That is an opinion editorial by Scott Sullivan.

Usually Bitcoiners don’t care an excessive amount of about what goes on in Shitcoin-land, however now that Ethereum has merged to proof-of-stake (PoS), there’s been fairly the thrill on Bitcoin Twitter. In fact, the Bitcoin community itself will stay unaffected, however I feel this “improve” remains to be price paying some consideration to. Now that Ethereum has cleansed itself of the “soiled” and “wasteful” externalities related to proof-of-work (PoW), we will anticipate the gloves to return off within the narrative battle, and I feel Bitcoiners ought to be able to punch again.

Studying how PoS works is a very good method to internalize the variations and trade-offs between PoW and PoS. Regardless that I had seen all of the high-level arguments towards PoS earlier than — that PoS is extra permissioned, centralizing, and oligarchical — I’ll admit that with out wanting into the main points, all of it felt type of hand-wavy. By truly diving into the PoS algorithm, we will start to see how all these properties naturally emerge from first rules. So in the event you’re interested in how the PoS algorithm works, and why it results in these sorts of properties, then learn on!

Fixing The Double-Spend Drawback

Let’s begin with a fast recap of the issue we’re attempting to resolve. Suppose we’ve got a big group of members in a cryptocurrency community attempting to keep up a decentralized ledger. Right here’s the issue: How can new transactions be added to everybody’s ledger, such that everybody agrees on which new transactions are “appropriate”? PoW solves this downside fairly elegantly: Transactions are grouped collectively in blocks, whereby every block takes a considerable amount of computational work to supply. The quantity of labor required can transfer up or down to make sure blocks are produced each ten minutes on common, giving every new block loads of time to propagate all through the community earlier than the subsequent one is created. Any ambiguity is resolved by choosing the chain with probably the most work, and double-spending is prevented resulting from requiring at the very least 51% of the worldwide hashpower for a double-spend block to catch up.

However suppose now we need to throw away Satoshi Nakamoto’s key perception that made all of this doable within the first place. In any case, these pesky ASICs are loud and annoying, they usually devour extra vitality than all of George Soros, Invoice Gates and Hillary Clinton’s personal jets mixed. Is there a way we will unambiguously agree on which transactions are true simply by speaking it out?

Ethereum’s proof-of-stake proposes to resolve this downside utilizing two key substances. The primary is to make particular “checkpoint blocks” now and again, whose goal is to provide assurance to everybody within the community concerning the “fact” of the system at varied cut-off dates. Making a checkpoint requires a two-thirds majority vote by stake, so there may be some assurance that almost all of validators agreed on what the reality truly was at that cut-off date. The second ingredient is to punish customers for including ambiguity to the community, a course of referred to as “slashing.” For instance, if a validator had been to create a fork, or vote on an older sidechain (just like a 51% assault), then their stake would get slashed. Validators may also be slashed for inactivity, however not as a lot.

This leads us to our first precept behind PoS, which is that PoS is predicated on a unfavorable (penalty-based) incentive system.

This contrasts closely with Bitcoin and proof-of-work, which is a constructive (reward-based) incentive system. In Bitcoin, miners can try to interrupt the principles — badly formatted blocks, invalid transactions, and so forth — however these blocks will simply get ignored by full nodes. The worst-case state of affairs is a little bit of wasted vitality. Miners are additionally free to construct on older blocks, however with out 51% of the hashpower, these chains won’t ever catch up, once more simply losing vitality. Any miner who participates in these actions, whether or not deliberately or not, needn’t fear about shedding their collected bitcoin or mining machines, however they received’t get new rewards. Relatively than stay in worry, bitcoin miners can err on the facet of taking motion and danger.

The world is a really totally different place for validators dwelling in Ethereum-land. As an alternative of working exhausting and being rewarded for including safety to the community, validators do no precise work, however should be cautious that their node by no means misbehaves, lest they watch their financial savings go up in flames. If any proposed modifications had been made to the community, a validator’s first intuition can be to adjust to no matter everybody else was doing, or else danger getting slashed. To be a validator is like strolling on eggshells on a regular basis.

By the way in which, dwelling below a unfavorable incentive system is among the, ahem, “advantages” of proof-of-stake, based on the Ethereum community’s co-founder Vitalik Buterin’s FAQ:

So how would slashing truly work on a technical degree? Wouldn’t we have to first create a listing of all of the validators, to be able to have one thing to slash within the first place? The reply is sure. To develop into a validator in Ethereum, one should first transfer ETH right into a particular “staking” deal with. Not solely is that this listing wanted for slashing, but in addition for voting since a two-thirds majority vote is required for checkpoint blocks.

There are some attention-grabbing implications to sustaining a listing of all validators always. How exhausting is it to affix? How exhausting is it to go away? Do validators get to vote on the standing of different validators?

This brings us to our second precept behind PoS, which is that PoS is a permissioned system.

Step one in changing into a validator is to deposit some ETH right into a particular staking deal with. How a lot ETH? The minimal required is 32 ETH, or about $50,000 on the time of this writing. For context, an honest bitcoin mining rig usually runs within the single-digit 1000’s of {dollars}, and a house miner can begin with a single S9 for a number of hundred bucks. To be truthful, ETH’s excessive entry payment has a technical justification, since the next stake means fewer validators, which lowers bandwidth.

So the deposit payment is excessive, however at the very least anybody who owns 32 ETH is free to affix or go away at any time, proper? Not fairly. There are safety dangers if giant coalitions of validators had been to all enter or exit on the identical time. For instance, if a majority of the community all left without delay, then they might double-spend a finalized block by replaying a fork during which they by no means left, with out getting slashed on both chain. To mitigate this danger, the on- and off-ramps have a built-in throughput restrict. At present this restrict is ready to max(4,|V|/65536) validators per epoch (each 6.4 minutes), and is identical for each getting into and leaving. This interprets roughly to at least one full validator set each ten months.

By the way in which, though it’s at present doable for validators to publish an “exit” transaction and cease validating, the code to truly withdraw funds hasn’t even been written but. Sounds a bit like “Resort California” …

There’s one final level concerning the incentives behind approving new validators. Suppose you had been a shareholder in a big and secure firm paying common dividends each quarter. Wouldn’t it make sense to provide new shares away totally free? In fact not, since doing so would dilute the dividends of all current shareholders. An analogous incentive construction exists in PoS, since every new validator dilutes the income of all current validators.

In concept, validators may merely censor each single transaction that provides a brand new validator; nevertheless, in follow, I feel such a blunt strategy can be unlikely. This is able to be very noticeable and would destroy Ethereum’s picture of “decentralization” in a single day, probably crashing the worth. I feel a extra refined strategy can be used as a substitute. For instance, the principles may slowly change over time making it tougher to develop into a validator, with excuses being provided corresponding to “safety” or “effectivity.” Any insurance policies that enrich current validators on the expense of latest validators would have monetary tailwinds, whether or not spoken out loud or not. We will begin to see why PoS would have a tendency in direction of oligarchy.

Overview Of The Casper Algorithm

Now that we all know the high-level technique behind PoS, how does the algorithm truly work? The primary concepts behind checkpoints and slashing had been put ahead in an algorithm referred to as Casper, so we’ll begin there. Casper itself doesn’t truly specify something about the right way to produce blocks, however relatively supplies a framework for the right way to superimpose a checkpoint/slashing technique on high of some already-existing blockchain tree.

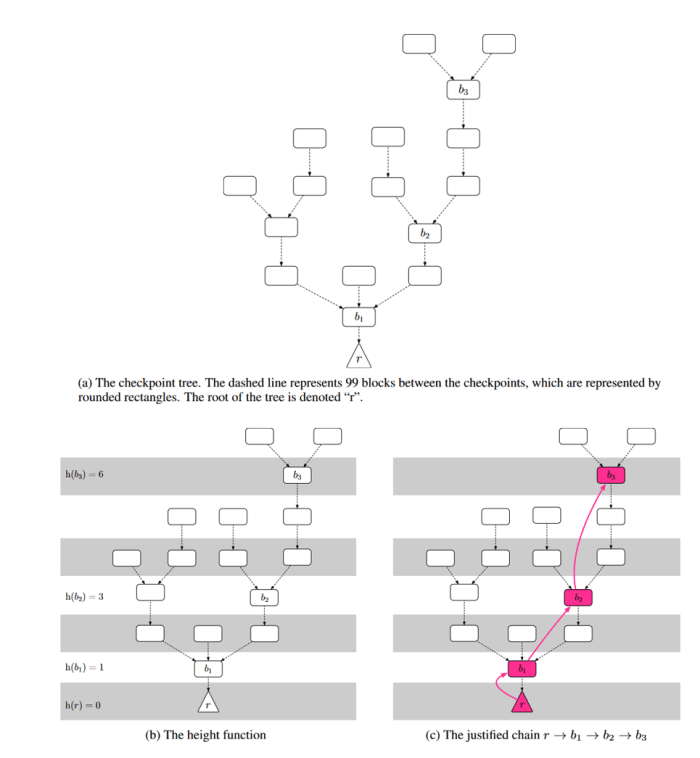

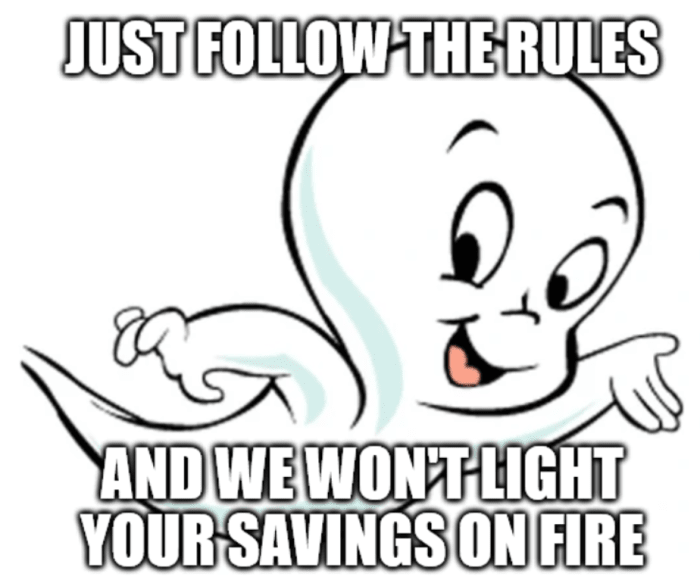

First, some arbitrary fixed (C) is chosen to be the “checkpoint spacing” quantity, which determines what number of blocks happen between checkpoints; for instance, if C=100 then checkpoints would happen at blocks 0, 100, 200, and so forth. Then the nodes all vote on which checkpoint block ought to be the subsequent “justified” checkpoint. Relatively than vote on single blocks in isolation, validators truly vote on (s,t) checkpoint pairs, which hyperlink some beforehand justified checkpoint supply “s” to some new goal checkpoint “t.” As soon as a checkpoint hyperlink (s,t) will get a two-thirds majority vote by stake, then “t” turns into a brand new justified checkpoint. The diagram beneath exhibits an instance tree of checkpoints:

On this diagram, the h(b) perform is referring to the “checkpoint peak,” e.g., the block’s a number of of 100. You’ll have observed that not each hundredth block is essentially justified, which might occur if the vote failed at a sure peak. For instance, suppose at peak 200 two separate checkpoints every acquired 50% of the vote. Since voting twice is a slashable offense, the system would get “caught” until some validators willingly slashed their very own stake to realize a two-thirds vote. The answer can be for everybody to “skip” checkpoint 200 and “strive once more” at block 300.

Simply because a checkpoint is justified, doesn’t imply it’s finalized. To ensure that a checkpoint to rely as finalized, it should be instantly adopted by one other justified checkpoint on the subsequent doable peak. For instance, if checkpoints 0, 200, 400, 500 and 700 had been all justified and linked collectively, solely checkpoint 400 would rely as “finalized,” since it’s the just one instantly adopted by one other justified checkpoint.

As a result of the terminology could be very exact, let’s recap our three classes. A “checkpoint” is any block which happens at peak C*n, so if C=100, each block with peak 0, 100, 200, 300, and so forth would all be checkpoints. Even when a number of blocks had been created at peak 200, they’d each be “checkpoints.” A checkpoint is then “justified” if it’s both the foundation block at peak 0, or if two-thirds of the validators voted to create a hyperlink between some beforehand justified checkpoint and the present checkpoint. A justified checkpoint is then “finalized” if it then hyperlinks to a different justified checkpoint on the subsequent doable peak. Not each checkpoint essentially turns into justified and never each justified checkpoint essentially turns into finalized, even within the remaining chain.

Casper Slashing Guidelines

The slashing guidelines in Casper are designed such that it’s inconceivable for 2 finalized checkpoints to exist in two separate forks, until at the very least one-third of the validators broke the slashing guidelines.

In different phrases, solely finalized checkpoints ought to ever be counted as unambiguous “fact” blocks. It’s even doable for 2 justified checkpoints to happen on each side of a fork, simply not two finalized checkpoints. There’s additionally no assure about when or the place the subsequent finalized checkpoint will happen, simply that if a series cut up had been to happen, then it is best to sit again and wait till a finalized block exhibits up someplace, and as soon as it does then you understand that’s the “appropriate” chain.

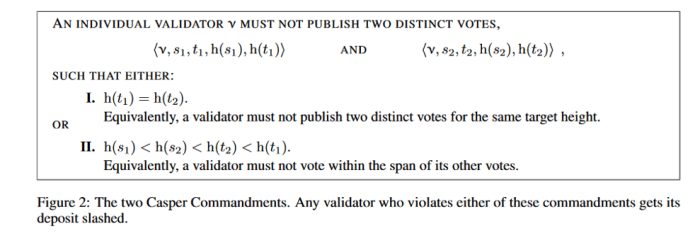

There are two slashing guidelines in Casper which implement this property:

The primary rule forbids anybody from double-voting on checkpoints with the identical goal peak, so if a validator voted for 2 totally different checkpoint blocks with goal peak 200, that may be a slashable offense. The aim of this rule is to stop the chain from splitting into two totally different justified checkpoints with the identical peak, since this is able to require 2/3 + 2/3 = 4/3 of the overall validator votes, implying that at the very least one-third of the validators broke the slashing guidelines. Nevertheless, as we noticed beforehand, it’s doable for justified checkpoints to “skip” sure block heights. What prevents a series from splitting into totally different goal heights? For instance, couldn’t checkpoint 200 fork into justified checkpoints at 300 and 400 with out anybody getting slashed?

That’s the place the second rule is available in, which principally prevents validators from “sandwiching” votes inside different votes. For instance, if a validator voted for each 300→500 and 200→700, that may be a slashable offense. Within the case of a series cut up, as soon as one department sees a finalized checkpoint, it turns into inconceivable for the opposite department to see a justified checkpoint afterwards until at the very least one-third of the validators broke rule #2.

To see why, suppose the blockchain forked into justified checkpoints 500→800 and 500→900, then in some unspecified time in the future the primary chain noticed a finalized checkpoint with hyperlink 1700→1800. Since each 1700 and 1800 can solely be justified on fork #1 (assuming no one broke the primary slashing rule), the one manner fork #2 may see a justified checkpoint after 1800 is that if there was some voted-in hyperlink between heights H<1700 and H>1800. However since this vote would “sandwich” the 1700→1800 hyperlink and require a two-thirds vote, and the 1700→1800 already handed with a two-thirds vote, then at the very least one-third of the validators would want to interrupt rule #2. The Casper paper has a pleasant diagram demonstrating this property:

And that’s it, simply observe the Casper guidelines and also you’re good!

Appears fairly easy, proper? I’m positive PoS would solely ever use slashing as an absolute final resort to keep up consensus, and never as an extortionary mechanism to stress validators into behaving a sure manner … proper?

(Source)

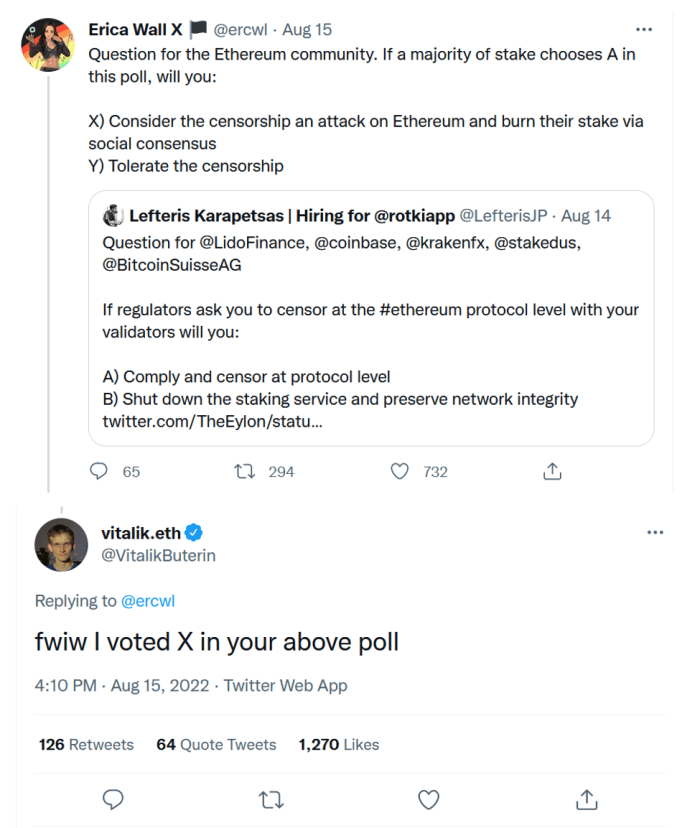

This brings us to our third precept behind PoS: There are not any guidelines. The “guidelines” are no matter everybody else says they’re.

Sooner or later your node might be technically following each Casper commandment to the letter, and the subsequent day your financial savings might be slashed since you had been doing one thing everybody else didn’t like. Accredited a “group purple” transaction that one time? Tomorrow the “group blue” majority would possibly slash you. Or possibly you probably did the alternative and omitted too many “group purple” transactions? Tomorrow the “group purple” majority would possibly slash you for censorship. The power to slash goes far past the restricted scope of OFAC (Workplace of Overseas Property Management) censorship. PoS is sort of a nonstop Mexican standoff, the place the implicit risk of slashing is ever-present always.

I wouldn’t be shocked if in a contentious exhausting fork, each side hard-coded the validation guidelines of the opposite fork, simply in case they wished to punish anybody who joined the “mistaken” facet. In fact, this is able to be a nuclear choice, and like nukes, both sides would possibly solely select to strike in retaliation. I might guess that almost all particular person validators are impartial in that they’d prioritize monetary self-preservation over political self-sacrifice, however would possibly outwardly take a facet in the event that they sensed that was the proper transfer to keep away from getting slashed.

What Time Is It?

Now that we all know the fundamentals of checkpoints and slashing, we will transfer onto the precise algorithm utilized in Ethereum, referred to as Gasper. This can be a portmanteau of Casper, which we’ve already lined, and GHOST, a technique for choosing the “finest” chain of blocks in between checkpoints.

The very first thing to know about Gasper is that point itself is the primary unbiased variable. Actual-world time is split into twelve-second models referred to as “slots,” the place every slot comprises at most one block. These slots then type bigger teams referred to as “epochs,” the place every epoch refers to at least one checkpoint. Every epoch comprises 32 slots, making them 6.4 minutes lengthy.

It’s price noting that this paradigm flips the causal relation between time and block manufacturing when in comparison with PoW. In PoW, blocks are produced as a result of a sound hash was discovered, not as a result of sufficient time had handed. However in Gasper, blocks are produced as a result of sufficient real-world time has handed to get to the subsequent slot. I can solely think about the difficult timing bugs such a system might encounter, particularly when it’s not only one program working on one laptop, however tens of 1000’s of computer systems attempting to run in sync all around the world. Hopefully, the Ethereum builders are accustomed to the falsehoods programmers consider about time.

Now suppose you had been beginning up a validator node, and also you had been syncing the blockchain for the primary time. Simply since you noticed that sure blocks referenced sure timestamps, how may you make certain that these blocks had been actually produced at these occasions? Since block manufacturing doesn’t require any work, couldn’t a malicious group of validators simulate a wholly pretend blockchain from day one? And in the event you noticed two competing blockchains, how would you understand which is true?

This brings us to our fourth precept behind PoS, which is that PoS depends on subjective fact.

There’s merely no goal method to choose between two competing blockchains, and any new nodes to the community should in the end belief some current supply of fact to resolve any ambiguity. This contrasts considerably with Bitcoin, the place the “true” chain is all the time the one with probably the most work. It doesn’t matter if a thousand nodes are telling you chain X, if a single node broadcasts chain Y and it comprises extra work, then Y is the proper blockchain. A block’s header can show its personal price, fully eradicating the necessity for belief.

By counting on subjective fact, PoS reintroduces the necessity for belief. Now I’ll admit, I’m maybe barely biased, so if you wish to learn the opposite facet, Buterin wrote an essay containing his views right here. I’ll admit that in follow, a series cut up doesn’t appear all that seemingly given the Casper guidelines, however regardless, I do get some peace of thoughts realizing that this isn’t even a chance in Bitcoin.

Block Manufacturing And Voting

Now that we’re accustomed to slots and epochs, how are particular person blocks produced and voted on? Initially of every epoch, the total validator set is “randomly” partitioned into 32 teams, one for every slot. Throughout every slot, one validator is “randomly” chosen to be the block producer, whereas the others are chosen to be the voters (or “attestors”). I’m placing “randomly” in quotes as a result of the method should be deterministic, since everybody should unambiguously agree on the identical validator units. Nevertheless this course of should even be non-exploitable, since being the block producer is a extremely privileged place because of the additional rewards obtainable from miner extractable worth (MEV), or because it’s being renamed, “most extractable worth.” “Ethereum Is A Darkish Forest” is a superb learn on this.

As soon as a block is produced, how do the opposite validators vote or “attest” to it? Block proposal is meant to occur inside the first half (six seconds) of a slot, and testifying inside the second half, so in concept there ought to be sufficient time for the attestors to vote on their slot’s block. However what occurs if the block proposer is offline or fails to speak or builds on a foul block? The job of an attestor just isn’t essentially to vote on that slot’s block, however relatively whichever block “seems to be the perfect” from their view at that cut-off date. Underneath regular situations this may often be the block from that slot, however is also an older block if one thing went mistaken. However what does “look the perfect” imply, technically? That is the place the GHOST algorithm is available in.

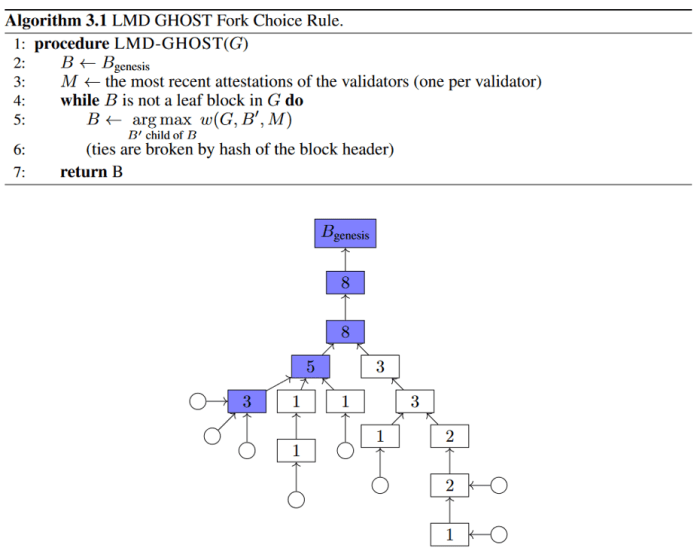

GHOST stands for “Greediest Heaviest Noticed SubTree” and is a grasping recursive algorithm for locating the block with probably the most “current exercise.” Principally, this algorithm seems to be in any respect the current blocks within the type of a tree, and walks down the tree by greedily choosing the department with probably the most cumulative attestations on that complete subbranch. Solely the newest attestation of every validator counts in direction of this sum, and ultimately this course of lands on some leaf block.

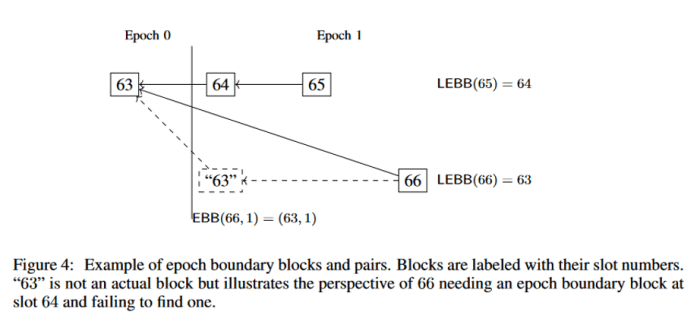

Attestations usually are not simply votes for the present finest block, but in addition the for the newest checkpoint which result in that block. It’s price noting in Gasper, checkpoints are primarily based on epochs relatively than block heights. Every epoch refers to precisely one checkpoint block, which is both the block in that epoch’s first slot, or if that slot was skipped, then the newest block earlier than that slot. The identical block can theoretically be a checkpoint in two totally different epochs if an epoch by some means skipped each single slot, so checkpoints are represented utilizing (epoch, block) pairs. Within the diagram beneath, EBB stands for “epoch boundary block” and represents the checkpoint for a selected epoch, whereas “LEBB” stands for “final epoch boundary block” and represents the newest checkpoint general.

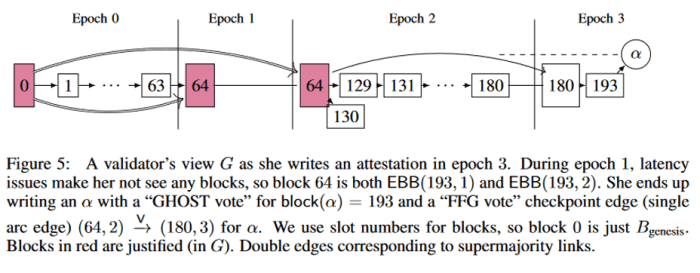

Just like Casper, a checkpoint turns into justified as soon as the overall variety of attestations passes the two-thirds threshold, and finalized if it was instantly adopted by one other justified checkpoint within the subsequent epoch. An instance of how this voting works is proven beneath:

There are two slashing situations in Gasper, that are analogous to the slashing guidelines in Casper:

- No voting twice in the identical epoch.

- No vote can comprise epoch checkpoints which “sandwich” one other vote’s epoch checkpoints.

Regardless of being primarily based on epochs as a substitute of block heights, the Casper guidelines nonetheless make sure that no two finalized checkpoints can happen on totally different chains until one-third of the validators might be slashed.

It’s additionally price noting that attestations are included within the blocks themselves. Just like how a block in PoW justifies itself utilizing its hash, a finalized checkpoint in PoS justifies itself utilizing all of its previous attestations. When somebody does break the slashing guidelines, these dangerous attestations are included in a block which proves the violation. There’s additionally a small reward for the block producer who included the violation, to be able to present an incentive to punish rulebreakers.

Forks

It’s attention-grabbing to consider what would occur within the case of a fork. To shortly recap, a fork refers to a change within the consensus guidelines, they usually are available two varieties: exhausting forks and gentle forks. In a tough fork, the brand new guidelines usually are not backwards-compatible, probably leading to two competing blockchains if not everybody switches over. In a gentle fork, the brand new guidelines are extra restrictive than the previous guidelines, whereas retaining them backwards-compatible. As soon as over 50% of the miners or validators begin imposing the brand new guidelines, the consensus mechanism switches over with out splitting the chain. Delicate forks are typically related to upgrades and new transaction sorts, however in addition they technically embody any kind of censorship enforced by a 51% majority. PoS additionally has a 3rd kind of “fork” not current in PoW: a series cut up with none modifications to the principles. However since we’ve already lined this, we’ll concentrate on exhausting and gentle forks.

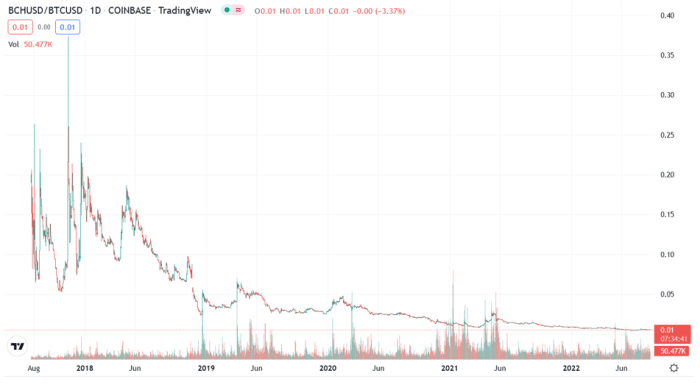

Let’s begin with the best case: a standalone contentious exhausting fork. By contentious, I imply a rule change that divides the customers politically. A bug repair or minor technical change seemingly wouldn’t be contentious, however one thing like altering the validation reward most likely can be. If a tough fork was contentious sufficient, it may lead to a series cut up and would get resolved economically by customers promoting one chain and shopping for the opposite. This is able to be just like the Bitcoin Money cut up in 2017, which appears to have a transparent winner:

Now suppose the validators had been sitting round sooner or later and determined they weren’t getting paid sufficient, and determined they need to elevate their rewards from 5% per yr to 10% per yr. This is able to be a transparent trade-off in favor of the validators on the expense of non-validators who would now be getting extra diluted. Within the occasion of a series cut up, which chain would win?

This results in our fifth precept of PoS, which is that cash is energy.

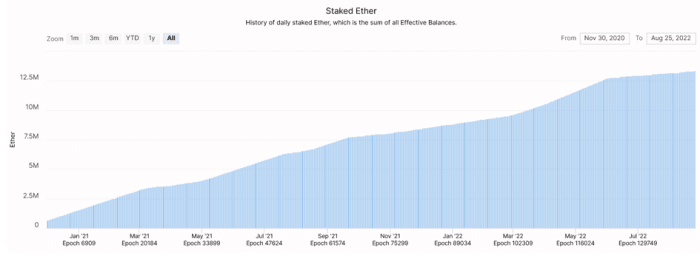

Out of the 120M ETH in existence, over 10% of that’s at present being staked, as seen within the chart beneath:

Given a contentious exhausting fork between the validators and non-validators, assuming that each one the non-validators market-sold the brand new chain and all of the validators market-sold the previous chain, then in concept the previous chain would win, for the reason that majority of ETH would nonetheless held by non-validators (90% versus 10%). However there’s a number of extra issues to contemplate. First, after any chain cut up, the validators would nonetheless be “in management” of each blockchains. If the validators had been capable of affect the opposite chain, they may be incentivized to make it fail. Second, there’s additionally the nuclear choice mentioned earlier, whereby the brand new chain would possibly slash anybody nonetheless validating the previous chain to stress them into becoming a member of. Lastly, the validators would seemingly carry vital social and political affect over everybody else within the community. If Buterin, the Ethereum Basis and the exchanges all determined in unison they had been going to lift the staking reward, I discover it tough to consider that common Ethereum customers and validators may hold the previous fork going whereas additionally making it extra priceless by means of shopping for stress.

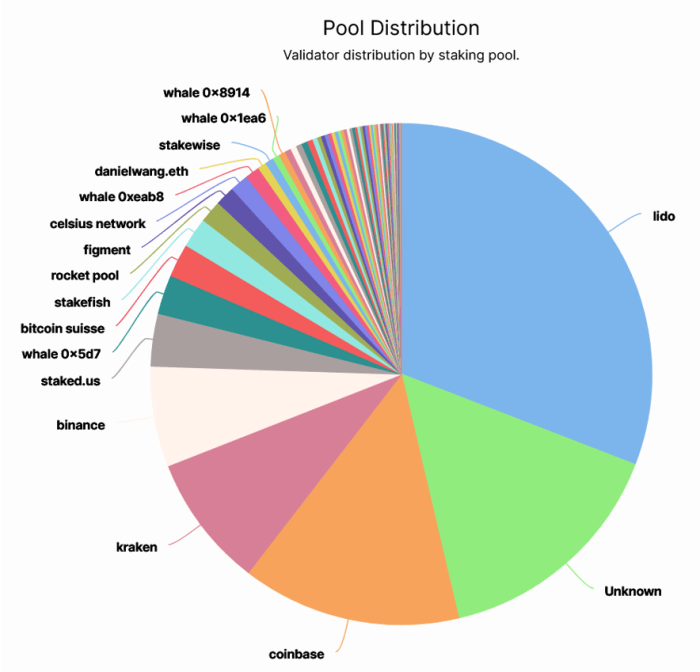

Transferring on to gentle forks, what would occur in a contentious gentle fork, corresponding to OFAC censorship? The validators are pretty centralized, as we will see within the chart beneath:

Not like PoW the place miners can change swimming pools on the press of a button, validators in Ethereum are locked right into a staking deal with till they course of an exit transaction. If Lido and the highest exchanges had been made to censor sure transactions, they might simply cross the two-thirds majority wanted for deciding checkpoints. Earlier, we noticed how Buterin and the opposite ETH validators may attempt to counter a censorship gentle fork with their very own counter-censorship exhausting fork, whereas slashing the censors within the course of. Even when they succeeded in making a fork, loads of worth can be destroyed within the course of, each from the slashing and from a lack of belief.

Closing Ideas

On this essay, we checked out how PoS solves the double-spend downside with Gasper, a mix of checkpoint/slashing guidelines referred to as Casper, and a “finest block” voting rule referred to as GHOST. To recap, Gasper divides time into models referred to as slots, the place every slot can have at most one block, and the slots are grouped into epochs, the place every epoch refers to at least one checkpoint. If a two-thirds majority votes on a checkpoint, it turns into justified, and if two justified checkpoints happen in a row, the primary of these two checkpoints turns into finalized. As soon as a checkpoint turns into finalized, it turns into inconceivable for a parallel chain to be finalized, until one-third of the validators may get slashed.

On this course of we uncovered 5 rules of PoS:

- PoS makes use of a unfavorable (penalty-based) incentive construction.

- PoS is a permissioned system.

- PoS has no guidelines.

- PoS depends on subjective fact.

- In PoS, cash is energy.

Every of those rules has reverse habits in PoW:

- PoW makes use of a constructive (reward-based) incentive system.

- PoW is a permissionless system (anybody can begin or cease mining at any time).

- In PoW, forks which change the principles get ignored.

- PoW depends on goal fact.

- In PoW, miners serve the customers and have little energy themselves.

I consider everybody ought to attempt to create the type of world that they need to stay in. If, like me, you need to stay in a permissionless world the place you may have management over your cash, the place exhausting work is rewarded and passive possession is a legal responsibility and the place your cash will retailer its worth far into the long run with out altering on a whim, then you might need to consider carefully concerning the trade-offs between PoW and PoS, and combat in favor of the rules you need to stay by.

This can be a visitor publish by Scott Sullivan. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.