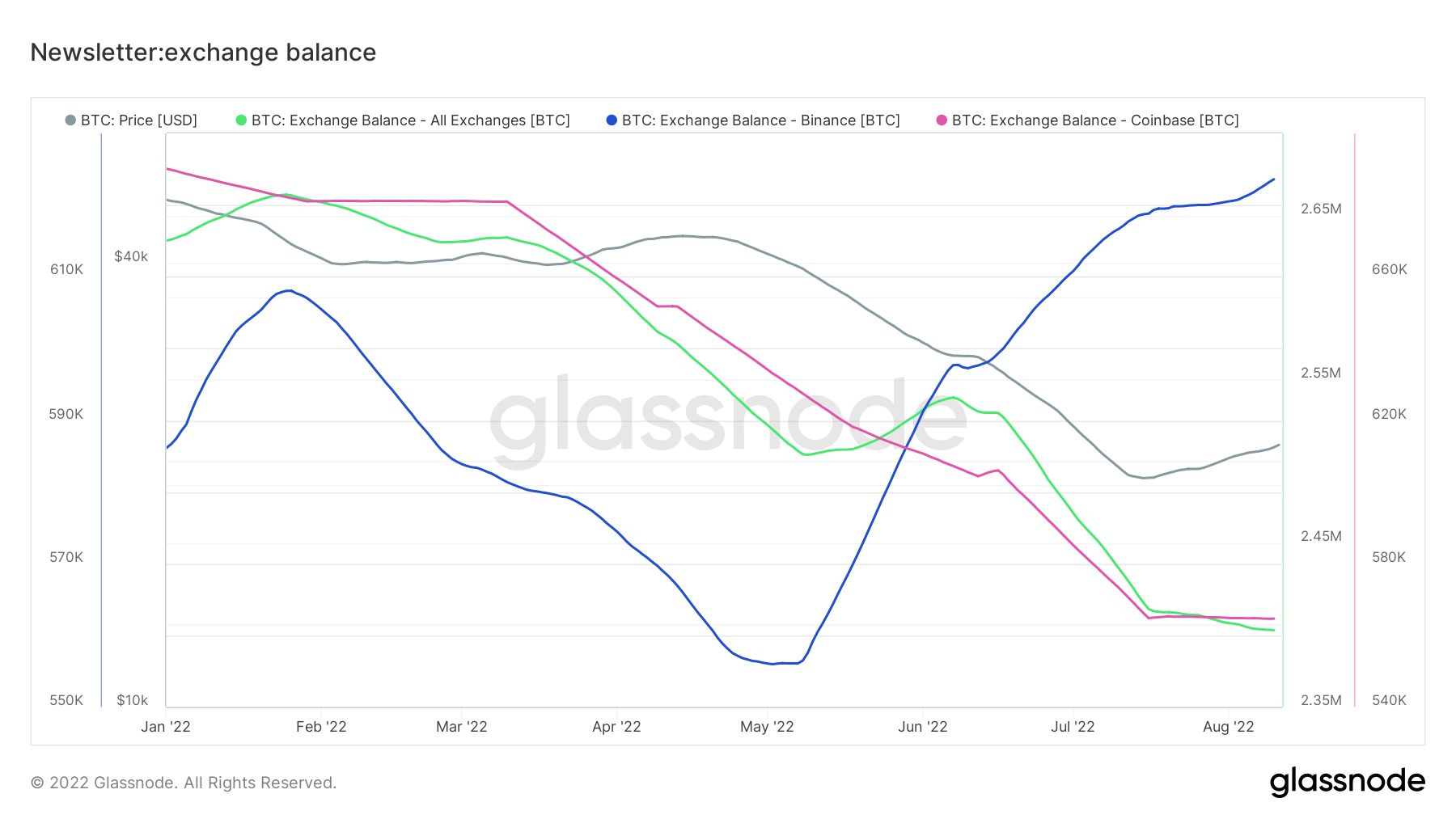

Change steadiness refers back to the quantity of Bitcoin sitting on exchanges, and it was following a downtrend since January 2022 for each Coinbase and Binance when instantly Binance’s trade steadiness took a flip and began to spike in Might. It’s nonetheless growing, whereas each total and Coinbase’s trade steadiness proceed to fall.

The chart above exhibits the cumulative Bitcoin trade steadiness, Bitcoin worth, and the trade balances of each trade giants Binance and Coinbase.

The inexperienced line representing the cumulative trade steadiness has adopted a pointy downtrend since February. At the start of the yr, there have been greater than 2,6 million Bitcoins on exchanges. This quantity is now beneath 2,4 million, proving a web outflow of 200,000 Bitcoins.

Which means that Bitcoin provide has been faraway from exchanges, indicating a long-term bullish holding tendency.

Coinbase

Coinbase has been following the identical pattern with the general steadiness. The trade held practically 690,000 Bitcoins initially of the yr and fell beneath 560,000 in eight months.

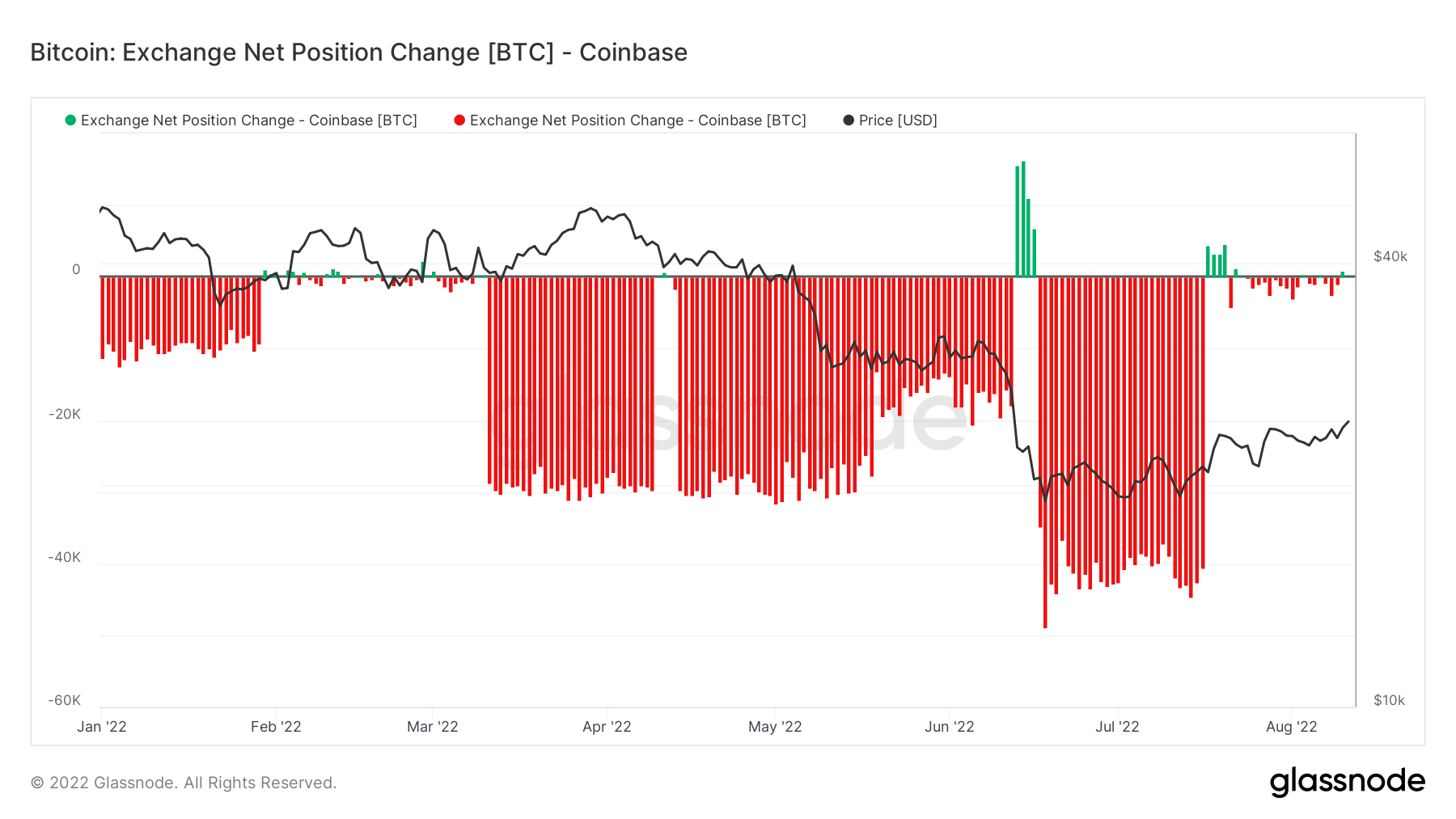

The chart above exhibits the actions of cash on Coinbase. Crimson traces characterize Bitcoins leaving the trade, whereas greens point out incoming balances. Coinbase has seen a substantial quantity of Bitcoin withdrawn for the reason that starting of the yr. Furthermore, the quantities taken out doubled as soon as between March and Might; and once more in July.

The truth that U.S establishments want Coinbase might need performed a task in these transactions. When confronted with a bear market, establishments usually tend to function on a buy-and-hold foundation, which could have motivated them to tug their Bitcoins out of Coinbase.

Binance

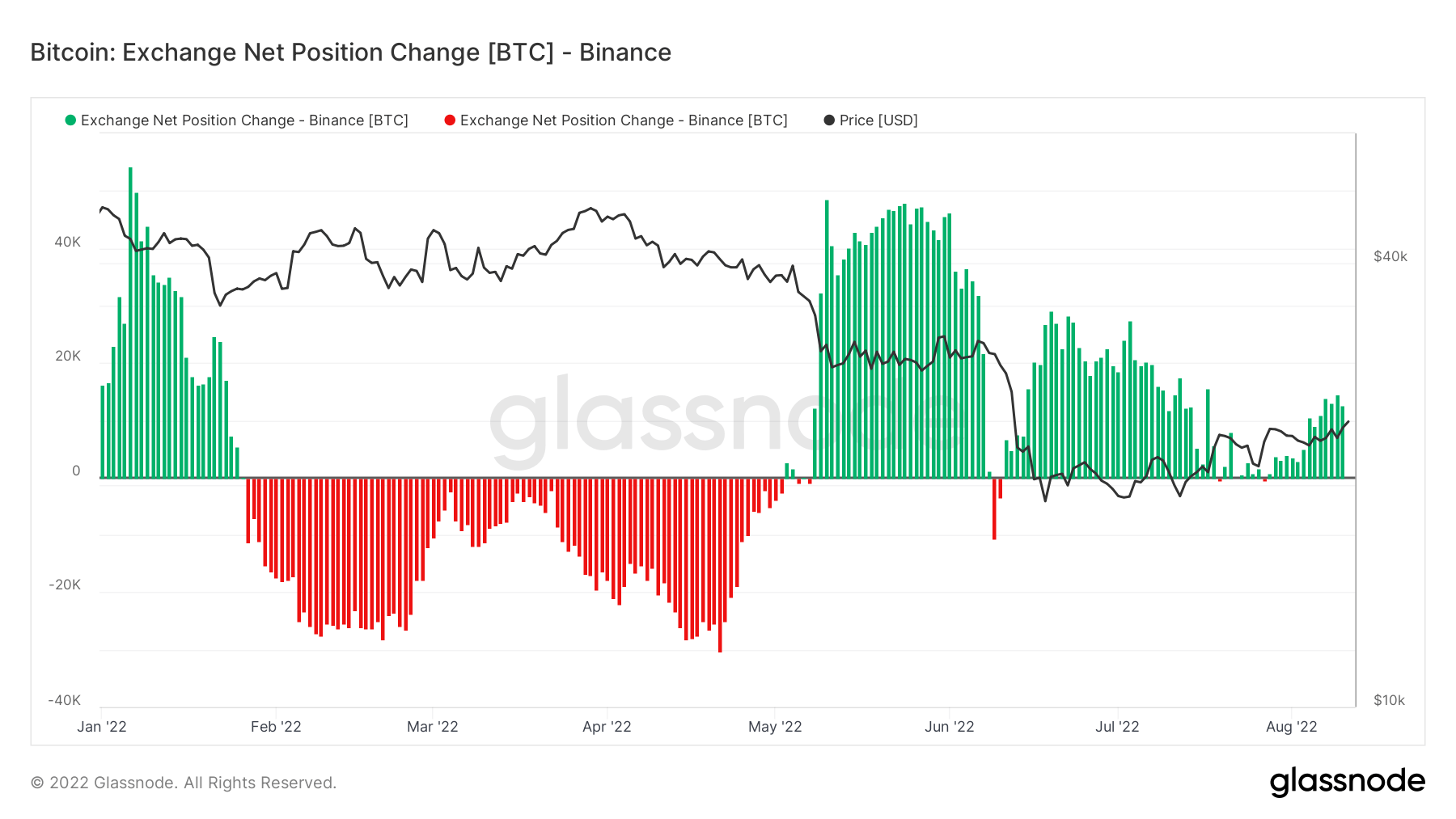

Though getting caught on the identical downtrend initially of the yr, Binance ended up with extra Bitcoins than January. The trade began the yr with 586,000 Bitcoins, fell beneath 560,000 till Might, and ended up at 623,000 Bitcoins as of August.

The chart above displays the shrinking Bitcoin reserves between February and Might, which then takes a flip.

Coinbase and Binance within the bear market

Judging by the information from the previous few months, Binance and Coinbase are dealing with the winter market in a different way. Whereas Binance doesn’t flinch within the harsh winter situations and continues to place its clients first, Coinbase offers with layoffs, lawsuits, and chapter speculations.

Binance

Earlier than the coldest winter in crypto historical past began, Binance U.S. was valued at $4.5 billion in a seed funding spherical, and the trade took step one in direction of increasing in Abu Dhabi. Binance continued its investments and hiring even after the winter began. Binance’s CEO, Changpeng Zhao, even mentioned that the corporate is in a really rich place and can begin buying different firms quickly.

Coinbase

Then again, Coinbase has been coping with the chapter wordings in its quarterly report simply earlier than the winter began. Quickly after, Coinbase customers misplaced their Wormhole Lunas whereas making an attempt to ship to the trade, which Coinbase refused to assist with on the time. Then, the trade was sued by its clients and Craig Wright. Along with coping with them, Coinbase’s staking product can also be put underneath investigation by SEC.

Within the meantime, the trade un-hired new recruits as a consequence of market situations and laid off 1,100 staff after a petition in opposition to executives. Lastly, in line with Goldman Sachs, Coinbase’s income may decline by 61% because of the winter situations, and the corporate may want to fireplace extra staff to outlive.