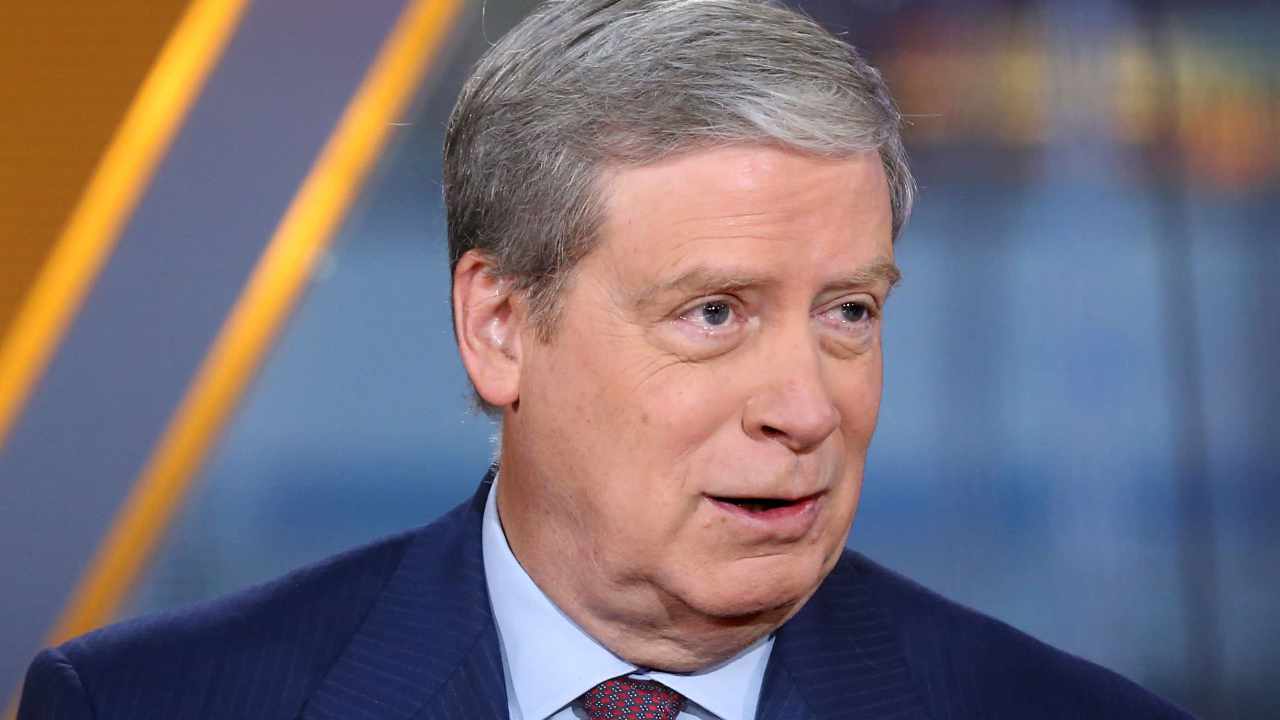

Famend billionaire hedge fund supervisor Stanley Druckenmiller says he may see cryptocurrency “having an enormous function in a Renaissance as a result of individuals simply aren’t going to belief the central banks.” He added that he might be “shocked” if the U.S. isn’t in a recession subsequent 12 months.

Stanley Druckenmiller: Folks Simply Aren’t Going to Belief Central Banks

Billionaire investor Stanley Druckenmiller mentioned the U.S. economic system and cryptocurrency in an interview on the CNBC Delivering Alpha convention Wednesday. Druckenmiller is the chairman and CEO of Duquesne Household Workplace LLC. He was beforehand a managing director at Soros Fund Administration the place he had total accountability for funds with a peak asset worth of $22 billion. Based on Forbes’ listing of billionaires, his private web price is at present $6.4 billion.

Referencing the information of the Financial institution of England shopping for 65 billion kilos of U.Ok. bonds, he mentioned “if issues get actually unhealthy” and different central banks take related motion within the subsequent two or three years:

I may see cryptocurrency having an enormous function in a Renaissance as a result of individuals simply aren’t going to belief the central banks.

Nevertheless, he revealed that he doesn’t personal any bitcoin or different cryptocurrencies, including, “it’s robust for me to personal something like that with central banks tightening.”

Specializing in the U.S. economic system, Druckenmiller pressured that the Federal Reserve was “taking unbelievable dangers.” He emphasised, “We’re taking this large gamble the place you threaten 40 years of credibility with inflation, and also you’re blowing up the wildest raging asset bubble I’ve ever seen,” asserting:

The Fed was unsuitable. They made an enormous mistake.

“In case you bear in mind, the Fed did $2 trillion in QE after vaccine affirmation,” the billionaire defined. “On the similar time, their companion in crime, the administration, was doing extra fiscal stimulus — once more, post-vaccine, after it was clear emergency measures weren’t wanted — than we did in your complete nice monetary disaster.”

Druckenmiller continued: “In case you have a look at what the Fed did, the unconventional gamble they took to get inflation up 30 foundation factors from 1.7 to 2, it’s, to me, type of a risk-reward wager … And so they misplaced.”

He elaborated: “And who actually misplaced? Poor individuals in america, ravaged by inflation, the center class, and my guess is the U.S. economic system for years to come back due to the extent of the asset bubble in time and period and breadth it went on.”

Relating to whether or not there might be a recession within the U.S., Druckenmiller shared:

Let me simply say this. I might be shocked if we don’t have a recession in ’23. Don’t know the timing, however actually by the tip of ’23.

In a subsequent interview with Bloomberg Wednesday, the Duquesne Household Workplace CEO reiterated that Federal Reserve policymakers “have put themselves and the nation, and most significantly the individuals of the nation, in a horrible place.” He warned that “Inflation is a killer,” noting that “To maximise employment over the long run, you should have steady costs.”

What do you consider the feedback by billionaire Stan Druckenmiller? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss brought about or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.