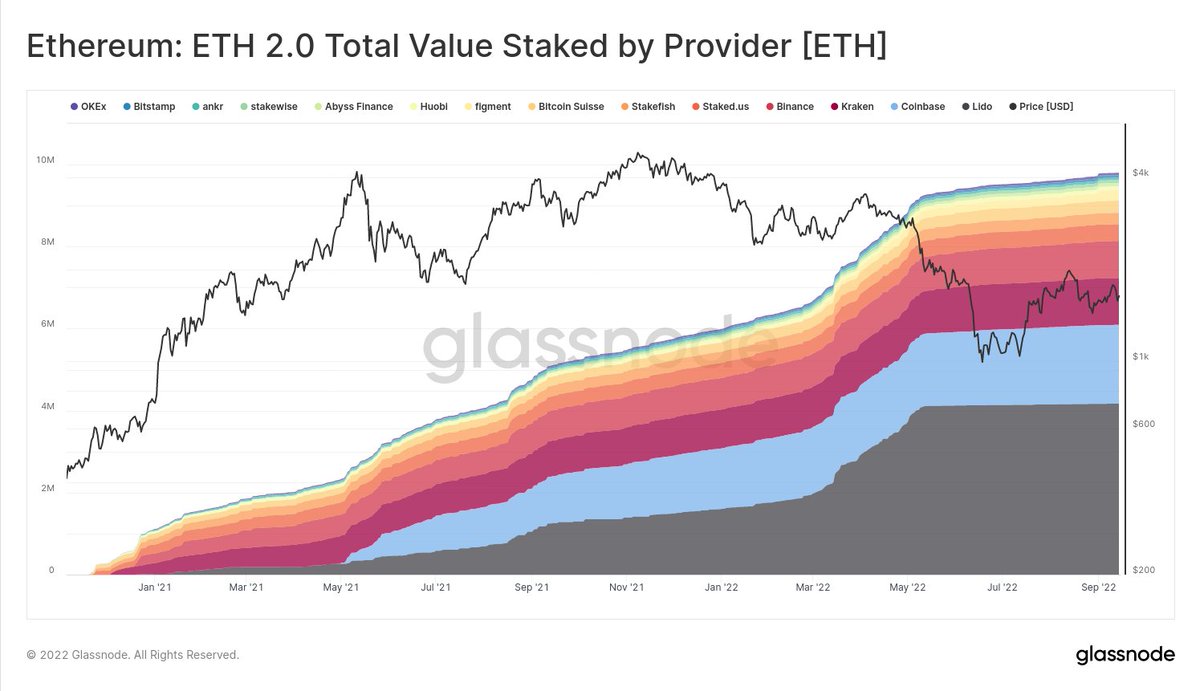

Previous to The Merge, Ethereum used to have dozens upon dozens of mining swimming pools dedicating hashrate towards the blockchain community. That has all modified and a lot of the miners transitioned or plan on transitioning to different Ethash appropriate cash like ethereum basic, ERGO, and the brand new fork ETHW. Now Ethereum blocks are verified by validators and on the time of writing, there are 429,278 validators. Nonetheless, quite a lot of the 13.7 million staked ethereum is held by 4 identified suppliers.

4 Recognized Suppliers Maintain 59% of the Staked Ethereum Right now

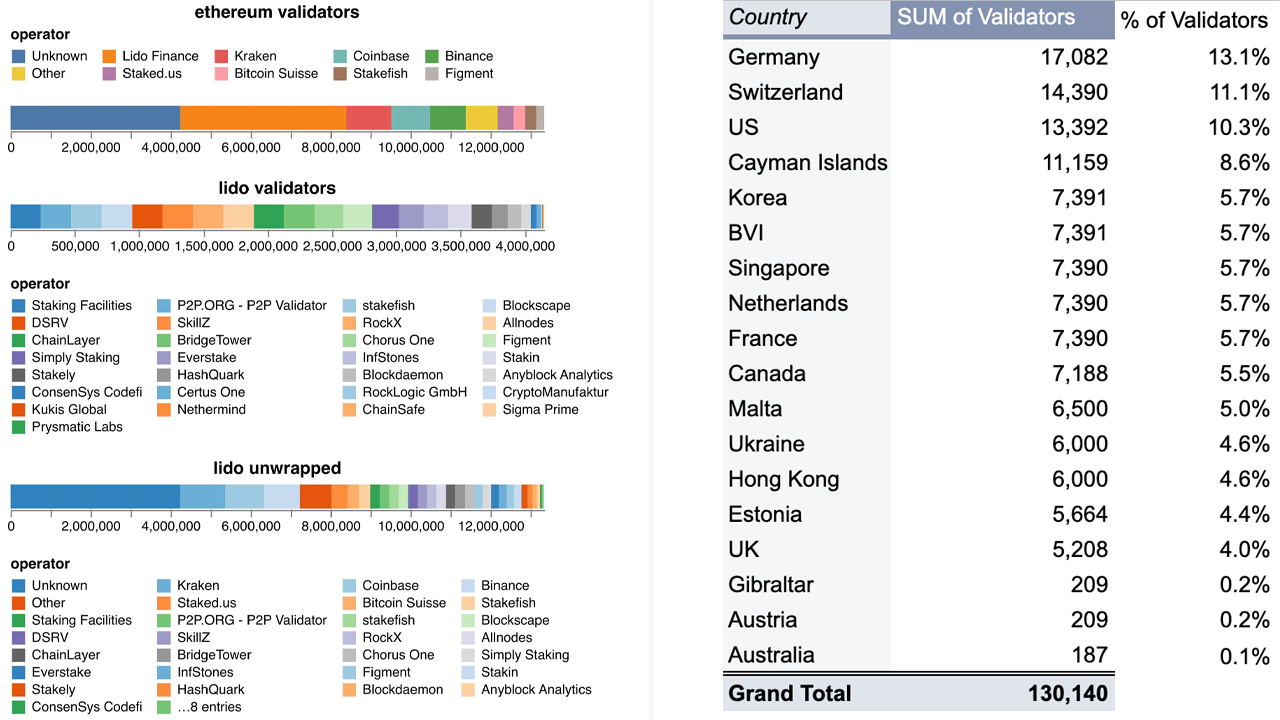

Bitcoin.com Information reported on Lido possessing 30% of the staked ether 4 days in the past. On September 15, the Twitter account Checkmate, the lead onchain analyst at Glassnode, wrote concerning the entities at present holding the lion’s share of immediately’s staked ETH. “We profiled just a few extra entities,” Checkmate wrote to somebody discussing Lido’s holdings. Checkmate stated knowledge reveals that there’s 13.7 million staked ETH and 10 million ether is held by identified suppliers. That equates to 73% of the staked ETH, and the highest 4 suppliers maintain 8.13 million ETH or 59.3% of the mixture.

“4.17M in Lido, 1.92M in Coinbase, 1.14M in Kraken, [and] 0.9M in Binance,” Checkmate stated. The tweet shared by the onchain analyst at Glassnode was additional mentioned by the favored bitcoiner Tuur Demeester, the editor at satoshipapers.org. “44% of ETH is staked by simply 2 entities, Lido [and] Coinbase. Add Kraken, and it jumps to 52% of whole ETH staked by 3 entities,” Demeester wrote. The editor additionally mocked a tweet written by Vitalik Buterin which talks concerning the thought of getting common customers validate the system.

SEC Chair Gensler Hints at Taking One other Take a look at Staking Cash, Jack Dorsey Shares Anti-PoS Editorial, Ethereum Proponents Consider Folks Are Getting Forward of Themselves

Along with bitcoiners like Demeester and Checkmate, the U.S. Securities and Trade Fee chair, Gary Gensler, lately talked about speaking concerning the Howey take a look at and staking cash. The Wall Road Journal (WSJ) reported that Gensler stated: “From the coin’s perspective … that’s one other indicia that underneath the Howey take a look at, the investing public is anticipating earnings based mostly on the efforts of others.” Whereas the WSJ stated Gensler remarked that he wasn’t referring to any cryptocurrency specifically, many crypto lovers assumed the SEC chair was discussing ethereum (ETH) and PoS cash.

BREAKING: Gary Gensler says utilizing of Proof-of-Stake may set off securities legal guidelines.

— Dennis Porter (@Dennis_Porter_) September 15, 2022

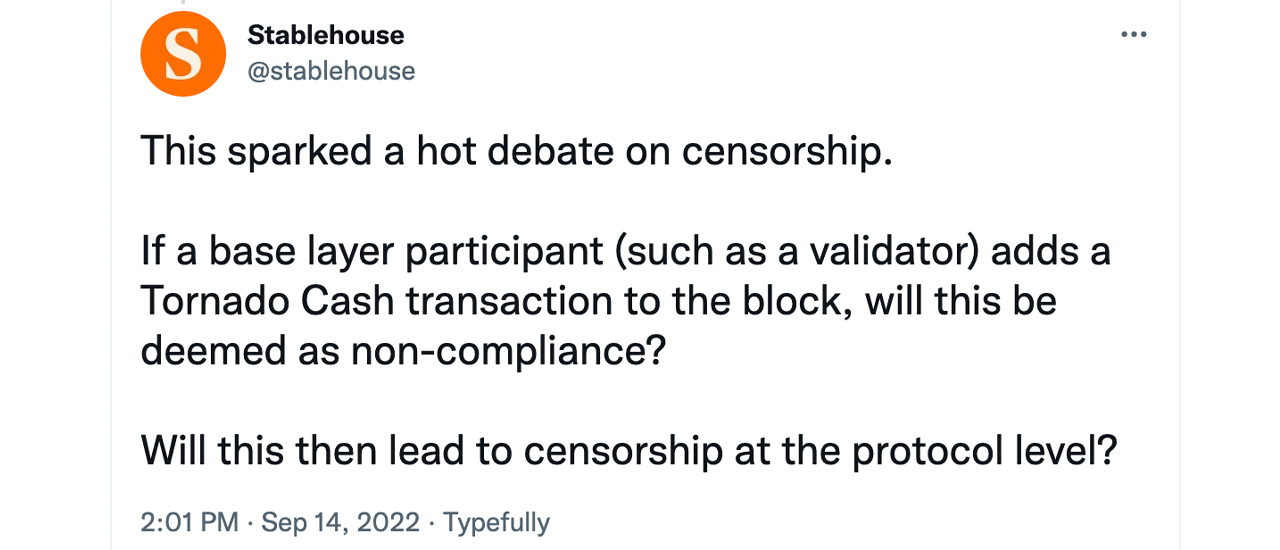

In mid-August, Coinbase co-founder and CEO Brian Armstrong was requested if the change would censor on the ethereum protocol stage with validators. “If regulators ask you to censor on the ethereum protocol stage together with your validators will you: (A) Comply and censor at [the] protocol stage (B) Shut down the staking service and protect community integrity,” the consumer requested.

Armstrong responded three days later and stated: “It’s a hypothetical we hopefully received’t really face. But when we did we’d go together with (B), I believe. Received to deal with the larger image. There could also be some higher possibility (C) or a authorized problem as nicely that might assist attain a greater end result.”

Quite a few individuals imagine that it’s fairly doable that identified validators might be pressured to adjust to regulatory coverage and censorship. With 4 centralized entities staking essentially the most ethereum (ETH) immediately, individuals have issues about whether or not or not validators will likely be centralized and censor transactions. On September 14, Twitter co-founder Jack Dorsey shared an editorial revealed on substack.com that criticizes PoS. The substack.com article is written by Scott Sullivan and it claims that “to be a validator is to stay day-after-day strolling on [eggshells]” and “PoS is a permissioned system.”

In the meantime, a lot of the criticism stems from bitcoiners, a few of whom are labeled as bitcoin maximalists. Ethereum proponents assume the thought is absurd and one supporter famous that he would merely leap to an ETH chain that doesn’t censor transactions. “Guys,” Ryan Adams tweeted, “[the U.S. government] isn’t attempting to censor [ethereum] validators proper now. Let’s not get forward of ourselves. However … in the event that they ever do … I’ll be on the fork of Ethereum that doesn’t censor transactions. Easy as that. Layer 0 is our safety layer,” Adams added.

Bitcoin supporter and blogger, Eric Wall, published a Twitter thread on September 16 that particulars within the case of Lido staking, “Lido isn’t even a pool.” Wall additional remarks in his thread that “Lido can’t determine what blocks anybody of their underlying node operators mine.” Wall does disclose that he’s an LDO investor, as lido dao (LDO) is the native governance token for the Lido Finance mission.

“Lido can also’t fireplace any of their node operators or take away stake from them because it at present stands. No more than 13.1% of Lido validators are based mostly in a single nation. The geographic distribution right here is definitely fairly spectacular,” Wall’s Twitter thread provides.

What do you concentrate on the criticism in opposition to Ethereum and the validators censoring transactions? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Banteg, Alex Svanevik, Checkmate, Twitter,

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss brought about or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.