Probably the most coated criticisms of Ethereum since its creation in 2015 has been its mammoth vitality utilization.

Whereas not as heavy as Bitcoin, it nonetheless consumes 0.2% of the world’s electrical energy, and is chargeable for between 20% and 39% of cryptocurrency’s electrical energy consumption as an entire (Bitcoin claims between 60% and 70%).

Now – and going ahead – that vitality consumption has fallen 99.95% following the profitable completion of the Merge. It’s an unimaginable achievement.

What’s the Ethereum PoW token?

Miners will thus have to search out one other coin to mine. Nevertheless, some are clinging to hope {that a} fork of Ethereum will keep the Proof-of-Work validation consensus which is able to enable them to proceed to mine.

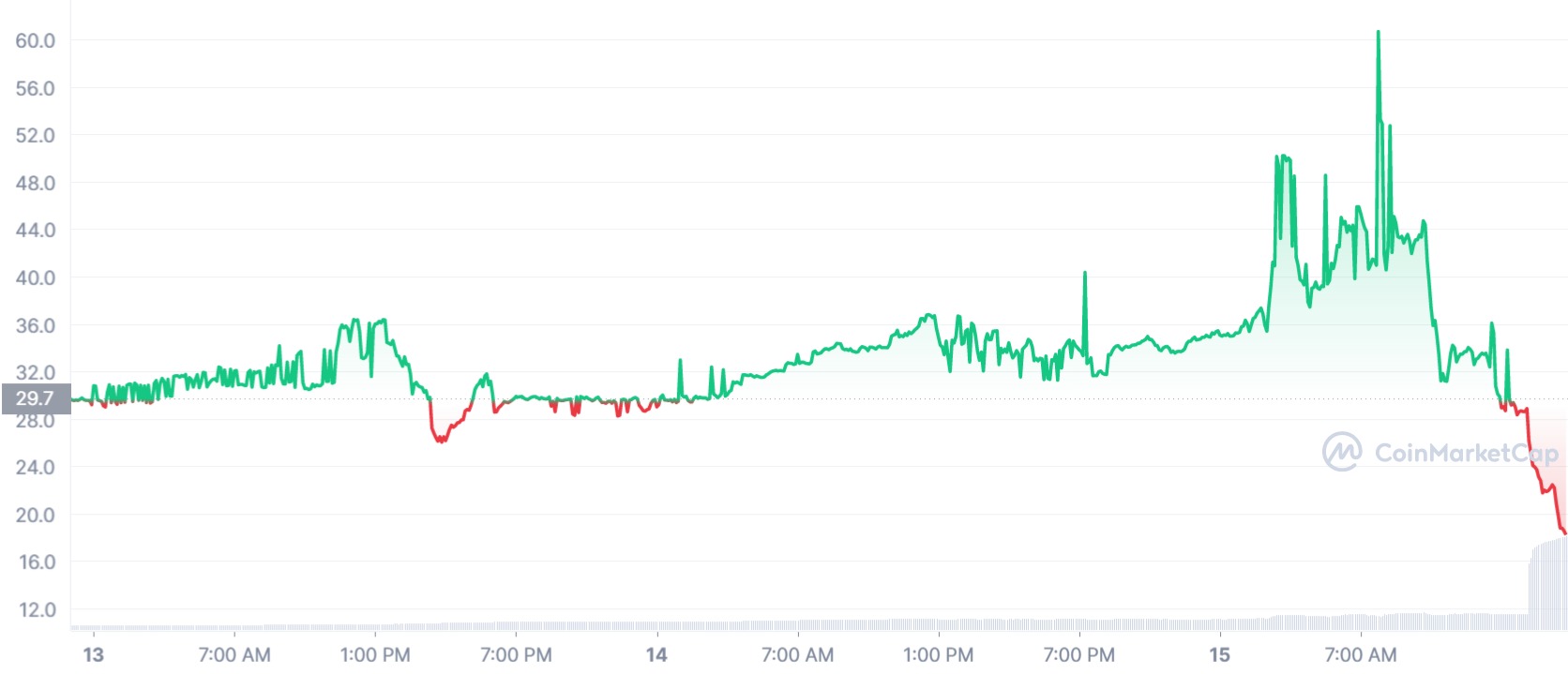

The PoW token can be acquired by way of airdrop to holders of Ethereum, with its worth various over the previous couple of days fairly drastically. Peaking as excessive as $60, it at the moment trades at $18.

How does Ethereum mining work?

Ethereum miners should date used highly effective computer systems often known as ASICs to validate transactions. With staking, that is not needed, which means their livelihoods are in query. Many have swapped to different cryptos in an effort to proceed to mine, and the impact of this may be seen within the hash fee of those different cryptos.

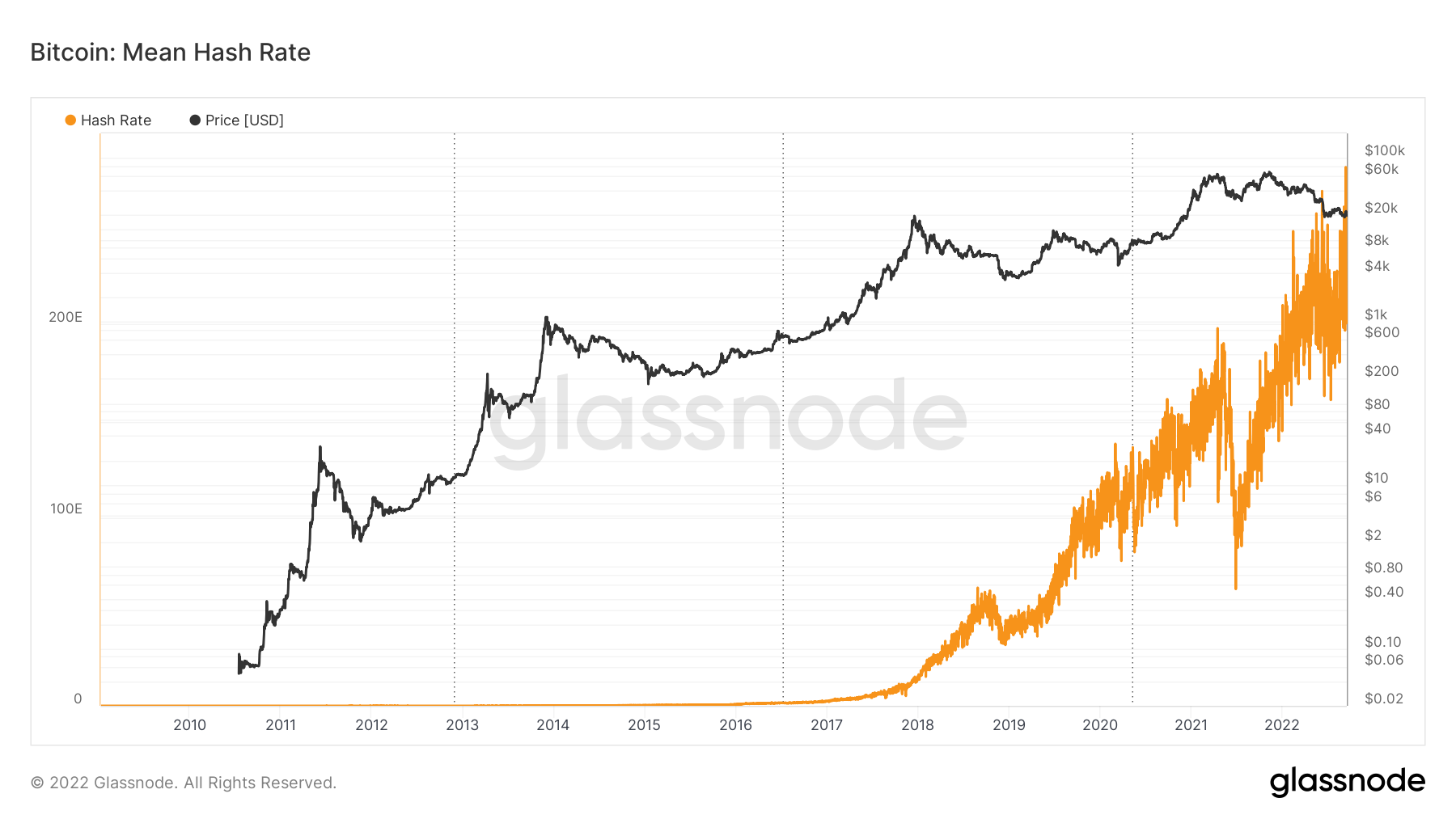

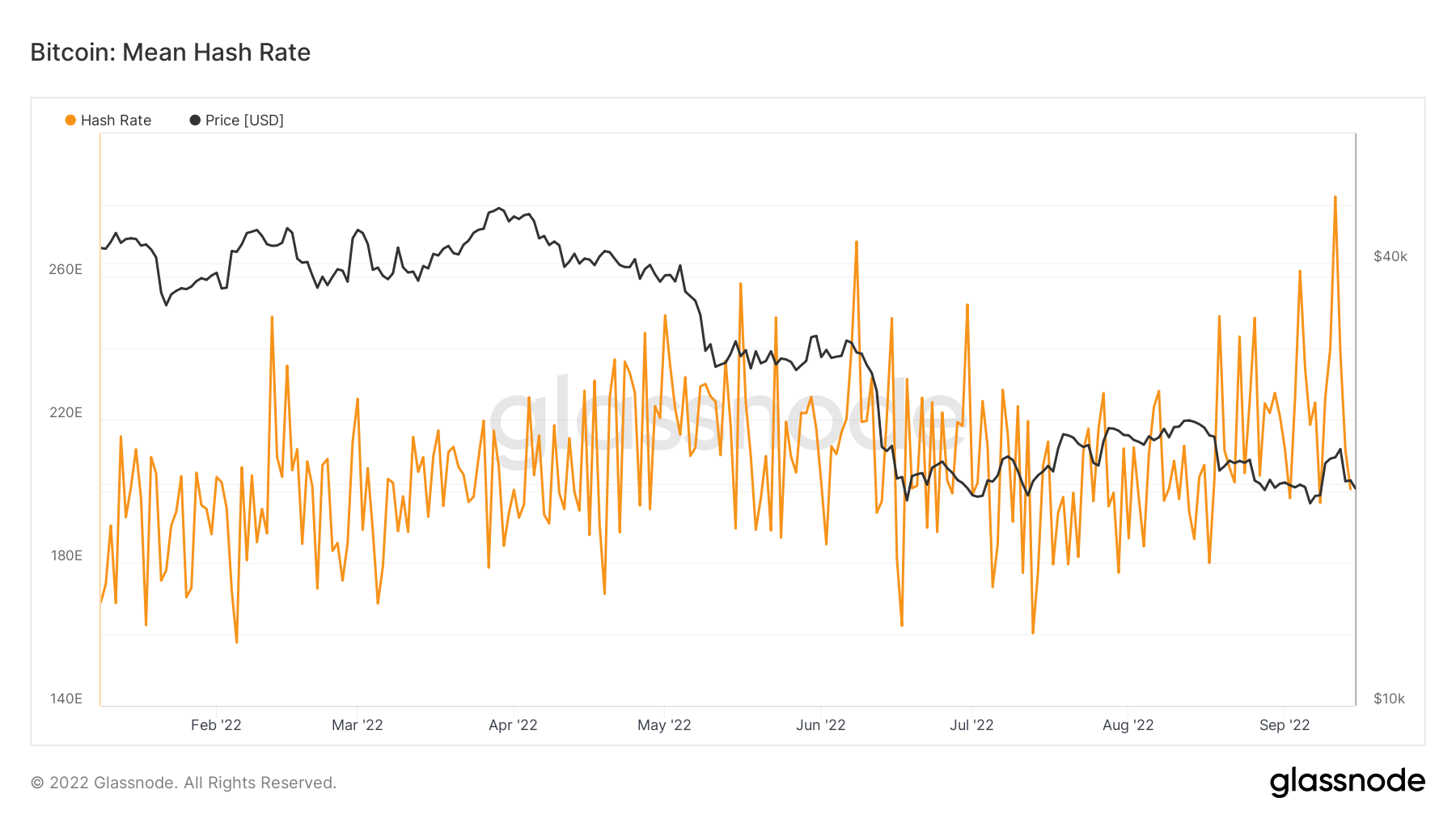

Hash fee is a measure of the computing energy on a community, and is a key safety indicator – the upper the hash fee, the upper the safety, as extra miners should confirm transactions. For Bitcoin, the hash fee hit an all-time excessive final week.

Let’s zoom in on this yr, which can be extra indicative.

This reveals the hash fee opened the yr at round 170 EH/s, but is now north of 200 EH/s (and hit 280 EH/s earlier this week). That is regardless of the value of Bitcoin plummeting from the mid $40K’s to under $20,000.

Ethereum Basic

Extra curiously, nonetheless, is the uptick in hash fee seen on Ethereum Basic. This has been drastic, rising from round 50 TH/s final week to over 300 TH/s. This factors in the direction of Ethereum miners flipping over to the Basic variant with their tools – a a lot simpler shift than could be required to maneuver to Bitcoin.

Certainly, different cash have seen upticks in hash fee as properly – Monero, Ravencoin, Ergo, to call a couple of.

Certainly, different cash have seen upticks in hash fee as properly – Monero, Ravencoin, Ergo, to call a couple of.

For the miners that haven’t flipped to options, they’ll maintain out hope that the Ethereum PoW various takes maintain. In any other case, they’ll be left with costly ASICs and no actual use case, now that Ethereum is Proof-of-Stake and not producing miner income.