We’ve spent the previous a number of weeks of this article wading into deep technical and philosophical debates round way forward for Ethereum – with subjects starting from maximal extractable worth (MEV), to the specter of censorship on Ethereum, to what makes a ‘true’ zero-knowledge Ethereum Digital Machine, or zkEVM.

However now, in the end, the Ethereum Merge is lastly across the nook. This week, I’d prefer to take a step again and shortly tackle a number of of the myths and misconceptions which have popped up surrounding the Merge, Ethereum’s transition to proof-of-stake scheduled for round Sept. 15.

I’d additionally prefer to request enter from the Legitimate Factors Group. When you’ve got any questions that aren’t answered within the FAQ – irrespective of how technical – please ship them to sam.kessler@coindesk.com.

Will Ethereum charges lower after the Merge?

Ethereum transaction charges should not anticipated to alter on account of the Merge. Future community updates, like danksharding and proto-danksharding, could assist to deal with Ethereum’s excessive community charges, however these updates should not anticipated till 2023 on the earliest.

The primary salve for Ethereum’s transaction price woes stays rollups – third-party networks like Arbitrum and Optimism that bundle transactions and course of them individually from Ethereum’s mainnet.

Will Ethereum transaction speeds enhance after the Merge?

On common, Ethereum blocks are issued as soon as each 13 or 14 seconds in in the present day’s proof-of-work (PoW) system. After the merge, proof-of-stake (PoS) blocks can be issued in common 12-second intervals. This isn’t an enchancment that the majority customers will discover, and it nonetheless locations Ethereum behind rival blockchain networks like Solana and Avalanche (although properly forward of Bitcoin, the place a brand new block is mined each 10 minutes on common).

Identical to with transaction charges, these in search of improved transaction speeds might want to look to Ethereum’s third-party rollups.

Will the Merge enhance the value of ether (ETH)?

With so many variables and unknowns, it’s not possible to foretell what’s going to occur to Ethereum’s token value on account of the Merge.

The Ethereum neighborhood has for years positioned the Merge as an enormous improve to the community’s core expertise. Together with addressing considerations concerning the community’s environmental influence, PoS will introduce a brand new type of utility for Ethereum’s native ether (ETH) token within the type of staking.

However the Merge is just not assured to spice up the ETH value. The Merge may even introduce adjustments to the speed at which ether is issued and the way it’s distributed. These adjustments may very well be optimistic or unfavourable relying upon whom you ask. There may be additionally a threat (nonetheless small) that the Merge will fail, or that PoS will show much less safe than PoW.

There may be additionally hypothesis the Merge has already been priced in by the market.

Is proof-of-stake higher than proof-of-work?

In response to the Ethereum Basis, the nonprofit that funds Ethereum ecosystem growth, PoS will reduce Ethereum’s power utilization by round 99.95%. PoS advocates additionally argue that PoW mining centralizes management within the palms of those that can afford to purchase fancy crypto mining rigs, referred to as ASICs. They are saying PoS – which palms community management to those that “stake” crypto with the community – makes assaults economically infeasible and self-defeating.

PoW proponents counter that PoS staking carries its personal centralization and safety dangers, making it attainable for malicious actors to instantly “purchase” management of the community. In addition they level out that PoS is a much less battle-tested system than PoW, which has confirmed resilient because the spine of the 2 largest blockchain networks.

When is the Merge occurring?

Why no laborious date? Every block on Ethereum’s PoW community carries an issue quantity representing how laborious miners should work so as to add it to the community. As an alternative of kicking in at a particular date, the Merge is scheduled to take impact as soon as the cumulative problem of all mined Ethereum blocks hits a sure quantity – the “whole terminal problem” (TTD).

In August, Ethereum’s core builders set the TTD at 58,750,000,000,000,000,000,000, which can be reached someday round Sept. 14 or 15. We solely have an estimate as a result of block problem and issuance charge differ over time.

Will Ethereum charges lower after the Merge?

Ethereum transaction charges should not anticipated to alter on account of the Merge. Future community updates, like danksharding and proto-danksharding, could assist to deal with Ethereum’s excessive community charges, however these updates should not anticipated till 2023 on the earliest.

The primary salve for Ethereum’s transaction price woes stays rollups – third-party networks like Arbitrum and Optimism that bundle up transactions and course of them individually from Ethereum’s mainnet.

Will Ethereum transaction speeds enhance after the Merge?

On common, Ethereum blocks are issued as soon as each 13 or 14 seconds in in the present day’s PoW system. After the Merge, PoS blocks can be issued in common 12-second intervals. This isn’t an enchancment that the majority customers will discover, and it nonetheless locations Ethereum behind rival blockchain networks like Solana and Avalanche (although properly forward of Bitcoin, the place a brand new block is mined each 10 minutes on common).

Identical to with transaction charges, these in search of improved transaction speeds might want to look to Ethereum’s third-party rollups.

Will the Merge enhance the value of ether (ETH)?

With so many variables and unknowns, it’s not possible to foretell what’s going to occur to Ethereum’s token value on account of the Merge.

The Ethereum neighborhood has for years positioned the Merge as an enormous improve to the community’s core expertise. Together with addressing considerations concerning the community’s environmental influence, PoS will introduce a brand new type of utility for Ethereum’s native ether (ETH) token within the type of staking.

However the Merge is just not assured to spice up the ETH value. The Merge may even introduce adjustments to the speed at which ether is issued and the way it’s distributed. These adjustments may very well be optimistic or unfavourable relying upon whom you ask. There may be additionally a threat (nonetheless small) that the Merge will fail, or that PoS will show much less safe than PoW.

There may be additionally hypothesis that the Merge has already been priced-in by the market.

Can I change into an Ethereum validator or staker?

Sure, you probably have some ETH.

It’s already attainable to “stake” 32 ether and earn rewards for validating Ethereum’s PoS Beacon Chain. Staked ether will accrue community rewards, however it will likely be not possible to withdraw till an replace anticipated round six to 12 months after the Merge.

Staking requires some know-how; in case you screw up or go offline, your stake could be “slashed” (ie, decreased).

These with much less blockchain experience can stake through centralized providers like these supplied by Coinbase (COIN) or Kraken. Along with dealing with the technical nitty-gritty, these providers – in change for a reduce of customers’ rewards – open up staking to these with lower than 32 ETH.

Additionally widespread for these with lower than 32 ETH are liquid staking swimming pools like Lido and Rocket Pool. When customers stake through these providers, they’re handed “staked ETH” tokens which commerce at a slight low cost to common ETH.

What is going to occur to staked ether after the Merge?

Staked ether will keep locked up with the community till round six to 12 months after the Merge.

At that time, those that have staked ether themselves will be capable to withdraw their stake, together with no matter rewards it has accrued.

Those that stake through centralized staking providers or swimming pools might want to preserve a watch out for bulletins on how withdrawals can be dealt with.

Will Ethereum customers or ETH holders must take any motion after the Merge?

For those who maintain ether (ETH) in the present day, you received’t want to assert new “PoS ETH” or “ETH2” tokens. Your steadiness will stay precisely the identical after the Merge, and also you’ll be capable to resume utilizing the community as if nothing has modified.

Whereas Ethereum customers won’t must take any motion come the Merge, Ethereum software program suppliers and node operators (the computer systems that function the Ethereum community) might want to replace their software program to make sure they’re speaking with the most recent model of the community.

What’s all this noise about PoW “forks”? Will I obtain free cash if I maintain ETH?

Some Ethereum miners, reluctant to let go of the community’s previous consensus mechanism, have introduced plans to “fork,” or kind a splinter community from Etheruem’s PoW chain. From what we are able to inform to date, these miners intend to simply clone the primary blockchain – balances and all – and proceed working their very own PoW variations of Ethereum post-Merge.

For those who maintain ETH earlier than the Merge, chances are you’ll mechanically obtain a steadiness of tokens on these new PoW forks. The method of claiming these tokens will differ relying on the chain. For those who maintain ETH on a centralized change like Coinbase, the change might want to record forked tokens so as so that you can declare your share (and it’s in no way clear if they may).

However patrons beware. Some forked ether tokens may need worth instantly following the Merge, however leaders within the Ethereum neighborhood warn that PoW Ethereum forks will simply be thinly-veiled money grabs.

Sure, however it’s unlikely.

Ethereum’s transition from proof-of-work to proof-of-stake will mark the primary experiment of its sort. If the Merge succeeds, it can signify an enormous feat of engineering and human coordination. If it fails, it dangers wiping out lots of of billions of {dollars} in worth (ether’s market cap is near $200 billion, and lots of different precious tokens are constructed on prime of the community).

The Merge is just now transferring ahead as a result of its core builders and different stakeholders have run by means of over a dozen profitable checks and Merge simulations (see: shadow forks and testnet Merges). There’s nonetheless an opportunity that the Merge would possibly fail, however such an final result appears extraordinarily unlikely.

Will the Ethereum community “pause” on account of the Merge?

The Merge will occur instantaneously after the ultimate PoW block is mined. From that time ahead, the community will proceed to function with the issuance of the primary PoS block.

Ethereum customers won’t must take any motion to improve to the PoS chain.

What’s on the Ethereum roadmap after the Merge?

After the Merge, Ethereum’s core builders will proceed engaged on the open-source community as they did earlier than, with enhancements to community charges, speeds and safety slated for the months and years forward.

One focus for builders post-Merge can be sharding, which goals to broaden Ethereum’s transaction throughput and reduce its charges by spreading community exercise throughout a number of “shards” – virtually like lanes on a freeway. (Updates of this type have been initially slated to accompany the Merge – initially referred to as “Ethereum 2.0,” or “ETH2” – however have been deprioritized with the success of third-party rollups at addressing a few of the similar issues).

What occurs to proof-of-work miners after the Merge?

After the Merge, Ethereum miners – lots of whom have invested in fancy mining-optimized computer systems – can be unable to mine new blocks on the community. Many miners will abandon mining and “stake” ether to earn rewards on the PoS community.

For individuals who want to put their mining {hardware} to continued use, they’ll want to maneuver to a different proof-of-work community, like Ethereum Traditional.

After the Ethereum Merge, some miners additionally plan to create a “forked” model of the proof-of-work blockchain – mainly, a clone of the blockchain that also runs utilizing the previous miner-friendly system. It’s unclear whether or not these chains will acquire sufficient traction to change into profitable for miners in the long run.

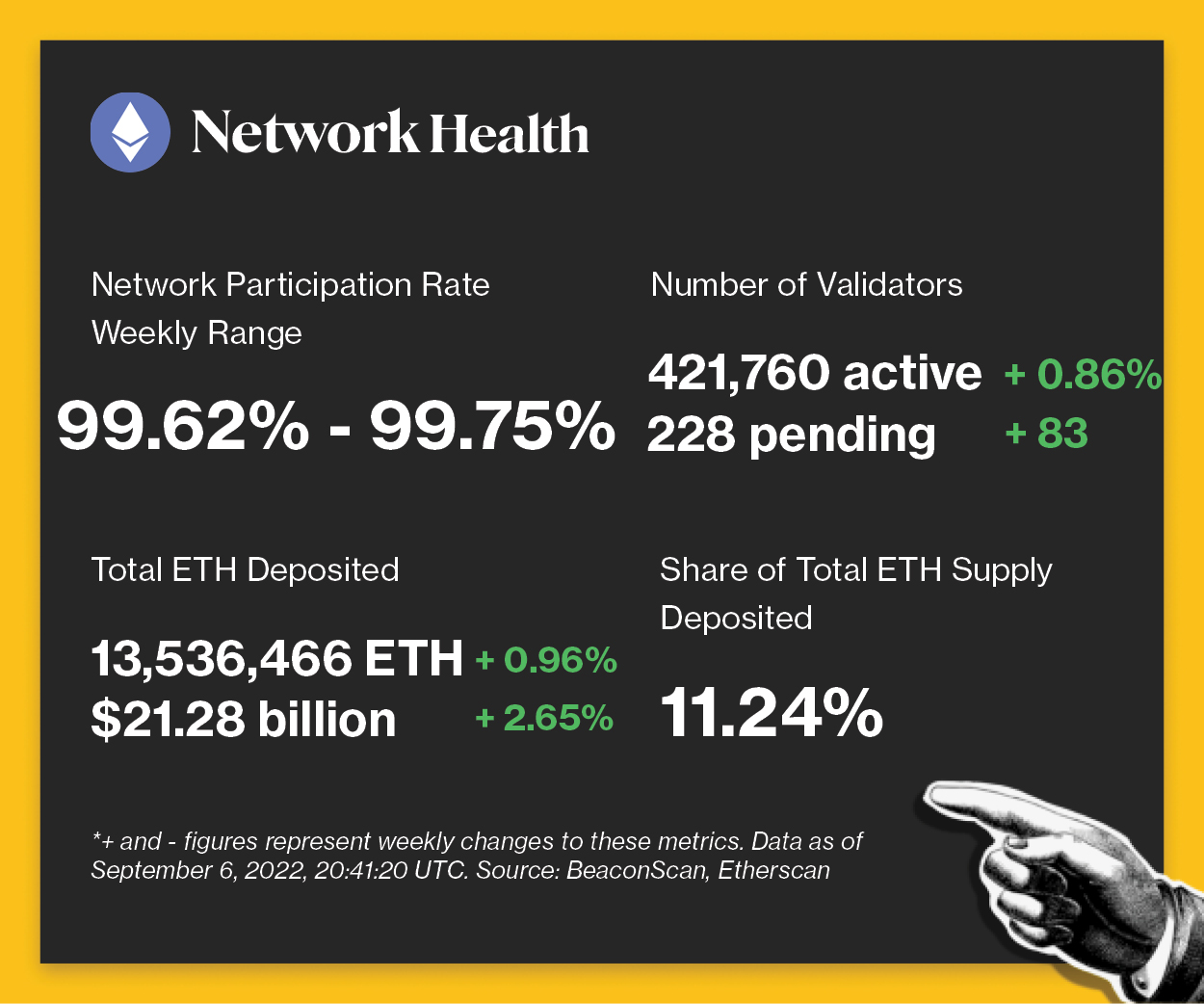

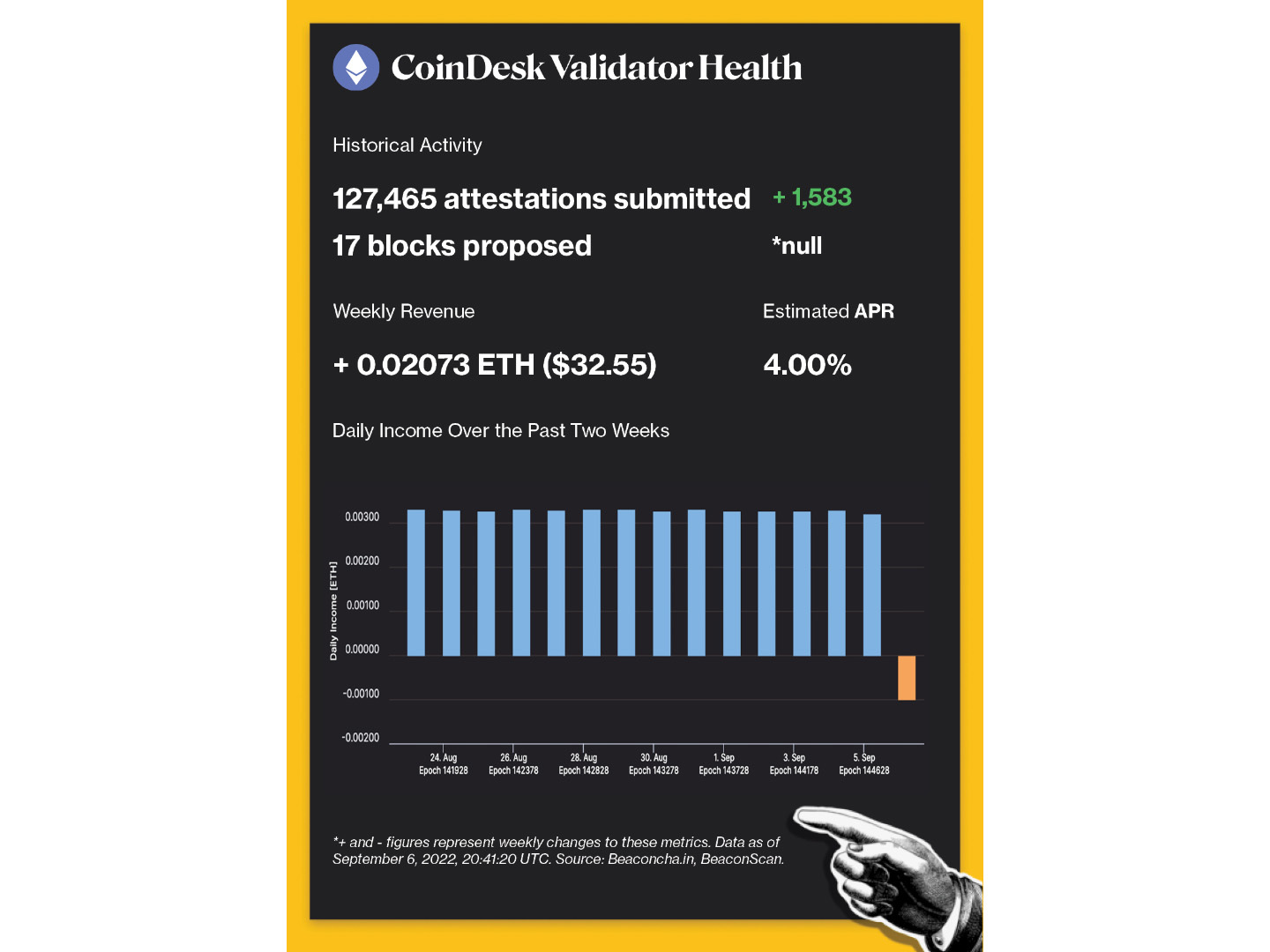

The next is an summary of community exercise on the Ethereum Beacon Chain over the previous week. For extra details about the metrics featured on this part, try our 101 explainer on Eth 2.0 metrics.

Community Well being

CoinDesk Validator Well being

Disclaimer: All income constructed from CoinDesk’s Eth 2.0 staking enterprise can be donated to a charity of the corporate’s selecting as soon as transfers are enabled on the community.

-

WHY IT MATTERS: Binance, the issuer of the third-biggest stablecoin and the world’s largest cryptocurrency change, each by quantity, mentioned it can convert all investments in USDC into its Binance USD (BUSD) token on Sept. 29. After the date, prospects transferring their USDC to Binance will see the tokens be mechanically transformed into Binance’s stablecoin. Nevertheless, prospects will be capable to withdraw cash denominated in USDC. USDC’s $52 billion market worth leads BUSD’s $19 billion. Learn extra right here.

-

WHY IT MATTERS: Activated on Tuesday, the Bellatrix improve is the community’s closing “laborious fork” earlier than the Merge. The activation of the Bellatrix improve on the Ethereum blockchain triggers the start of the Merge, which can seemingly be accomplished someday round Sept. 13-16. It prepares Ethereum’s proof-of-stake Beacon Chain – additionally referred to as its Consensus layer – for a Merge with Ethereum’s mainnet Execution layer. Learn extra right here.

-

WHY IT MATTERS: Between Aug. 30 and Sept. 2, the Aave neighborhood overwhelmingly voted to cease loaning ether, setting apart democratized finance’s free market precept to mitigate protocol-wide dangers which will come up from crypto merchants betting on the Merge, Ethereum blockchain’s upcoming technological overhaul. “Forward of the Ethereum Merge, the Aave protocol faces the chance of excessive utilization within the ETH market. Quickly pausing ETH borrowing will mitigate this threat of excessive utilization,” the proposal highlighted by analysis agency Block Analitica mentioned. Learn extra right here.

Factoid

Legitimate Factors incorporates data and information about CoinDesk’s personal Ethereum validator in weekly evaluation. All income constructed from this staking enterprise can be donated to a charity of our selecting as soon as transfers are enabled on the community. For a full overview of the undertaking, try our announcement publish.

You may confirm the exercise of the CoinDesk Eth 2.0 validator in actual time by means of our public validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Seek for it on any Eth 2.0 block explorer web site.

DISCLOSURE

Please notice that our privateness coverage, phrases of use, cookies, and don’t promote my private data has been up to date.

The chief in information and knowledge on cryptocurrency, digital property and the way forward for cash, CoinDesk is a media outlet that strives for the best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an unbiased working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups. As a part of their compensation, sure CoinDesk workers, together with editorial workers, could obtain publicity to DCG fairness within the type of inventory appreciation rights, which vest over a multi-year interval. CoinDesk journalists should not allowed to buy inventory outright in DCG.