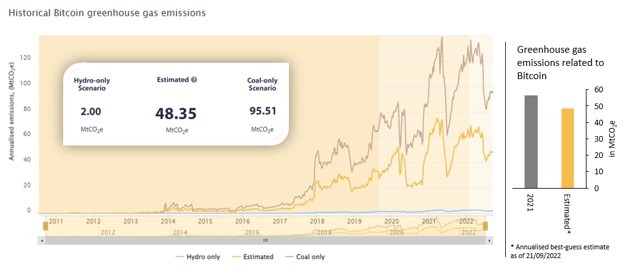

In keeping with a current report printed by the Cambridge Centre for Various Finance (CCAF), bitcoin mining worldwide accounts for round 0.10% of worldwide greenhouse fuel (GHG) emissions or 48.35 million tons of carbon dioxide each year. Furthermore, CCAF’s report particulars that “Bitcoin’s environmental footprint is extra nuanced and sophisticated” and due to complexity points it “underscores the necessity for impartial information.”

Cambridge Centre for Various Finance Research: ‘Bitcoin Community Produces 48.35 Million Tons of CO2 per Annum’

On Tuesday, the Cambridge Centre for Various Finance (CCAF) printed a brand new report known as “A deep dive into Bitcoin’s environmental impression,” which was written by the CCAF venture lead Alexander Neumueller. The report highlights how bitcoin’s rising recognition has put a highlight on “environmental points related to the manufacturing of Bitcoin.”

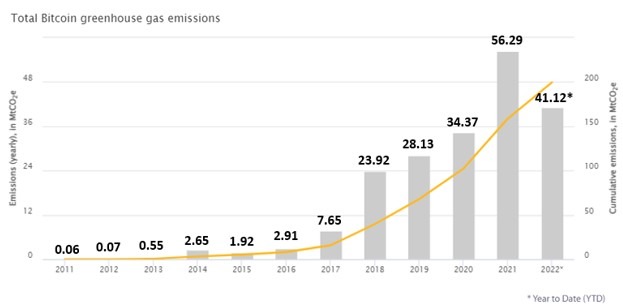

CCAF’s examine claims that the Bitcoin community produces 48.35 million tons of carbon dioxide each year. The metric equates to roughly 0.10% of worldwide greenhouse fuel emissions and Neumueller says it’s about “14.1% decrease than the estimated GHG emissions in 2021.”

Neumueller’s analysis additional particulars that 37.6% of the power leveraged by bitcoin (BTC) miners derives from sustainable varieties of power. CCAF’s “best-guess estimate” of 0.10% of worldwide greenhouse fuel emissions equates to the identical quantity of power utilized by Nepal or the Central African Republic.

Bitcoin mining power represents a contact lower than half of the 100.4 million tons of carbon dioxide gold mining makes use of per 12 months. Neumueller believes that the GHG emissions in 2022 have been decrease than in 2021 due to a “substantial lower in mining profitability.”

CCAF notes that the decline might have been throughout a shift from much less environment friendly mining rigs to extra environment friendly next-generation machines. Neumueller says that CCAF’s assumption has been “confirmed by anecdotal proof of Bitcoin miners.”

Miners face strain from three angles: Falling BTC value, rising hashrate & working prices. Rev per hash is near the ’20 lows, and power prices are rising, ASICs extra environment friendly although. This 12 months may separate the wheat from the chaff, consolidation forward? pic.twitter.com/WRqbTD8raG

— Alexander Neumüller (@alexneumueller) June 16, 2022

Along with altering out previous {hardware} for newer and extra environment friendly bitcoin miners, CCAF particulars that when China’s hashrate declined, the crypto asset’s “electrical energy combine turned extra numerous.” Neumueller and CCAF clarify that information suggests the usage of sustainable power has declined in current occasions.

Beginning in 2021, information exhibits electrical energy combine fluctuations at the moment are “visibly much less” unstable. “Since it isn’t but doable to touch upon how the emission depth modified from 2021 to 2022, as solely January information is at present out there, Bitcoin’s common emission depth in 2020 (491.24 gCO2e/kWh) was in comparison with that of 2021 (531.81 gCO2e/kWh), suggesting that the sustainability of the electrical energy combine has deteriorated,” Neumueller notes.

The CCAF report surmises that the bitcoin mining business is ever-changing and the CCAF analysis and instruments proceed to be adjusted. With real-world information out there researchers are in a position to have a look at the state of affairs with “larger granularity.”

The CCAF venture lead ends the examine by mentioning that “fascinating ideas and developments are already rising round bitcoin mining.” These embrace ideas like mitigating flare fuel, waste warmth restoration, and utilized demand response purposes.

“Time will inform if these are merely novel concepts that fail to ship on their promise, or if they are going to turn out to be a extra integral a part of the Bitcoin mining business sooner or later,” Neumueller’s report concludes.

What do you concentrate on the newest bitcoin mining report printed by the Cambridge Centre for Various Finance? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Cambridge Centre for Various Finance, Twitter,

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss induced or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.