Bitcoin’s extremely unstable value has devastated the vast majority of the crypto market and is now dragging miners down with it. Whereas typically thought-about the muse of the Bitcoin community and its most resilient gamers, miners are affected by quickly lowering revenue margins.

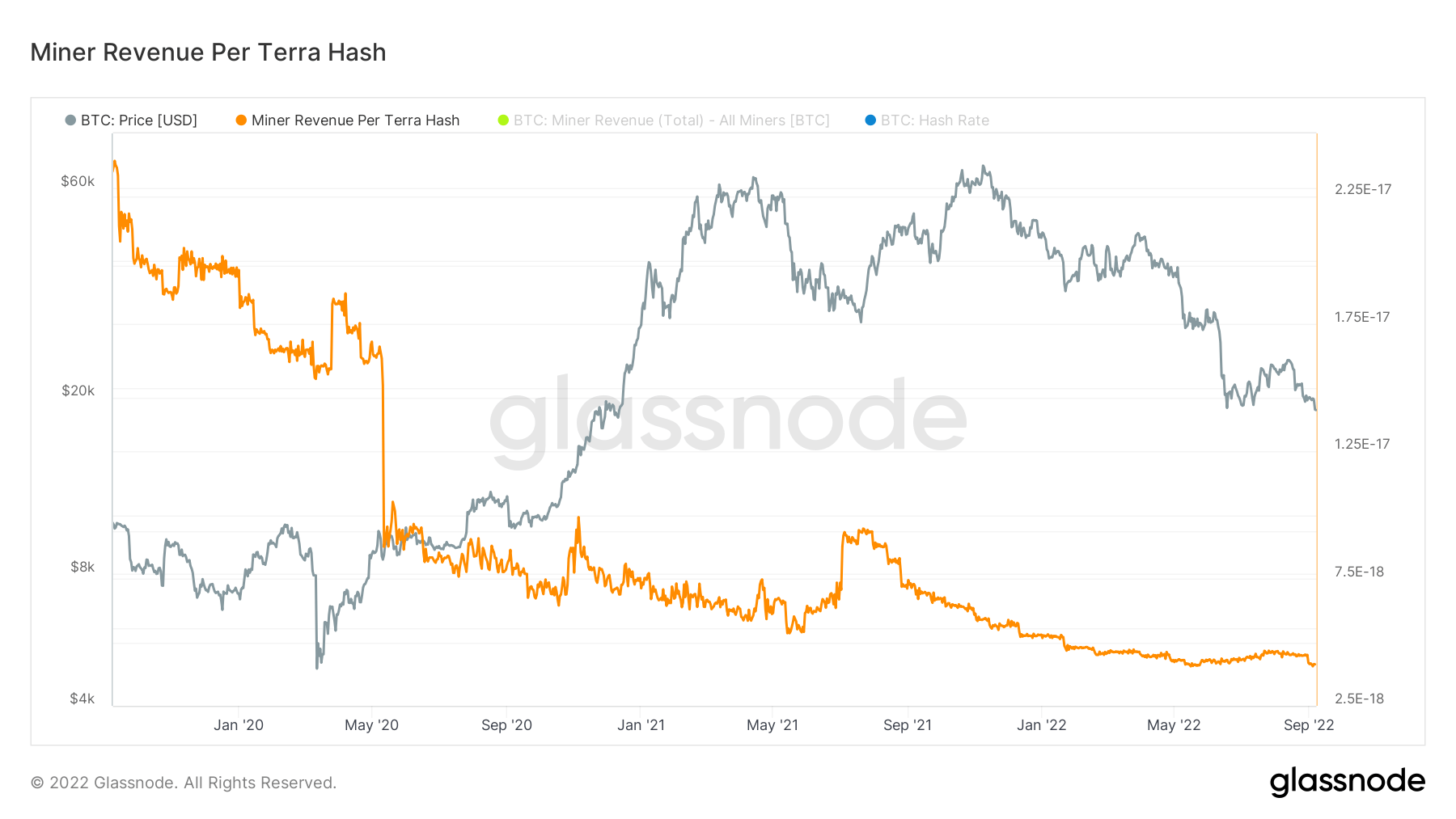

Bitcoin mining issue at present stands at simply 1% beneath its all-time excessive and is squeezing a big proportion of miners out of the community. Mining profitability is about to succeed in one in every of its lowest factors, as mining income per terra hash dropped beneath $5,000 firstly of September.

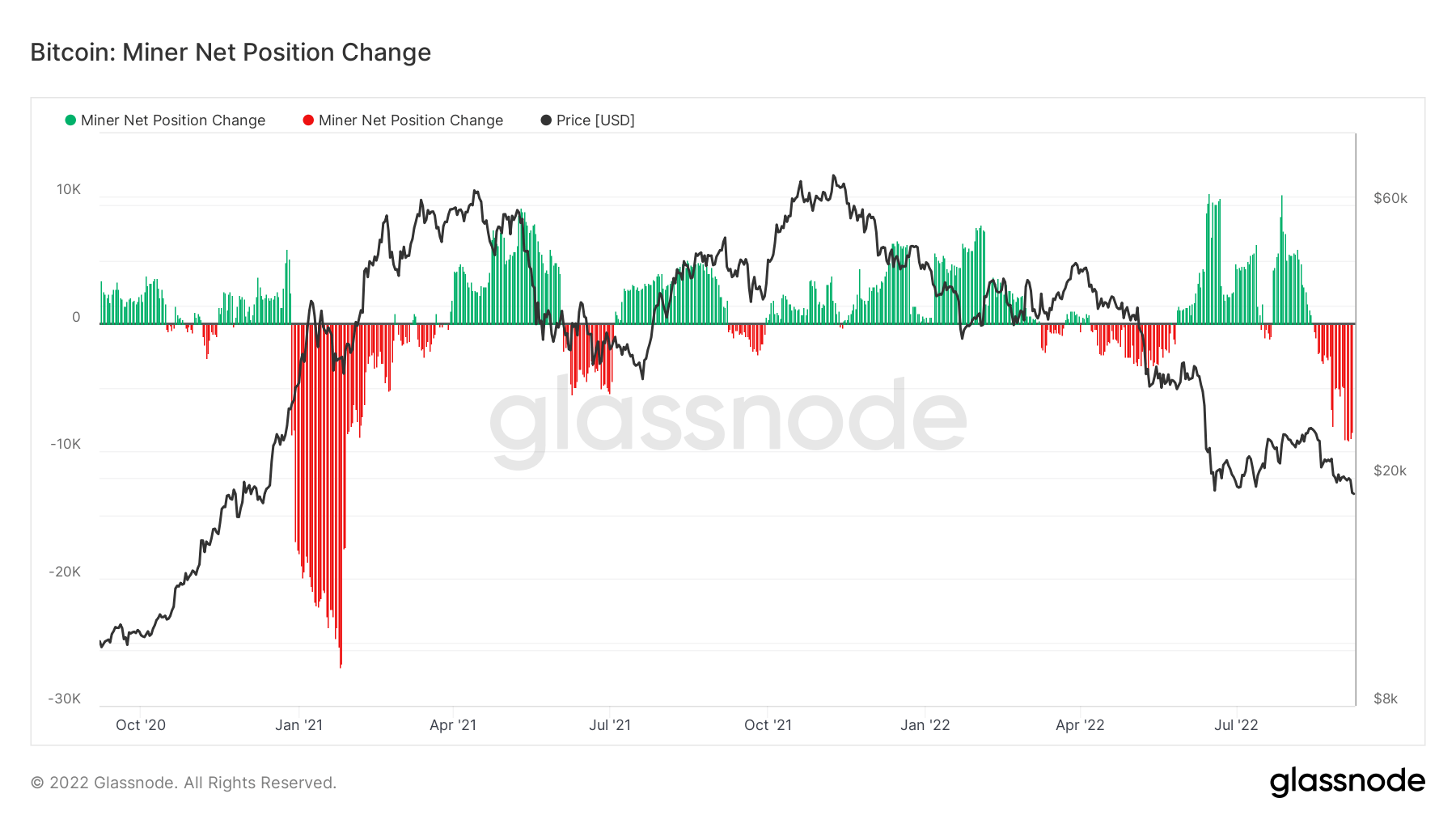

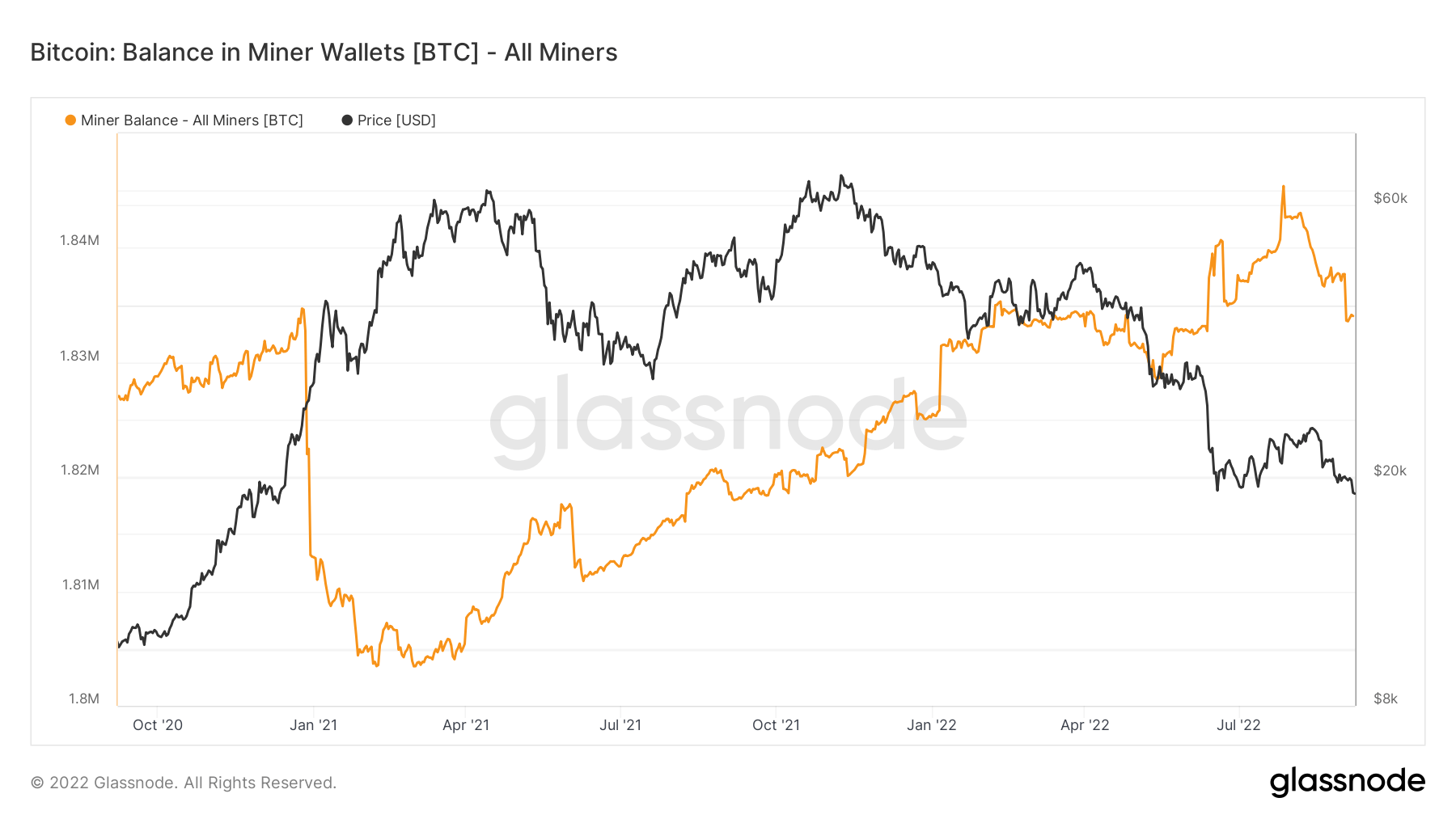

Confronted with elevated mining issue and lowering profitability, miners have been pressured to promote their Bitcoin holdings en masse. Miners bought over 12,000 BTC since July when the entire Bitcoin provide held in miner addresses reached its peak of 1.84 million BTC.

Information from Glassnode has proven {that a} comparable capitulation occurred in November 2021 when Bitcoin reached its all-time excessive. On the time, miners bought round 30,000 BTC. If miners observe an analogous sample all through the autumn, we may see a fair greater sell-off within the coming weeks.

Whereas hash ribbons present that the worst of the capitulation is over, shrinking miner balances paint a unique image.

Nevertheless, the huge sell-off we’ve seen previously two months may really be good for Bitcoin in the long term. Whereas brutal, fluctuations in mining profitability purge the community from unprofitable operations and weak miners unable to bear the volatility. When the market stabilizes, the Bitcoin community will probably be left standing on the shoulders of probably the most resilient and most worthwhile miners — strengthening it for future cycles and volatility.