In the course of the winter, Voyager Digital fell as a result of its excellent liquidity points. Because of this, the agency filed for Chapter 11 chapter in July to help it with the state of affairs after halting withdrawals on its platform.

The crypto winter for 2022 was a drastic one which tumbled nearly all of the cryptocurrencies. Coupled with the collapse of the algorithmic Terra and its ecosystem, the trade was thrown into disaster.

Many crypto-related firms struggled to maintain their steadiness. Nevertheless, not all of them may climate the storm and the consequences of the tough bearish development on the crypto house.

Then got here the drowning of some crypto companies, similar to high-interest lending platforms. A few of the halted withdrawals whereas battling chapter. The primary agency to indicate indicators of insolvency was Three Arrow Capital (3AC). Its incapacity to climate off the impression of the bearish development created a contagion for others.

Voyager Digital was launched in 2019 as a crypto lending platform. Its operation cuts throughout accepting prospects’ deposits and paying curiosity on the deposited quantities. Additionally, the agency makes use of the deposited funds for lending to different customers. On the time of its chapter submitting, Voyager had complete liabilities of about $4.8 billion.

Voyager Auctioned Its Distressed Property

In a latest growth, a report from Wall Avenue Journal revealed that Binance and FTX are battling to amass Voyager’s belongings. Sadly, the 2 massive crypto exchanges have bided for assist. Following its distressed state of affairs, Voyager auctioned its holdings to the general public on September 13 this 12 months. This motion has seen some contributors indicating their curiosity within the belongings.

In accordance with the supply, Binance has bided larger than FTX by an extra $50 million. FTX has been concerned in a shopping for spree because the 12 months because it appears out for attainable good belongings. Nevertheless, its strikes have resulted within the agency being distressed with the recurring bearish development within the crypto market.

The bidding for Voyager’s belongings noticed Binance and FTX taking the lead. However there are different contributors like CrossTower, a buying and selling platform, and Wave Monetary, a crypto funding supervisor. The announcement for the successful bid is predicted on September 29 although it may come before anticipated.

Voyager Liquidity Points Got here From Tie With 3AC

Voyager digital was hit with the issue of insolvency resulting in its submitting for chapter. This was majorly linked to its monetary tie of over $650 million with Three Arrows Capital, a hedge fund platform.

On the time of chapter, Voyager lent about $377 million to Alameda Analysis, a crypto buying and selling agency. Alameda Analysis can be owed by the CEO of FTX, Sam Bankman-Fried. Alameda Analysis bought a portion of Voyager throughout its submitting, which is a 9.5% fairness stake.

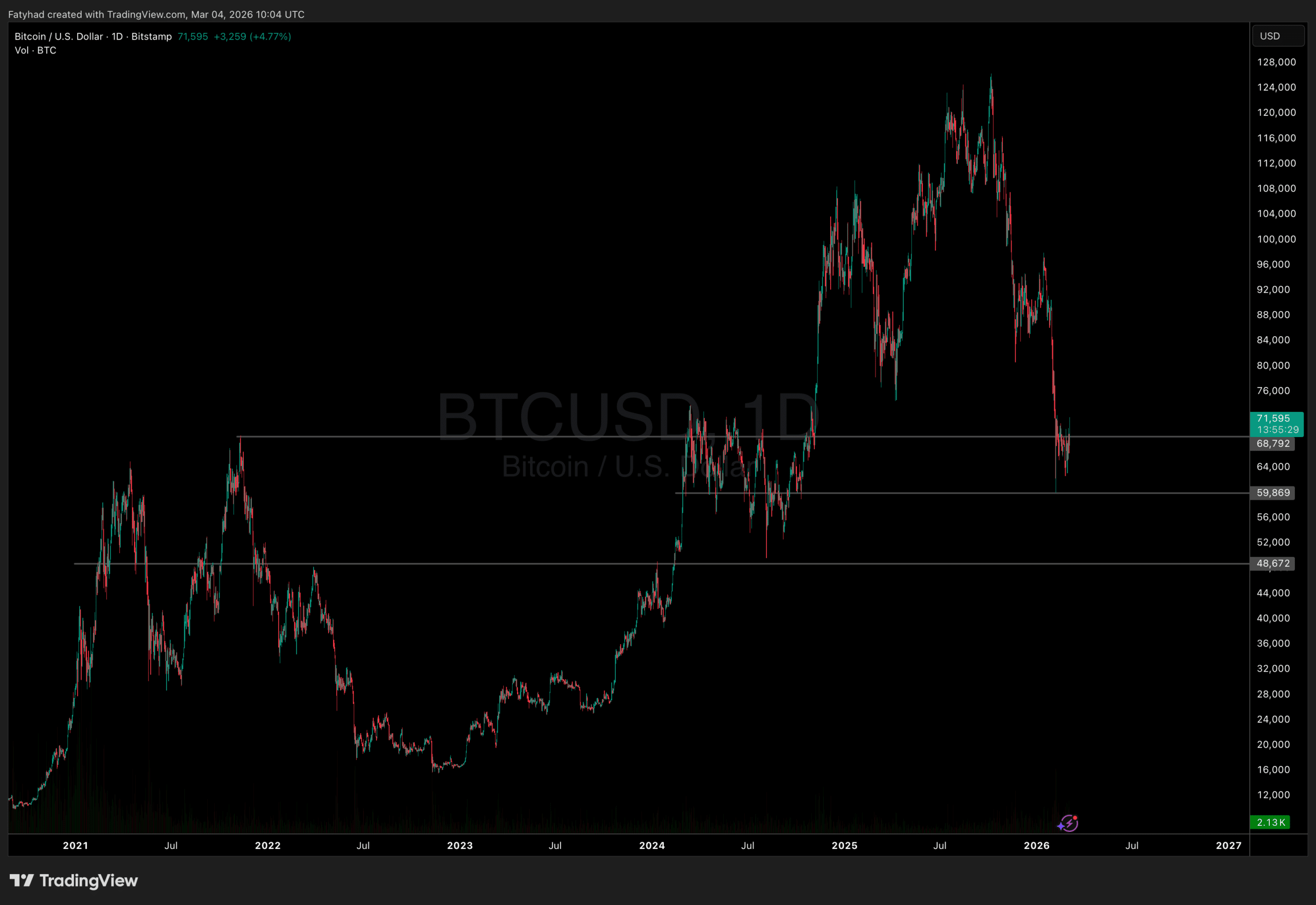

Featured picture Pixabay, Chart: TradingView.com