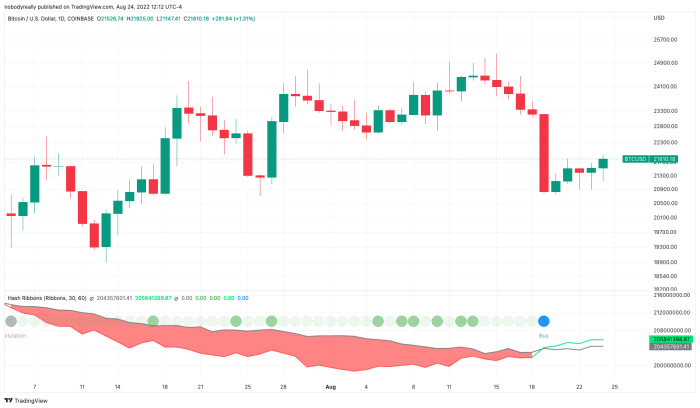

Hash ribbons, an indicator with a confirmed monitor report of recognizing opportunistic entry factors for bitcoin, has flashed a purchase sign suggesting now could be a first-rate interval to buy the peer-to-peer foreign money.

Realizing when is the most effective time to make an funding is the need of many however the accomplishment of few. Certainly, funding methods akin to dollar-cost averaging (DCA) have emerged to take away the guesswork from the equation and allow a extra stress-free investing expertise. However, many nonetheless search for alternatives to make a major allocation that guarantees outsized returns. Whereas there’s no single indication of when such a time is right here, methods exist to assist recognizing these intervals –– and, within the Bitcoin world, hash ribbons is one in all them.

Hash ribbons, publicly accessible on TradingView, is an indicator made up of two easy shifting averages (SMAs) of bitcoin’s hash fee: the 30-day and the 60-day SMA. A downward cross of the short-term MA on the long-term MA marks the start of a capitulation interval, whereas an upward cross spots its finish. Shopping for bitcoin on the finish of a miner capitulation interval usually produces outsized returns for traders because the worst is believed to be over and the market is starting a restoration.

The hash ribbons indicator signaled “purchase” on Friday as BTC dropped by greater than 7%. Bitcoin is up over 4% since. (Bitcoin worth chart/TradingView)

“There’s a good chance that the underside is in,” stated Charles Edwards, inventor of hash ribbons and founding father of Capriole Investments, a quantitative crypto fund whose goal is to outperform bitcoin. “Taking a look at Bitcoin, we’ve got the strongest sign for a serious accumulation zone doable: a hash ribbon purchase, and the timing of this sign makes it much more precious.”

The newest hash ribbons purchase sign comes within the second half of this halving cycle –– the four-year interval between halvings. (The halving is the occasion via which the protocol “halves” the block reward.) Edwards explains that late-cycle hash ribbons alerts have been “essentially the most dependable and performant prior to now.” Nevertheless, a hash ribbon purchase doesn’t imply worth will immediately shoot up.

“It’s price noting that 15% downdraw on a hash ribbon sign wouldn’t be out of the extraordinary,” Edwards added. “Timing bottoms isn’t straightforward. The primary goal for us as traders is to establish excessive chance worth areas and act on these –– no matter whether or not or not they find yourself being absolutely the backside.”

“We consider we’re in a type of excessive chance areas in the present day,” he stated.

Within the earlier Bitcoin bear market, following the 2017 blow-off prime, hash ribbons flagged a purchase alternative as BTC was buying and selling at round $3,600 on Jan. 10, 2019. Over the next yr, bitcoin’s worth elevated by 127% to $8,200 after having scored returns of 233% within the first six months.

Regardless of the attested earlier returns on performing on hash ribbons purchase alerts, the present macroeconomic backdrop poses some challenges as a broader risk-off sentiment stays connected to world markets. However Edwards argues there’s been a counterargument to performing on the indicator each time it’s flashed a sign.

“There have been six ‘dwell’ hash ribbon alerts because the technique went public three years in the past,” he stated. “Nearly all of them have had skepticism or good theoretical counter-arguments to counsel this time is completely different, however up to now none of those counter-points had been legitimate.”

The reality is that returns are by no means assured, and traders themselves ought to resolve whether or not and when to purchase bitcoin in accordance with their particular person situations. Moreover, as highlighted by Edwards, the worldwide high-inflation interval the world is at present experiencing is “positively” a superb counterpoint to hash ribbons’ sign.

“Such intervals solely occur about each half century,” he stated. “So it’s arduous to evaluate how Bitcoin will behave and the way such Bitcoin particular methods will carry out. Little question there will probably be an impression.”