A extensively adopted crypto analyst says the entry of a $47 billion asset supervisor may present a much-needed shot within the arm for decentralized alternate (DEX) protocol SushiSwap (SUSHI).

Will Clemente tells his 660,800 Twitter followers that one of many constant use instances of crypto is enabling market members to commerce extremely illiquid altcoins on decentralized exchanges.

Says Clemente,

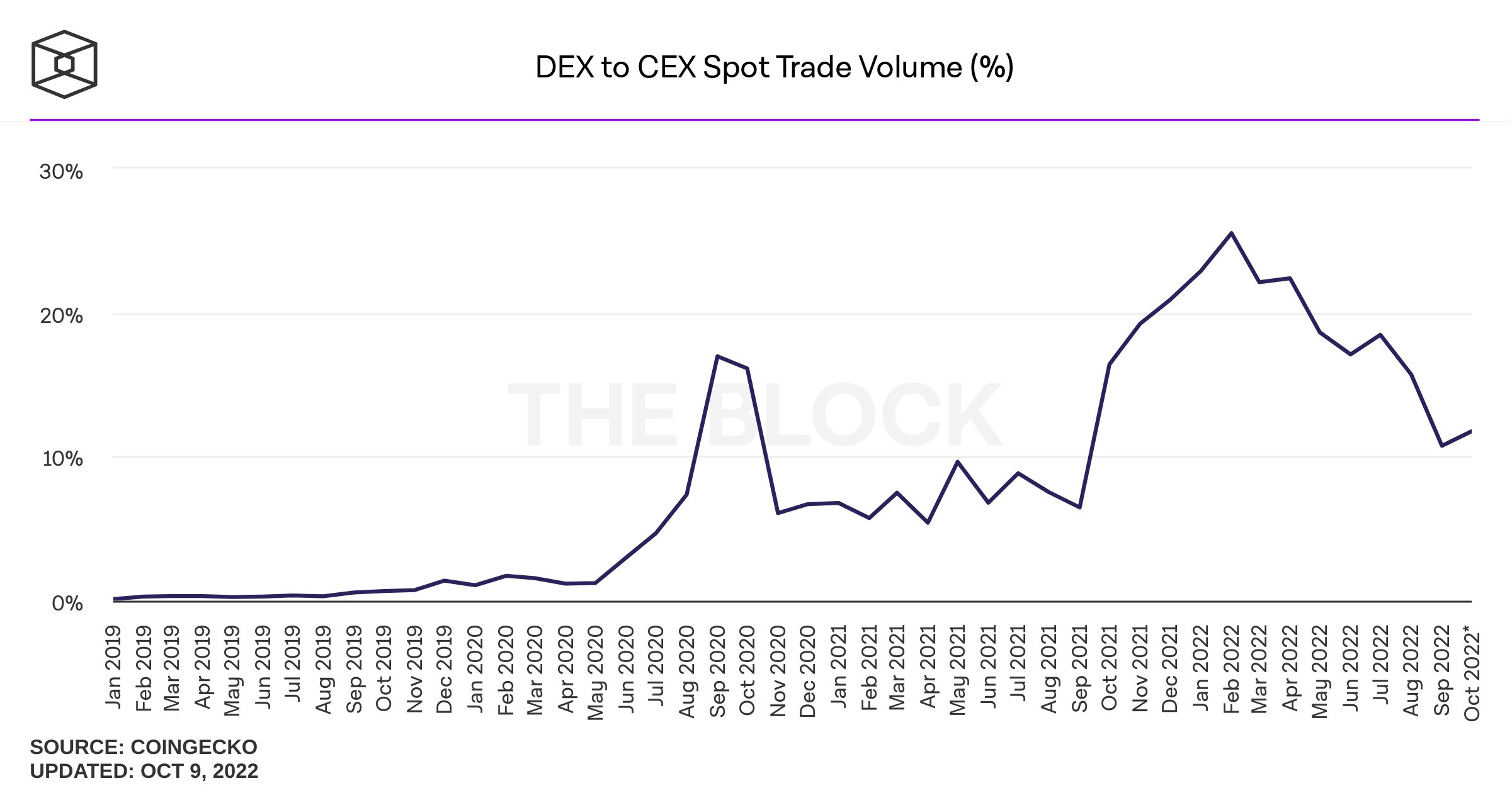

“The truth is, the ratio of DEX quantity to centralized alternate spot quantity is greater than it was this time final yr mid bull run. There may be clearly a constant underlying demand to gamble within the crypto on line casino.”

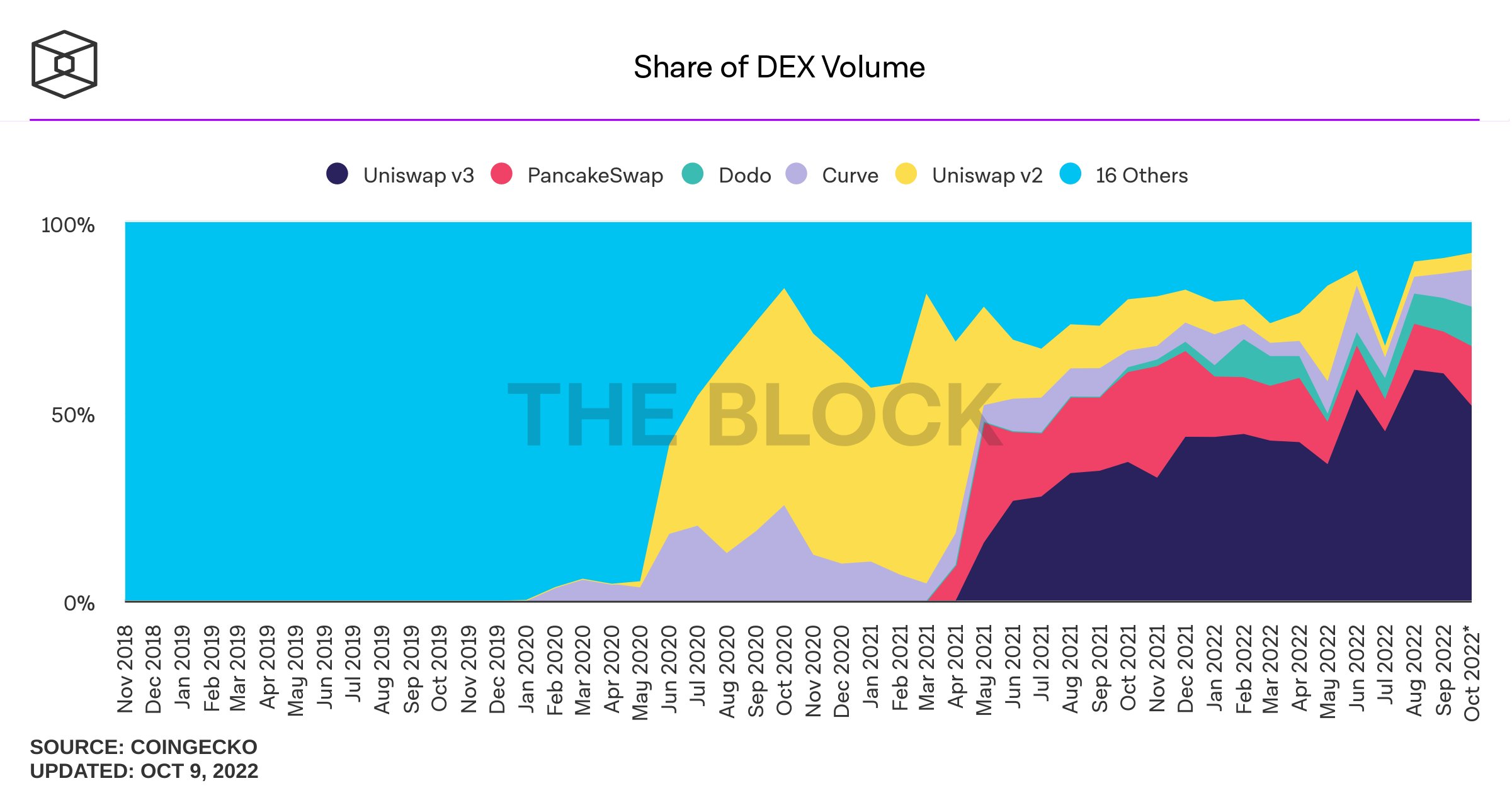

Even amid elevated demand from crypto merchants, Clemente highlights that buying and selling quantity on SushiSwap is massively down this yr.

“As a consequence of management points amongst different issues, SushiSwap’s volumes (filtered for wash buying and selling) are down an estimated 89% year-to-date by Messari. This has put them considerably behind rivals akin to Uniswap.”

Nonetheless, Clemente says that issues are beginning to search for for the decentralized alternate protocol after SushiSwap employed Jared Gray as head chef. Gray, the previous CEO of defunct crypto alternate Bitfineon, beforehand said that he plans to return Sushi to its “rightful standing amongst its friends.”

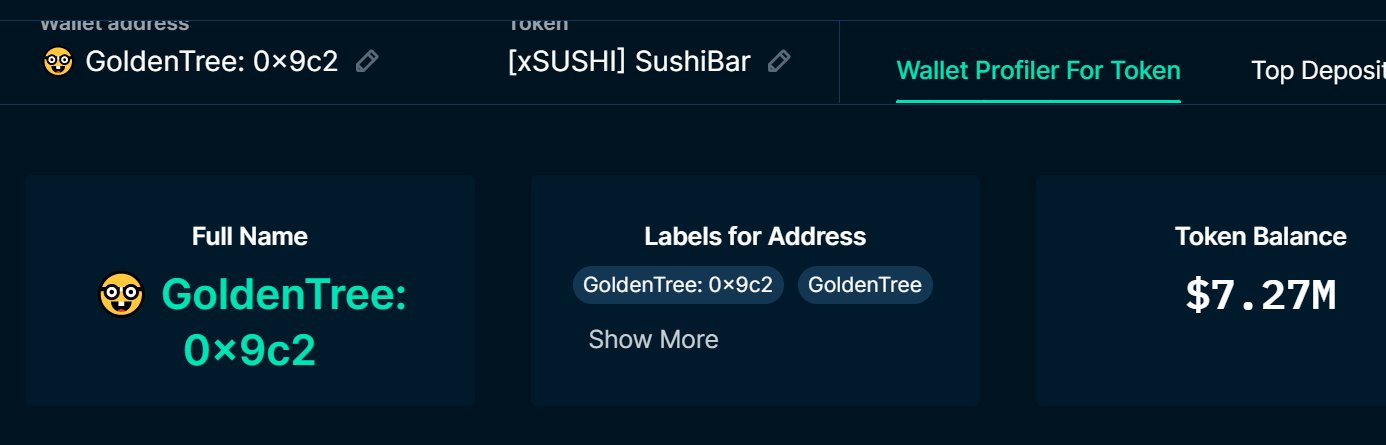

Clemente additionally highlights that New York-based asset supervisor GoldenTree has taken a comparatively small place in SUSHI.

“Subsequent, [$47 billion] asset supervisor GoldenTree has taken a $7.27 million place in Sushi. Expressing dedication by publicly sharing their pockets and intentions to make adjustments to show across the protocol with a put up within the Sushi discussion board.”

In keeping with Clemente, the entry of GoldenTree and its public revelation of its place may change the fortunes of SUSHI.

“Except for the belief that the good Avi Felman and GoldenTree will do all the things of their energy to not let their first main public crypto place go bust, I feel this affords an fascinating uneven alternative for SUSHI.

If GoldenTree orchestrates one optimistic change, the market will extrapolate that they’ll make a number of extra. Make two adjustments and the market will extrapolate out even additional. This might create a reflexive impact for the SUSHI turnaround narrative.

Much like Alameda’s guess on DOGE, I feel the asymmetry is favorable right here in that Avi, GoldenTree and the assets behind them will possible implement not less than a number of optimistic structural adjustments, which is all of the market must mission out additional optimistic expectations.”

At time of writing, SUSHI is swapping fingers for $1.27, down over 8% on the day.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any loses you could incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/arleksey/WindAwake