In 32 days, Ethereum is predicted to improve from a proof-of-work (PoW) consensus algorithm to a proof-of-stake (PoS) system after the community used PoW for seven years. Whereas the testnets have carried out the brand new guidelines, most individuals envision a comparatively clean mainnet transition. Nevertheless, one other chain is predicted to fork away from the Ethereum department and since August 8, the proposed fork known as ETHW has gained market worth in a couple of IOU markets. Regardless of the worth gathered, the potential token misplaced greater than half of its USD worth in lower than six days’ time.

Whereas ETHW Captures Worth, Proposed Ethereum Fork Token’s Worth Shudders by Extra Than 53%

Ever because the bitcoin miner Chandler Guo began speaking a few new proof-of-work (PoW) model of Ethereum, after the chain transitions to proof-of-stake (PoS), the thought has gained some traction. The crypto asset change Poloniex revealed the launch of ETHW markets and there’s a brand new web site known as ethereumpow.org.

Statistics from coinmarketcap.com point out that MEXC, Digifinex, Gate.io, and Poloniex listing ETHW IOU markets. However the ETHW website additionally claims to have connections with a lot of “communities, exchanges, miners and people [that] have labored collectively to make ETHW doable.” Twitter vertical trends present that the ETHW fork is controversial amongst die-hard Ethereum supporters and Ethereum Basic supporters have chimed in as effectively.

The web site exhibits connections by ETHW change listings, and alleged mining supporters with talked about companies equivalent to Binance, FTX, Antpool, Poolin, Coincheck, Huobi, Hiveon, Flexpool.io, 2miners.com, F2pool, and Bitfly. ETHW has been listed on exchanges providing IOU markets for roughly six days to date.

$ETC is the unique chain. $ETH is a fork. And $ETHW is a fork of a fork. pic.twitter.com/0PkIYu4RrE

— ETCPOW (@ETCPOW) August 5, 2022

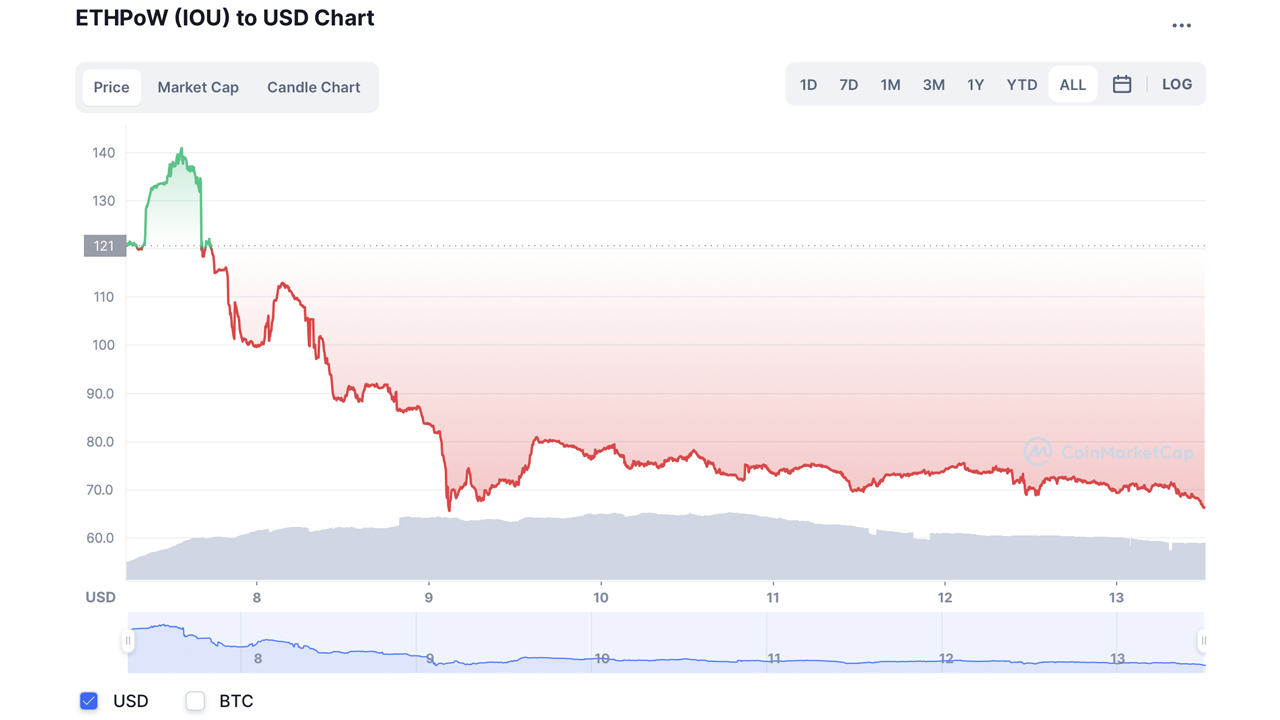

Ethereumpow.org additionally claims it has a bridge companion and advertises Bridgetech’s emblem on the location. When markets formally launched and ETHW got here out the gate, the worth jumped to an all-time excessive of round $141.36 per unit.

Since then, ETHW has misplaced 53% in worth and in comparison with ETH’s present worth, ETHW represents 3.2% at present market costs. ETHW tapped an all-time low on August 10, 2022, reaching $65.17 per coin and it’s up 1.9% on the time of writing, buying and selling for roughly $66.10 per unit.

There are 5 primary variations between this ETH1-ETH2 fork and the ETC-ETH fork. (1) The ETC-ETH fork was primarily as a result of ideology. It was PoW vs PoW; the miners may simply mine whichever chain was extra worthwhile.

— Galois Capital (@Galois_Capital) August 6, 2022

ETHW’s worth is extra corresponding to ethereum basic’s (ETC) present worth, which is round $43.86 per unit on the time of writing. Meaning ETHW is $23 increased in USD worth in the present day than ETC’s present worth. But many crypto supporters have mentioned how ETC was created for ideological causes whereas ETHW is being called a “cash seize.”

So Far, There’s Been No Significant Rises in Ethereum Basic’s Hashrate

A lot of the mining swimming pools talked about on ethereumpow.org already mine ethereum basic (ETC). For example, 2miners.com is the second largest ETC mining pool, dedicating shut to 6 terahash per second (TH/s) to ETC’s PoW community.

What ETH PoW fork will imply for me:

Situation A:

worth is cut up throughout each chains

Technique: Promote $ETHW for $ETH

Consequence: extra $ETH than earlier than.Situation B:$ETHW worth is $0 from starting

Technique: submit memes laughing about

Consequence: free enjoyableCan’t think about a greater occasion

— Alejandro Perezpayá (@aperezpaya) August 6, 2022

So far as the ETHW fork, if even one of many aforementioned mining swimming pools that allegedly help the chain begin mining it, ETHW will turn into a actuality. Presently, dozens of ethereum mining swimming pools are seemingly mining ETH to the very finish, because the crypto asset’s rise has made it fairly helpful to take action.

ETH’s hashrate is way bigger than ETC’s and to date, there’s been no significant rises in ETC’s hashrate, apart from the preliminary spike on July 28, 2022. Ethereum is presently one of the worthwhile crypto networks to mine in the present day, as Bitmain’s new Antminer E9, with 2.4 gigahash per second (GH/s) or 0.0024 TH/s, can get an estimated revenue of round $63.43 per day.

What do you consider the proposed Ethereum fork and the way the IOU token has already shed half of its worth this previous week? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss induced or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.