The value of Solana (SOL) has been risky in opposition to tether (USDT), inflicting extra ache for hodlers. Regardless of displaying such energy, the worth of Solana (SOL) has risen from $30 in current weeks to round $45, as many buyers hoped for extra aid rallies to round $60. Solana (SOL) costs have been rejected and have continued to fall with no important bounce. (Information from Binance)

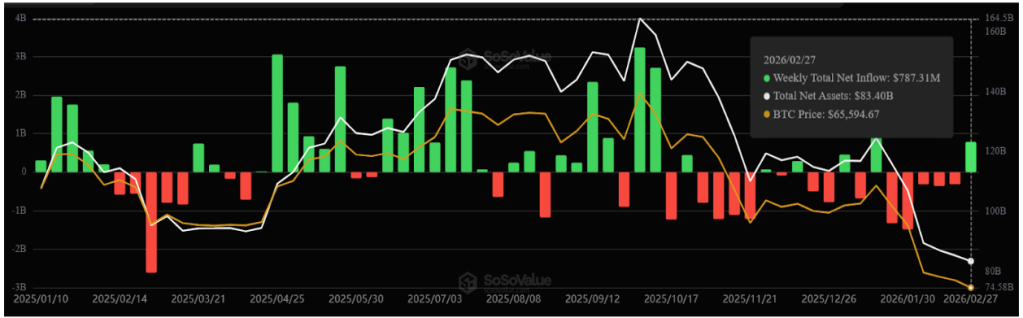

Solana (SOL) Worth Evaluation On The Weekly Chart

SOL’s value dropped from $250 to round $30, representing a drop of greater than 70% from its all-time excessive. After touching a weekly low of $32, the worth of SOL rallied to $45, demonstrating nice energy as many set costs and expectations for a rally again to $60, however the value was met with rejection.

On the weekly chart, the worth of SOL shaped a downtrend line because it continued to respect this resistance line, bouncing off to proceed its bearish run. Nonetheless, the worth of SOL was rejected from the trendline resistance after some time, and it couldn’t break this trendline.

SOL is buying and selling above the important thing assist stage of $30; the worth of SOL should stay above this stage to keep away from falling to $24-$20. With the worth of SOL holding this assist, we might be able to commerce greater to the $35 area. A break beneath $30 would sign a return to decrease demand zones and a reluctance of bulls to enter purchase orders as there could be extra agitation for decrease costs.

To renew its bullish pattern, SOL’s value should break and maintain above the trendline resistance that’s stopping the worth of SOL from trending greater. If the worth of SOL continues to reject the trendline resistance, the worth could fall as a result of there are extra promote orders than purchase orders.

Weekly resistance for the worth of SOL – $45.

Weekly assist for the worth of SOL – $30.

Worth Evaluation Of SOL On The Every day (1D) Chart

The each day timeframe for SOL costs continues to deteriorate as costs break to the draw back, with costs ranging in a channel with $45 as resistance and $30 as assist.

The value of SOL should get away of this vary channel with important quantity to revive hope and aid to most buyers. A break and shut beneath $30 could be dangerous for the SOL construction as a result of the worth would face extra promote orders and panic. If the worth of SOL breaks and closes above $45, we may even see a minor aid bounce to the $60-$80 vary.

The Relative Energy Index (RSI) for SOL is above 40 on the each day chart, indicating extra promote order quantity.

Every day resistance for the SOL value – $45.

Every day assist for the SOL value – $30.

Featured Picture From zipmex, Charts From Tradingview