Yields on long-dated U.S. Treasuries have been erratic this yr and this week, the 10-year Treasury yield crossed 3.5% for the primary time in a decade. Following the Fed’s 75bps (foundation factors) fee hike, 10-year notes reached 3.642% and two-year Treasury notes jumped to a 15-year excessive at 4.090%. The curve between the two- and 10-year notes signifies the possibilities of a deep U.S. recession have grown stronger, and up to date studies say bond merchants have been “confronted with the wildest volatility of their careers.”

2 Quarters of Adverse GDP, Pink-Scorching Inflation, and Extraordinarily Unstable T-Notes

On the finish of July, after the second consecutive quarter of adverse gross home product (GDP), quite a few economists and market strategists confused that the U.S. is in a recession. Nevertheless, the Biden administration disagreed and the White Home revealed an article which defines the beginning of a recession from the Nationwide Bureau of Financial Analysis’s perspective. Moreover, red-hot inflation has been wreaking havoc on Individuals, and market analysts imagine that rising shopper costs additionally level to a recession in the USA.

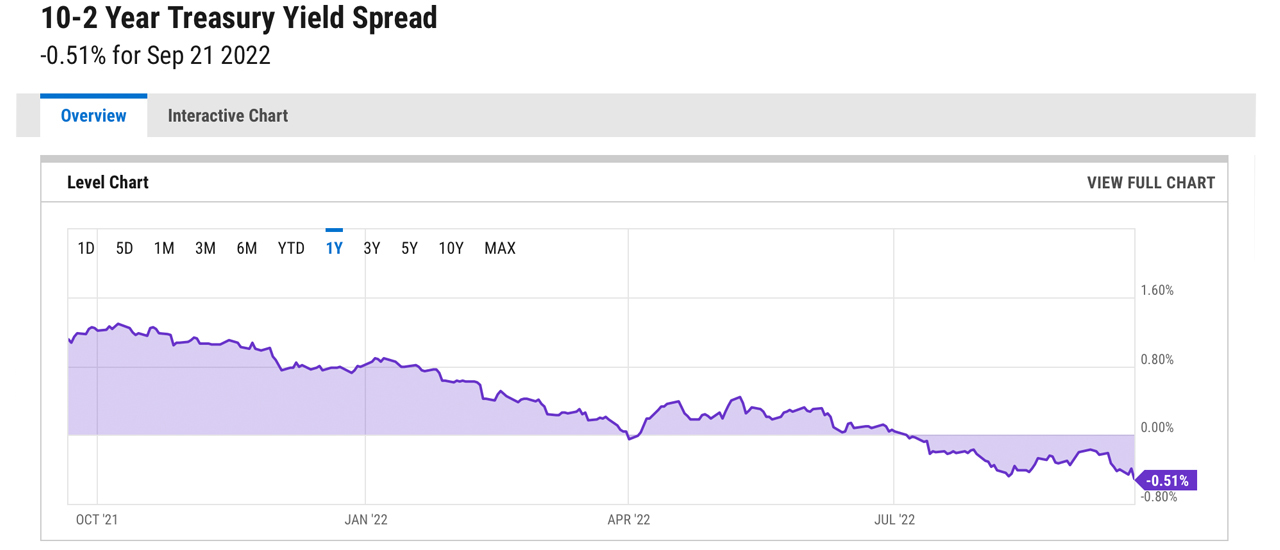

One of many greatest indicators, nonetheless, is the yield curve which measures long-term debt with short-term debt by monitoring two and 10-year Treasury observe yields. Many analysts imagine an inverted yield curve is likely one of the strongest indicators that factors to a recession. The inverted yield curve is uncommon however not in 2022, as bond merchants have been coping with a loopy buying and selling setting this yr. This week, two- and 10-year Treasury observe (T-note) yields broke information because the 10-year T-note surpassed 3.5% on September 19, for the primary time since 2011. On the identical day, the two-year T-note tapped a 15-year excessive reaching 3.97% for the primary time since 2007.

Even though such bond market volatility is normally an indication of a weakening financial system within the U.S., skilled merchants declare bond markets have been thrilling and “enjoyable.” Bloomberg authors Michael MacKenzie and Liz Capo McCormick say bond markets are “characterised by sudden and sweeping every day swings which are usually a good setting for merchants and sellers.” Paul Hamill, the top of worldwide fastened revenue, currencies, and commodities distribution at Citadel Securities agrees with the Bloomberg reporters.

“We’re proper within the candy spot of charges actually being an fascinating market, with purchasers being excited to commerce,” Hamill defined on Wednesday. “Everyone seems to be spending all day speaking to purchasers and speaking to one another. It’s been enjoyable.”

Sovereign Danger Rises, Yield Curve Between 2- and 10-Yr T-Notes Slips to 58bps — BMO Capital Markets Analyst Says ‘Buyers Are Working out of Havens’

Nevertheless, not everybody thinks the fairness and bond market volatility is all enjoyable and video games. The chief strategist at bubbatrading.com, Todd ‘Bubba’ Horwitz, not too long ago stated that he expects to see “a 50 to 60 % haircut” in fairness markets. The latest U.S. Treasury yield fluctuations have given market strategists causes to be involved about looming financial points. Throughout the first week of September, Lead-Lag Report writer and portfolio supervisor, Michael Gayed, warned that the erratic bond market may spark a sovereign debt disaster and “a number of black swans.”

Research and empirical proof present a unstable U.S. Treasury observe market isn’t good for overseas international locations holding U.S. T-notes and coping with important debt points. That’s as a result of when U.S. T-notes are leveraged for restructuring functions and a decision device, “sudden and sweeping every day swings” can punish international locations attempting to make use of these monetary automobiles for debt restructuring. Moreover, for the reason that Covid-19 pandemic, the large U.S. stimulus applications, and the Ukraine-Russia conflict, sovereign danger has elevated throughout the board, in a myriad of nations worldwide.

On Wednesday, Bloomberg authors MacKenzie and McCormick additionally quoted Ian Lyngen, the top of U.S. charges technique at BMO Capital Markets, and the analyst famous that the existence of so-called monetary protected havens is waning. “This can be a defining week for Fed fee expectations between now and the top of the yr,” Lyngen stated simply earlier than the Fed raised the federal funds fee by 75 foundation factors. Lyngen remarked that there’s a “[sense of investors] not desirous to be lengthy the market. As we shift to a really aggressive financial coverage stance, traders are operating out of havens.”

On Thursday, the yield curve between the two- and 10-year T-notes slipped to 58bps, a low not seen for the reason that deep lows in August after which 40 years in the past, again in 1982. On the time of writing, the yield curve between the two- and 10-year T-notes is down 0.51%. The crypto financial system is down 0.85% over the last 24 hours and is coasting alongside at $918.12 billion. Gold’s worth per ounce is down 0.14% and silver is down 0.28%. Fairness markets opened decrease on Thursday morning as all 4 main indexes (Dow, S&P500, Nasdaq, NYSE) have printed losses.

What do you consider the erratic bond markets in 2022 and the indicators that present the financial system and protected havens are unreliable lately? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.