That is an opinion editorial by Leon Wankum, one of many first monetary economics college students to write down a thesis about Bitcoin in 2015.

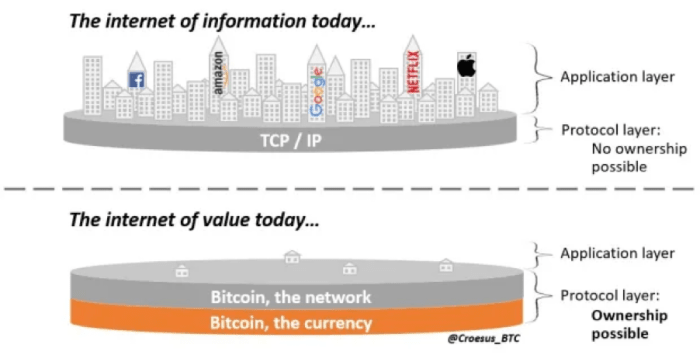

Bitcoin has a novel worth proposition. As a protocol for exchanging worth it lets you instantly personal a part of it. The Bitcoin community is a transaction processing system. From transaction processing comes the power to alternate cash, specifically bitcoin, the community’s native forex, which represents the worth of the underlying system. It’s each a fee community and an asset, backed by probably the most resilient laptop community on this planet.

In case you might personal a part of the web, would you say no? In reality, that’s proudly owning bitcoin — proudly owning shares in a brand new breakthrough protocol that may rework the web from an area the place not solely info, but in addition worth, may be freely exchanged.

With Bitcoin, it is potential to take an possession stake in your complete web of worth. This was by no means potential with the web of data. Possession and worth seize is constructed instantly into the community (Guy Swann). It is a paradigm shift that new traders must “wrap their heads round” to know Bitcoin’s full potential (Croesus_BTC).

Supply: Croesus_BTC

Michael Saylor has famously in contrast shopping for bitcoin to purchasing actual property in downtown Manhattan 100 years in the past. A few of New York’s wealthiest households have made their fortunes proudly owning actual property. When one thing that’s restricted is in excessive demand, it will increase in worth.

Shortage has quite a bit to do with the worth of issues, which is why sure distinctive items of artwork are value a lot and why actual property in a densely populated space is costlier than in a non-densely populated space(surferjim, 2020. Bitcoin As Actual Property). Certain, actual property has worth as a result of individuals pay hire to stay in it, however the worth is primarily decided by the restricted provide of constructing land. There are solely “so many” properties to be inbuilt prime places. Bitcoin’s attraction additionally stems from the truth that its provide is proscribed (Brown, R. 2014. “Welcome to Bitcoin Island). There’ll by no means be greater than 21,000,000 bitcoin.

However bitcoin, in contrast to actual property, doesn’t generate any revenue. It is like bitcoin is a digital property that does not earn hire.

So would not calling bitcoin land be a extra correct comparability?

In reality, as described by Richard Brown, bitcoin is similar to land because of the community’s accounting construction. However I wish to construct on that and increase this comparability as a result of bitcoin has a a lot greater complexity in its utility than land, for which actual property is one of the best comparability. In idea, proudly owning actual property is fascinating as a result of it generates revenue (hire) and can be utilized as a method of manufacturing (manufacturing). However for probably the most half, actual property now serves a distinct function. Given the excessive ranges of financial inflation in latest a long time, merely holding cash in a financial savings account shouldn’t be sufficient to protect the worth of cash and sustain with inflation. Consequently, many, together with rich people, pension funds and establishments, sometimes make investments a good portion of their disposable money in actual property, which has turn out to be one of many most well-liked shops of worth. Most individuals don’t desire actual property to allow them to stay in it or use it for manufacturing. They need actual property to allow them to retailer worth (Jimmy Tune).

Retailer Of Worth

Bitcoin is extensively accepted as a digital retailer of worth, which is barely logical in a world the place financial growth is ever growing.

Whereas the provision of bitcoin is finite, the properties related to bitcoin make it a perfect retailer of worth. It’s simply moveable, divisible, sturdy, fungible, censorship-resistant and noncustodial. Actual property can not compete with bitcoin as a retailer of worth. Bitcoin is rarer, extra liquid, simpler to maneuver and tougher to confiscate. It may be despatched wherever on this planet at virtually no value on the velocity of sunshine. Actual property, alternatively, is straightforward to confiscate and really troublesome to liquidate in occasions of disaster. This was not too long ago illustrated in Ukraine. After the Russian invasion on February 24, 2022, many Ukrainians turned to bitcoin to guard their wealth, convey their cash with them, settle for transfers and donations, and meet every day wants. Actual property, alternatively, would have needed to have been left behind.

Collateral

Except for getting used as a retailer of worth, actual property is likely one of the most typical types of collateral used within the conventional banking system. It’s generally used as collateral from a borrower to a lender to safe the reimbursement of a mortgage. Banks lend to individuals and establishments that personal actual property. For comparability: bitcoin possession has turn out to be synonymous with “creditworthiness” within the bitcoin house and the popular collateral accepted by bitcoin monetary service suppliers. Utilizing bitcoin as collateral to safe the reimbursement of a mortgage has sure benefits for each debtors and lenders. As digital property, bitcoin has a a lot greater velocity than actual property, which is bodily. It’s simpler to entry, purchase, retailer, use and preserve. You may stay in a distant village, however so long as you may have a flip cellphone and may ship and obtain texts, you should purchase and maintain bitcoin. It has the power for use wherever on this planet. You would stay in Berlin however get a mortgage from a financial institution in Singapore in the event that they settle for your bitcoin as collateral.

As collateral, actual property has a property that makes conventional banks select it over bitcoin. They’re much less risky. Conventional monetary service suppliers are usually not used to the excessive volatility of bitcoin. Every asset has its personal specifics. With bitcoin, it is volatility, which is definitely not dangerous in any respect. Whereas bitcoin’s volatility may be disastrous for market contributors who do not anticipate it, it is usually helpful to the economic system. Bitcoin’s volatility will most certainly end in a extra resilient market. Companies should be higher capable of save and never leverage as a lot, as worth declines might rapidly result in a margin name, as we noticed after the newest 70% crash in bitcoin. After that, quite a lot of closely indebted firms went bankrupt. The Bitcoin market is consistently testing its “improvements within the crucible of a aggressive market.” Nevertheless, this text shouldn’t be meant to debate the particular traits of the 2 belongings as collateral or to make any predictions about bitcoin’s volatility, however is meant to point out the totally different use circumstances of bitcoin. I’ll present a comparability of the properties of each belongings as collateral in a separate article.

Conclusion

In abstract, actual property shouldn’t be like bitcoin within the literal sense, however it’s the most acceptable metaphor to explain the varied functions of bitcoin and a few of the alternatives it presents. Bitcoin is a part of a basic step in direction of digitizing the world round us. It’s a software that may assist society arrange itself extra effectively. Simply because the introduction of personal property rights enabled the creation of cities, bitcoin permits a brand new approach of wealth creation within the digital house (Bitcoin Journal, 10 Yr Anniversary Version). It’s a basis for reaching the following nice section of financial development and the betterment of life on earth (”Bitcoin is Venice” p. 172).

It is a visitor publish by Leon Wankum. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.