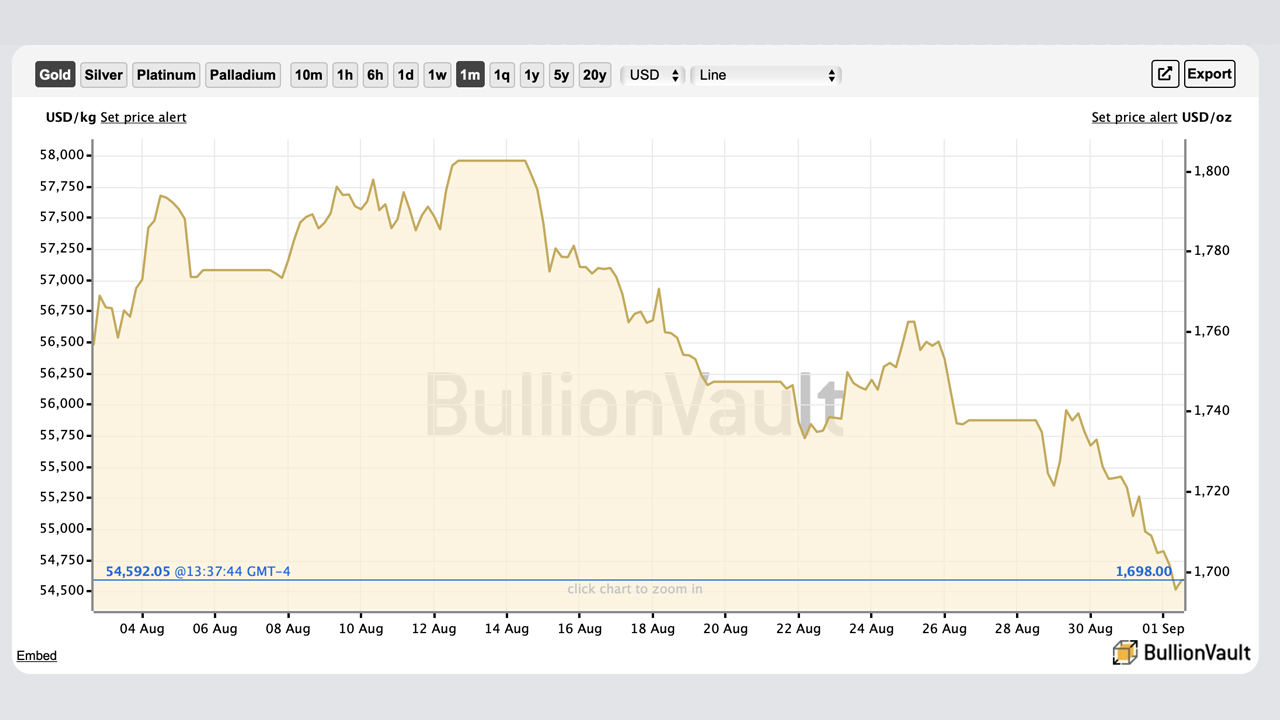

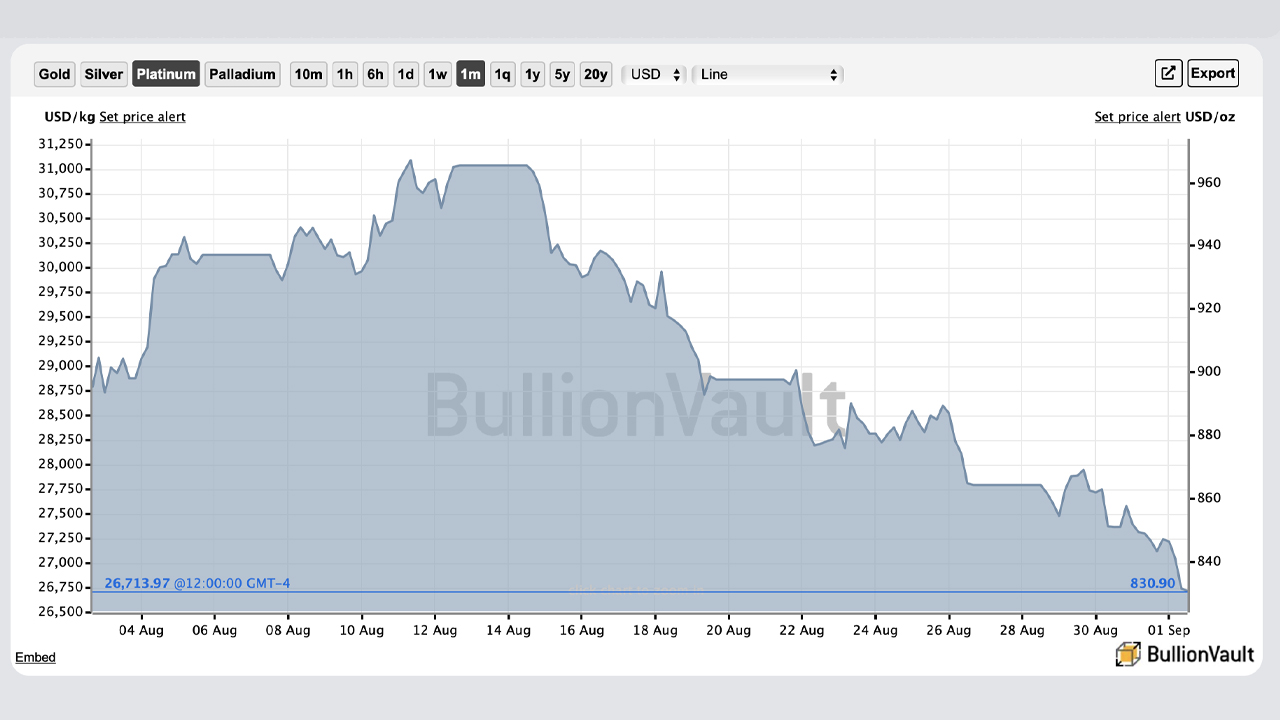

Valuable steel markets have shuddered throughout the previous few weeks, as gold’s worth per ounce nears a six-week low hovering just below $1,700 per unit. Silver crashed by way of the $18 vary slipping to $17.80 per ounce. Whereas each gold and silver dipped between 0.85% to 0.89% in opposition to the U.S. greenback in 24 hours, platinum dropped 2.82% and palladium shed 4.18% in opposition to the USD over the last day.

Regardless of Scorching World Inflation, Gold Hasn’t Been a Secure Haven in 2022

Whereas your entire world is affected by red-hot inflation, many would assume that the world’s valuable metals could be a protected haven in opposition to the surging costs. That hasn’t been the case in 2022, regardless of the U.S. and the Eurozone inflation charge rising above 9% this summer season.

In 2022, an oz. of effective gold managed to achieve a lifetime worth excessive in opposition to the U.S. greenback at $2,070 per ounce. On the identical day (March 8, 2022), an oz. of silver tapped a 2022 excessive at $26.46 per ounce.

12 months-to-date, silver is down 23.14% because it was buying and selling for 23.16 nominal U.S. {dollars} per troy ounce on January 1, 2022. For the reason that excessive on March 8, silver is down 32% decrease than the nominal U.S. {dollars} per troy ounce worth. Gold’s nominal U.S. greenback worth per troy ounce on January 1, 2022, was $1,827.49 per ounce and at at this time’s $1,695.45 per ounce worth, gold is down 7.22%.

Moreover, any buyers who purchased gold on the lifetime worth excessive on March 8, misplaced roughly 18.09% in USD worth since that day. Platinum, palladium, and rhodium values have seen related declines in worth and much more volatility than gold and silver.

Valuable metals (PMs) have lengthy performed a key function within the world financial system and historically, PMs like gold and silver have been seen as a hedge in opposition to inflation. Nevertheless, this has not been the case in 2022, and the blame is being positioned on a sturdy dollar and the Federal Reserve mountain climbing rates of interest.

Analysts Say Sturdy Greenback, Hawkish Fed Factors to Decrease Gold Costs, Greenback Index Faucets 20-12 months Excessive

Przemyslaw Radomski, CEO of funding advisory agency Sunshine Income informed Forbes on the finish of June {that a} “extra hawkish Fed, implying larger actual rates of interest, and a stronger U.S. greenback, each level to decrease gold costs.” The market strategist at dailyfx.com, Justin McQueen, says “a firmer USD and a renewed rally in world bond yields have dragged gold costs.”

The fxstreet.com analyst Dhwani Mehta defined on Thursday that gold costs might drop even decrease from right here, if gold bears maintain the market reigns. “The Technical Confluence Detector exhibits that the gold worth is gathering energy for the following push decrease, as bears intention for the pivot level one-day S2 at $1,700,” Mehta wrote on September 1. The fxstreet.com analyst added:

If sellers discover a sturdy foothold under the latter, a pointy sell-off in the direction of the pivot level one-day S3 at $1,688 will likely be inevitable.

David Meger, the director of metals buying and selling at Excessive Ridge Futures, blames gold’s poor efficiency on the statements Federal Reserve chair Jerome Powell made final week on the Jackson Gap Symposium.

“There’s continued stress on gold from Powell’s final week feedback that raised [the] expectation of a extra aggressive Fed,” Meger stated. “Gold being a non-interest bearing asset can have extra competitors.”

Furthermore, the U.S. Greenback Index tapped a 20-year excessive of 109.592 on Thursday, and the reasoning behind the sturdy dollar is being positioned on an aggressive Fed, in keeping with a Reuters report revealed on September 1.

What do you concentrate on the valuable steel market motion in current weeks? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Bullionvault,

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.