That is an opinion editorial by Archie Chaudhury, a blockchain fanatic and former winner of high prize on the 2021 MIT Bitcoin Expo.

When Satoshi Nakamoto first printed the Bitcoin white paper in October of 2008, the world was reeling from a monetary disaster attributable to the irresponsibility and negligence of the establishments that managed our monetary system. Hedge funds, central banks and different highly effective brokers had been all too blissful to put over-leveraged bets on the economic system, and to revenue from the financial losses incurred by the working class when these bets collapsed.

Governments, in a determined try and preserve these establishments alive, spent lots of of billions of {dollars} in bailouts and different financial injections as a substitute of making certain the well-being of the typical citizen. Bitcoin was Satoshi Nakamoto’s reply to state-backed cash; it was a imaginative and prescient for a decentralized digital foreign money that might present the effectivity of on-line banking, the relative pseudonymity of bodily money, and the shortage of gold.

In contrast to earlier makes an attempt at creating digital money, Bitcoin was not backed by or managed by a singular entity or celebration, however reasonably by an nameless developer (builders?), a set of faceless discussion board guests and a small on-line neighborhood that believed in utilizing cryptographic software program for privateness and independence from authoritarian powers. Nakamoto’s final purpose was to create an asset that was autonomous, decentralized and was not inclined to the greed or will of anybody particular person. October 31, the day Satoshi Nakamoto formally introduced their white paper to the Cypherpunks Mailing Listing, has come to be referred to as “Bitcoin White Paper Day” and is well known as a casual declaration of independence from corrupt state-backed cash, heard internationally. The aim of this text is to replicate on how far now we have come since then, and the way a lot work stays to be completed with a purpose to accomplish Nakamoto’s targets.

The Bitcoin that we use immediately is vastly totally different from the Bitcoin that Satoshi Nakamoto and his fellow contributors created within the late 2000s and early 2010s. Past the quite a few technical upgrades and onerous forks, the community itself has grown considerably, with increasingly folks taking the proverbial “orange capsule” and deciding to make use of bitcoin in some capability.

There may be one other approach by which Bitcoin has modified: the core community, and asset (BTC), is considered extra as a retailer of worth reasonably than a platform for micropayments. Certainly, there was a big cultural schism throughout the Bitcoin neighborhood that led to this transformation: the well-known, and aptly titled, “Blocksize Wars” roughly 5 years in the past led to this transformation, with forks reminiscent of Bitcoin Money and later Bitcoin SV being created by neighborhood members who believed in scalability over all else, and the core Bitcoin chain being upheld by members who sought to protect decentralization and to take a look at different strategies reminiscent of Layer 2 cost channels to assist scalability. The Lightning Community, which is the most well-liked cost channel, has slowly gained recognition, just lately reaching a capability of 5000 bitcoin.

Regardless of these modifications, the core technological tenets espoused by Nakamoto in 2008 (Nakamoto Consensus with proof-of-work mining and a static most provide of 21 million) stay fixed. This isn’t solely due to a technological or financial cause; in reality, it has been argued that altering Bitcoin’s underlying consensus mechanism or provide cap may result in elevated efficiency and adoption respectively. Somewhat, Bitcoin’s consistency in these areas could be attributed to the philosophy of its underlying neighborhood, who consider strongly in shortage, safety and decentralization over all else.

In the meantime, bitcoin is being utilized by folks world wide to stave off unruly financial circumstances. Bitcoin’s pure shortage makes it enticing for residents the place corruption has led to unrestricted inflation. This adoption has even led some governments, reminiscent of El Salvador, to declare bitcoin a nationwide foreign money, a transfer that may have been unfathomable to Nakamoto and Bitcoin’s authentic contributors.

Maybe essentially the most attention-grabbing factor to take from Bitcoin’s progress over the previous couple of years is that it has occurred with out a central chief: in contrast to different property which are extra akin to decentralized software program platforms, bitcoin features purely as cash, with key “coverage” selections being made by a neighborhood. There is no such thing as a Bitcoin group or consultant solely accountable for selling adoption, neither is there a central “chief scientist” that has a big influence on key protocol-level selections. Whereas there are definitely main influences throughout the neighborhood, the protocol as a complete doesn’t have an organizational construction to guide both adoption or growth. In truth, Bitcoin’s lack of hierarchy needs to be a purpose for different distributed ledger initiatives who, whereas maybe decentralized to a sure diploma, are nonetheless largely influenced by a singular entity or particular person.

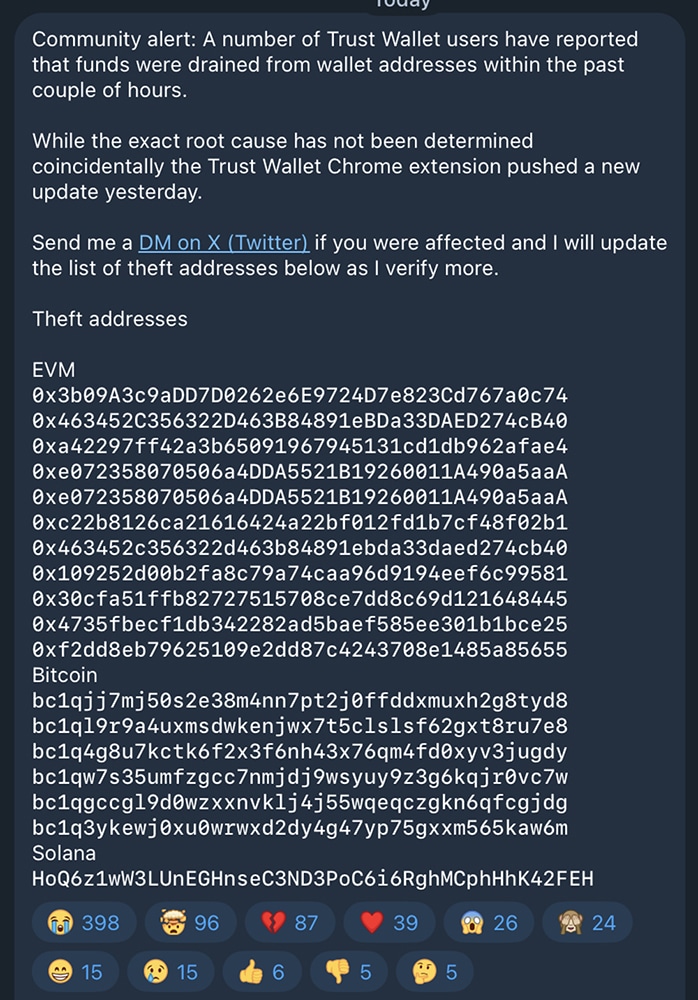

Whereas Bitcoin has definitely grown from its humble beginnings as a white paper and a pair hundred strains of scrappy code, it nonetheless has an extended solution to go whether it is to attain the bold targets mentioned by Nakamoto and different early adopters of their e-mail chains and discussion board posts. From a technical standpoint, the Bitcoin neighborhood must proceed constructing expertise that not solely allows additional scalability and safety, however maybe extra importantly, additionally helps make the community extra decentralized. Probably the most staunch mottos that Bitcoin neighborhood members have adopted is the time period “Don’t belief, confirm.” That is, after all, in reference to working a full Bitcoin node and never counting on knowledge from exterior third events, reminiscent of node suppliers. Community optimization, rollups, and different scalability analysis has been proposed by varied people within the Bitcoin neighborhood as a approach for the community to concurrently scale whereas lowering the associated fee it takes to run a full node. A current report, printed by John Gentle by analysis funded by the Human Rights Basis, Starkware and CMS Holdings, offers extra element about rollups-related scalability analysis.

Regardless of its roots in expertise, Bitcoin has developed over time to grow to be one thing extra: it’s now a neighborhood, a community, if you’ll, of like minded-individuals who all have some various levels of perception in a singular thought. Bitcoin is not a software program, aware about solely builders, coders or these with a extremely technical background, and this marked shift also needs to sign extra non-technical priorities for the Bitcoin neighborhood to deal with over the subsequent decade.

Extra effort must be spent on educating most people and making them conscious of not solely Bitcoin’s expertise, but in addition the failures of the legacy monetary methods that they use immediately. Extra effort must be spent not solely on touting bitcoin’s economics and expertise, but in addition drawing on distinctions between bitcoin and different cryptocurrency platforms. Lastly, extra effort must be made among the many cryptocurrency neighborhood as a complete to return collectively when the elemental rules that Satoshi Nakamoto and his fellow cypherpunks believed in are threatened by authoritarian governments, whatever the platform that’s being attacked.

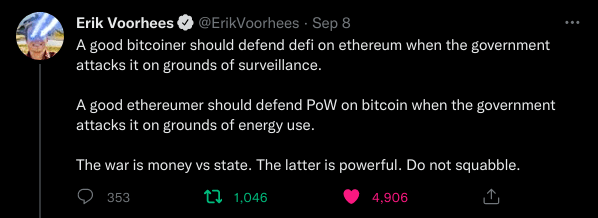

Whereas discussions round various blockchain networks have at all times been tribalistic to a level, the current development has been to advertise the success of your platform over all else, and even chide or insult platforms who face potential regulatory scrutiny. Whereas believing that bitcoin is essentially the most sound digital asset by way of economics/development, and stepping into arguments about stated perception is okay, and will even be inspired, celebrating when another platform is threatened with regulatory motion or censorship goes in opposition to what Bitcoin is essentially all about.

The cypherpunks, Satoshi Nakamoto and a majority of Bitcoin’s neighborhood all consider in the concept someday, there could be a digital peer-to-peer foreign money fully impartial of any authorities, middleman or biased celebration. Whereas we definitely have varied disagreements in regards to the professionals and cons of our respective expertise, belong to totally different “maximalist” teams, and generally have various beliefs, all of us in the end belong to an area that was motivated by the concept of a censorship-resistant and non-partisan digital asset/community. We might do nicely to keep in mind that basic precept as we proceed to work on Bitcoin over the subsequent 14 years.

Tweet from Erik Vorhees on the sanctioning of Twister Money and potential BTC regulation by ESG proponents.

This can be a visitor put up by Archie Chaudhury. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.