Macro Overview

Fed scores a hat-trick

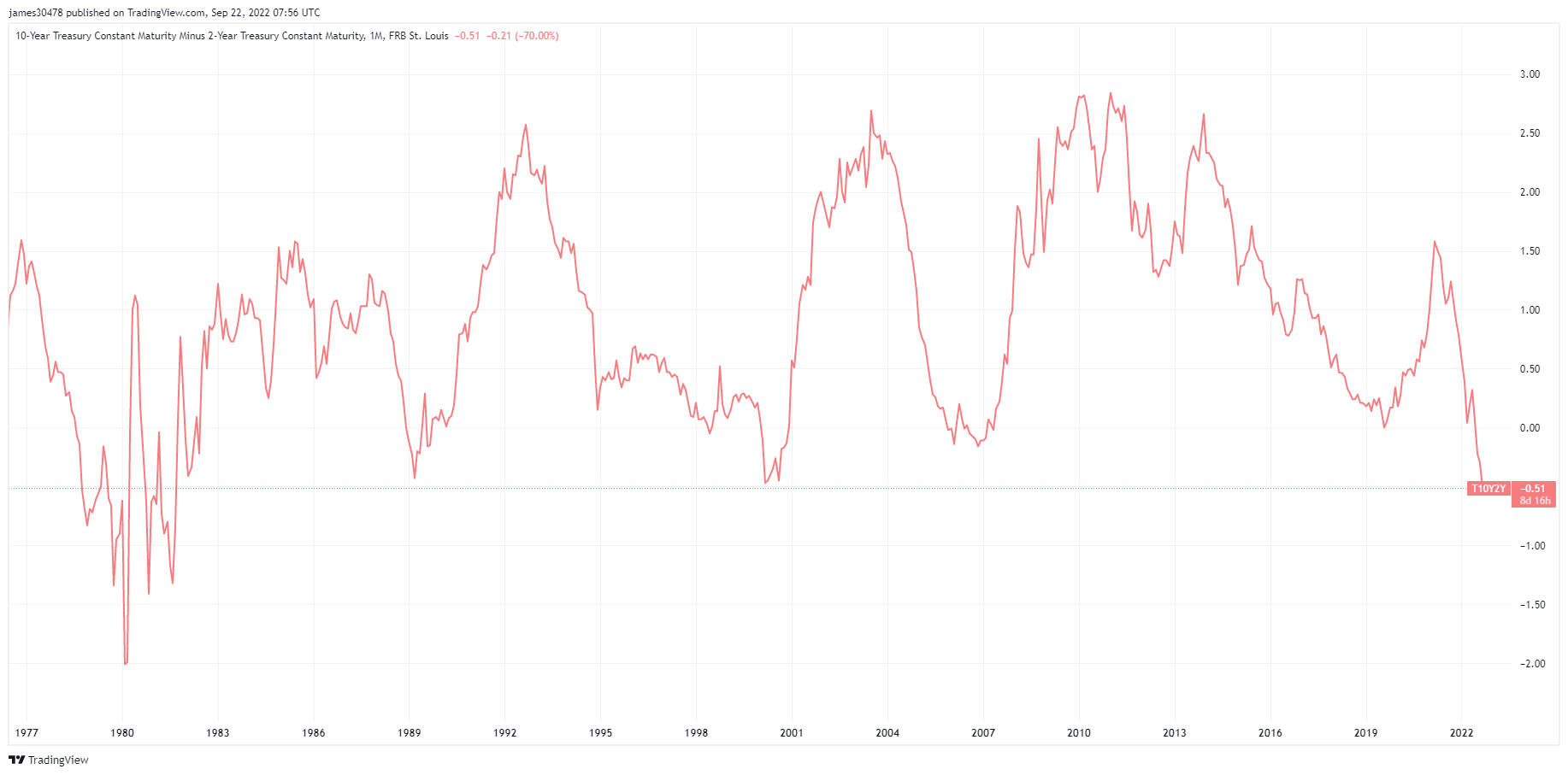

The fed delivered its third consecutive 75 foundation level hike accompanied by increased forecasts of future charges, pushing the greenback index and stuck earnings yields to new highs. Volatility throughout all asset lessons had picked up, which had seen the ten-year minus two-year yields finally shut the widest for the reason that 12 months 1988.

The FOMC’s 75bps hike took the goal vary from 3% to three.25%, with forecasts for the benchmark projected to achieve the top of 2022 at 4.4%. Unemployment for 2023 elevated to 4.4% from 3.9%, with price hikes anticipated to chill the labor market.

Because of this, the Euro hit its lowest level since 2002 vs. USD (0.96). The pound dropped to 1.08, and USDJPY had smashed via 145, with 10- 12 months Japanese authorities bonds nonetheless hitting 0.25%.

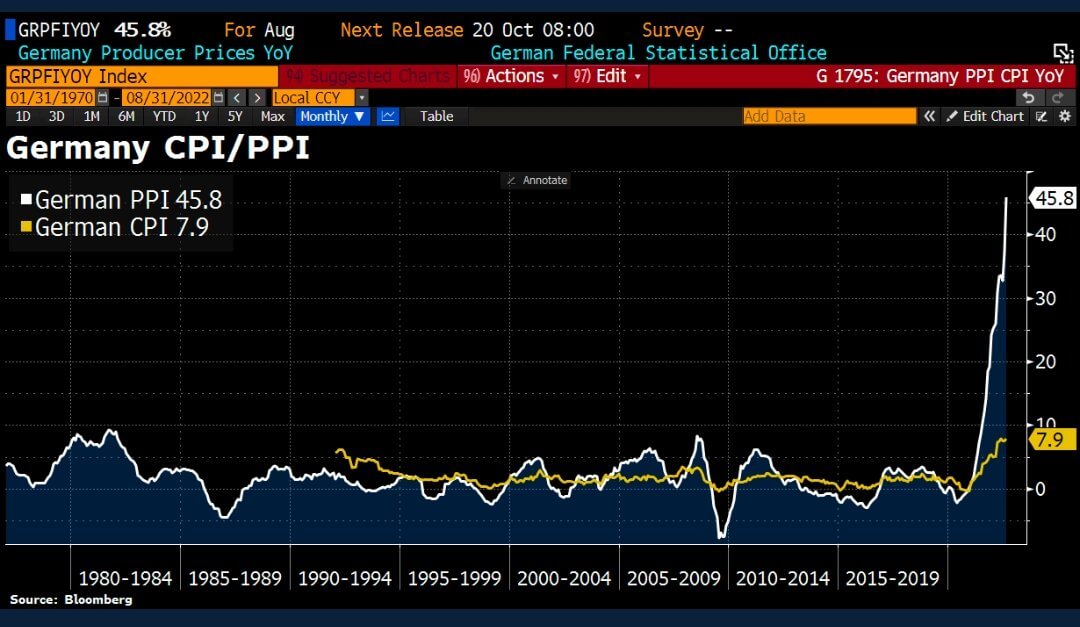

Weimar Republic II

German August Producer Costs Index (PPI) surged 45.8% (vs. 37.1% anticipated) from a 12 months in the past. This was pushed primarily by hovering vitality costs, elevating probabilities of increased CPI inflation within the subsequent studying.

Regarding vitality, PPI rose virtually 15% in comparison with August 2021; nonetheless, vitality costs had been twice as excessive as in the identical interval final 12 months, a rise of 139%. This is able to be why vitality costs will not be thought of within the CPI print, as central banks must enhance rates of interest aggressively.

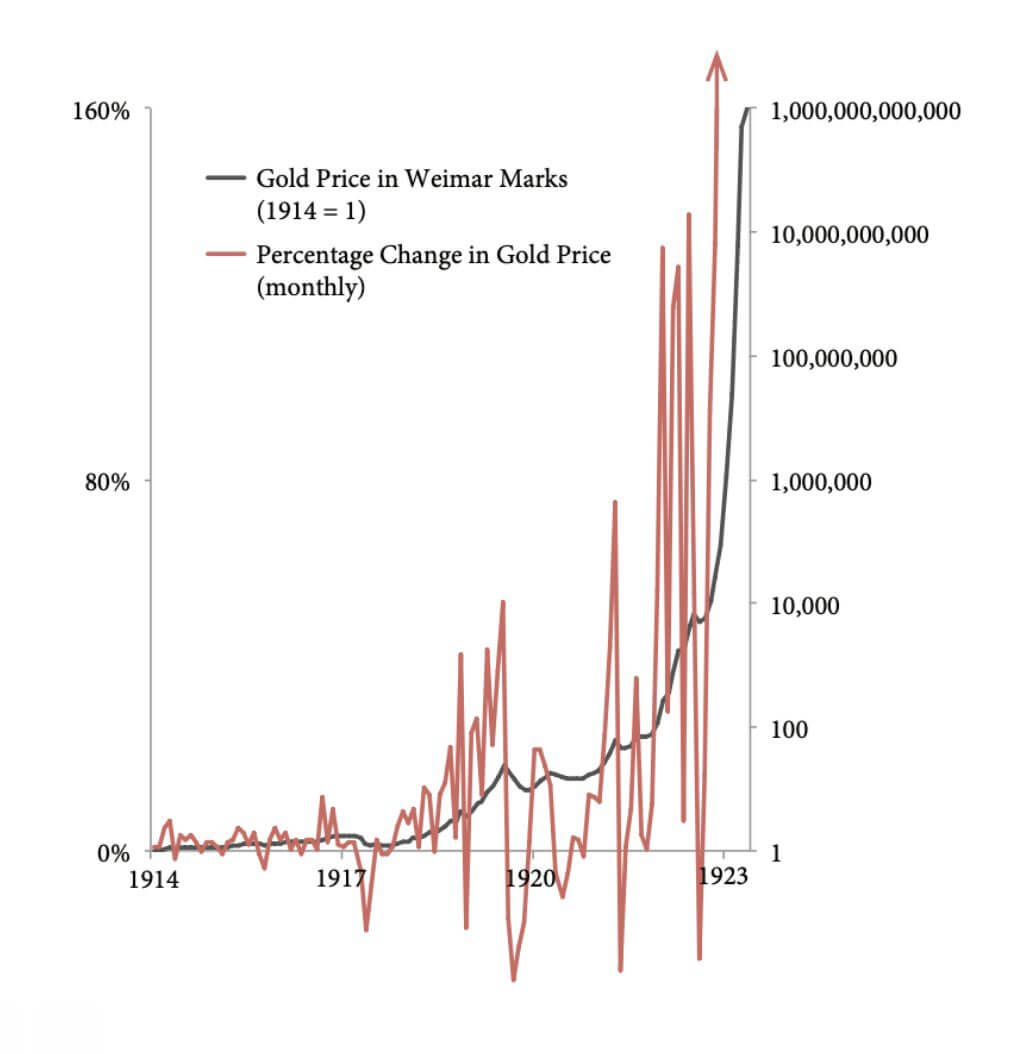

Germans have dangerous reminiscences of hyperinflation because it affected the German Papiermark, the forex of the Weimar Republic, within the early Nineteen Twenties. To pay for the reparations of WW1, Germany suspended the gold normal (convertibility of its forex to gold). The Germans used to pay conflict reparations by mass printing financial institution notes to purchase overseas forex to pay for the reparations, which led to higher and higher inflation.

“A loaf of bread in Berlin that value round 160 Marks on the finish of 1922 value 200,000,000,000 Marks by late 1923”- Historical past Each day

The gold value in Weimar Marks in 1914 equaled 1, as golds provide elevated solely round 2% a 12 months, a comparatively secure asset. Nevertheless, inside the subsequent decade, the proportion change in gold value fluctuated as a result of the denominator (Weimar Marks) elevated drastically within the cash provide.

An identical state of affairs occurred within the 2020s, as Bitcoin has comparable traits to gold. Bitcoin is unstable in nature but additionally exasperated because of the enhance in M2 cash provide (consisting of M1 plus financial savings deposits).

Correlations

Manipulation of forex

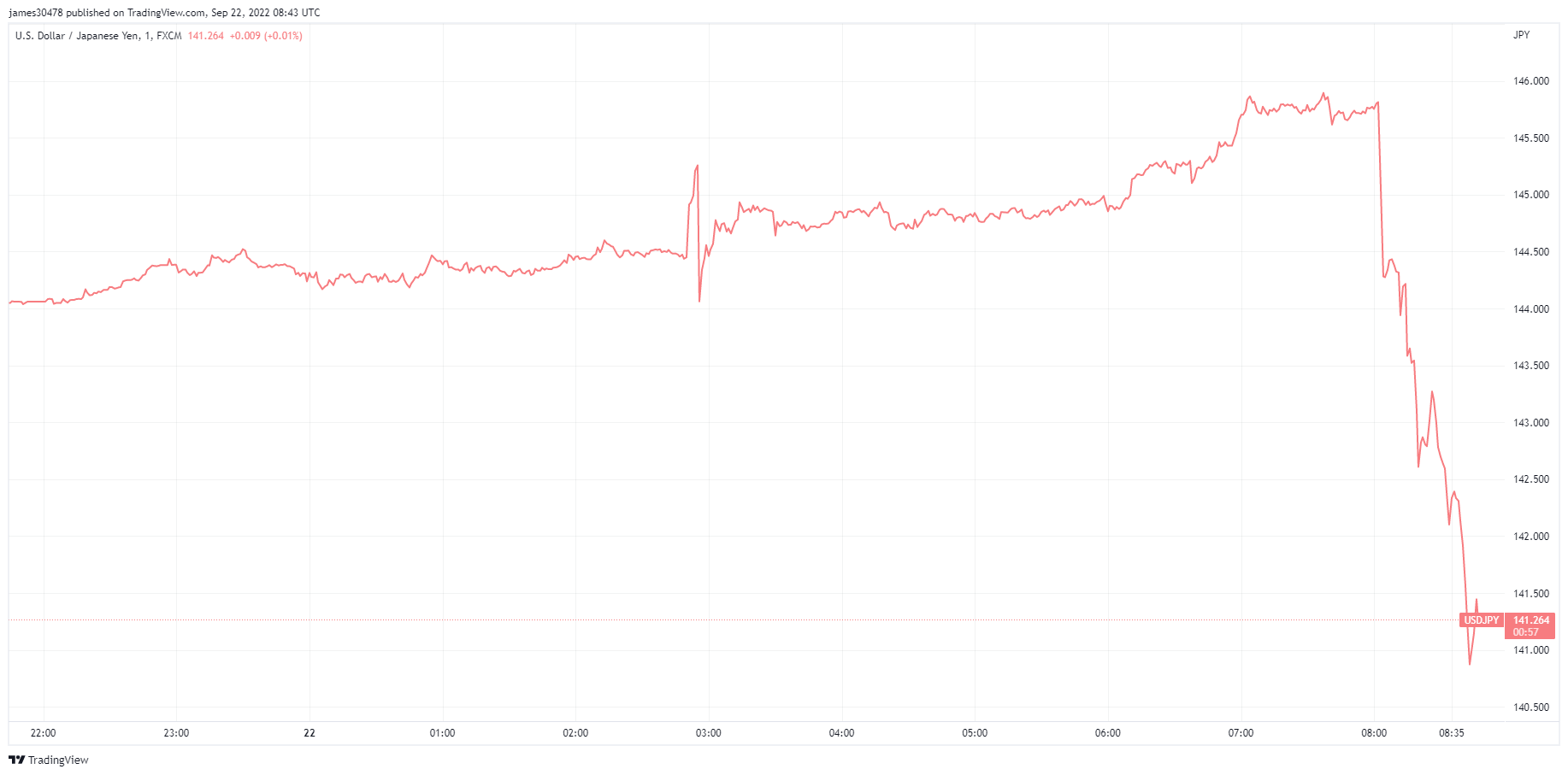

The Financial institution of Japan left its coverage price unchanged at damaging 0.1% and dedicated to conserving the ten-year treasury to 0.25%, sending the yen to a 24-year low in opposition to the greenback.

Nevertheless, on Sept 22, Japan’s prime forex diplomat Kanda confirmed they intervened within the FX market. The Japanese authorities stepped into the market to purchase yen for {dollars} and performed the primary FX intervention since June 1998. The yen soared in opposition to the DXY, dropping from 145 to 142.

“When you manipulate the important thing side of cash, you manipulate all of our time. And when you have got manipulation in cash, you have got, you MUST have misinformation in every single place in society… Bitcoin is the alternative system. Hope, fact, higher future. Spend time there.” – Jeff Sales space.

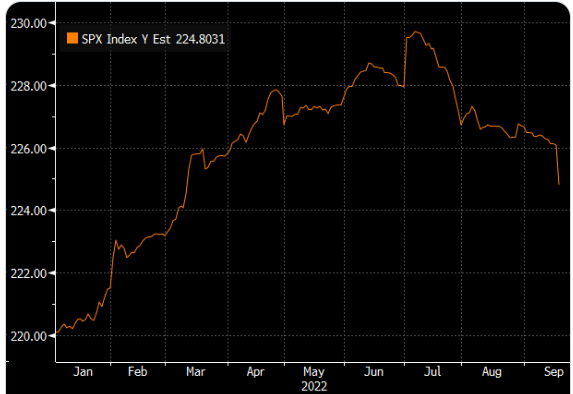

Equities & Volatility Gauge

The Normal and Poor’s 500, or just the S&P 500, is a inventory market index monitoring the inventory efficiency of 500 giant corporations listed on exchanges in the US. S&P 500 3,693 -4.51% (5D)

The Nasdaq Inventory Market is an American inventory alternate based mostly in New York Metropolis. It’s ranked second on the record of inventory exchanges by market capitalization of shares traded, behind the New York Inventory Alternate. NASDAQ 11,311 -4.43% (5D)

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the approaching 30 days. Traders use the VIX to measure the extent of danger, worry, or stress out there when making funding selections. VIX 30 8.37% (5D)

Equities proceed to plunge

Equities tried to placed on a courageous face however continued to get battered by rising rates of interest. To date, in 2022, fairness markets have been downgraded massively in valuations. With the top of the quarter and quarterly earnings season approaching, anticipate downgrades in earnings to proceed this onslaught.

As provide chains proceed to interrupt down, the price of capital will increase, and a surging DXY are all liabilities for public corporations. Anticipate to see the unemployment price begin to spike from This autumn onwards.

Commodities

The demand for gold is decided by the quantity of gold within the central financial institution reserves, the worth of the U.S. greenback, and the will to carry gold as a hedge in opposition to inflation and forex devaluation, all assist drive the value of the dear metallic. Gold Worth $1,644 -2.00% (5D)

Much like most commodities, the silver value is decided by hypothesis and provide and demand. Additionally it is affected by market situations (giant merchants or buyers and brief promoting), industrial, business, and shopper demand, hedge in opposition to monetary stress, and gold costs. Silver Worth $19 -0.77% (5D)

The worth of oil, or the oil value, usually refers back to the spot value of a barrel (159 litres) of benchmark crude oil. Crude Oil Worth $79 -7.56% (5D)

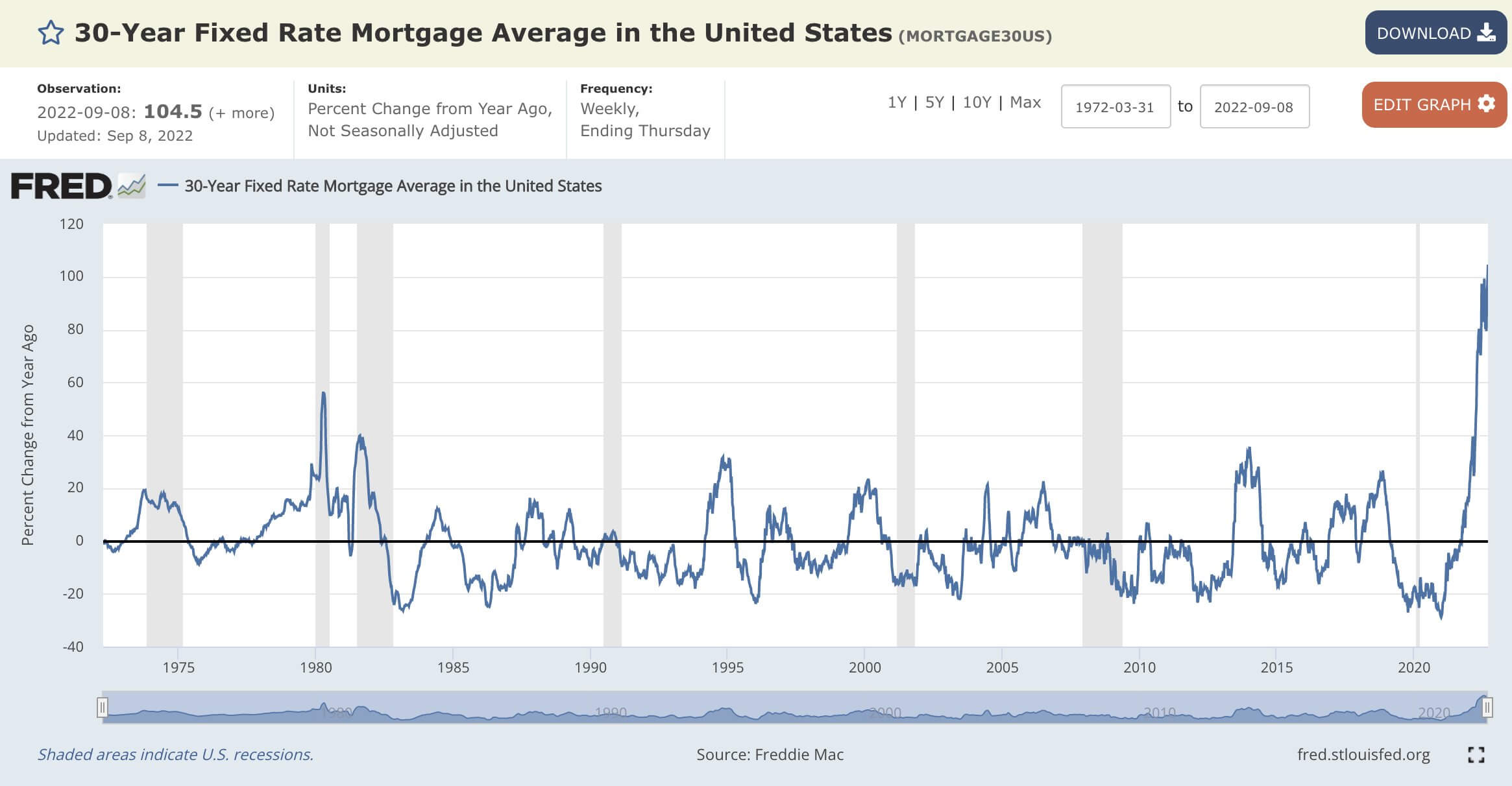

Don’t get left holding the true property bag

The common fastened 30-year mortgage price has accelerated by +104.5% on a year-over-year foundation. This seems to be the quickest change price for the reason that knowledge was collected in 1972.

The present 30-year fastened mortgage on Sept. 21 was 6.47% highest since 2008; it was simply 2.86% in September 2020.

September 2020: a median residence value of $337k with a 30-year mortgage price of two.86% would see a complete paid over 30 years of $502k.

Nevertheless, in comparison with September 2022: a median residence value of $440k with a 30-year mortgage price of 6.47% would see a complete paid over 30 years of $998k.

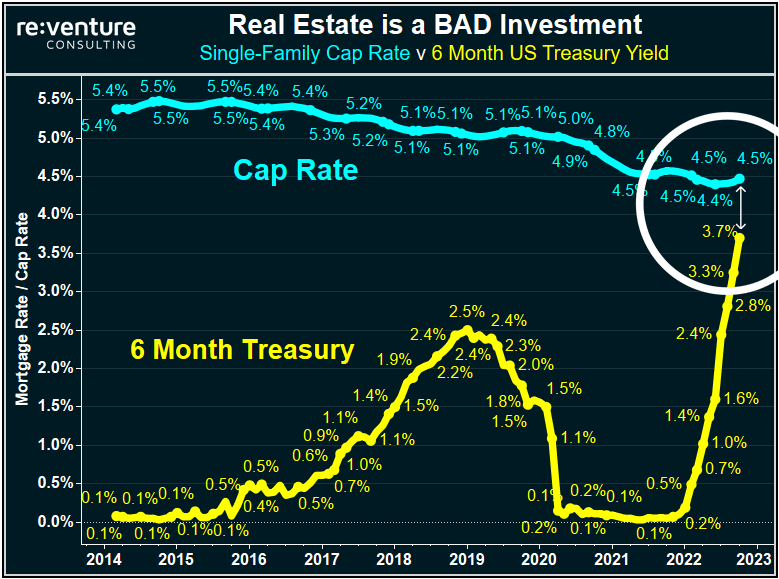

Issues proceed to pile up for actual property buyers. The only-family cap price vs. six-month US treasury yield identifies why actual property is a legal responsibility with rising rates of interest. The 6-Month US Treasury now yields virtually the identical, if no more, in sure states as shopping for & renting out a home in America (aka Cap Charge).

Actual property has much less incentive for buyers to be in these markets because of costs happening. The subsequent obvious signal is diminished investor demand and margin calls to promote properties and get the asset off the books. Every time the federal reserve will increase rates of interest, the capital value will increase on current portfolios. A pattern to observe is to see wall avenue and large banks seeking to exit as rapidly as attainable, as they’ve already earned their charges.

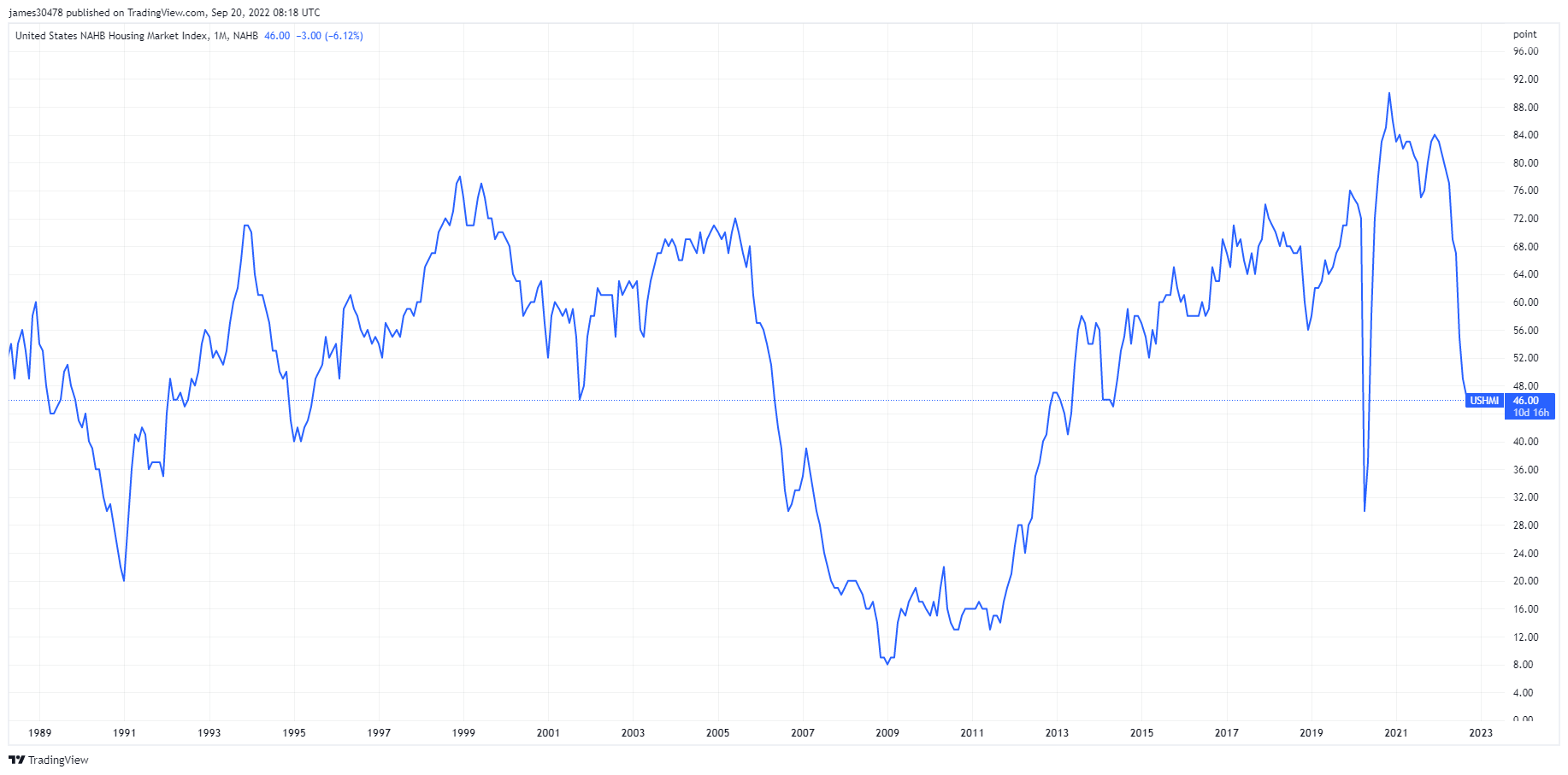

One other indicator that signifies a darkening outlook for US homebuilders is the NAHB housing market index which got here out on Sept. 19. The index fell for a ninth consecutive month and by greater than anticipated in September. The index is threatening to sink to ranges final seen in the course of the housing disaster between 2006 and 2013, with exercise in gross sales within the new properties market virtually grinding to a halt.

Charges & Forex

The ten-year Treasury observe is a debt obligation issued by the US authorities with a maturity of 10 years upon preliminary issuance. A ten-year Treasury observe pays curiosity at a set price as soon as each six months and pays the face worth to the holder at maturity. 10Y Treasury Yield 3.68% 6.78% (5D)

The U.S. greenback index is a measure of the worth of the U.S. greenback relative to a basket of foreign currency. DXY 112.97 3.09% (5D)

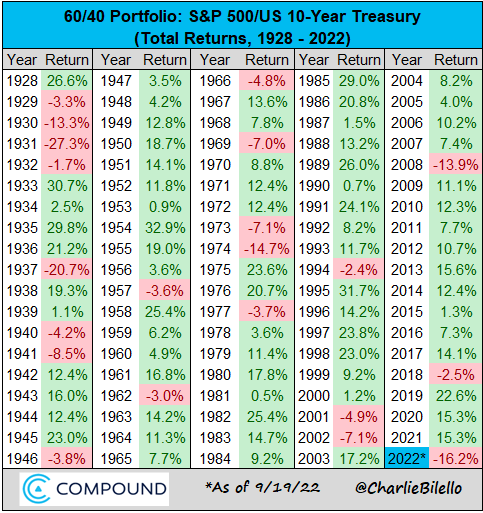

60/40 portfolio is bleeding out

The 60/40 portfolio has served buyers properly for the previous 40 years, with low inflation, volatility, and falling rates of interest. The balanced portfolio would see 60% in equities and 40% in bonds.

Why was this technique the final word insurance coverage

- Sturdy danger: in an period of low-interest charges, the buy-and-hold technique was excellent for equities. On the similar time, bonds supplied portfolio insurance coverage throughout market stress, particularly in the course of the 2000 tech growth and GFC.

- A number of disinflationary forces, similar to globalization, the expansion of China, and getting older demographics and contained inflation.

Why it isn’t anymore

- Susceptible to inflation: buyers acquired affordable nominal returns within the Nineteen Seventies, however when you think about excessive inflation, portfolios misplaced a major worth. In an inflationary setting, bonds endure greater than equities; they won’t defend the elemental significance of portfolios.

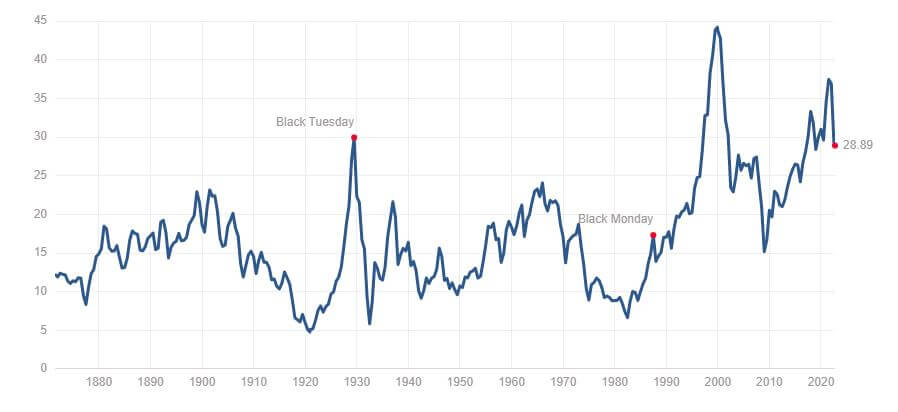

- Based on the CAPE ratio, bonds and equities had been close to all-time valuations. The ratio is calculated by dividing an organization’s inventory value by the typical of the corporate’s earnings for the final ten years, adjusted for inflation. The present ratio is valued at round 29, coming down from ranges of 35. The index is at comparable ranges to black Tuesday (1929 nice despair) and considerably extra elevated than the GFC.

A 60/40 portfolio of US shares/bonds is down 16.2% in 2022, which is on tempo for its worst calendar 12 months since 1937.

Bitcoin Overview

The worth of Bitcoin (BTC) in USD. Bitcoin Worth $19,042 -2.58% (5D)

The measure of Bitcoin’s whole market cap in opposition to the bigger cryptocurrency market cap. Bitcoin Dominance 40.61% -1.82% (5D)

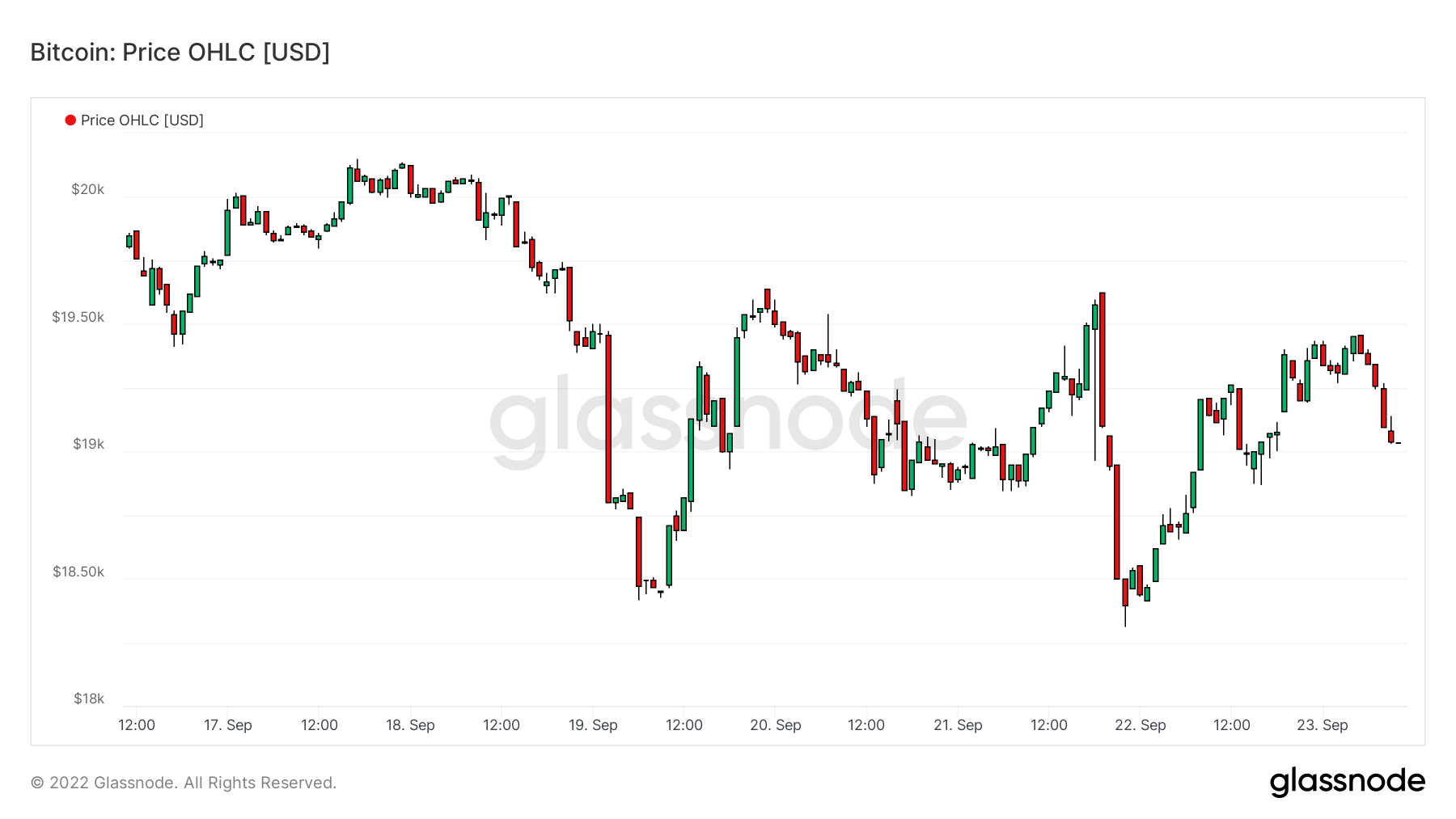

- Bitcoin has been ranging between the $18k and $20k vary for the week commencing Sept. 19

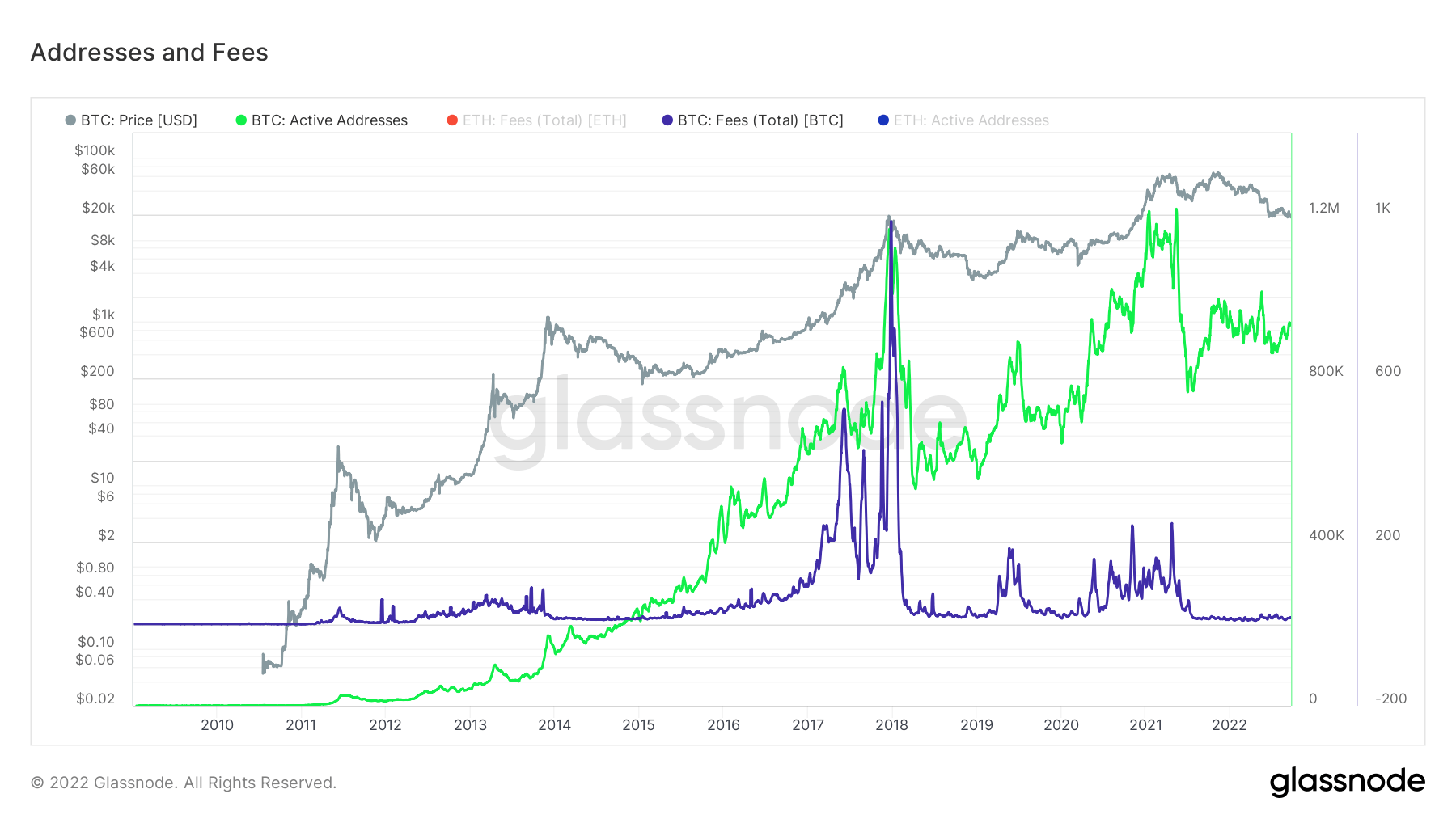

- Addresses and gasoline charges are at multi-year lows.

- MicroStrategy bought an extra 301 Bitcoins on Sept. 9; MicroStrategy now holds 130,000 Bitcoin.

- Miners’ income continues to get squeezed.

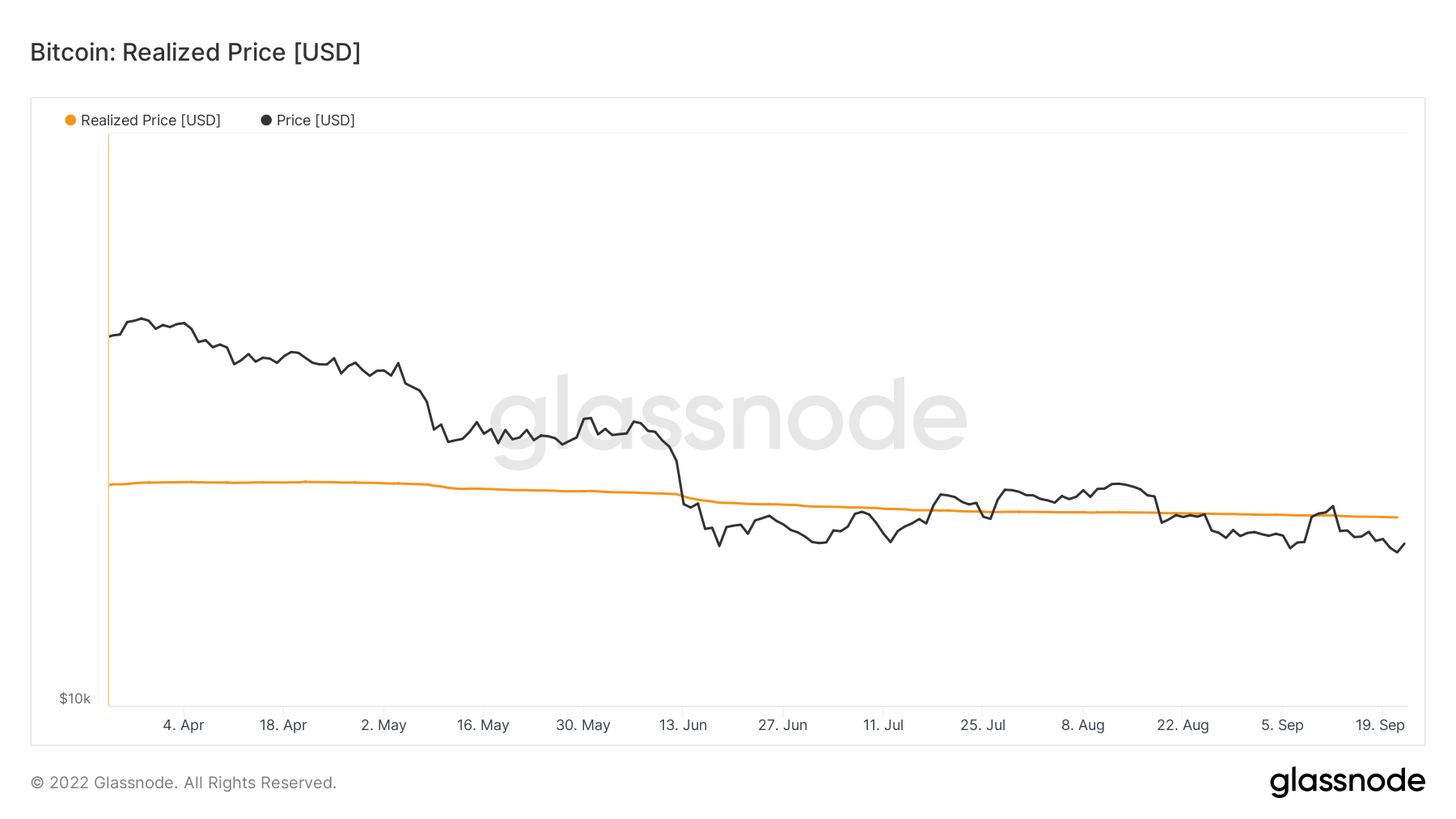

- BTC has been wrestling with the realized value because it went under it in mid-June

Addresses

Assortment of core handle metrics for the community.

The variety of distinctive addresses that had been energetic within the community both as a sender or receiver. Solely addresses that had been energetic in profitable transactions are counted. Lively Addresses 862,692 -9.54% (5D)

The variety of distinctive addresses that appeared for the primary time in a transaction of the native coin within the community. New Addresses 2,799,904 -4.16% (5D)

The variety of distinctive addresses holding 1 BTC or much less. Addresses with ≥ 1 BTC 904,423 0.24% (5D)

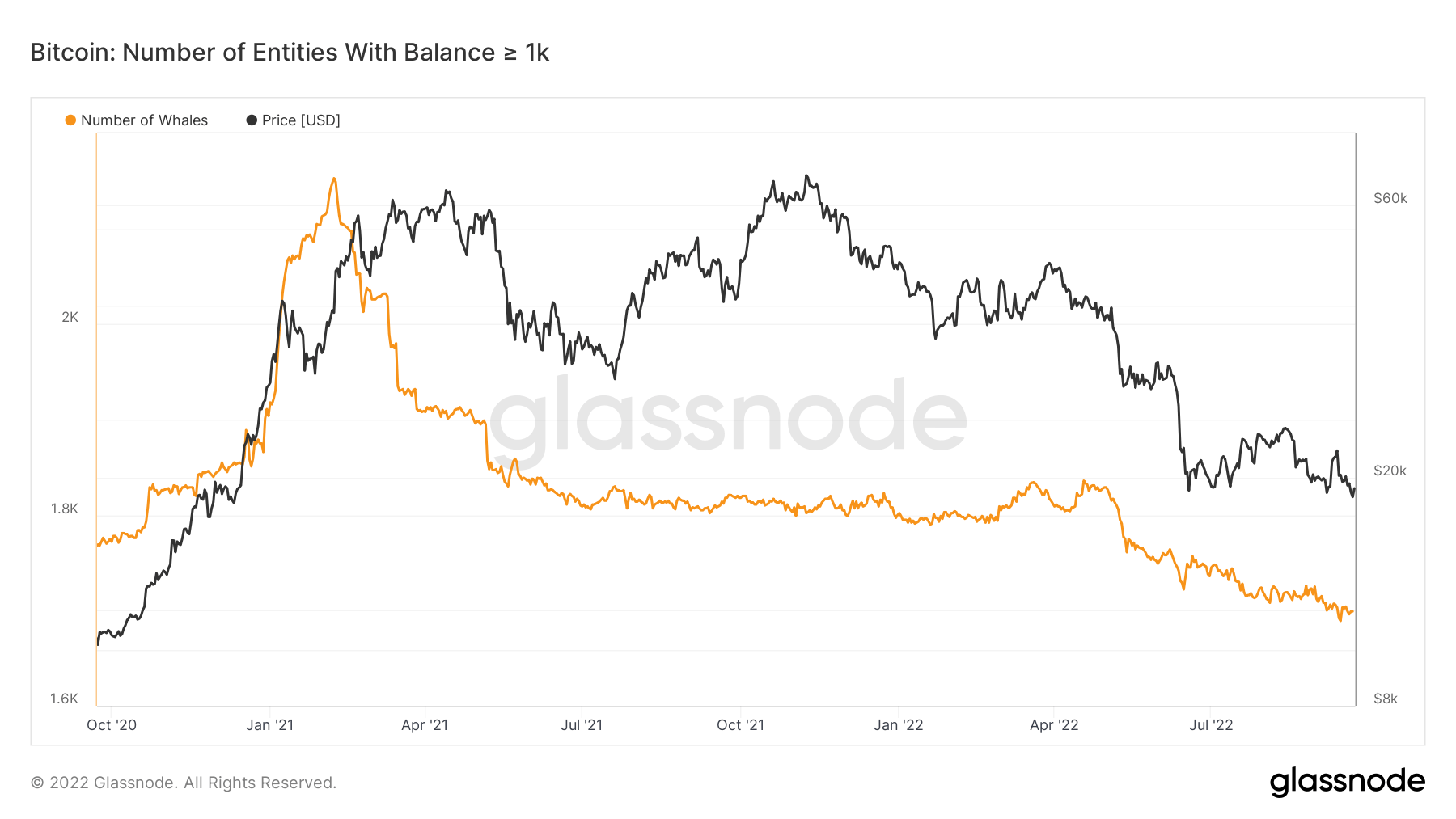

The variety of distinctive addresses holding no less than 1k BTC. Addresses with Steadiness ≤ 1k BTC 2,119 -0.7% (5D)

Ghost city

Lively addresses are the variety of distinctive addresses energetic within the community, both as a sender or receiver. Solely addresses that had been energetic in profitable transactions are counted. Addresses are an effective way to know what exercise is happening on the community. Lively addresses have been flat/muted for nearly two years now, displaying little exercise on the community as speculators have left the ecosystem.

As well as, gasoline charges are meager and muted at ranges seen virtually since 2018. Charges will go up based mostly on transactional exercise, which additionally helps the case that it’s a ghost city on the Bitcoin community.

Entities

Entity-adjusted metrics use proprietary clustering algorithms to supply a extra exact estimate of the particular variety of customers within the community and measure their exercise.

The variety of distinctive entities that had been energetic both as a sender or receiver. Entities are outlined as a cluster of addresses which might be managed by the identical community entity and are estimated via superior heuristics and Glassnode’s proprietary clustering algorithms. Lively Entities 273,390 -3.43% (5D)

The variety of BTC within the Goal Bitcoin ETF. Goal ETF Holdings 23,613 0.04% (5D)

The variety of distinctive entities holding no less than 1k BTC. Variety of Whales 1,698 -0.29% (5D)

The full quantity of BTC held on OTC desk addresses. OTC Desk Holdings 2,153 BTC -46.59% (5D)

Whales proceed to promote

The variety of entities with a stability of 1,000 or extra Bitcoin is taken into account a whale. Through the peak of the early 2021 bull run, there have been virtually 2,500 whales as Bitcoin approached $60,000. Nevertheless, as whales are thought of the good cash of the Bitcoin ecosystem, they offered when the value was excessive; anticipate to see this cohort’s accumulation if Bitcoin traits decrease in value.

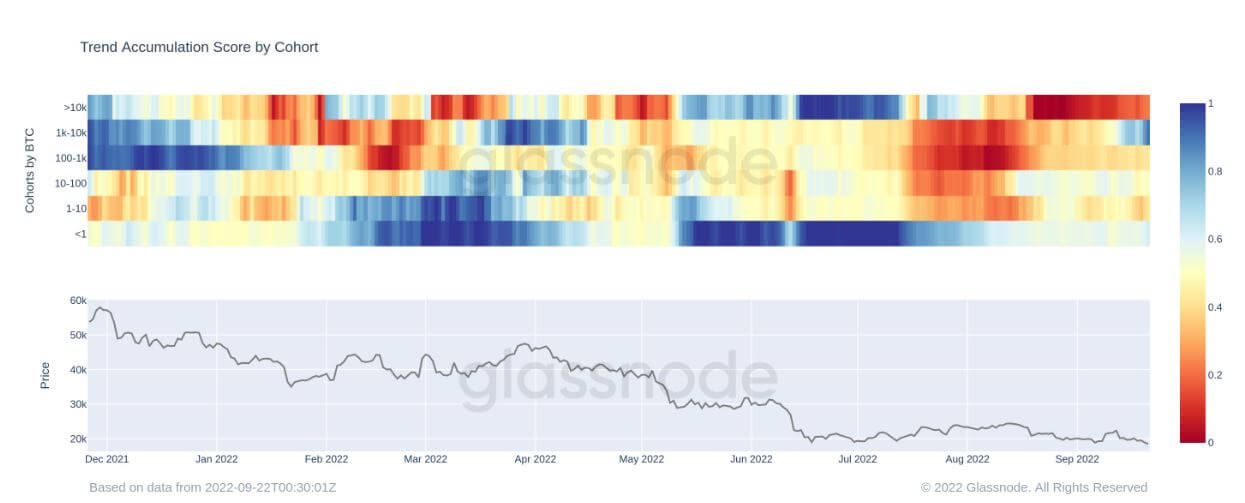

The buildup pattern rating by the cohort confirms the thesis above; the metric monitor’s distribution and accumulation by every entity’s pockets. The 1k-10k entity has began to extend its holdings since Sept. 19, signified by the darkish blue, which is encouraging to see as they see Bitcoin as worth for cash at these value ranges.

Miners

Overview of important miner metrics associated to hashing energy, income, and block manufacturing.

The common estimated variety of hashes per second produced by the miners within the community. Hash Charge 230 TH/s 1.77% (5D)

The full provide held in miner addresses. Miner Steadiness 1,834,729 BTC -0.01% (5D)

The full quantity of cash transferred from miners to alternate wallets. Solely direct transfers are counted. Miner Web Place Change -17,692 BTC 21,838 BTC (5D)

Miners must capitulate for the underside to be confirmed

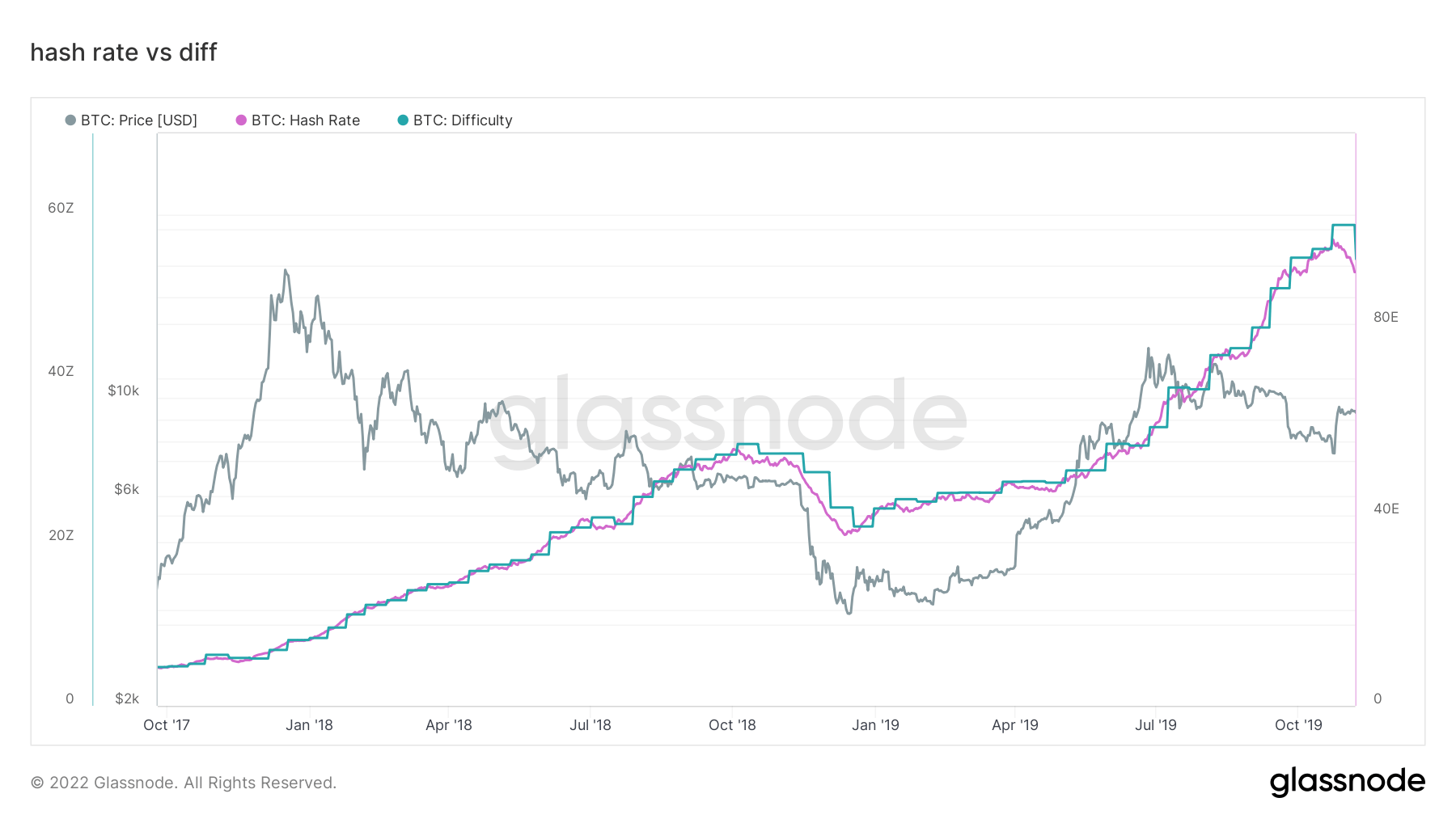

Wanting again on the 2017-18 cycle, the ultimate capitulation wasn’t till the miners capitulated. The Bitcoin hash price fell over 30% from the height as miners shut down because of being unprofitable. With rising vitality payments and charges, one thing comparable most definitely happens in the course of the winter because the pressure will intensify on unprofitable miners.

As well as, miner income per TeraHash (hash price/ miner income) hasn’t damaged down under its all-time lows, which has the potential to occur because of rising hash price and BTC falling costs.

The mining business is a sport of survival of the fittest; any respectable minor makes use of stranded vitality and has a set PPA. As borrowing charges enhance with vitality costs, unprofitable miners will begin to capitulate and fall off the community.

On-Chain Exercise

Assortment of on–chain metrics associated to centralized alternate exercise.

The full quantity of cash held on alternate addresses. Alternate Steadiness 2,391,523 BTC 19,541 BTC (5D)

The 30 day change of the provision held in alternate wallets. Alternate Web Place Change 281,432 BTC 262,089 BTC (30D)

The full quantity of cash transferred from alternate addresses. Alternate Outflows Quantity 185,654 BTC -23 BTC (5D)

The full quantity of cash transferred to alternate addresses. Alternate Inflows Quantity 173,456 BTC -32 BTC (5D)

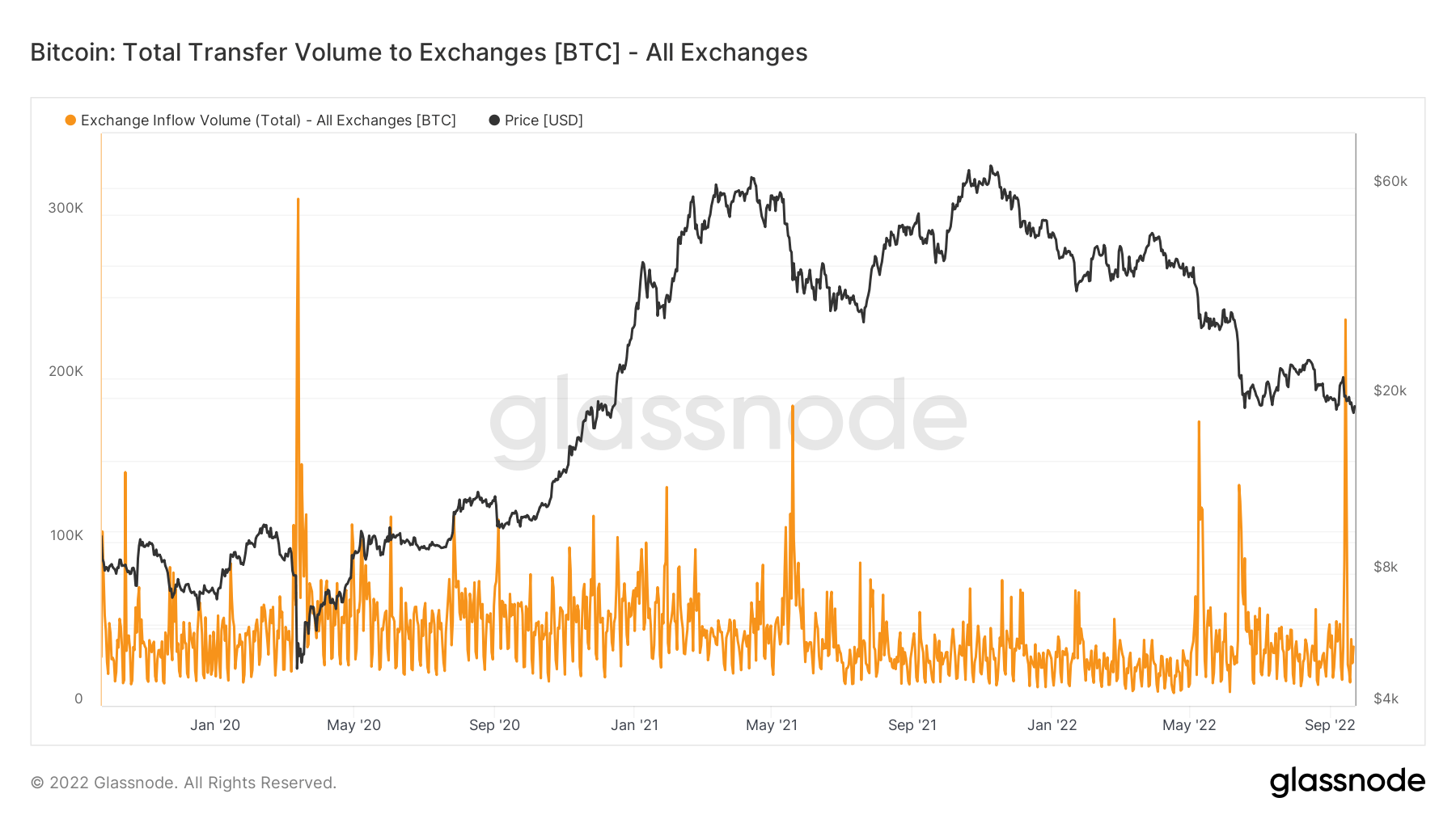

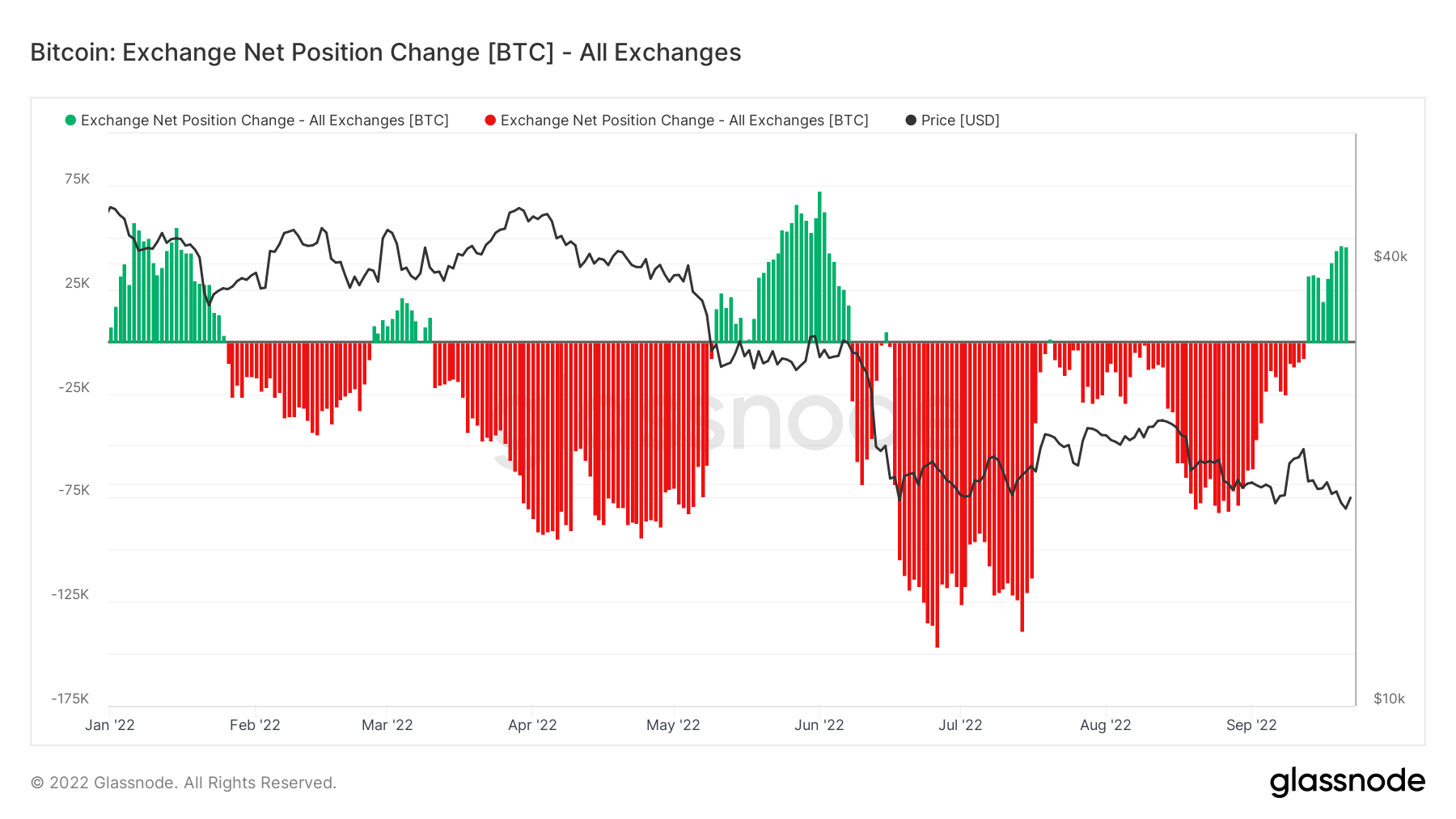

Bitcoin on-chain exercise seems to be bleak

On-chain exercise can decide what number of cash are being spent to and from exchanges. The primary metric contextualizes this, whole switch quantity to exchanges. On Sept 19, 250k BTC was despatched again onto exchanges which might be the very best quantity since March 2020.

That is additional supported by the metric alternate internet place change, which exhibits inflows are the dominant regime. This has occurred solely 4 occasions this 12 months, each across the Russian invasion and the Luna collapse. Quite a lot of bearish sentiment is being trickled via onto exchanges.

Provide

The full quantity of circulating provide held by completely different cohorts.

The full quantity of circulating provide held by long run holders. Lengthy Time period Holder Provide 13.65M BTC 0.29% (5D)

The full quantity of circulating provide held by brief time period holders. Brief Time period Holder Provide 3.07M BTC -1.64% (5D)

The % of circulating provide that has not moved in no less than 1 12 months. Provide Final Lively 1+ Yr In the past 66% 0.08% (5D)

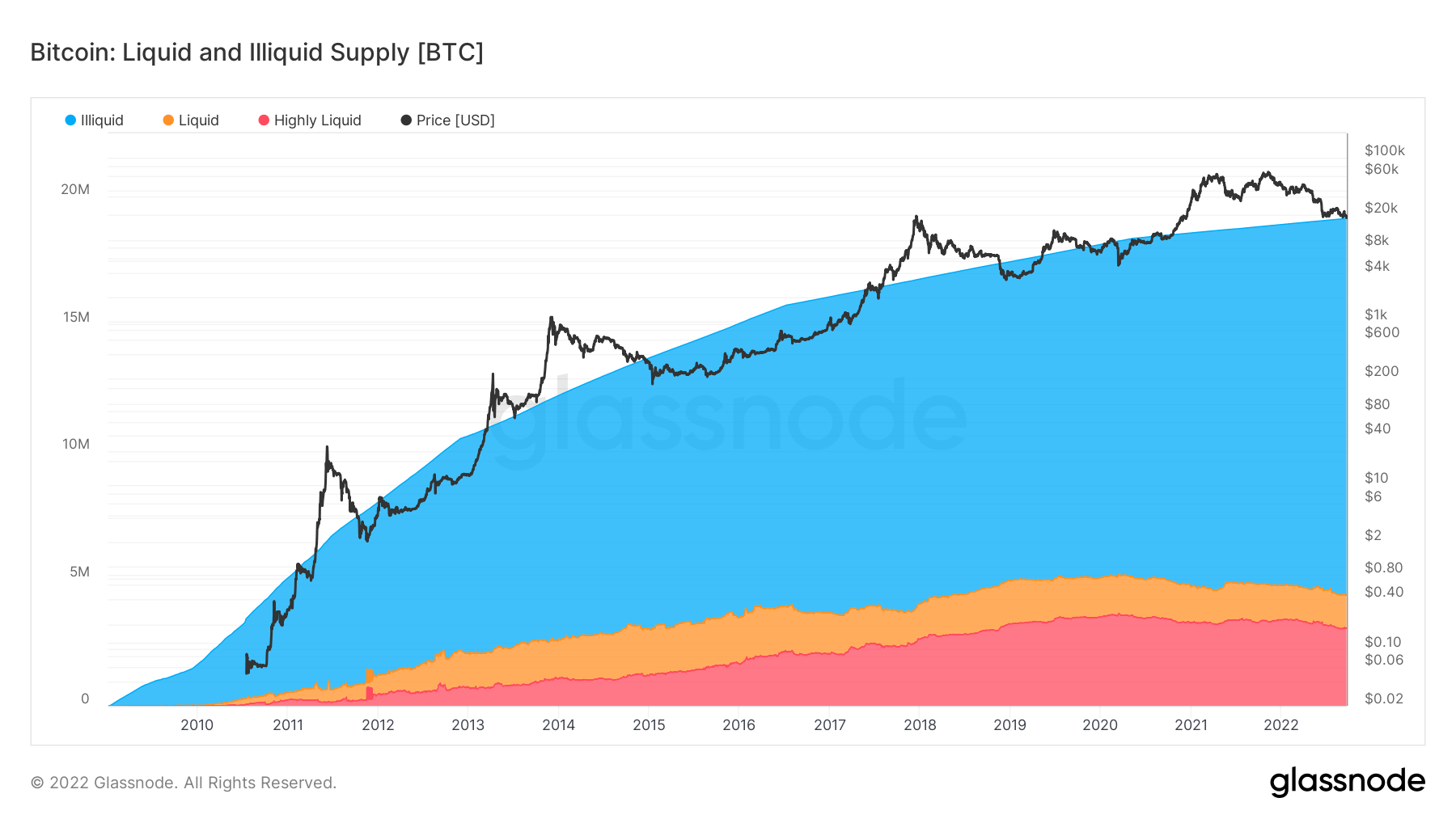

The full provide held by illiquid entities. The liquidity of an entity is outlined because the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is taken into account to be illiquid / liquid / extremely liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively. Illiquid Provide 14.8M BTC 0.01% (5D)

Observe the information

The full provide held by illiquid, liquid, and extremely liquid entities. The liquidity of an entity is outlined because the ratio of cumulative outflows and inflows over the entity’s lifespan. An entity is taken into account to be illiquid / liquid / extremely liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively.

Bitcoin is closing in on 15 millionth bitcoin turning into illiquid; these are cash stored offline in scorching or chilly storage wallets. The circulating provide is round 19 million, with a staggering quantity of the illiquid provide at present sitting at 79%.

This metric additionally breaks down the liquid and extremely liquid provide. For the reason that starting of the 12 months, liquid and extremely liquid BTC has decreased by round 400k BTC and change into illiquid, which is bullish over the long run as fewer buyers are speculating over the asset and holding it as a retailer of worth.

Cohorts

Breaks down relative habits by numerous entities’ pockets.

SOPR – The Spent Output Revenue Ratio (SOPR) is computed by dividing the realized worth (in USD) divided by the worth at creation (USD) of a spent output. Or just: value offered / value paid. Lengthy-term Holder SOPR 0.57 -6.56% (5D)

Brief Time period Holder SOPR (STH-SOPR) is SOPR that takes into consideration solely spent outputs youthful than 155 days and serves as an indicator to evaluate the behaviour of brief time period buyers. Brief-term Holder SOPR 0.98 0.00% (5D)

The Accumulation Development Rating is an indicator that displays the relative dimension of entities which might be actively accumulating cash on-chain when it comes to their BTC holdings. The dimensions of the Accumulation Development Rating represents each the scale of the entities stability (their participation rating), and the quantity of latest cash they’ve acquired/offered over the past month (their stability change rating). An Accumulation Development Rating of nearer to 1 signifies that on mixture, bigger entities (or an enormous a part of the community) are accumulating, and a price nearer to 0 signifies they’re distributing or not accumulating. This gives perception into the stability dimension of market individuals, and their accumulation habits over the past month. Accumulation Development Rating 0.43 152.94% (5D)

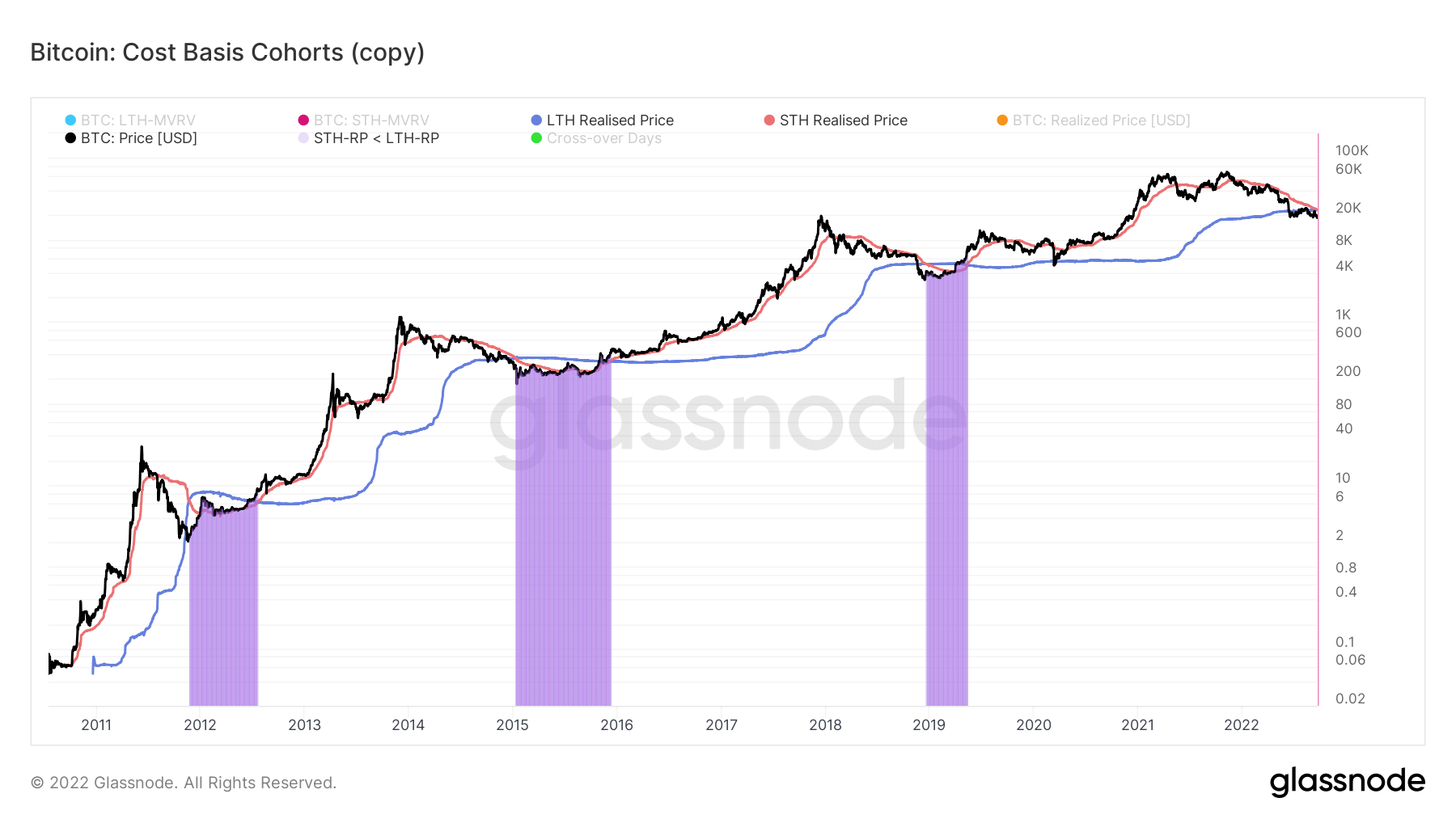

The place are we when it comes to cost-basis?

Realized value was the combination value when every coin was final spent on-chain. Additional analyzing brief and long-term holder cohorts, we are able to calculate the realized value to mirror the combination value foundation of every group.

This metric calculates the ratio between LTH and STH realized value:

- Uptrend when STHs understand a loss that may be a higher price than LTHs (e.g., accumulation in a bear market)

- Downtrend when LTHs spend cash and switch them to STHs (e.g., bull market distribution)

Throughout bear markets, as the value continues to fall, STH realized value will fall under LTH realized value. When capitulation happens, highlighted by the purple zone, these occasions often occur throughout late-stage bear markets.

The worth has been in a downward spiral for nearly a 12 months, since November 2021, and we’re but to cross over; the expectation of this crossover may happen earlier than the top of September. In earlier bear market cycles, it often takes on common 220 days to get well after the crossover.