The lethal battle that began with Russia’s assault on Ukraine has elevated crypto-related exercise in each international locations, in response to Chainalysis. Fiat inflation and sanctions stress led to a number of spikes in transaction volumes this 12 months, the blockchain forensics agency has discovered, whereas Jap Europe as a complete sustained its function within the world crypto ecosystem.

Russians and Ukrainians Flip to Crypto Amid Penalties of Escalating Army Conflict

The Russian invasion of Ukraine and ensuing navy battle that’s presently escalating have affected all facets of life within the two nations, and cryptocurrency isn’t any exception, Chainalysis stated in an excerpt from its upcoming 2022 Geography of Cryptocurrency Report. Residents of each international locations have felt the struggle’s financial impression and skilled excessive inflation.

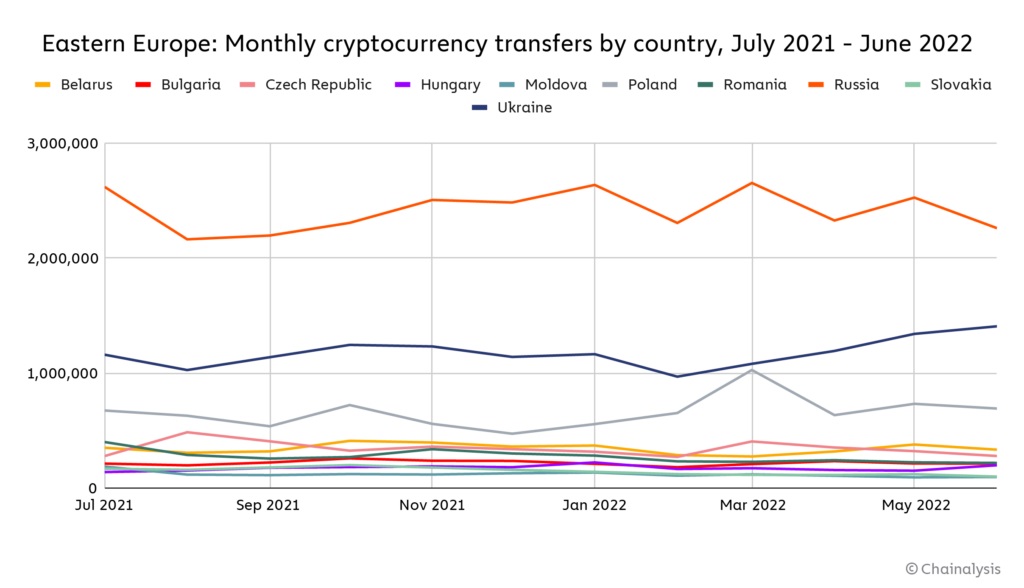

Shortly after the hostilities started in late February, Russian and Ukrainian cryptocurrency transfers noticed a rise. Within the following weeks and months tendencies diverged, and whereas Russian transactions wavered in a comparatively slender vary, probably influenced by restrictions on companies, Ukrainian transactions steadily rose by June.

In March, proper after the struggle began, Ukrainian hryvnia-denominated commerce quantity jumped 121% to $307 million, whereas Russian ruble-denominated commerce quantity rose 35% to $805 million. “After that, we see volumes drop off for each international locations, ebbing and flowing by August, however by no means reaching their March highs,” the authors of the examine famous.

Amid forex controls launched underneath the martial legislation imposed by Kyiv, together with restrictions on the money purchases of U.S. {dollars} or euros and transfers overseas, some Ukrainians might have regarded to change their hryvnia holdings for cryptocurrency, in response to Tatiana Dmytrenko, a high-ranking adviser in Ukraine’s Ministry of Finance and member of the World Financial Discussion board’s Digital Belongings Process Pressure. Crypto buying and selling volumes declined when these measures had been relaxed in July.

Chainalysis quotes a cash laundering specialist who commented on related exercise in Russia, the place forex restrictions had been additionally utilized. “The most important query not only for oligarchs but additionally extraordinary Russians grew to become, ‘How do you get cash out of Russia?’” stated the professional who selected to stay nameless. “Many started searching for new locations the place they might money out their crypto,” he added citing the UAE, Turkey, Kazakhstan, and Georgia as jurisdictions the place Russians may have discovered such companies.

Whereas in response to the researchers, crypto markets are hardly liquid sufficient to help systematic sanctions evasion, cryptocurrency may doubtlessly play a job in financing Russia’s international commerce, after its banks had been reduce from the worldwide cost messaging community SWIFT. The professional identified that the Central Financial institution of Russia just lately agreed to legalize crypto funds for cross-border settlements and a few corporations might have already began utilizing digital property for such transactions. In his opinion, stablecoins would probably be most popular as a medium of change as they don’t seem to be unstable like bitcoin.

Jap Europe Maintains 10% Share of World Crypto Transactions, Chainalysis Knowledge Exhibits

As a complete, Jap Europe is the fifth-largest cryptocurrency market with $630.9 billion in worth obtained on-chain between July 2021 and June 2022, which is a little bit over 10% of the worldwide transaction exercise throughout that interval, Chainalysis stated. The area’s “comparative function within the greater, worldwide crypto ecosystem has stayed surprisingly constant over the previous few years” whereas different areas have seen extra volatility, the corporate elaborated.

“Dangerous and illicit exercise remains to be distinguished after we take a look at Jap Europe’s on-chain exercise: Excessive-risk exchanges – these with no or low KYC necessities – account for six.1% of transaction exercise within the area,” the report additional notes. In response to the compiled knowledge, over 18% of all cryptocurrency obtained by Jap Europe comes from addresses related to dangerous or illicit exercise, greater than some other area, in response to Chainalysis.

Do you count on crypto exercise in Russia and Ukraine to extend much more if their navy battle deepens additional? Share your ideas on the topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.