- I jumped on-chain and seen a key indicator – miner income – means that Bitcoin could also be prepping for an upward transfer

- However in isolation, this implies nothing. Pattern dimension for Bitcoin is simply too small, with the present surroundings the one macro bear promote it has seen since launch in 2009

- Till risk-off sentiment in wider market dissipates, on-chain indicators needs to be taken with pinch of salt

Probably the most fascinating issues about Bitcoin for me is the power to leap on-chain and monitor an entire vary of indicators. Because the years go by and we construct up extra of a pattern of how Bitcoin performs, these metrics turn out to be all of the extra highly effective.

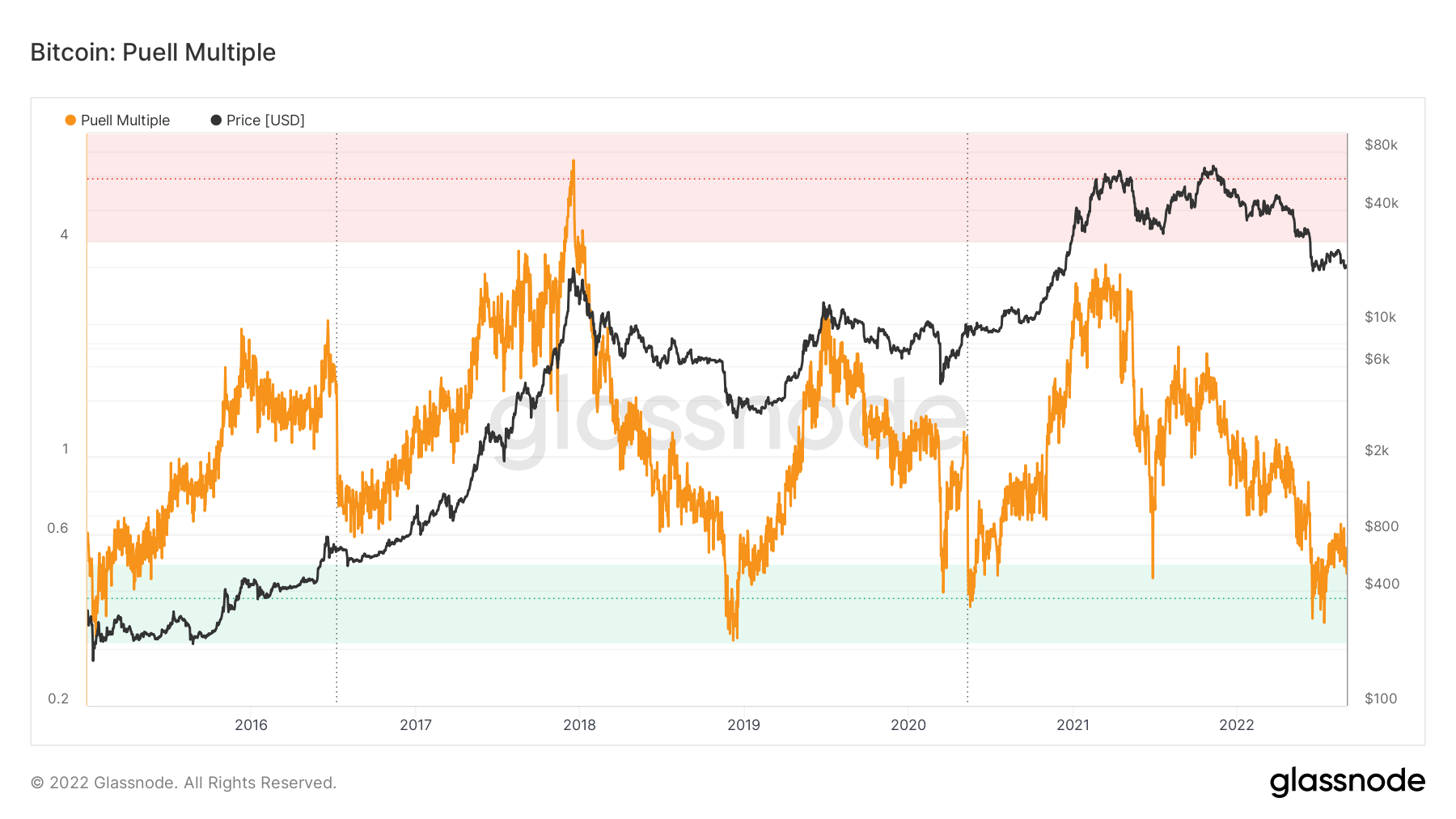

Certainly one of my favorite on-chain indicators is the Puell indicator. This takes the entire miner income and adjusts it by its yearly shifting common. So, the calculation of the indicator takes mining income and divides it by the 365-day easy shifting common of mining income.

Miner actions usually present distinctive insights into the market. They’re usually considered as obligatory sellers as a result of their income is in Bitcoin, whereas their mounted prices – electrical energy, largely – are in fiat. Clearly, they must cowl these mounted prices and so the issuance of bitcoins from miners will at all times be intrinsically associated to cost.

The Puell indicator just about tracks when the quantity of bitcoins getting into the market is simply too nice or too little relative to historic norms. Trying again at it traditionally, there may be fairly a powerful relationship – the worth tends to maneuver upward when the Puell indicator falls into the inexperienced zone on the chart under.

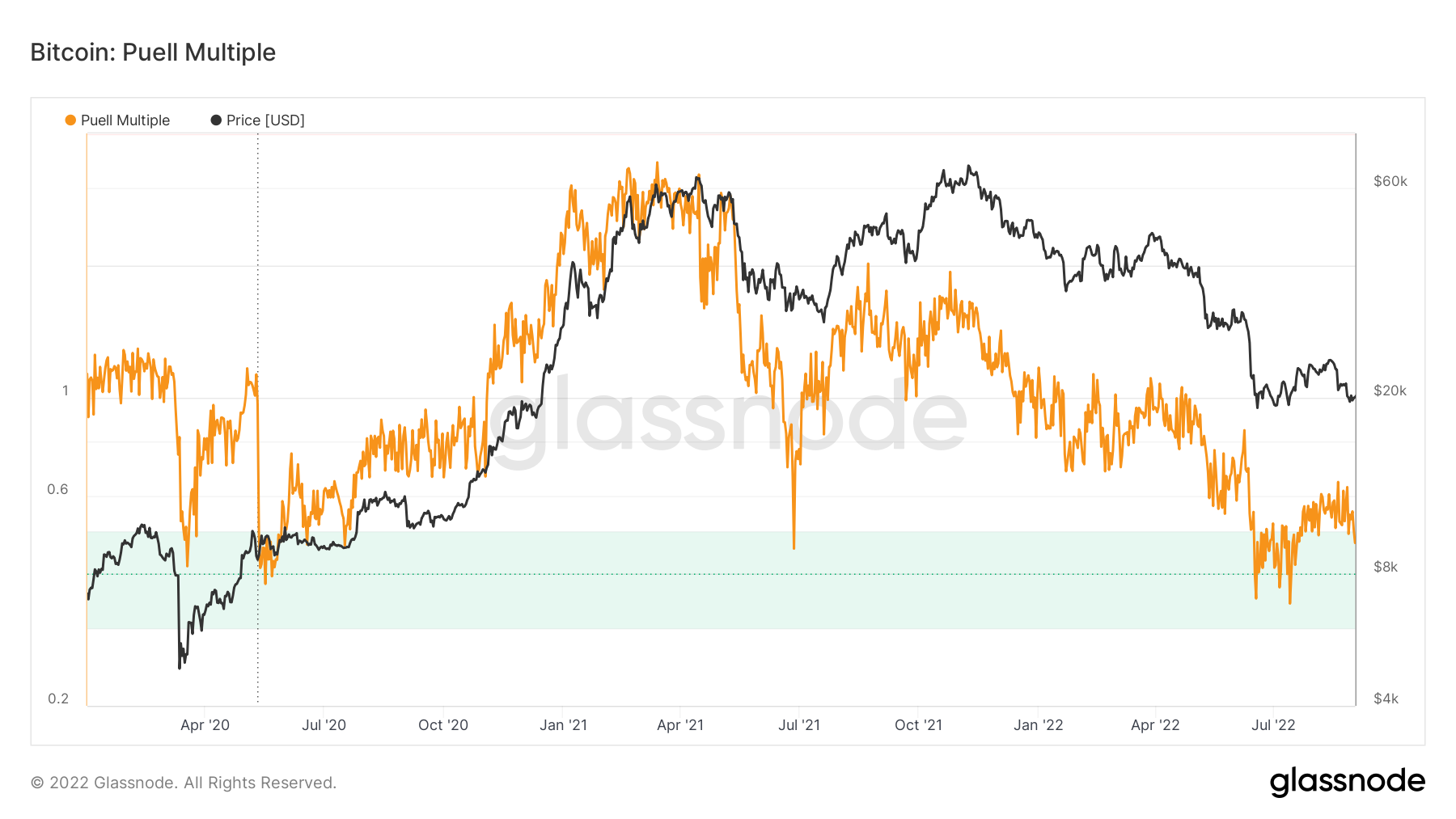

The newest time the Puell indicator dipped into the “purchase” zone was mid-June. Once more, we noticed upward motion quickly after, as Bitcoin had its little rally from about $20,000 up above $24,000. After all within the final week or so we’ve dipped again all the way down to under $20,000, because the Fed’s feedback on rate of interest plans and inflation sparked a wave of risk-off sentiment throughout all asset courses.

Apparently, I seen yesterday that the Puell indicator has dipped again into the “purchase” zone. Zooming on the time interval because the begin of 2020 demonstrates this a bit clearer on the chart.

Then once more, I’m at all times hesitant to make use of on-chain indicators in isolation. That is by no means extra true than within the present local weather, the place we’ve an unprecedented mix of a hawkish Fed, rampant inflation and a geopolitical local weather rising extra risky by the day.

That is the one time in Bitcoin’s brief historical past that we’ve seen this macro mix. Certainly, Bitcoin was solely launched in early 2009, which means it has resided throughout a interval of sustained up-only bull market dynamics. The historic pattern dimension of its worth motion merely isn’t lengthy sufficient to attract any agency conclusions, due to this fact.

The way in which I’d finally have a look at the Puell indicator is that Bitcoin appears primed to maneuver upward IF the macro surroundings cooperates. However that may be a severely large if. It has been the case all 12 months – and it’ll proceed to be the case – that macro developments are driving markets.

Bitcoin is following the inventory market, which is following the information within the inflation, rate of interest and geopolitical sectors. So whereas this can be a bullish on-chain indicator for Bitcoin, it means nothing till we get additional cooperation within the wider world.