That is an opinion editorial by Kudzai Kutukwa, a passionate monetary inclusion advocate who was acknowledged by Quick Firm journal as one in every of South Africa’s top-20 younger entrepreneurs beneath 30.

There’s a battle happening on the earth at the moment that’s largely hidden from most people’s view. This isn’t a battle between nation-states, ethnic teams or spiritual fanatics preventing over sources and territories. Two financial methods are on a collision course, every with its personal distinct ideology and values. One system is a instrument for monetary enslavement, and the opposite, for monetary freedom. It’s a battle that not solely requires our consideration, however our lively participation. It’s the battle for the way forward for cash: bitcoin versus fiat.

During the last two years, we witnessed the largest encroachment on our freedoms by The State on a world scale. Medical martial regulation was unleashed on the world which crushed companies and destroyed livelihoods; the keyboard thought police within the type of “fact-checkers” had been deployed to implement the state’s sole narrative of occasions with different views being labeled “harmful misinformation” and censored. Thousands and thousands extra had been coerced into taking the COVID-19 vaccine as a result of their livelihoods had been on the road, whereas fully disregarding their particular person danger profile, spiritual beliefs and private preferences.

The media cheered on these gross human rights violations and gaslit everybody whereas chanting in style slogans like “we’re all in this together” and “it’s just 15 days to slow the spread.” In different phrases, take one for the group. Those who dared to protest in opposition to these draconian measures just like the Canadian truckers did, had their financial institution accounts frozen on the drop of a hat and have become victims of economic censorship.

The state overreach I outlined above was enabled by the ability of the cash printer. The results of which have now come to hang-out the worldwide economic system. The U.S. authorities, for instance, spent a complete of $5.2 trillion on COVID-19 aid by mid-2021. To place this in perspective, the U.S. authorities coughed up the equal of $4.7 trillion in at the moment’s {dollars} to fund the costliest battle in historical past, World Warfare II. Hovering inflation, damaged provide chains, ever-increasing rates of interest, will increase in unemployment, looming sovereign debt crises, the European vitality disaster, accelerated forex devaluation and an financial recession are just some of the implications caused by the financial response to the pandemic, with extra to come back. The worldwide economic system is in such a multitude that the U.N. needed to plead with central bankers to not hike rates of interest! Not solely do these occasions give us larger perception into the harmful nature of the fiat system, however they’re a harbinger of issues to come back ought to this technique stay intact with out an alternate.

The world’s central banks are presently engaged in a “international arms race” to roll out central financial institution digital currencies (CBDCs), with not less than 105 international locations actively exploring launching a CBDC. CBDCs are the central planners’ approach of attempting to take care of relevance within the international economic system because of the menace posed to fiat currencies by bitcoin and stablecoins. They don’t remedy the largest flaw of fiat currencies; absolutely the necessity of governments to engineer development by way of financial inflation. In truth they’re really fiat on steroids. The specter of CBDCs being merged with a Chinese language-style social credit score system continues to develop and they’re an Orwellian type of cash as a result of they provide zero privateness, are simpler for The State to confiscate and so they nonetheless get debased — however at a a lot sooner charge on account of their programmable nature. CBDCs are surveillance know-how masquerading as cash, designed to develop The State’s management over our monetary lives.

In accordance with a latest paper by the Bitcoin Coverage Institute titled, “Why the U.S. Ought to Reject Central Financial institution Digital Currencies”:

“Central banks took on unprecedented ranges of debt throughout the COVID-19 pandemic–a disaster that solely accelerated the final development of rising sovereign debt that has been ongoing for the reason that mid-Twentieth century. World debt-to-GDP ratio had risen to a unprecedented 356% by the tip of 2021, with 30% of the rise occurring since 2016. As of mid-2021, fast will increase in sovereign debt had already pushed a number of international locations into sovereign default and positioned dozens of others on the brink. Even international locations which are structurally extra solvent as a result of their debt is denominated in their very own currencies, like the US, the UK, Japan, and China, are involved concerning the destructive financial results of ballooning debt…In brief, governments want cash, quick. As we’ll see, CBDCs symbolize a chance to extract it from non-public money holdings.”

In different phrases CBDCs would make it doable for The State to conduct monetary repression of the best kind on the push of a button by not directly taxing individuals’s financial savings via the setting of destructive rates of interest on all CBDC balances. This tactic isn’t new and has additionally been beforehand really helpful by the IMF in a 2015 paper titled “The Liquidation of Authorities Debt.” Historically, this was completed by creating synthetic demand for presidency bonds so as to scale back their yields; the decreased yields paired with a excessive inflation charge would end in destructive actual rates of interest. The paper clearly outlines this technique of economic repression in nice element and explicitly recommends it as a great factor regardless of its injury to individuals’s financial savings. Whoever controls your cash, controls you, and it’s clear that CBDCs should not simply helpful for surveillance — they’re instruments for financial repression and social engineering.

As currencies weaken and develop into extra unstable, the powers that be often attempt to forestall their residents from dumping the weaker native forex for a stronger one, which finally results in individuals’s financial savings being severely devalued. The distinction now could be the stronger forex is bitcoin; a incontrovertible fact that was not too long ago identified in a tweet by Microstrategy Chairman, Michael Saylor the place he confirmed the devaluation of each main world forex in opposition to the greenback within the final yr, and the greenback’s loss in worth in opposition to bitcoin. Along with the CBDC pilot initiatives, we are able to already see media campaigns warning concerning the environmental impression of bitcoin and the gradual roll out of presidency laws which are crafted with the intention of dissuading bitcoin possession and self-custody. Slowly however certainly they’re attempting to dam the exits out of the fiat system.

As famous within the opening paragraph, the battle for the way forward for cash is on and the central planners, the gerontocracy, in addition to their cantillionaire buddies are going to throw every part at bitcoin to attempt to cease it. With CBDCs quick approaching, and aggressive assaults being thrown out in opposition to Bitcoin, how can we be certain that hyperbitcoinization turns into a actuality? Whereas there is no such thing as a single right reply to this query, one factor’s for positive: Merely sounding the alarm in opposition to the risks of CBDCs and exposing the fraudulent fiat system is nice, nevertheless it’s not sufficient. Informing individuals of what to not do, doesn’t routinely end in them doing what they need to.

My most popular answer to unleashing Bitcoin’s full potential and fostering mass adoption is the constructing of a parallel economic system (AKA a Bitcoin round economic system) that has a bitcoin normal as its basis, with items and companies being priced in bitcoin. Grass-roots bitcoin communities equivalent to Bitcoin Seaside in El Salvador, Bitcoin Ekasi in South Africa, Harlem Bitcoin in New York, Bitcoin Lisboa in Portugal, BTC Seaside Camp in Thailand and Bitcoin Lake in Guatemala function examples of bottom-up initiatives that may result in hyperbitcoinization, as was the case with Bitcoin Seaside which turned one of many catalysts that led to the adoption of bitcoin as authorized tender in El Salvador. These communities additionally function the very best foundations for constructing a bitcoin-based parallel economic system that may finally decouple from the U.S. greenback. At its core Bitcoin was designed to be a peer-to-peer financial system, the place “one bitcoin = one bitcoin,” not as a fiat-denominated speculative asset.

So as to speed up bottom-up grassroots adoption, new user-friendly instruments like wallets should be constructed that may make it doable to onboard as many individuals as doable, significantly in areas the place monetary exclusion is the norm. An instance of such a instrument is Machankura, which is an unstructured supplementary service information (USSD)-based custodial pockets that runs on-top of the Lightning Community and doesn’t require an web connection. Whereas being a custodial service has its disadvantages, the group at Machankura are presently exploring the concept of a non-custodial service that makes use of SIM playing cards as a signing gadget for signing and broadcasting transactions to the remainder of the community. Ought to they handle to drag it off, it might be a big breakthrough of monumental proportions.

Regardless of USSD being previous know-how, 90% of all cellular transactions in Africa at the moment are powered by USSD. That is primarily because of the dominance of characteristic telephones, which represent 58.3% of Africa’s cellphone market. Given these dynamics, Machankura’s answer of growing a USSD-powered bitcoin pockets is an ideal match. Presently, Machankura has a footprint in 9 African international locations, particularly South Africa, Zambia, Namibia, Kenya, Tanzania, Uganda, Nigeria, Ghana and Malawi.

The primary objective behind the mission is to drive monetary inclusion via the Bitcoin ecosystem in locations with underdeveloped web infrastructure and/or low smartphone penetration, as is the case in lots of African international locations in addition to in many of the World South. Nonetheless, regardless of the low smartphone penetration in Africa, 70% of the $1 trillion price of cellular cash transactions globally had been performed by customers in Africa. Whereas analysis has proven the constructive impression of cellular cash on growing a financial savings tradition in low revenue households, the customers of those companies aren’t shielded from the results of financial inflation as their financial savings will nonetheless be denominated in a fiat forex that progressively loses worth. Furthemore, cellular cash companies may probably be obsoleted as soon as a CBDC is rolled out, or the service suppliers might be co-opted into being CBDC distributors. As a bitcoin-focused service, Machankura is proof against all the above.

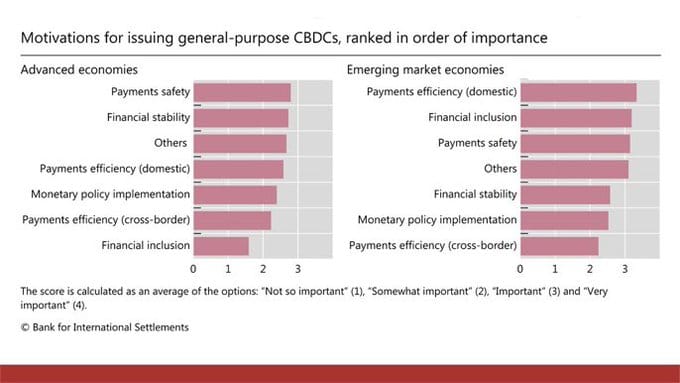

In accordance with the Worldwide Labour Group’s (ILO) estimates, not less than two billion individuals globally are informally employed. In Africa, the place not less than 57% of adults are unbanked, the casual sector accounts for over 85% of all employment and contributes not less than 55% to the continent’s $1.95 trillion GDP in keeping with research performed by the UN and the African Improvement Financial institution. With the vast majority of these casual staff being unbanked, money turns into the default possibility for transacting, thus making them straightforward targets for CBDCs, which might be marketed to them as a path to monetary inclusion. Even the Financial institution of Worldwide Settlements (BIS) recognized monetary inclusion as a key driver of CBDC adoption in rising markets. As a low-tech answer that’s already operational, Machankura is a crucial instrument that’s helpful in not solely banking the unbanked however in facilitating free commerce and thus driving Bitcoin adoption earlier than the vast majority of CBDCs have been formally rolled out. With the casual economic system already present exterior of The State’s permissioned “formal economic system,” embedding sound cash into it by way of Machankura is a no brainer.

Within the phrases of Heritage Falodun, a Nigerian-based software program engineer and Bitcoin analyst:

“Bitcoin adoption in Africa is not going to be spurred on by laws alone, however by growing much less advanced cost rails that decrease the obstacles to entry into the Bitcoin ecosystem, and Machankura is a good instance of this.”

I couldn’t agree extra. For instance, Paco de la India, a Bitcoin educator touring the world solely on Bitcoin on a tour dubbed “Run With Bitcoin,” was tremendously impressed by Machankura’s ease of use when he used the service in Nigeria. Whereas the service is comparatively new in Nigeria, de la India and an area Nigerian Bitcoiner, Apata Johnson, weren’t solely capable of discuss concerning the energy of bitcoin however to reveal it by sending sats to a number of the locals by way of Machankura. Bitcoin Ekasi in South Africa have additionally included Machankura into their orange pilling toolkit and are utilizing it for sending sats on a weekly foundation to their beneficiaries.

Throughout an interview I had with Kgothatso Ngako, the founding father of Machankura, stablecoins got here up and I requested him if they’d any intention of incorporating stablecoin funds into Machankura, to which he responded, “No we’re simply centered solely on bitcoin.” A formidable response, provided that a lot of bitcoin’s critics are fast to level to bitcoin’s worth volatility as one of many explanation why it’s unsuitable as a method of alternate. Stablecoins are then introduced as the reply to the medium of alternate operate. Whereas stablecoins do provide “worth stability” within the quick time period, making them an essential intermediate step in the direction of hyperbitcoinization, being tokenized fiat currencies they aren’t proof against debasement over the long run. In brief, inflation is the value for fiat “stability” {that a} stablecoin affords. Bitcoin alternatively is a deflationary forex with a steady financial coverage that will increase in worth over time. It is a level that Austrian economist, Hans-Hermann Hoppe, brilliantly specified by “How Is Fiat Cash Attainable?” when he wrote:

“Furthermore, what’s so nice about ‘steady’ buying energy anyway (nevertheless that time period could also be arbitrarily outlined)? To make certain, it’s clearly preferable to have a ‘steady’ cash fairly than an ‘inflationary’ one. But certainly a cash whose buying energy per unit elevated — ’deflationary’ cash — could be preferable to a ‘steady’ one.”

Machankura’s bitcoin focus cements its place as a significant a part of the worldwide hyperbitcoinization infrastructure for tons of of hundreds of thousands of individuals in Africa and around the globe who do not need entry to dependable web, however nonetheless want sound cash. The fiat financial system was by no means designed to work for everyone because the growing world has for many years had inflation exported to it by the developed world. Along with that, the fiat system’s misaligned incentives be certain that the unproductive are rewarded on the expense of the productive. The appearance of Bitcoin modified all of this by redesigning a greater type of cash from the bottom up. Instruments like Machankura are important for driving adoption and making Bitcoin accessible to everybody, in every single place. Moreover Machankura is an extension of Satoshi Nakamoto’s imaginative and prescient of a peer-to-peer financial system, one which reduces reliance on fiat intermediaries whereas powering Bitcoin round economies.

It is a visitor publish by Kudzai Kutukwa. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.