“Fed Watch” is a macro podcast, true to bitcoin’s insurgent nature. In every episode, we query mainstream and Bitcoin narratives by inspecting present occasions in macro from throughout the globe, with an emphasis on central banks and currencies.

Watch This Episode On YouTube Or Rumble

Hear To The Episode Right here:

On this episode, CK and I cowl a big chunk of the continuing macro information. First, we coated New York Federal Reserve President John William’s speech on inflation, then the U.N. report demanding central banks change course and eventually the OPEC choice to chop quotas by 2 million barrels per day (mbd).

Charts And Bitcoin Sentiment

Every week, CK and I lead off with a bitcoin chart to middle our macro dialog from this attitude.

The every day chart from this week reveals a slight bullish curl because it approaches the diagonal development line. A number of indicators are bullish, together with extra important weekly and month-to-month indicators.

On the weekly chart, the primary ever weekly bullish divergence has locked in. This doesn’t imply we are able to’t have additional draw back. Should you have a look at the crimson columns on the chart beneath that signify weekly bearish divergences, you’ll be able to see they usually are available multiples. Nonetheless, on the first signal of a weekly divergence, it does sign that we’re very near the final word reversal.

The sentiment within the Bitcoin ecosystem has began to shift from worry to being barely extra constructive. If the value can capitalize right here and get away, we might expertise a large shift into bullish momentum.

On this part, CK and I additionally focus on a doable bitcoin decoupling from shares. The correlation has been fairly excessive just lately, however bitcoin does supply some basically completely different properties. As CK factors out, bitcoin isn’t weakened by being uncovered to a selected firm’s revenues in a credit score disaster. The place firms may face harsh credit score circumstances, bitcoin doesn’t. Bitcoin really advantages from a flight away from credit score danger.

How The Fed Defines Inflation

On this phase, I learn a number of quotes from a current speech by John Williams, president of the New York Federal Reserve. Most of it revolved round a humorous definition of inflation, which Williams calls the “Inflation Onion.”

The primary layer of this onion is commodity costs, the second layer is costs of merchandise like home equipment and autos. The innermost layer of the inflation onion is — anticipate it — underlying inflation.

There we’ve it: Inflation is an onion of various layers of costs. On the root is provide and demand and underlying inflation. No point out in any respect of cash printing or debasement. I feel what he intends to painting is that inflation works its approach by way of the economic system. Costs of commodities trickle inward to merchandise, on this case, which in flip trickle inward to issues like rents and labor.

U.N. Tells Central Banks To Halt Price Hikes

This week noticed the discharge of the United Nations’ annual Commerce and Improvement Report, through which they described the present standing of the worldwide economic system and supplied coverage suggestions. General, I used to be shocked by the cogent nature of the report, getting many issues proper. They even used phrases like “super-hysteresis” and shadow banking, concepts we’ve been speaking about on “Fed Watch” for years.

We undergo a number of quotes proper out of the report and discover ourselves agreeing with them a number of instances. It’s only when the U.N. involves make suggestions that they lose us.

The coverage selections are straight out of the World Financial Discussion board or communist playbook. They’re filled with phrases like “equitable distribution of revenue” and “redistributive insurance policies.” What they need the Fed to do is to cease charge hikes which can be disproportionately hurting rising markets and as a substitute use worth controls and regressive taxation.

OPEC+ Reduces Quota By 2 Million Barrels Per Day

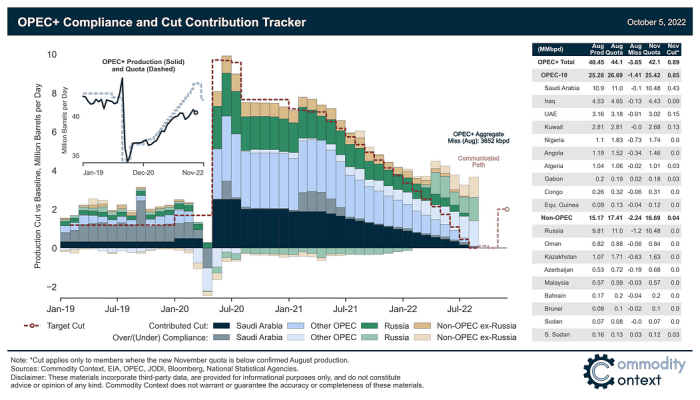

Loads of this story doesn’t make sense to me. OPEC+ had an in-person assembly on October 5, 2022 and determined to cut back their oil manufacturing quota by 2 mbd. Nonetheless, this comes as they’re presently producing 3.6 mbd beneath their present quota.

Below the voluntary manufacturing quota lower, OPEC’s complete voluntary quota in November is 42.1 mbd, however their August manufacturing was 40.45 mbd. Because it stands now, the discount within the quota of two mbd, with present manufacturing ranges, solely shrinks OPEC’s shortfall. They are going to nonetheless have 1.6 mbd of room to extend manufacturing!

Some persons are figuring the brand new voluntary quotas by nation, which leads to a 0.86 mbd discount, largely from Saudi Arabia, however the complete is as acknowledged above. I’ve been calling it voluntary as a result of OPEC officers harassed that these quotas have been voluntary.

Wait, what? How is that this some form of emergency? It’s not. CK and I speculate on precisely why we see all of the fear-mongering headlines we do from this story and it boils all the way down to election season timing and narratives.

This can be a visitor submit by Ansel Lindner. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.

![[LIVE]BTC’s Post-High Bull Trap, $12B BlackRock Bet Rattles ETH Supply: Best Crypto To Buy Now? [LIVE]BTC’s Post-High Bull Trap, $12B BlackRock Bet Rattles ETH Supply: Best Crypto To Buy Now?](https://sbcryptogurunews.com/wp-content/themes/jnews/assets/img/jeg-empty.png)