Introduction

Stablecoins have come underneath elevated authorities and regulatory scrutiny as their international adoption has accelerated lately. Add to this the latest USD $40 billion collapse of the Tera/Luna stablecoin, and calls for his or her regulation have turn into more and more vocal.

Stablecoins Outlined

A stablecoin is outlined by the next traits:

· a singular type of cryptocurrency or digital foreign money

· blockchain-based

· pegged to/worth parity with a low volatility reserve/underlying asset

· worth of the stablecoin shouldn’t be primarily based upon forces of provide and demand

· international and borderless in its operation

· absence of a central financial institution

Stablecoin Goal

A stablecoin is designed to attain three (3) key objectives:

· a medium of change — secure change worth for different items and companies

· a retailer of worth — maintains its worth over time

· unit of account — exact measurement of unit

As well as, stablecoins are a programmable foreign money. They are often designed to cater for a myriad of wants, necessities and use instances.

Significance of Stablecoins

Stability within the worth of cash over time is key to significant financial planning and to facilitating commerce. Predictability of worth permits contracts and agreements to be denominated in a significant and dependable method.

Making use of this to cryptocurrencies which have been inherently risky and topic to a lot short-term hypothesis, the significance of stablecoins turns into readily obvious.

Stablecoin World Market Dimension

In line with CoinMarketCap, the World Market Cap for stablecoins was USD $221 Billion, with a each day buying and selling quantity of USD $128 Billion. The distinctive variety of stablecoins was 105. That is proven in Determine 1 beneath:

Determine 1: Stablecoin Market Capitalisation[1]

Rising Know-how

Are stablecoins an rising expertise?

Rotolo et al[2] outline “rising expertise” by way of a framework that features 5 (5) key attributes;

1. radical novelty

2. comparatively quick development

3. coherence

4. outstanding affect

5. uncertainty and ambiguity

1. Radical Novelty (ranking — 5/6)

Radical novelty for stablecoins was assessed via Google searches between 2018 and 2022 and by way of Google Scholar between 2017–2022, utilizing 2014 as a reference yr (the identical yr the Tether stablecoin was launched). The numerous curiosity that’s growing for stablecoins is clearly proven in Graph 1 and Desk 1 beneath:

Person-based Google Searches from 2018–2022

Graph 1: Google Searches for Stablecoins 2018–2022[4]

Scholar-based Printed Articles — Google Scholar

2. Comparatively Quick Rising (ranking — 5/6)

The data proven in Determine 3 beneath demonstrates the fast development in market capitalisation of a number of stablecoins. This development is very outstanding from October 2020 onwards.

Determine 3: Development in Market Capitalisation — Stablecoins[6]

3. Coherence (ranking — 4/6)

Coherence was measured in accordance with the variety of latest Google searches, the emergence of recent terminology to explain stablecoins and the variety of listed stablecoins at CoinMarketCap.

a) Google Search (twenty first July 2022) — 19,200,000 outcomes

b) Emergence of recent terminology to explain stablecoins:

· Commodity-backed — use a commodity reminiscent of valuable metals, diamonds and oil as a secure to protect worth in a centralised reserve

· Crypto-collateralised — use a (or basket) cryptocurrency or digital property as a reserve. Often held in good contracts.

· Fiat-collateralised — use a (or basket) fiat foreign money as a secure reserve. Tokens are normally issued on a 1:1 foundation of the underlying fiat worth

· Algorithmic/Non-collateralised/Seigniorage — an algorithm mechanically adjusts the availability of cash to stabilise the token worth. They don’t have any reserve collateral

· Central Financial institution Digital Currencies (CBDCs) — act as a tokenised illustration of a specified fiat foreign money

c) Variety of Stablecoins[7] — 105

4. Outstanding Impression (ranking — 5/6)

The Outstanding Impression of stablecoins is described as follows:

“A world stablecoin would revolutionise the worldwide financial system. It could promote larger entry to the monetary system globally.”[8]

Stablecoins, then again, would cut back central banks’ capability to regulate financial coverage.”[9]

Use Instances

The Outstanding Impression of Stablecoins is additional demonstrated by the myriad of use instances that derive from them as outlined in Determine 4 beneath:

Determine 4: Stablecoin Use Instances

5. Uncertainty and Ambiguity (ranking — 5/6)

Regulatory confusion and uncertainty has been used as a measure of Uncertainty and Ambiguity. That is confirmed by the next report from the Presidents Working Group (PWG)[10]:

“First, the PWG had bother defining a stablecoin. The report stated that “stablecoins, or sure elements of stablecoin preparations, could also be securities, commodities and/or derivatives.”[11]

It seems that the PWG report raises extra questions than it solutions.

_________________

Based mostly upon the evaluation of the 5 (5) key attributes, stablecoins could be categorised as an rising expertise.

Implications of Stablecoins — Moral, Financial and Authorized

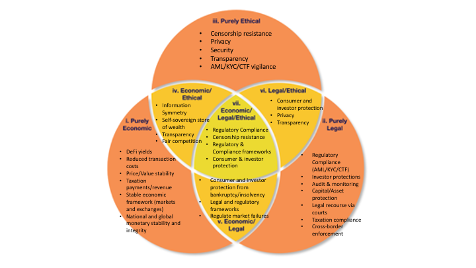

A number of the key concerns and implications relating to Stablecoins are outlined in Determine 5 beneath:

Determine 5: Moral, Authorized and Financial Mapping for Stablecoins[12]

Social Points and Dangers

A big proportion of customers have little understanding of cryptocurrencies and stablecoins[13]. This might probably expose them to unknown dangers and important monetary loss. With out correct asset reserves for stablecoin, the monetary dangers related to asset devaluation or collapse turn into very actual — lack of financial savings and investments resulting in monetary hardship.

A digital divide might develop between people who’re savvy and educated with regard to digital property, together with stablecoins. This might probably create information and wealth inequalities.[14]

Customers might start to alter their behaviour with regard to financial savings and wealth and select to maintain their property and wealth saved exterior the current fiat-based banking techniques. Customers might start to belief stablecoins over government-issued foreign money. A shift to stablecoins to be used as cash and fee mechanisms may de-stabilise nationwide financial techniques[15] and end result within the compromise of the operation of presidency and financial coverage.

Moral Points and Dangers

Stablecoin operators can nonetheless freeze digital accounts or entry to tokens and restrict their potential to be transferred or redeemed.[16]

Stablecoin operators maintain a accountability to forestall their stablecoin from getting used for illicit actions. Stablecoin issuers have a task to implement compliance requirements via KYC/AML/CTF processes and promotes safety in opposition to unlawful actions. Regulation nonetheless lags behind with regard to those necessities.

Stablecoin operators have an obligation and obligation to keep up token stability and buying energy. Unbiased, licensed audits of asset reserves that are clear to customers, traders, and regulators have to be established.

Authorized Points and Dangers

· shopper safety for information privateness, storage, and retention

· regulation and legal guidelines are required to determine reserve segregation and coin holder claims within the case of chapter or insolvency[17]

· regulatory compliance for capital asset safety and reserves may restrict the unfold of monetary contagion within the occasion of a stablecoin collapse and allow some safety for the integrity of monetary and financial techniques and for customers and traders[18]

· working throughout a number of jurisdictions and their international nature make it very troublesome to manage uniformly and restrict regulatory arbitrage — AML/KYC/CTF[19] and taxation

· troublesome to police and implement laws and compliance throughout multi-jurisdictional borders[20]

Regulation Outlined

“Regulation is any rule endorsed by authorities the place there’s an expectation of compliance.”[21]

In line with Lawrence Lessig “code is legislation”[22]. Lessig goes on to explain 4 (4) forces that which constrain actions in a regulatory context. These are code/structure, market, legislation and norms and are outlined beneath in Determine 6 for Stablecoins:

Determine 6: Lessig’s 4 Forces

Baldwin et al.[23] argue the time period ‘regulation’ is able to getting used within the following completely different senses:

• “As a particular set of instructions”[24]

• “As deliberate state affect together with using financial incentives (taxes or subsidies) contractual powers, deployment of sources, provide of knowledge”[25]

• “As all types of social or financial affect — the place all mechanisms affecting behaviour are deemed regulatory”[26]

Theories & Approaches to Regulation

Outlined beneath in Determine 7 are the assorted theories and approaches to regulation:

Determine 7: Theories and Approaches to Regulation[27]

As governments, policymakers, and regulators grapple with new regulatory challenges introduced by rising applied sciences, 4 key questions are important to addressing this[28]:

· What’s the present state of regulation within the space?

· What’s the suitable time to manage?

· What’s the suitable strategy to regulation?

· What has modified since laws had been first enacted?

The 4 key questions are depicted graphically beneath in Determine 8:

Determine 8: The 4 Key Questions[29]

Regulatory Challenges

“Within the wake of those developments, regulatory leaders are confronted with a key problem: the way to finest shield residents, guarantee truthful markets, and implement laws, whereas permitting these new applied sciences and companies to flourish?”[30]

These regulatory challenges are depicted beneath in Determine 10:

Determine 10: Challenges to conventional regulation[31]

Within the face of rising applied sciences reminiscent of stablecoins, conventional regulatory frameworks will come underneath elevated stress to adapt and alter. New forms of regulatory frameworks are outlined beneath in Determine 11:

Determine 11: Rules for the way forward for regulation

Australian Regulation — Stablecoins

The Council of Monetary Regulators (CFR) is the coordinating physique for Australia’s primary monetary regulatory companies and contains the Australian Prudential Regulation Authority (APRA), the Australian Securities and Investments Fee (ASIC), the Reserve Financial institution of Australia (RBA), and The Treasury.

The CFR[32] has established a working group to contemplate the applying of current laws to stablecoins. Its key goals[33] are to:

· “establish key forms of stablecoin preparations that would have an effect on the Australian monetary system or Australian customers”[34]

· “assess how these preparations could be handled underneath current regulatory frameworks”[35]

· “develop suggestions to deal with rising regulatory gaps and dangers”[36]

· “present a discussion board to share data and coordinate Australian contributions on worldwide work associated to stablecoins”[37]

Conclusion

With the latest fast development and adoption of stablecoins globally, this rising expertise presents regulatory our bodies and governments throughout the globe with a serious headache. Stablecoins characterize quite a few points and dangers when thought-about from a social, moral, and authorized perspective.

Stablecoins are distinctive in that they transcend sovereign borders making coordination and cooperation for the needs of regulation, laws, taxation, monitoring, and cross-border enforcement very troublesome. Add to this the objectives of defending customers, traders, and nationwide and international monetary market integrity and stopping or limiting potential stablecoin monetary contagion (e.g. Terra Luna), this activity appears virtually insurmountable.

Clearly, new methods of regulating and legislating for stablecoins will quickly be required.

[1] CoinMarketCap, High Stablecoin Tokens by Market Capitalization (twenty first July 2022) (Net Web page) < https://coinmarketcap.com/view/stablecoin/>.

[2] Daniel Rotolo, Diana Hicks and Ben Martin, What’s an rising expertise? (2015) Analysis Coverage 44, 1839.

[3] Royal Melbourne Institute of Know-how, LAW 2571 Legislation and Coverage for Rising Applied sciences (July-Dec 2022) 3.1.2 Traits of rising expertise.

[4] Google, Google Traits: Stablecoins (twenty second July 2022) (Net Web page) <https://developments.google.com/developments/discover?date=2018-07-01percent202022-07-21&q=stablecoins>.

[5] Google, Google Scholar: Stablecoins (twenty second July 2022) (Net Web page) <https://scholar.google.com.au/scholar?hl=en&as_sdt=0percent2C5&q=stablecoins&btnG=>.

[6] statista, Market capitalization of the ten greatest stablecoins from January 2017 to June 19, 2022 (twenty second July 2022) (Net Web page) <https://www.statista.com/statistics/1255835/stablecoin-market-capitalization/>.

[7] CoinMarketCap, High Stablecoin Tokens by Market Capitalization (twenty second July 2022) (Net Web page) <https://coinmarketcap.com/view/stablecoin/>.

[8] Aakriti Shoree, Paths to the Future: What Stablecoins and the CBDC Imply for the World Monetary System (ninth Could 2022) UNSW Sydney <https://www.unsw.edu.au/information/2022/05/what-stablecoins-and-the-cbdc-mean-for-the-global-financial-system>.

[9] Ibid.

[10] Presidents Working Group on Monetary Markets, Federal Deposit Insurance coverage Company, Workplace of the Comptroller, Report on Stablecoins (November 2021) U.S. Division of the Treasury < https://dwelling.treasury.gov/system/information/136/StableCoinReport_Nov1_508.pdf>.

[11] Jan van Eck, What the Authorities’s Suggestions for Stablecoins Received Fallacious, and Learn how to Do Higher (ninth February 2022) Barron’s <https://www.barrons.com/articles/what-the-governments-recommendations-for-stablecoins-got-wrong-and-how-to-do-better-51644419137>.

[12] Royal Melbourne Institute of Know-how, LAW 2571 Legislation and Coverage for Rising Applied sciences (July-Dec 2022) 1.2.4 Authorized.

[13] Nicolas Vega, Greater than 1 in 3 cryptocurrency traders know little to nothing about it, survey finds (4th March 2021) CNBC <https://www.cnbc.com/2021/03/04/survey-finds-one-third-of-crypto-buyers-dont-know-what-theyre-doing.html>.

[14] David DiMolfetta, Crypto advocates warn of recent digital divide as regulators start inquiries (fifth Could 2022) S&P World Market Intelligence <https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/crypto-advocates-warn-of-new-digital-divide-as-regulators-begin-inquiries-69819590>.

[15] Victoria Guida, Treasury, Fed worry stablecoins may disrupt monetary system (twentieth September 2021) (Net Web page) Politico <https://www.politico.com/information/2021/09/20/stablecoin-cryptocurrency-regulation-513209>.

[16] Brett Hemenway Falk, Sarah Hammer, Meltdown within the Wild West: The Stablecoin Collapse of 2022 and Client Safety Concerns (2nd June 2022) SSRN <https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4119627>.

[17] Christian Catalini and Jai Massari, Stablecoins and the Way forward for Cash (tenth August 2021) Harvard Enterprise Overview < https://hbr.org/2021/08/stablecoins-and-the-future-of-money>.

[18] Worldwide Financial Fund, World Monetary Stability Report: COVID-19, Crypto, and Local weather: Navigating Difficult Transitions (October 2021) Worldwide Financial Fund, 44 < https://www.imf.org/en/Publications/GFSR/Points/2021/10/12/global-financial-stability-report-october-2021>.

[19] Anti-Cash Laundering and Counter-Terrorism Financing Act 2006 (Cth).

[20] World Financial Discussion board, Navigating Cryptocurrency Regulation: An Business Perspective

on the Insights and Instruments Wanted to Form Balanced Crypto Regulation (September 2021) World Financial Discussion board, World Future Council on Cryptocurrencies, 7–8 < https://www3.weforum.org/docs/WEF_Navigating_Cryptocurrency_Regulation_2021.pdf>.

[21] Australian Authorities, Division of the Prime Minister and Cupboard, Regulatory Impression Evaluation (RIC) Huge Open On-line Course (MOOC) (Net Web page) <https://www.pmc.gov.au/ria-mooc/introduction/what-do-we-mean-regulation>.

[22] Lawrence Lessig, Code and different legal guidelines of our on-line world (New York, Fundamental Books, 1999).

[23] Robert Baldwin, Martin Cave and Martin Lodge, Understanding Regulation: Idea, Technique, and Follow, (Oxford College Press 2012) 3.

[27] Royal Melbourne Institute of Know-how, LAW 2571 Legislation and Coverage for Rising Applied sciences (July-Dec 2022) 2.2.1 — Public curiosity principle.

[28] William Eggers, Mike Turley and Pankaj Kamleshkumar Kishnani, The way forward for regulation. Rules for regulating rising expertise (nineteenth June 2018) Deloitte Centre for Authorities Insights evaluation. Deloitte Insights <https://www2.deloitte.com/us/en/insights/trade/public-sector/future-of-regulation/regulating-emerging-technology.html>.

[29] William Eggers, Mike Turley and Pankaj Kamleshkumar Kishnani, The way forward for regulation. Rules for regulating rising expertise (nineteenth June 2018) Deloitte Centre for Authorities Insights evaluation. Deloitte Insights <https://www2.deloitte.com/us/en/insights/trade/public-sector/future-of-regulation/regulating-emerging-technology.html>.

[31] William Eggers, Mike Turley and Pankaj Kamleshkumar Kishnani, The way forward for regulation. Rules for regulating rising expertise (nineteenth June 2018) Deloitte Centre for Authorities Insights evaluation. Deloitte Insights <https://www2.deloitte.com/us/en/insights/trade/public-sector/future-of-regulation/regulating-emerging-technology.html>.

[32] Council of Monetary Regulators, Regulation of Saved-value Services in Australia (October 2019)

<https://www.cfr.gov.au/publications/policy-statements-and-other-reports/2020/regulation-of-stored-value-facilities-in-australia/pdf/report.pdf>.

[33] Australian Securities and Funding Fee, Senate Choose Committee on Australia as a Know-how and Monetary Centre: Third points paper (July 2021) 7 <https://asic.gov.au/media/cmvhlkeg/selectcommitteeausfintechcent-asic-submission-july-2021.pdf>.

Nathan van den Bosch is a Behavioural Economist, Tokenomics Specialist and Blockchain Strategist, with greater than 30 years of expertise in rising and disruptive applied sciences. Nathan has levels in Economics, Commerce, Behavioural Economics and Utilized Blockchain.

Nathan specialises in designing the reward and incentive schemas for gamified metaverses, digital ecosystems and digital economies. His focus relies upon understanding the behavioural drivers that spur adoption and sustained utilization in blockchain-based community environments.