That is an opinion editorial by Mike Ermolaev, head of public relations on the ChangeNOW trade.

As a retail dealer or somebody who simply obtained began with bitcoin not way back, chances are you’ll be looking for clues about what to anticipate subsequent with its value. A second opinion can also be necessary for seasoned bitcoin buyers to check their very own views.

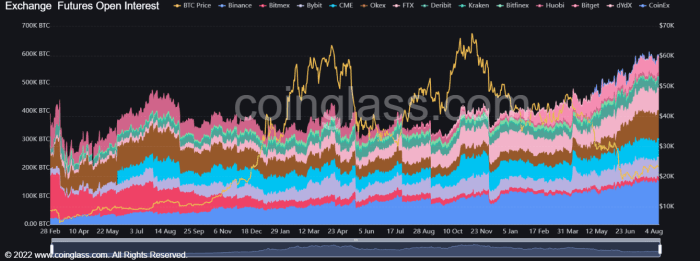

Analyzing Open Curiosity Of Bitcoin Futures

Bitcoin open curiosity gives perception into how a lot cash is flowing into and out of the bitcoin derivatives market. Derivatives like bitcoin futures and perpetual swaps are utilized by merchants to invest on whether or not bitcoin’s value will rise or fall with out having to personal the digital asset. A better bitcoin open curiosity means extra merchants have opened positions, whereas a decrease one means extra merchants have closed them.

As of writing, bitcoin-denominated open curiosity had elevated to 592,000 BTC from 350,000 BTC at first of April 2022. A take a look at the bitcoin denomination might help isolate durations of elevated leverage from value fluctuations.

In USD phrases, present open curiosity is $13.67 billion, which is comparatively low, similar to early bull market ranges in January 2021 and June 2021 sell-off lows.

At any time when there’s a massive improve in open curiosity on a BTC foundation, however not on a USD foundation, that indicators markets are taking over extra BTC publicity, however nonetheless do not count on it to maneuver a lot.

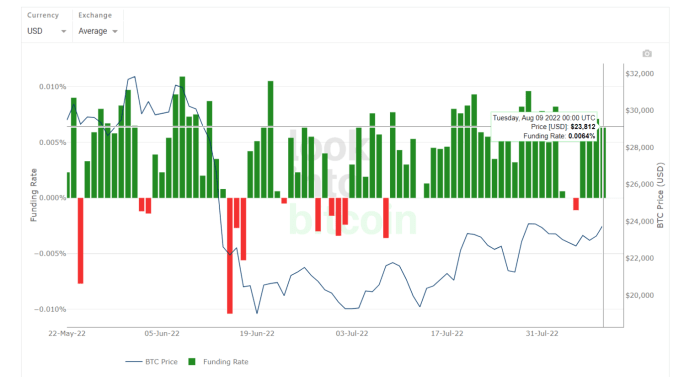

Funding Charges Rise For Perpetual Swaps

With the intention to perceive how most merchants are positioned out there, we will take a look at funding charges used on perpetual swap contracts: spinoff monetary contracts distinctive to bitcoin and cryptocurrency that haven’t any expiration date or settlement. They permit merchants to make use of leverage — as much as 100x — when betting on the value of bitcoin. A funding price is a periodic fee made to or by a dealer who’s lengthy or brief based mostly on the distinction between the perpetual contract value and the spot value.

Typically, we will say that constructive funding charges point out merchants are taking lengthy positions and are typically bullish concerning the value transferring upward, whereas adverse funding charges point out merchants are normally taking brief positions and are typically bearish, believing the value will transfer downward. Funding charges breaking above 0.005% sign elevated speculative premium, a development that’s at present occurring.

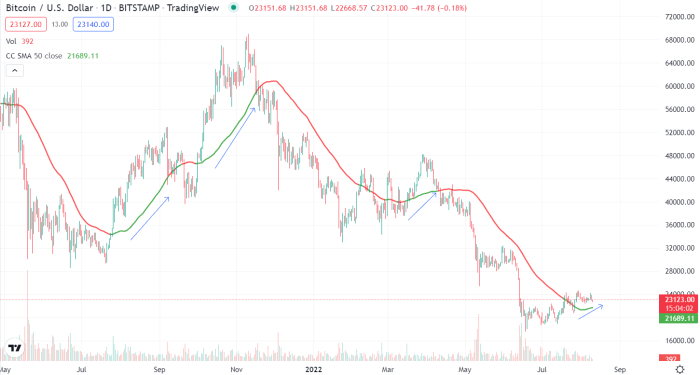

The Bitcoin Value Is Above Its 50-Day Easy Transferring Common

Analysts like myself who use technical evaluation charts and patterns to make funding selections, be aware that bitcoin is at present buying and selling above its 50-day easy transferring common (SMA) — an efficient development indicator — for the primary time since mid-July. This confirms that underlying momentum could also be constructing.

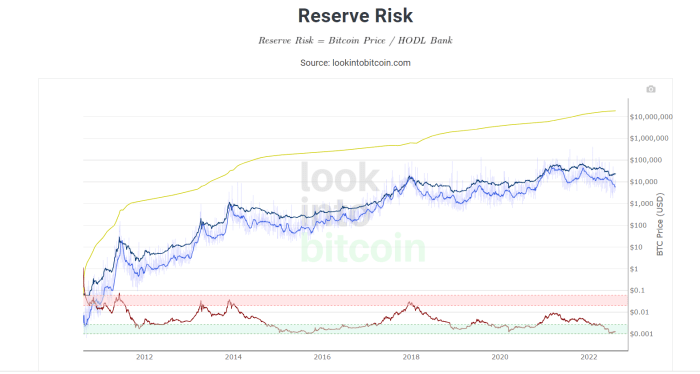

Lengthy-Time period Holders See Bitcoin As An Interesting Danger/Reward Funding

Under is one other chart that visualizes how long-term BTC holders really feel about bitcoin relative to its value. Bitcoin’s long-term holders are typically higher at figuring out the most effective time to purchase and promote bitcoin. This isn’t shocking, since they’ve extra expertise within the discipline than newcomers who’re simply getting began. You will need to acknowledge when they’re assured that the primary cryptocurrency will rise in value sooner or later.

The reserve danger chart is at present within the inexperienced zone, that means a excessive degree of confidence mixed with a low value, making bitcoin a lovely danger/reward funding. Buyers who make investments throughout inexperienced reserve danger have traditionally loved excessive returns over time.

Conclusion

Market perceptions of assorted savvy market contributors, who’ve historically been good in making their funding selections, present that they’re more and more assured about the way forward for bitcoin value and are keen to tackle extra value danger. There’s a cautious upward bias in bitcoin derivatives markets and long-term buyers look like pretty assured. The bitcoin value can also be displaying indicators of enchancment based mostly on technical indicators.

Disclaimer: This isn’t monetary recommendation. All opinions, statements, estimates, and projections expressed on this article are solely these of Mike Ermolaev, PR Head at ChangeNOW.

It is a visitor submit by Mike Ermolaev. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.