The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Liquidity Is In The Driver Seat

By far, probably the most necessary elements in any market is liquidity — which could be outlined in many various methods. On this piece, we cowl some methods to consider world liquidity and the way it impacts bitcoin.

One high-level view of liquidity is that of central banks’ steadiness sheets. As central banks have change into the marginal purchaser of their very own sovereign money owed, mortgage-backed securities and different monetary devices, this has provided the market with extra liquidity to purchase belongings additional up the chance curve. A vendor of presidency bonds is a purchaser of a special asset. When the system has extra reserves, cash, capital, and so forth. (nonetheless one desires to explain it), they need to go someplace.

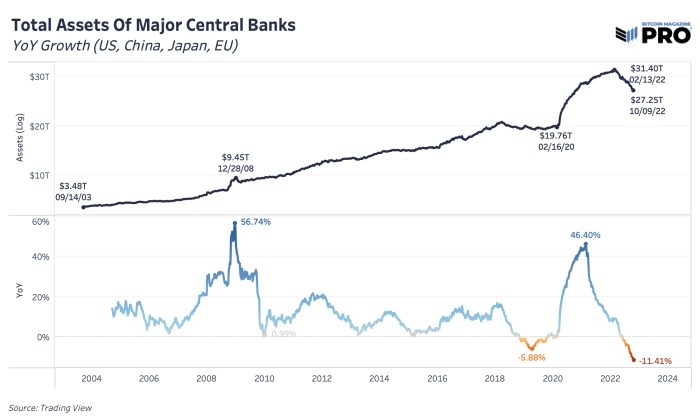

In lots of ways in which has led to one of many largest rises in asset valuations globally over the past 12 years, coinciding with the brand new period of quantitative easing and debt monetization experiments. Central financial institution steadiness sheets throughout the USA, China, Japan and the European Union reached over $31 trillion earlier this 12 months, which is almost 10X from the degrees again in 2003. This was already a rising pattern for many years, however the 2020 fiscal and financial insurance policies took steadiness sheets to file ranges in a time of world disaster.

Since earlier this 12 months, we’ve seen a peak in central financial institution belongings and a world try and wind down these steadiness sheets. The height within the S&P 500 index was simply two months previous to all the quantitative tightening (QT) efforts we’re watching play out immediately. Though not the one issue that drives value and valuations out there, bitcoin’s value and cycle has been affected in the identical manner. The annual rate-of-change peak in main central banks’ belongings occurred simply weeks previous to bitcoin’s first push to new all-time highs round $60,000, again in March 2021. Whether or not it’s the direct influence and affect of central banks or the market’s notion of that influence, it’s been a transparent macro driving drive of all markets over the past 18 months.

At a market cap of simply fractions of world wealth, bitcoin has confronted the liquidity steamroller that’s hammered each different market on the planet. If we use the framework that bitcoin is a liquidity sponge (extra so than different belongings) — soaking in all the extra financial provide and liquidity within the system in occasions of disaster enlargement — then the numerous contraction of liquidity will reduce the opposite manner. Coupled with bitcoin’s inelastic illiquid provide profile of 77.15% with an enormous variety of HODLers of final resort, the damaging influence on value is magnified far more than different belongings.

One of many potential drivers of liquidity out there is the sum of money within the system, measured as world M2 in USD phrases. M2 cash provide consists of money, checking deposits, financial savings deposits and different liquid types of forex. Each cyclical expansions in world M2 provide have occurred in the course of the expansions of world central financial institution belongings and expansions of bitcoin cycles.

We view bitcoin as a financial inflation hedge (or liquidity hedge) fairly than one towards a “CPI” (or value) inflation hedge. Financial debasement, extra models within the system over time, has pushed many asset courses larger. But, bitcoin is by far the best-designed asset in our view and one of many best-performing belongings to counteract the longer term pattern of perpetual financial debasement, cash provide enlargement and central financial institution asset enlargement.

It’s unclear how lengthy a cloth discount within the Fed’s steadiness sheet can truly final. We’ve solely seen an approximate 2% discount from a $8.96 trillion steadiness sheet drawback at its peak. Finally, we see the steadiness sheet increasing as the one choice to preserve all the financial system afloat, however up to now, the market has underestimated how far the Fed has been keen to go.

The shortage of viable financial coverage choices and the inevitability of this perpetual steadiness sheet enlargement is likely one of the strongest instances for bitcoin’s long-run success. What else can central banks and financial coverage makers do in future occasions of recession and disaster?

Related Previous Articles: