The beneath is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Right here Comes Yield Curve Management

A key theme in our long-term Bitcoin thesis is the continued failure of centralized financial coverage throughout international central banks in a world the place centralized financial coverage will possible not repair, however solely exacerbate, bigger systemic issues. The failure, pent up volatility and financial destruction that follows from central financial institution makes an attempt to resolve these issues will solely additional widen the mistrust in monetary and financial establishments. This opens the door to an alternate system. We predict that system, or perhaps a important a part of it, will be Bitcoin.

With the purpose to offer a secure, sustainable and helpful international financial system, central banks face one in every of their greatest challenges in historical past: fixing the worldwide sovereign debt disaster. In response, we are going to see extra financial and financial coverage experiments evolve and roll out all over the world to try to hold the present system afloat. A type of coverage experiments is called yield curve management (YCC) and is changing into extra essential to our future. On this put up, we are going to cowl what YCC is, its few historic examples and the long run implications of elevated YCC rollouts.

YCC Historic Examples

Merely put, YCC is a technique for central banks to manage or affect rates of interest and the general price of capital. In follow, a central financial institution units their ideally suited rate of interest for a selected debt instrument available in the market. They hold shopping for or promoting that debt instrument (i.e., a 10-year bond) it doesn’t matter what to keep up the particular rate of interest peg they need. Usually, they purchase with newly printed foreign money including to financial inflation pressures.

YCC will be tried for a couple of completely different causes: preserve decrease and secure rates of interest to spur new financial progress, preserve decrease and secure rates of interest to decrease the price of borrowing and rate of interest debt funds or deliberately create inflation in a deflationary surroundings (to call a couple of). Its success is barely nearly as good because the central financial institution’s credibility available in the market. Markets should “belief” that central banks will proceed to execute on this coverage in any respect prices.

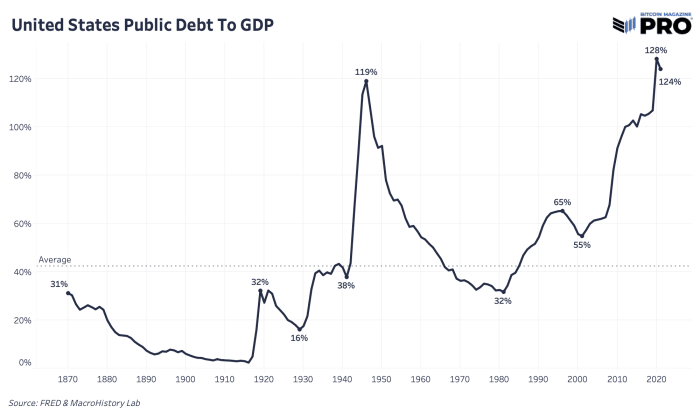

The biggest YCC instance occurred in america in 1942 put up World Warfare II. The USA incurred large debt expenditures to finance the conflict and the Fed capped yields to maintain borrowing prices low and secure. Throughout that point, the Fed capped each quick and long-term rates of interest throughout shorter-term payments at 0.375% and longer-term bonds as much as 2.5%. By doing so, the Fed gave up management of their steadiness sheet and cash provide, each growing to keep up the decrease rate of interest pegs. It was the chosen technique to cope with the unsustainable, elevator rise in public debt relative to gross home product.

YCC Present And Future

The European Central Financial institution (ECB) has successfully been participating in a YCC coverage flying below one other banner. The ECB has been shopping for bonds to try to management the unfold in yields between the strongest and weakest economies within the eurozone.

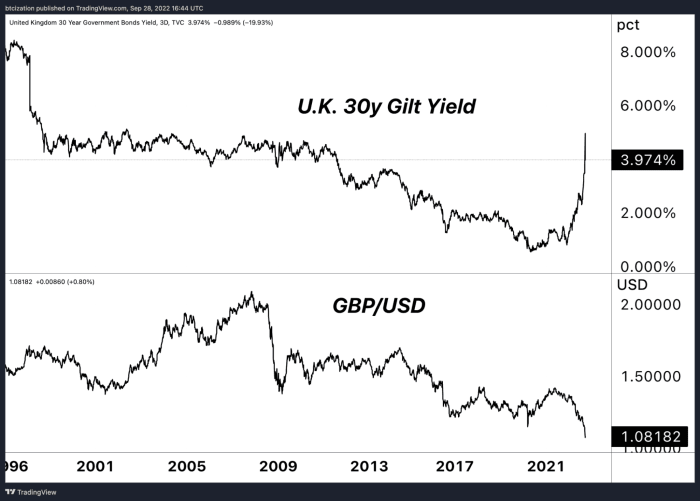

Yields have change into too excessive too shortly for economies to perform and there’s an absence of marginal patrons within the bond market proper now as sovereign bonds face their worst year-to-date efficiency in historical past. That leaves the BoE no selection however to be the client of final resort. If the QE restart and preliminary bond shopping for isn’t sufficient, we may simply see a development to a extra strict and long-lasting yield cap YCC program.

It was reported that the BoE stepped in to stem the route in gilts as a result of potential for margin calls throughout the U.Ok. pension system, which holds roughly £1.5 trillion of property, of which a majority have been invested in bonds. As sure pension funds hedged their volatility threat with bond derivatives, managed by so-called liability-driven funding (LDI) funds. As the worth of long-dated U.Ok. sovereign bonds drastically fell, the spinoff positions that have been secured with mentioned bonds as collateral grew to become more and more in danger to margin calls. Whereas the specifics aren’t all that notably necessary, the important thing level to grasp is that when the financial tightening grew to become probably systemic, the central financial institution stepped in.

Though YCC insurance policies might “kick the can” and restrict disaster injury short-term, it unleashes a complete field of penalties and second order results that must be handled.

YCC is actually the top of any “free market” exercise left within the monetary and financial programs. It’s extra lively centralized planning to keep up a selected price of capital that the complete financial system capabilities on. It’s carried out out of necessity to maintain the system from complete collapse which has confirmed to be inevitable in fiat-based financial programs close to the top of their shelf life.

YCC prolongs the sovereign debt bubble by permitting governments to decrease the general rate of interest on curiosity funds and decrease borrowing prices on future debt rollovers. Primarily based on the sheer quantity of public debt dimension, tempo of future fiscal deficits and important entitlement spending guarantees far into the long run (Medicare, Social Safety, and many others.), rate of interest bills will proceed to take up a larger share of tax income from a waning tax base below strain.

Ultimate Notice

The primary use of yield curve management was a worldwide wartime measure. Its use was for excessive circumstances. So even the tried rollout of a YCC or YCC-like program ought to act as a warning sign to most that one thing is severely incorrect. Now we’ve two of the biggest central banks on this planet (on the verge of three) actively pursuing yield curve management insurance policies. That is the brand new evolution of financial coverage and financial experiments. Central banks will try no matter it takes to stabilize financial circumstances and extra financial debasement would be the consequence.

If there was ever a advertising and marketing marketing campaign for why Bitcoin has a spot on this planet, it’s precisely this. As a lot as we’ve talked in regards to the present macro headwinds needing time to play out and decrease bitcoin costs being a probable short-term end result within the situation of great fairness market volatility, the wave of financial coverage and relentless liquidity that must be unleashed to rescue the system shall be large. Getting a decrease bitcoin worth to build up a better place and avoiding one other potential important drawdown in a worldwide recession is an efficient play (if the market supplies) however lacking out on the subsequent main transfer upwards is the true missed alternative in our view.

Related Previous Articles