Crypto analytics agency Santiment says each Bitcoin (BTC) and XRP are flashing bullish alerts amid the market downturn.

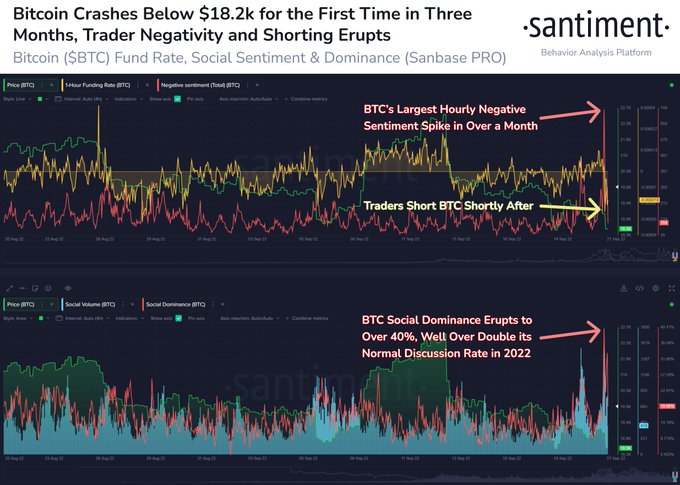

Beginning with Bitcoin, Santiment says that the social dominance metric of the flagship crypto asset has gone up.

In line with Santiment, the social dominance metric, which signifies the proportion of discussions on numerous platforms centered on one asset at any given time relative to different property, has traditionally acted as a dependable sign for predicting the underside.

“Bitcoin’s worth has hit a three-month low. In line with our sentiment information, unfavourable feedback surged to month highs. Shorting on exchanges has not less than halted the bleeding. BTC social dominance has additionally spiked, which is traditionally an excellent backside sign.”

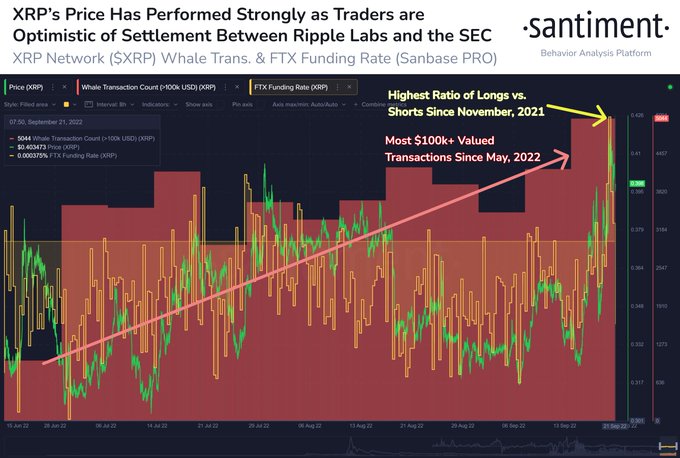

Turning to XRP, Santiment says that optimism amongst merchants that Ripple Labs and the U.S. Securities Change will attain a settlement within the ongoing lawsuit has contributed to a worth bump for the sixth-largest crypto asset by market cap.

“XRP Community is +17% this previous week, whereas Bitcoin (-5%), Ethereum (-16%), and most of crypto has declined. The continued battles between Ripple and the SEC concerning elevated regulation has primarily led to elevated dealer optimism and excessive whale motion.”

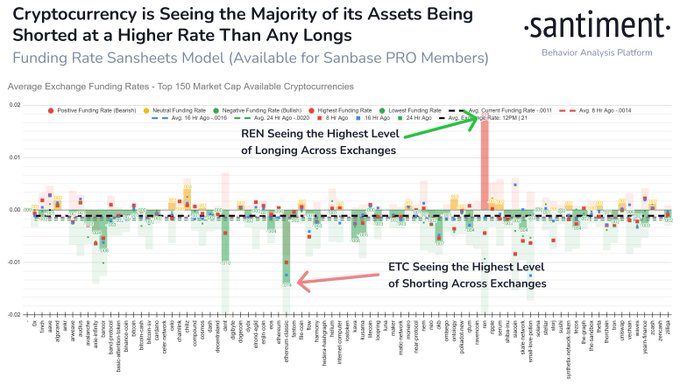

Santiment subsequent turns to Ethereum (ETH) fork and proof of labor blockchain, Ethereum Traditional (ETC). The crypto analytics agency says that the Twenty second-biggest crypto asset by market cap is ready to fall additional as quick curiosity surges.

In line with Santiment, Ethereum Traditional is experiencing the very best stage of quick curiosity on exchanges amongst 150 crypto property, in distinction with blockchain interoperability platform Ren (REN) which is witnessing the very best stage of lengthy curiosity.

“Ethereum Traditional has seen a excessive stage of bets towards its worth, notably after final week’s ETH merge. On the opposite finish, there are plenty of longs towards Ren. General, although, the perpetual contract funding charges on exchanges level to merchants anticipating additional draw back.”

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Verify Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses it’s possible you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in online marketing.

Featured Picture: Shutterstock/Helen Pazyuk/WindAwake