Crypto Conquest 8.11.22

All the things it’s worthwhile to know of right now’s fast-moving crypto markets

The crypto market is a wild, wondrous and intimidating place, don’t trek alone! Subscribe to The Crypto Conquest and allow us to be your information

Subscribe to this day by day e-newsletter TO NEVER MISS AN ISSUE.

- Blackrock’s bitcoin belief.

- Did the market entice FOMOers?

- Mailchimp suspends crypto-based companies.

- Devs transfer up the Ethereum Merge timetable.

- Opensea updates stolen NFT coverage.

Good morning,

The world’s largest asset supervisor, Blackrock, with $10T property beneath administration (AuM), has introduced the launch of a non-public spot Bitcoin belief for US institutional buyers.

The transfer outcomes from elevated curiosity in cost-effectively buying crypto-based property by institutional purchasers. Though, the motion countermands CEO Larry Fink’s former stance on crypto.

The personal belief, unavailable to retail buyers, advantages from not having to register with US regulators. Furthermore, Blackrock partnered with cryptocurrency change Coinbase per week in the past to permit entry to crypto property through the agency’s institutional platform, Aladdin.

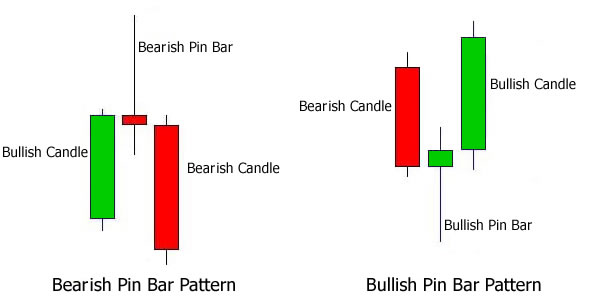

BTC/USDT 1D

After a CPI-induced pump, the market pressured Bitcoin (BTC) downwards, making a bearish pinbar candlestick sample on the 24k resistance stage. The sample signifies a pattern reversal if a bearish candle completes the setup.

The market could also be getting into a traditional situation that traps keen patrons after the discharge of optimistic information. Watch the uptrend assist (inexperienced) to substantiate a break of the pattern. BTC accomplished the day by day session down -0.02% to $23,959.

Excessive-resolution chart

DXY/USD

The Greenback Index (DXY), which weighs the {dollars} versus numerous currencies, seems to have damaged its upward trendline (inexperienced). The transfer away from {dollars} typically signifies buyers’ willingness to depart the protection of the reserve foreign money to enter riskier property. Nonetheless, preserve an eye fixed out that the DXY doesn’t reenter its upward pattern within the coming days.

Excessive-resolution chart

When you’re having fun with this report and assume it’s value 20 sats (.01 cent) please press the clap button beneath to assist assist my writing. (As much as 50 instances!) THANKS!

Cuban faces lawsuit. The entrepreneur and proprietor of the Dallas Mavericks, Mark Cuban, is facing a category motion lawsuit for allegedly selling the bankrupt Voyager crypto change. The case notes Cuban’s illustration of Voyager on a number of events and states he and Ehrlich, Voyager’s CEO, labored collectively to lure buyers right into a “Ponzi Scheme.”

Mailchimp suspends service. The e-mail/e-newsletter service supplier has suspended the accounts of crypto-based companies, together with Messari, Decrypto, Edge, and a number of other others. Mailchimp up to date its insurance policies to incorporate a provision that prohibits companies concerned with cryptocurrency from utilizing the service.

70% of establishments eye blockchain fees. Based on a Ripple report specializing in international crypto developments, 70% of economic establishments are fascinated with using blockchain for funds.

Information tidbits:

- Indian Regulation Enforcement accuses WazirX change of laundering.

- Polygon announces partnership with Neowiz to launch gaming platform Intella.

- Arthur Hayes notes buy-side strain in Ethereum futures for The Merge.

On the protocol stage ⛓

Transfer up The Merge. After a profitable merge of Goerli Tesnet, Ethereum builders have tentatively scheduled a mainnet merge for September fifteenth or sixteenth. So we’re in the future nearer to The Merge!

MakerDAO considers a transfer. The Founding father of MakerDAO famous he’s contemplating transferring away from utilizing USDC as collateral after Twister Sanctions pressured Circle to freeze USDC in a number of wallets. By freezing USDC affected by Twister Money sanction, Circle has confirmed the problems behind centralization and it may maintain extreme ramifications for the stablecoin’s future in a decentralized ecosystem. MakerDAO at the moment holds $3.5 billion value of USDC that will go into shopping for Ether.

NFT & metaverse replace ?

- Opensea has up to date its insurance policies to prohibit the itemizing of beforehand stolen NFTs. Moreover, NFT house owners can now ship police experiences to the Opensea workforce to substantiate theft. The replace has blended opinions, however some claim it’s a step in the proper path.

- MiCA Regulation: European Union (EU) to control NFTs just like cryptocurrencies.

- The music NFT platform HitPiece is now dwell. Co-founder Rory Felton has famous the up to date model focuses on possession rights for artists.

- The governing physique of desk tennis, World Broad Tennis (WTT), stated it’s eyeing a partnership with NFT tech to assist increase the sport. Desk Tennis NFTs, anybody?

My 5 cents…

Whether or not the cryptoverse likes it or not, Institutional adoption has arrived.

It was certain to occur. Some developments up to now couple of years have confirmed its arrival:

Blackrock initializing a bitcoin belief is a robust exclamation level.

However many have famous the corrupt methodology of the method, which now permits institutional buyers a protected avenue acquire publicity to Bitcoin. However, the spot-bitcoin ETF that will be accessible to retail buyers continues to be rejected by the Securities Trade Fee (SEC). As soon as once more, the little man loses.

Comply with me on Twitter or subscribe to this day by day e-newsletter TO NEVER MISS AN ISSUE.