One of the thrilling developments to the crypto panorama are the assorted methods of utilizing your cryptocurrency in on a regular basis life. Crypto debit playing cards (also called Bitcoin debit playing cards) permit crypto fanatics to spend their holdings as simply as some other card of their pockets or cellphone.

What are crypto debit playing cards?

Crypto debit playing cards are used for making purchases both on-line or in particular person, very similar to a standard debit or bank card. As an alternative of drawing funds from a checking account, crypto debit playing cards are pre-loaded with cryptocurrency from the person’s most well-liked crypto pockets. With every buy, the suitable quantity is deducted from the cardboard stability.

Crypto debit playing cards shouldn’t be confused with crypto bank cards, that are much like common bank cards however typically give cardholders the chance to earn cryptocurrency rewards. Each choices provide customers a extremely versatile approach to make use of or earn crypto, however their variations mirror these between conventional debit and bank cards.

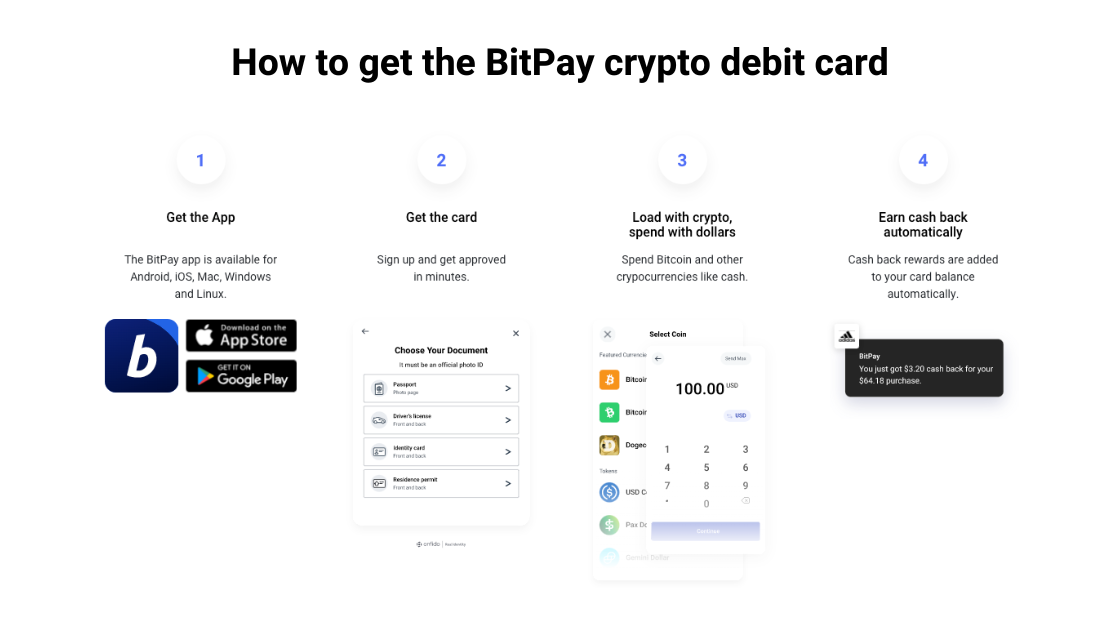

The right way to get a crypto debit card

The method of getting a crypto debit card of your personal will differ relying on the supplier you select. BitPay has made the sign-up and approval course of for the BitPay pay as you go debit card quick, simple and safe. Merely enroll, get prompt approval and begin spending inside minutes. In contrast to with a crypto bank card, there isn’t any credit score verify required to get a crypto debit card, and utilizing the cardboard received’t affect your credit score. A number of suppliers provide a digital card solely, whereas others, like BitPay, additionally provide a bodily card choice as effectively. As soon as accepted, you’ll be able to begin spending utilizing your digital debit card instantly.

The right way to use crypto debit playing cards

The very first thing you’ll want is a crypto pockets, this might be used to load up your crypto debit card with funds you plan to spend. Suitable wallets will probably differ by supplier. The BitPay Card, for instance, might be loaded out of your BitPay Pockets or Coinbase account.

Crypto debit playing cards can be found in each digital and bodily kind, and each variations can be utilized both on-line or in-store. When you’ve join your pockets and the cardboard is loaded with money, there are a variety of how to make use of your crypto debit card:

- Use the digital card for on-line purchases

- Join the digital card to your Apple Pay or Google Pay pockets in your cellphone for carry crypto spending energy in your pocket wherever you go

- Carry the bodily card in your pockets to faucet or swipe at checkout

- Insert your bodily card and pull money straight from any suitable ATM world wide

One of the best crypto debit playing cards may also have an intuitive app the place you may monitor purchases and handle card preferences, along with topping off the cardboard.

Crypto debit card rewards

Some crypto debit playing cards provide rewards packages to encourage continued use. The BitPay Card affords prompt money again once you use it at 1000’s of places, routinely including it to your stability with each buy and with no restrictions on how it may be spent. Others require customers to stake crypto funds in an effort to earn money again within the type of a local token, usually within the 1-8% vary relying on the tier of card. Many playing cards, together with the BitPay Card, additionally provide referral bonuses the place customers are rewarded when mates enroll and cargo their card.

How to decide on one of the best crypto debit card

Selecting one of the best crypto debit card for you is dependent upon your priorities and spending habits. What’s the greatest crypto debit card? That can depend upon what points are most necessary to you. To search out the perfect card for you, contemplate the next:

How a lot will you spend?

Some playing cards impose limitations on the quantity of funds you may load onto them every day, usually within the $10,000-$30,000 vary for many base tier playing cards. Completely different suppliers provide variations of their crypto debit playing cards with fewer loading restrictions, however could require customers to lock up a specified quantity of crypto to qualify. Day by day spending and ATM withdrawal limits additionally differ by card, with most falling throughout the $1,000-$10,000 vary. The BitPay Card affords a every day load restrict of $10,000 and a complete stability restrict of $25,000.

Do you primarily need to spend a single cryptocurrency or a number of cryptocurrencies?

If most of your crypto spending is finished in Bitcoin or one other single cryptocurrency, multi-coin assist may not matter to you. Nonetheless in case you intend to transform a number of cryptocurrencies to money with a debit card then you definately’ll desire a card that helps as many as potential. The BitPay Card helps Bitcoin (BTC), Ethereum (ETH), Bitcoin Money (BCH), Dogecoin (DOGE), Shiba Inu Coin (SHIB), Litecoin (LTC), Dai (DAI), Wrapped bitcoin (WBTC), Gemini USD (GUSD), USD Coin (USDC) and Binance USD (BUSD). We’re continually evaluating and including assist for brand new cash.

How do you need to load the cardboard?

With a purpose to load your crypto debit card with funds, you’ll first want a crypto pockets or an change account. From there, you may switch the specified quantity of funds to prime off the stability in your crypto debit card. The BitPay app drastically simplifies the method, permitting customers to transform crypto to money, spend, reload and money in crypto rewards all from one place.

The place do you propose to make use of the cardboard?

A crypto debit card is barely helpful if it’s accepted the place you spend most. You’ll discover that almost all crypto debit playing cards carry both the Visa or Mastercard insignia, which implies they can be utilized at tens of millions of world retailers and repair suppliers. The BitPay Card can be utilized world wide at any service provider or ATM the place Mastercard is accepted.

What forms of charges are you OK with?

These will differ by supplier, however a few of the commonest ones embody activation or issuance charges, month-to-month utilization charges, ATM charges and overseas transaction charges. A few of these charges are waived if sure month-to-month spending thresholds or different circumstances are met, so be sure you learn the fantastic print earlier than selecting your card.

Do you need to earn rewards for utilizing the cardboard?

Many crypto debit playing cards provide rewards packages that permit customers earn money or crypto on on a regular basis purchases. Relying on the supplier, crypto debit card customers can obtain as a lot as 8% cashback, but it surely’s necessary to have a look at any further charges or necessities it could be vital to fulfill earlier than qualifying. BitPay customers can earn money again with each buy at 1000’s of retailers. The rewards are routinely added to their pre-loaded card stability, with no hoops to leap by way of.

One of the best crypto card for spenders

FAQs about crypto debit playing cards

What charges can I anticipate to pay with a crypto debit card?

There are a variety of charges card issuers impose on customers, together with activation/issuance charges, month-to-month utilization charges, ATM withdrawal charges and overseas transaction charges. A few of these charges might be forgiven or waived if sure necessities are met. Nonetheless, this all is dependent upon the supplier.

Will utilizing a crypto debit card affect my credit score?

Some crypto debit card suppliers could require a Social Safety quantity for know-your-customer (KYC) compliance, however few if any will truly pull your credit score report earlier than issuing a card. The BitPay Card is a pre-paid crypto debit card that’s loaded straight from a person’s crypto pockets, so no credit score verify is required and signing up for one won’t affect your credit score rating. To join the BitPay Card you will want to confirm your id and standing as a U.S. resident.

Are there load or spending limits for crypto debit playing cards?

Limitations on every day spending or how a lot crypto might be loaded onto a card will differ from card to card. The BitPay card, for instance, has a every day load restrict of $10,000 and a month-to-month spending restrict of $25,000. Most playing cards will fall inside this vary, however sure playing cards provide totally different tiers the place these limits might be considerably greater or decrease.

Can the BitPay Card be used exterior of the U.S.?

Sure. Though the cardboard is barely out there to U.S. residents, when you’re accepted you need to use the BitPay Card worldwide, together with overseas ATM withdrawals, offered the ATM itself is suitable.

What cryptocurrencies can I load onto a debit card?

This may differ by supplier, however the BitPay card lets customers immediately convert a rigorously curated checklist of over a dozen in style cryptocurrencies, tokens and stablecoins together with Bitcoin (BTC), Ethereum (ETH), Bitcoin Money (BCH), Dogecoin (DOGE), Shiba Inu (SHIB), Litecoin (LTC), Dai (DAI), Wrapped Bitcoin (WBTC), Gemini USD (GUSD), USD Coin (USDC) and Binance USD (BUSD).

Are crypto debit playing cards free?

Some crypto debit playing cards carry a small activation charge or a charge to obtain a bodily card. Nonetheless, many, just like the BitPay Card, present a free digital card that you may begin utilizing immediately after being accepted.

Are crypto debit playing cards accepted in every single place?

Most crypto debit playing cards both carry a Visa or Mastercard insignia. In these circumstances, the playing cards can be utilized wherever that Visa and Mastercard are accepted.