Alternate move metrics are used to evaluate investor sentiment and habits. Inflows into exchanges normally denote token holders cashing out income. Whereas outflows usually relate to holders transferring tokens off exchanges for long-term storage.

Each inflows and outflows have tapered off considerably from November 2021 market highs, with inflows seeing essentially the most important change by sinking to multi-year lows.

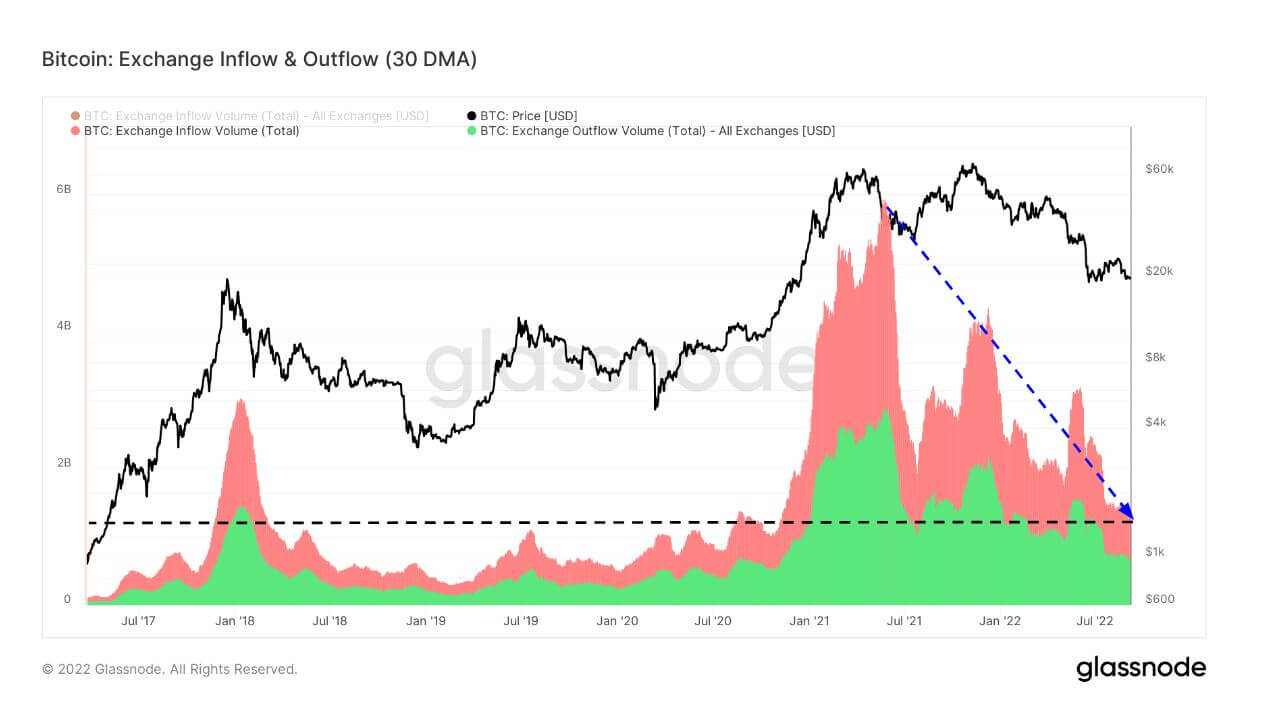

Bitcoin Alternate Influx and Outflow

Alternate influx and outflow present the full quantity of Bitcoin transferred to and from alternate wallets in USD. The chart beneath reveals that over a 30-day transferring common, inflows have exceeded outflows constantly since mid-2017. That is anticipated habits in a bull cycle as sensible cash holders ship BTC to exchanges to money out income.

For the reason that November 2020 market high, this disparity has been significantly noticeable, with inflows considerably outpacing outflows culminating in a June 2021 peak of roughly $6 billion.

Nevertheless, since that peak, inflows have markedly dropped off, matching covid crash ranges seen in July 2020.

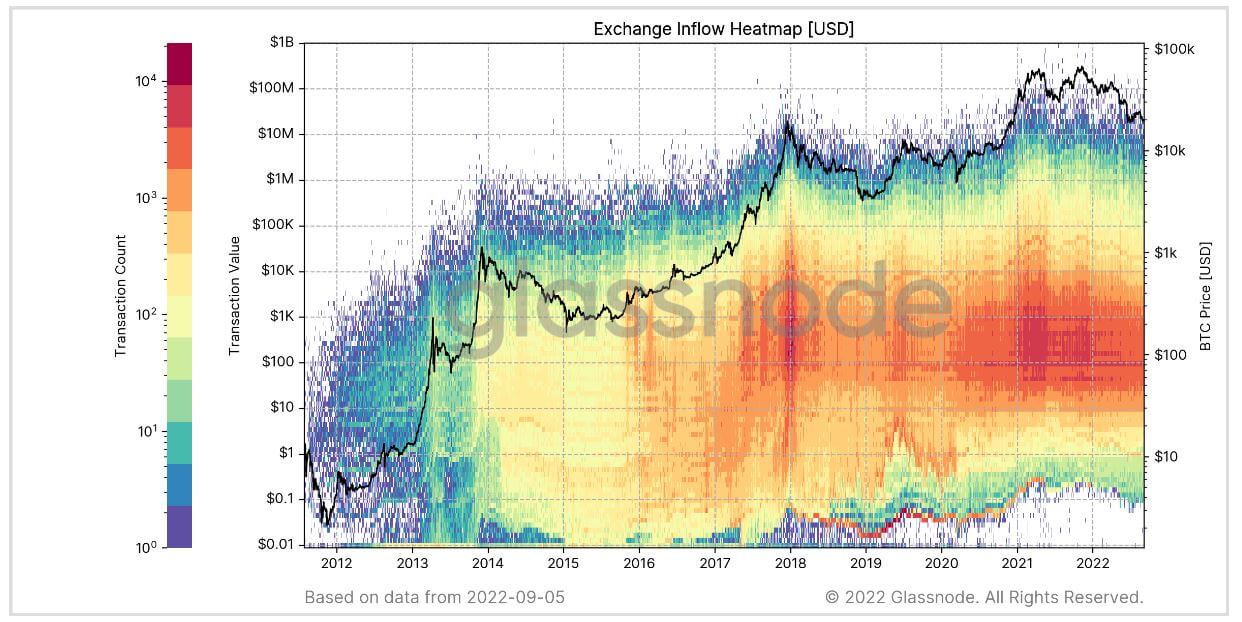

Alternate Influx Heatmap

Heatmaps present a breakdown of the full switch quantity despatched to and withdrawn from exchanges in USD.

The left y-axis represents the scale of particular person transaction quantity in USD. The colour represents the variety of transactions in every of the 100 quantity buckets. On the similar time, the best y-axis reveals the Bitcoin value in USD on a logarithmic scale. Alongside the underside x-axis is time.

The chart beneath reveals excessive influx quantity occurring through the December 2017 earlier bull cycle peak. Equally, this sample performed out throughout Bitcoin’s double high, when its value hit $64,000 and $69,000 in March 2021 and November 2021, respectively.

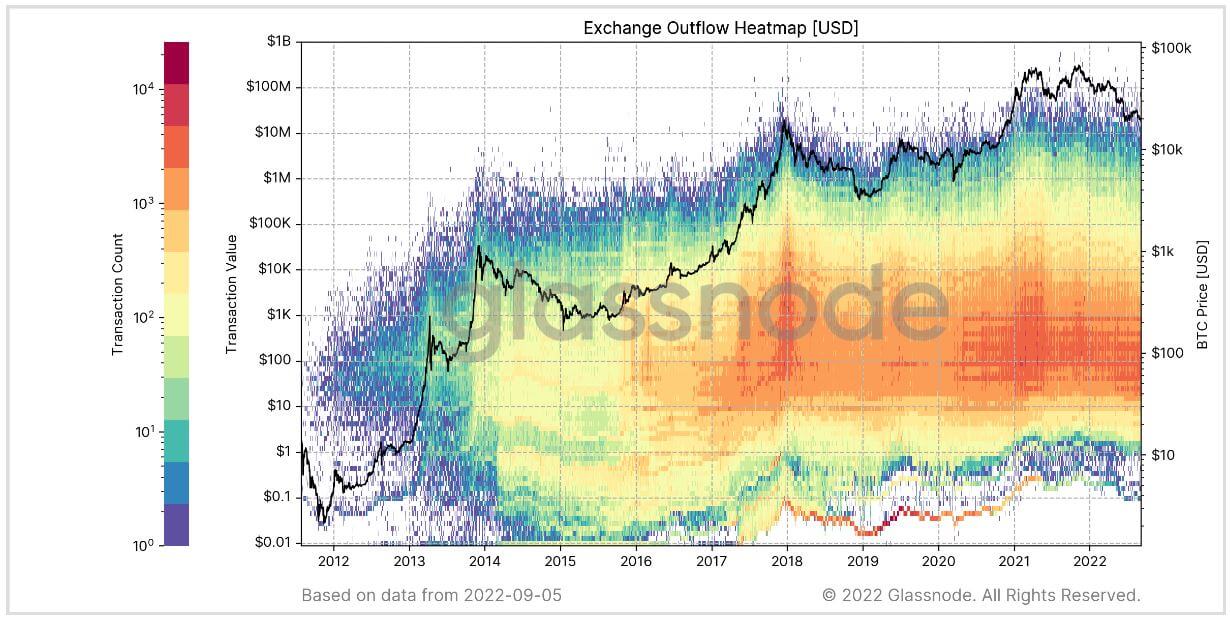

Alternate Outflow Heatmap

Token outflows comply with an analogous sample to inflows, with peak transaction counts occurring in December 2017, March 2021, and November 2021.

Taken at the side of earlier observations, this implies that short-term holders purchased Bitcoin closely throughout each bull cycle peaks whereas long-term holders have been promoting on the high.