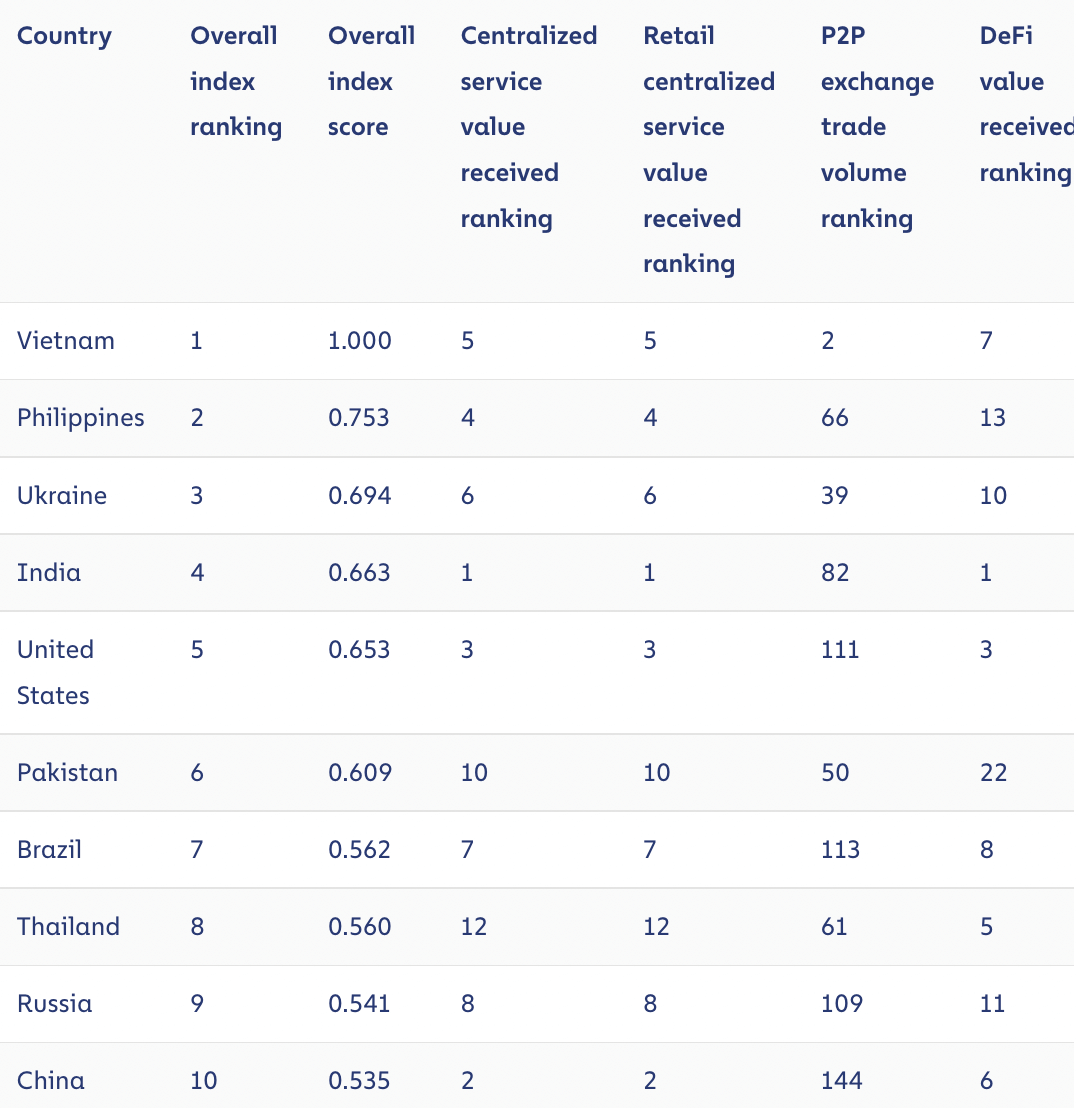

On Sept. 14, Chainalysis launched a report on International Cryptocurrency Adoption for 2022. The analysis revealed that Vietnam has the best crypto adoption, the Philippines and Ukraine comply with as second and third, and the U.S. comes fifth in line.

The report said that the domination of rising international locations within the adoption index, which stood out final yr, endured this yr as effectively. In accordance with the World Financial institution’s earnings categorizations, Vietnam, the Philippines, Ukraine, India, and Pakistan are lower-middle-income international locations. Brazil, Thailand, Russia, and China, alternatively, are upper-middle-income international locations.

Solely the US stands out within the high 10 as a high-income nation.

Adjustments since final yr

This yr marked Vietnam’s second consecutive yr on the high of the leaderboard, coming in first for crypto adoption.

The U.S. was ranked sixth in 2020, eighth in 2021, and fifth in 2022. Though it recorded a small de-ranking from 2020 to 2021, the U.S. nonetheless holds the center line and stands out as the one high-income nation with such excessive adoption.

China was ranked thirteenth final yr, however this yr it managed to make its option to the highest 10. The report states China is very sturdy in centralized providers, which drove adoption increased. The World Financial institution says that the nation’s ban on crypto buying and selling was both ineffective or loosely enforced as a result of it didn’t hinder the adoption surge in any respect.

Adoption surge regardless of the bear market

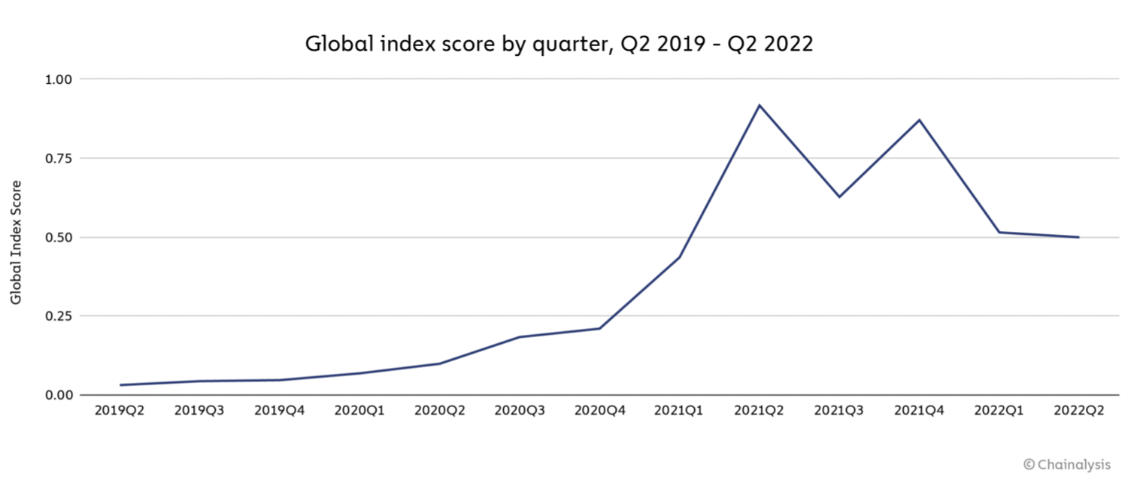

One other spotlight from the report was the speed of adoption. General, crypto adoption slowed worldwide as a result of bear market however managed to stay above the pre-bull market ranges.

In accordance with the report, the adoption charges have been rising steadily since mid-2019. The adoption charge reached its all-time excessive within the second quarter of 2021 and has been going up and down since. The report states:

“[adoption rates] have fallen in every of the final two quarters as we’ve entered a bear market. Nonetheless, it’s necessary to notice that world adoption stays effectively above its pre-bull market 2019 ranges.”