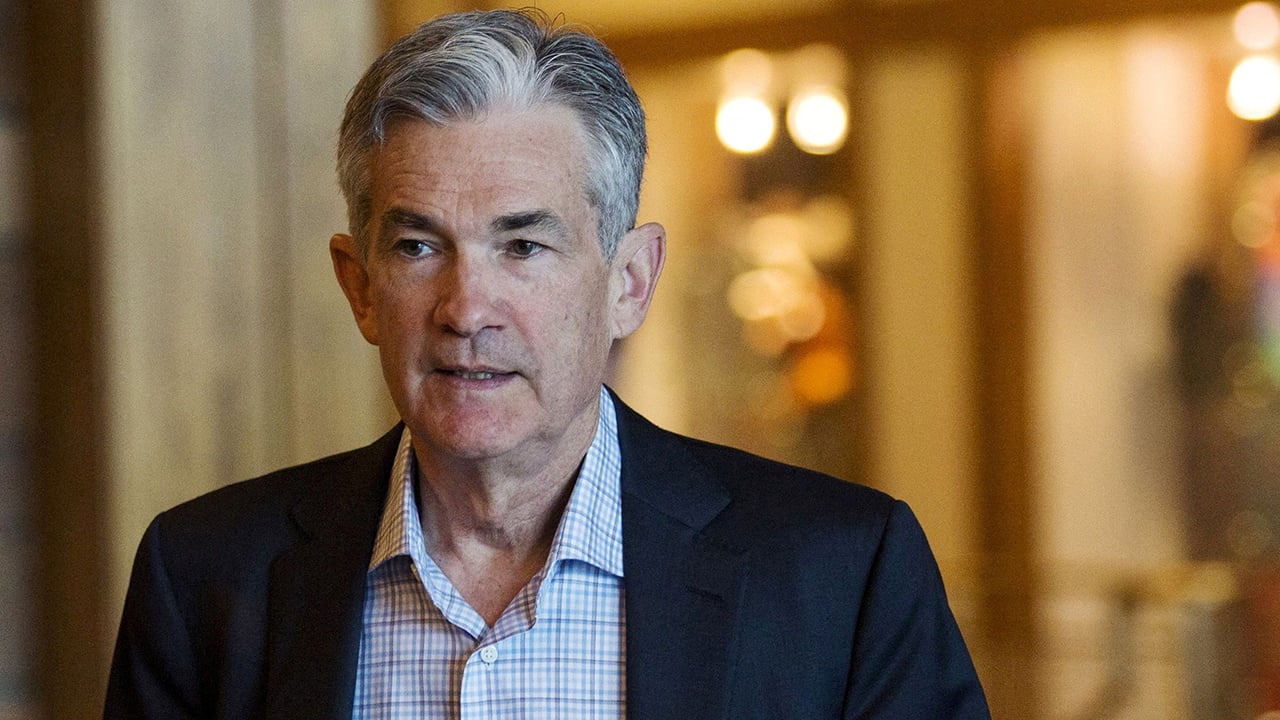

On Friday, Jerome Powell spoke on the annual Jackson Gap Financial Symposium and the Federal Reserve chair defined that the U.S. central financial institution is concentrated on preventing the nation’s red-hot inflation. Powell confused on the occasion that strict financial coverage is important, and his commentary hinted that the Fed gained’t hit the brakes on financial tightening till inflation is tamed.

Fed Chair Jerome Powell Says US Central Financial institution’s Inflation Coverage May Convey ‘Some Ache to Households and Companies’

Jerome Powell had lots to say on Friday whereas the Fed’s chief spoke for ten minutes at this yr’s Jackson Gap Financial Symposium hosted by the Federal Reserve Financial institution of Kansas Metropolis. The occasion dubbed “Reassessing Constraints on the Financial system and Coverage” featured quite a few the world’s central financial institution officers and policymakers.

Powell mentioned inflation within the U.S. and he famous that taking away the nation’s worth volatility will take “a while.” Powell additional warned that the Fed’s battle with inflation will convey “some ache to households and companies.” Regardless of the ache, Powell insisted that it was the “unlucky prices of decreasing inflation.” The sixteenth chair of the Federal Reserve added:

However a failure to revive worth stability would imply far better ache.

The statements didn’t sit effectively with Wall Avenue traders and the Dow Jones dropped 3% on Friday, recording the worst day the Dow has seen since Could. Tech shares stemming from the Nasdaq composite completed down 4% on the closing bell. Cryptocurrency markets shed 6.1% in 24 hours, and gold and silver additionally took proportion losses throughout Friday’s buying and selling classes as effectively. In the course of the speech, Powell opined that increased rates of interest will sluggish development and that “softer labor market situations will convey down inflation.” Powell continued:

In some unspecified time in the future, because the stance of financial coverage tightens additional, it possible will change into acceptable to sluggish the tempo of will increase.

Primarily, Powell guarantees “forceful and fast steps to reasonable demand” with the intention to to “preserve inflation expectations anchored.” The pattern, he stated, will proceed, and the Fed will preserve tackling inflation till the U.S. central financial institution is “assured the job is finished.” Powell detailed that worth stability is “the bedrock” of the U.S. economic system, and he emphasised that the Fed’s “duty to ship worth stability is unconditional.”

Credibility Misplaced? Powell’s Jackson Gap 2022 Statements Are a Entire Lot Completely different Than Feedback Made in 2021

The College of Chicago Sales space College of Enterprise deputy dean and former Fed governor Randall Kroszner advised CNN that he believes the Fed continues to be credible, regardless of the criticisms in opposition to the U.S. central financial institution ballooning the steadiness sheet and saying inflation could be “transitory.” “Thankfully, the Fed has not misplaced credibility, and that’s one thing I feel they may proceed to depend on,” Kroszner advised CNN on Friday.

@federalreserve has zero credibility…. And I’m sure Jerome Powell gained’t deal with the truth that the steadiness sheet wind down isn’t going as deliberate.

— MortgageCFO (@MortgageCFO) August 25, 2022

Powell’s latest statements are a complete lot totally different than the feedback he made final yr on the 2021 Jackson Gap Financial Symposium. “Inflation at these ranges is, in fact, a trigger for concern,” Powell stated final yr. “However that concern is tempered by quite a few elements that recommend that these elevated readings are prone to show short-term.”

Eventually yr’s Jackson Gap gathering, the Fed chair doubled down on his perception that the rising U.S. inflation wouldn’t final lengthy, and that the central financial institution would have the ability to preserve the two% goal inflation price locked tight. The speech recorded final yr in Kansas Metropolis has been used on a number of events to spotlight the Fed’s lack of credibility.

“Longer-term inflation expectations have moved a lot lower than precise inflation or near-term expectations, suggesting that households, companies, and market members additionally imagine that present excessive inflation readings are prone to show transitory and that, in any case, the Fed will preserve inflation near our 2 % goal over time,” the Fed’s head banker Powell added on the 2021 Jackson Gap gathering.

What do you consider Jerome Powell’s hawkish statements about decreasing inflation and the way the Fed’s battle might convey “some ache to households and companies?” Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Editorial picture credit score: David Paul Morris through Getty Photographs

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.