The beneath is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

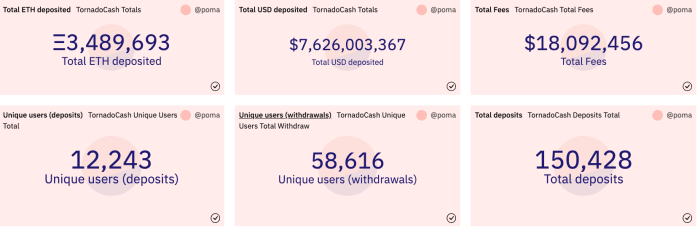

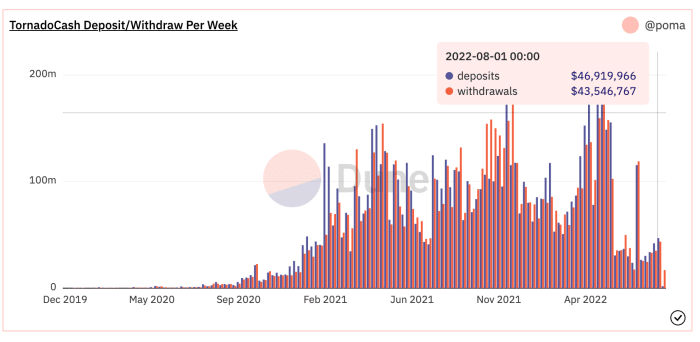

Early on August 8, 2022, it was introduced by the U.S. Treasury that Twister Money was added to the U.S. OFAC (Workplace of Overseas Property Management) SDN record (the record of specifically designated nationals with whom People and American companies will not be allowed to transact). Twister Money, a non-custodial open supply software program venture constructed on Ethereum, allowed customers to combine their cash by way of the usage of the Twister Money good contract, obfuscating the earlier path of the cash (that are in fact being transacted throughout a clear ledger).

The sanctions positioned have been significantly notable as a result of they have been positioned not on a person particular person or specific digital pockets deal with, however quite the usage of a wise contract protocol, which in probably the most primary kind is simply info. The precedent set by these actions will not be very best for open supply software program improvement.

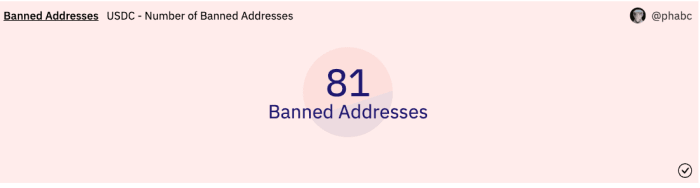

Following the announcement, it may very well be seen that Circle, the centralized issuer of stablecoin USDC, blacklisted each sanctioned deal with from utilizing USDC.

These actions have led many to query the protection of holding centralized digital belongings, even for non-criminals who simply want to make use of privacy-enhancing instruments.

The full variety of USDC addresses which are blacklisted now stands at a present whole of 81. Readers can monitor the banned deal with record right here.

On a equally scary notice for lively bitcoin/crypto builders, the co-creator of Twister Money Roman Semenov had his GitHub (open supply improvement repository) account suspended. This could fear freedom-loving bitcoin/crypto fans, given the character of the sanctions positioned on Twister Money — which, as acknowledged earlier within the piece, is solely non-custodial software program.

These actions additionally beg the query as to what’s the way forward for many instruments within the so-called DeFi house, that rely upon centralized stablecoins and which will have centralized improvement choke factors.

As brutal as it could be, the natural and decentralized nature of bitcoin’s rise is the one purpose it’s nonetheless standing right now. Open-source software program will proceed to function as designed, however given the rising stress that can doubtless be positioned on software program/pockets/protocol builders, solely the strongest and most really decentralized networks is not going to be co-opted.

Lastly, it needs to be reiterated that stablecoins themselves, whereas helpful to flee the short-term volatility of bitcoin/different crypto belongings and assist many world wide entry U.S. {dollars}, are centralized.

Zooming out additional, when trying on the long-term case for bitcoin, amongst its strongest worth propositions is the truth that it’s an asset that has no counterparty threat nor dilution (devaluation) threat. But, extra importantly in gentle of many authorities laws which are taking form and are more likely to come, Bitcoin’s true decentralized properties and censorship resistance will likely be simply as essential.