Watch This Episode On YouTube Or Rumble

Pay attention To The Episode Right here:

“Fed Watch” is a macro podcast, true to bitcoin’s insurgent nature. Every episode we query mainstream and Bitcoin narratives by inspecting present occasions in macro from throughout the globe, with an emphasis on central banks and currencies.

On this episode, Christian Keroles and I dive into the shock charge cuts by the Folks’s Financial institution of China (PBOC) and skim by a few of Jamie Dimon’s lately leaked feedback in regards to the international economic system and geopolitics.

China’s Shock Charge Minimize

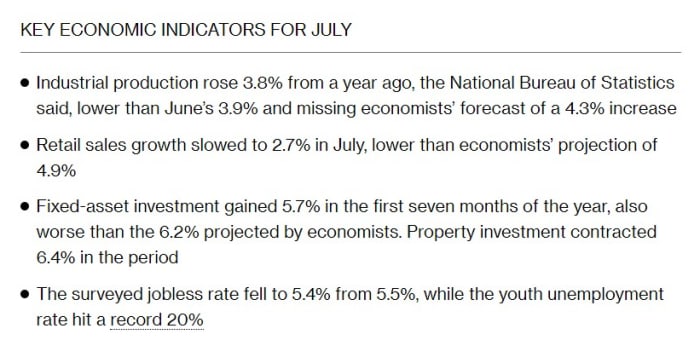

After a quick take a look at the bitcoin chart, we start discussing the July 2022 financial numbers from China. I learn off a Bloomberg article with the headline, “China Shocks With Charge Minimize as Knowledge Present ‘Alarming’ Slowdown.”

Up and down the information launch, the Chinese language economic system carried out worse than final month and much under estimates. After a long time of business manufacturing rising in China at excessive single and even double digits, it’s underperforming bearish estimates at solely 3.8% year-over-year.

Different essential metrics for the Chinese language economic system is retail gross sales progress, as they try to interrupt out of the middle-income entice, and grow to be a consumption-led economic system. Progress was horrible at solely 2.7%, with a projection of 4.9%.

The property and actual property sector posted a 6.4% decline, which is probably going a rosy studying. In current episodes, we’ve proven how the Chinese language actual property market, like new residence gross sales, has crashed by 30% month-other-month in current months. That is completely devastating for a sector constructed round presales and which is trapped in a slow-motion credit score default.

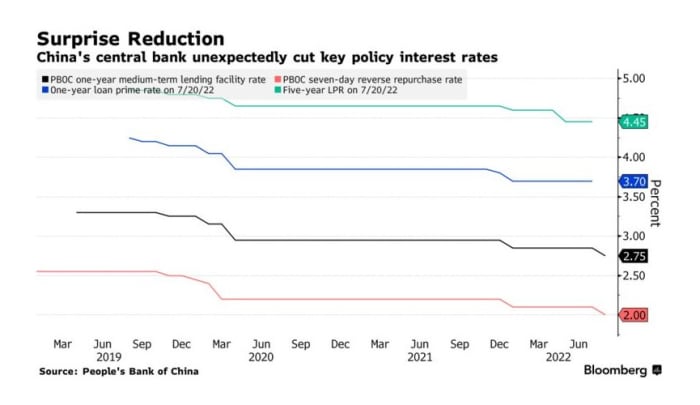

The final replace for China this week is that the PBOC additionally minimize their two short-term coverage charges, every by 10 foundation factors. It’s not a lot, however it places them in direct opposition to different central banks, who’re pursuing a path of tightening.

As you’ll be able to see within the chart under, the PBOC has been constantly slicing charges since lengthy earlier than COVID. This current weak point is perhaps blamed on their zero-COVID coverage, however the information reveals that China is experiencing solely a return to development — a development that’s heading towards a monetary disaster.

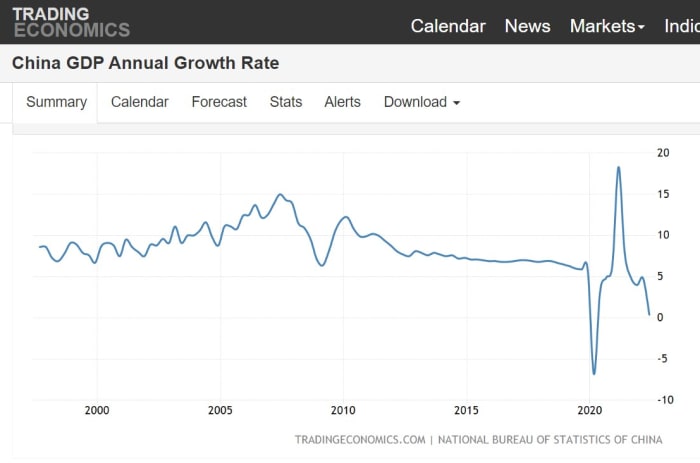

Within the chart under, we will see the expansion charge within the final 25 years of Chinese language gross home product. Progress basically modified in China in the course of the World Monetary Disaster and has been trending down ever since. COVID was a large shock, however now issues are settling again on development towards a disaster.

I do know Jamie Dimon just isn’t the preferred man within the Bitcoin neighborhood, however he’s a heavyweight on this planet of banking and finance. That’s the reason, when a few of his feedback to high-net-worth purchasers leaked this week, we should always at the very least look at what he stated. I’ll additionally notice, Jamie Dimon is the CEO of JPMorgan Chase and the Wall Road banks influences the Federal Reserve. It’s seemingly that that is just like what we’d hear from a candid dialog with Jerome Powell.

Concerning the coming recession, Dimon gauged the outcomes to be 10% tender touchdown, 20-30% gentle recession, 20-30% tougher recession and 20-30% one thing worse. Meaning he thinks there’s a roughly 50% probability of a tough recession or one thing worse. That’s vital however blended, portraying a excessive stage of uncertainty on the very prime of banking and finance.

He was additionally unsure in regards to the path of the patron value index and Fed coverage. Essential right here as a result of Powell is probably going additionally unsure.

Dimon was way more sure on different issues, China for instance. He stated, “China has severe points,” and “Autocratic administration can work in sure issues, however would not work in the long term.” Following that up with, “I believe it’s a mistake to say that America has the quick finish of the stick.”

We’d view Jamie Dimon because the stereotypical Davos Man, pleasant to the World Financial Discussion board and their agenda, however in these feedback he blasts environmental, social and governance (ESG) and recommends pumping extra oil within the U.S. He implied that extra, relatively than much less, oil from the U.S. is healthier for the setting.

Lastly, Dimon even made some feedback on “woke capitalism” the hallmark of the ESG motion. It was slightly unclear what his direct ideas had been, however he actually prefers abandoning insurance policies which can be tearing us aside and hurting the economic system. As an alternative, he desires to concentrate on coming collectively and supporting one another.

That does it for this week. Because of the watchers and listeners. In case you take pleasure in this content material please like, subscribe, evaluation and share!

Don’t overlook to take a look at the “Fed Watch Clips” channel on YouTube.

This can be a visitor submit by Ansel Lindner. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.