoin has gotten a elevate as properly; and when equities are promoting off (seemingly alongside an increase within the VIX), bitcoin would face draw back strain as properly.

Market contributors ought to recall that following the implosion of LUNA/UST, bitcoin was consolidating across the $30,000 for almost a month earlier than fairness market volatility elevated as shares took a brand new leg decrease, which pulled bitcoin down with out key help.

So what stands out within the present pattern? Effectively, each markets have exogenous variables that may have an effect on value and historic realized correlations. As equities proceed to bid, because of passive flows and a squeeze of late bearish positioning, bitcoin’s value motion has began to meaningfully flip over, with its spinoff market quick squeeze largely occurring already.

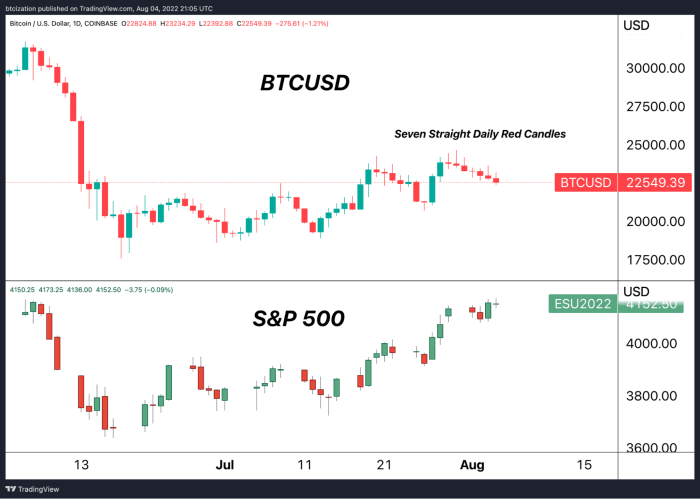

Bitcoin notably is within the midst of its seventh pink every day candle in a row (decrease closing value than opening).

Provided that equities have been in a broader uptrend, the underperformance over the quick time period is regarding for bulls, as one ought to ask themselves the place bitcoin will commerce if/when fairness markets flip decrease and/or legacy market volatility considerably will increase.

Whereas this difficulty is targeted much less on long-term fundamentals and extra on short-term value motion, this aligns with our broader market thesis that danger property haven’t bottomed, as coated in our July Month-to-month Report. Macro guidelines all on the present second, and given bitcoin’s nonetheless nascent place as a mere pond amid a world ocean of complete property, realized correlations and relative underperformance are anticipated and noteworthy, respectively.