As we speak’s blustery world financial system has everybody on edge as inflation has wreaked havoc on the wallets of bizarre folks and power costs proceed to soar worldwide. In response to Credit score Suisse, “the worst is but to return,” as the worldwide funding financial institution’s analysts imagine the European Union (EU) and the U.Okay. are already coping with a recession. S&P International has an identical speculation as a report revealed by the Manhattan company explains that the U.Okay. is presently contending with a full-year recession.

Nord Stream Pipeline Rupture Heightens Tensions Between Russia and the West — Putin Claims the ‘Finish of Western Hegemony Is Inevitable’

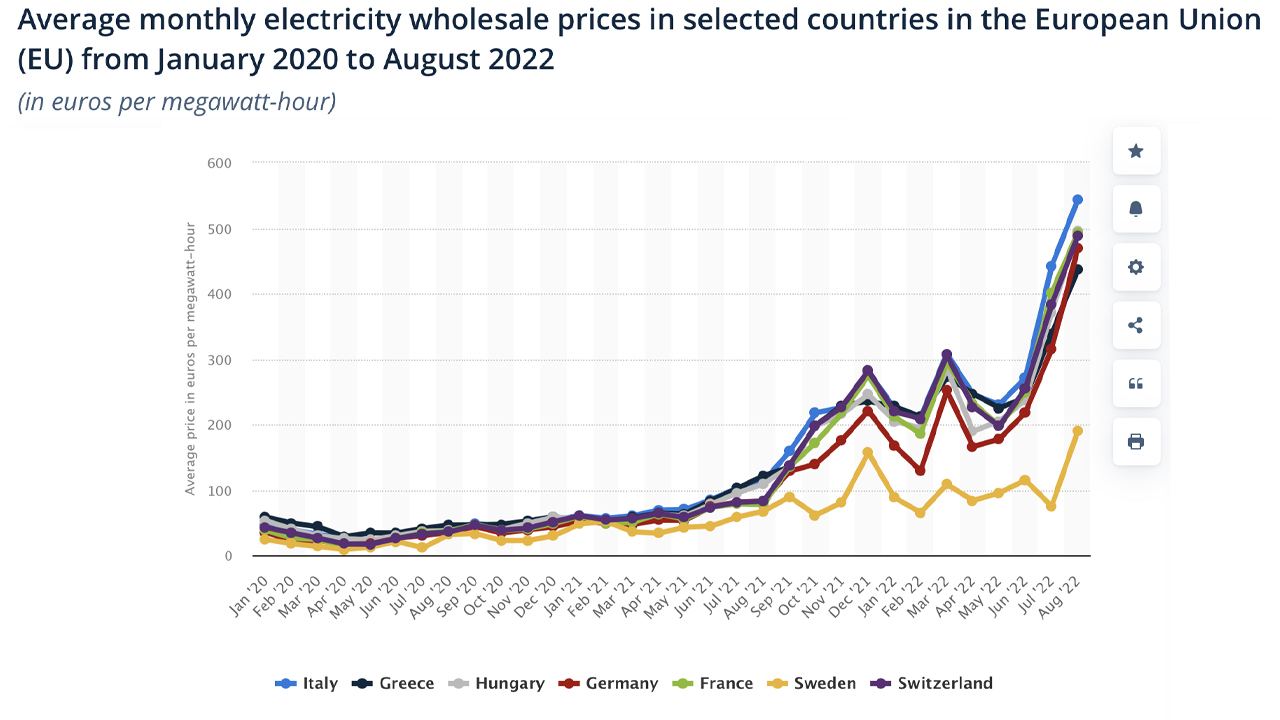

The world’s financial system appears even worse following the Nord Stream pipeline rupture as many individuals imagine the battle between the West and Russia has heightened a fantastic deal. The United Nations particulars that the destruction might need been the most important methane launch ever recorded in historical past. Moreover, the Nord Stream pipeline concern means Europe could have a more durable time accessing pure fuel this winter. The value of pure fuel within the EU has skyrocketed to a lifetime excessive alongside a myriad of European power sources.

Furthermore, each side are blaming one another for the Nord Stream pipeline rupture as Vladimir Putin declared the act an “unprecedented sabotage” and an “act of worldwide terrorism.” In the meantime, U.S. president Joe Biden stated the Nord Stream leak was a “deliberate act of sabotage” as nicely, and he additional famous that the Kremlin blaming the U.S. for the rupture was merely unfaithful. Putin additionally famous throughout a latest speech that “the tip of Western hegemony is inevitable.” The speech translated by Konstantin Kisin on September 30 explains that Putin thinks the West is grasping and seeks to enslave nations like Russia.

Kisin’s translation additional says that Putin remarked that the West leverages finance and know-how to convey different nations to submission. The West collects a “hegemon’s tax,” in response to the Russian president. “They don’t want us to be free, they need Russians to be a mob of soulless slaves,” Putin instructed the attendees on the occasion.

There was a powerful response from the attendees and one particular person says:

We’ll beat all of them, we’ll kill all of them, we’ll plunder all their stuff. It’s going to be what we like to do.

Credit score Suisse and S&P International Experiences Notice Europe and the UK Are Already Dealing With a Recession — ‘Europe Faces a Troublesome and Unsure Geopolitical and Financial Outlook’

Amid the heightened pressure, a Credit score Suisse report says the U.Okay. and Europe are already in a recession and the U.S. is “flirting” with one. The worldwide funding financial institution’s analyst defined that a few of the weight stemmed from central banks elevating rates of interest. “Increased charges mixed with ongoing shocks lead us to chop GDP forecasts,” the Credit score Suisse report particulars. “The euro space and the U.Okay. are in recession, China is in a progress recession, and the U.S. is flirting with recession.”

The Credit score Suisse report provides:

Crucially, the rising share of worth classes above central financial institution inflation goal ranges reveals inflation is broadening out from a restricted group of provide shock associated drivers to extra basic inflation. This broadening requires tighter coverage and weaker economies as a result of it more and more displays tight labor markets.

The report from Credit score Suisse follows the latest statements Citadel CEO Ken Griffin made final Wednesday at a convention. Griffin defined that Citadel is “very targeted on the opportunity of a recession.” Additional, analysts in a report revealed by S&P International clarify that the U.Okay. and Europe are already in a recession and the Ukraine-Russia conflict is exacerbating the area’s gloomy financial system. S&P International’s regional credit score situations chairman, Paul Watters, says the EU has a tricky winter forward, and the European financial system faces heightened credit score dangers.

Watters believes the EU’s measures to place worth caps on power will shield Europeans this winter from the inflationary pressures. “Fiscal assist measures deployed by the federal government, notably the higher restrict set on typical family power payments, will considerably shield family budgets from a fair higher inflation squeeze over the winter,” Watters claims. “This, together with ongoing resilience of the labor market, are the primary causes we don’t anticipate the U.Okay. financial system to carry out worse.”

S&P International’s report continues:

Europe faces a tough and unsure geopolitical and financial outlook as Russia’s political danger urge for food seems to extend after losses of territory in Ukraine, and exorbitant power costs gasoline inflation, triggering interventions to assist customers and companies, with central banks recalibrating curiosity ranges in fast order.

In the meantime, the U.S. Greenback Index (DXY) has dropped from the latest highs recorded 9 days in the past, and a myriad of fiat currencies worldwide have rebounded in opposition to the buck. The euro has managed to rebound by 2.15% through the previous seven days in opposition to the U.S. greenback, and the U.Okay.’s pound has elevated 3.95% this week. Nonetheless, the pound is down 14.98% over the past six months, and the euro has shed 11.25% in opposition to the buck. Russia’s ruble, then again, has elevated 42.44% in opposition to the U.S. greenback over the past six months.

What do you concentrate on the studies that say Europe and the U.Okay. are already in a recession? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss brought on or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.