Here’s a record of the perfect Decentralized Exchanges (DEXs):

| Title of the DEX | Supported Blockchain Community | Buying and selling Charge |

|---|---|---|

| 1. Rango alternate | 42+ blockchains supported | No charges – Related DEX may cost a charges |

| 2. GMX | Arbitrum (Ethereum Layer 2) AVAX |

0.1% of the buying and selling dimension |

| 2. ParaSwap | Ethereum Polygon Binance Good Chain |

Paraswap – No payment. Related DEX could cost their payment. |

| 3. Uniswap | Ethereum | Variable (0.05%, 0.3% or 1% of transaction worth) |

| 4. QuickSwap | Polygon | 0.3% of transaction worth |

| 5. 1Inch Trade | Ethereum Polygon Binance Good Chain |

1Inch – No payment. Related DEX could cost their payment. |

| 6. SushiSwap | Ethereum Polygon Binance Good Chain Fantom HECO xDai Concord Avalanche OKExChain |

0.3% of transaction worth |

| 7. PancakeSwap | Binance Good Chain | 0.2% of transaction worth |

| 8. Curve.fi | Ethereum | 0.04% of transaction worth |

| 9. Raydium | Solana | 0.25% of transaction worth |

| 10. Balancer | Ethereum | Variable |

| 11. Bancor | Ethereum EOS |

Variable |

| 12. THORSwap | Ethereum Bitcoin Bitcoin Money Litecoin Binance Chain |

Variable |

We’re all paranoid about dropping our cryptocurrencies to theft on centralized exchanges.

Aren’t we?

That worry makes us search for safer and safe cryptocurrency exchanges.

Now, everyone knows that centralized cryptocurrency exchanges are good however not the perfect for security. Furthermore, incidents akin to Mt. Gox hack and Bitfinex hack imbibe extra worry.

Regardless of all, we have been pressured to make use of centralized exchanges up to now, which essentially violated the essential tenants of a decentralized crypto economic system.

Sure, we have been pressured to make use of it as a result of we didn’t have many choices contemplating the decentralized cryptocurrency infrastructure and exchanges. Decentralized Finance (DeFi) modified all of it.

That stated, DeFi infrastructure continues to be at a really nascent stage. As soon as the decentralized infrastructure is prepared in a full-fledged method, it can breathe new life into the cryptosphere. Folks will be capable to take part with out worrying in regards to the security of their funds.

What extra can we crypto fans want?

I’ve shed some mild on why decentralized crypto exchanges would be the future.

You may learn the complete story right here: Why Are Decentralized Exchanges The Future Of Cryptocurrencies?

Consistent with that, it turns into pronounced that we begin searching for the best-decentralized cryptocurrency exchanges that can be utilized to commerce in in the present day’s day and time.

13 Finest Decentralized Exchanges To Be Used Proper Now

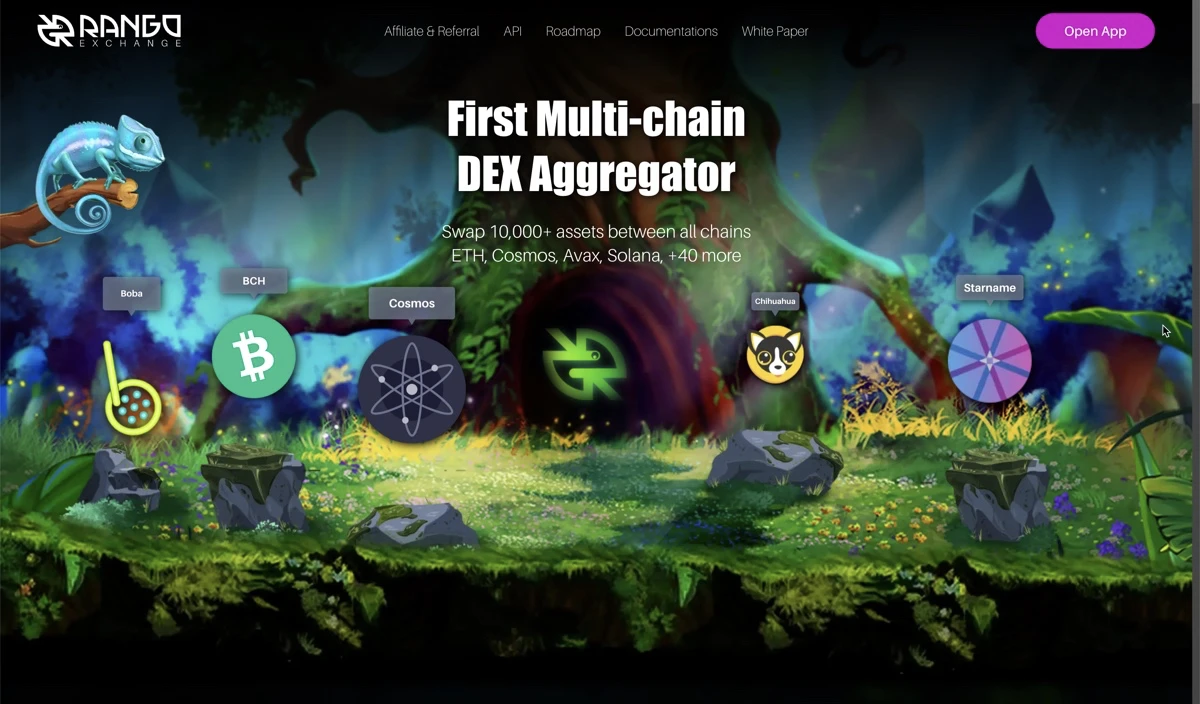

1. Rango Trade

I’m beginning this huge record of the perfect Dexes with an aggregator known as Rango alternate. It is a multi-chain Dex aggregator; what which means for you is –

- You are able to do a cross-chain swap.

- You’ll get the perfect charges for the swap.

- Helps 42+ blockchains

- Help all in style crypto wallets

- No-KYC required

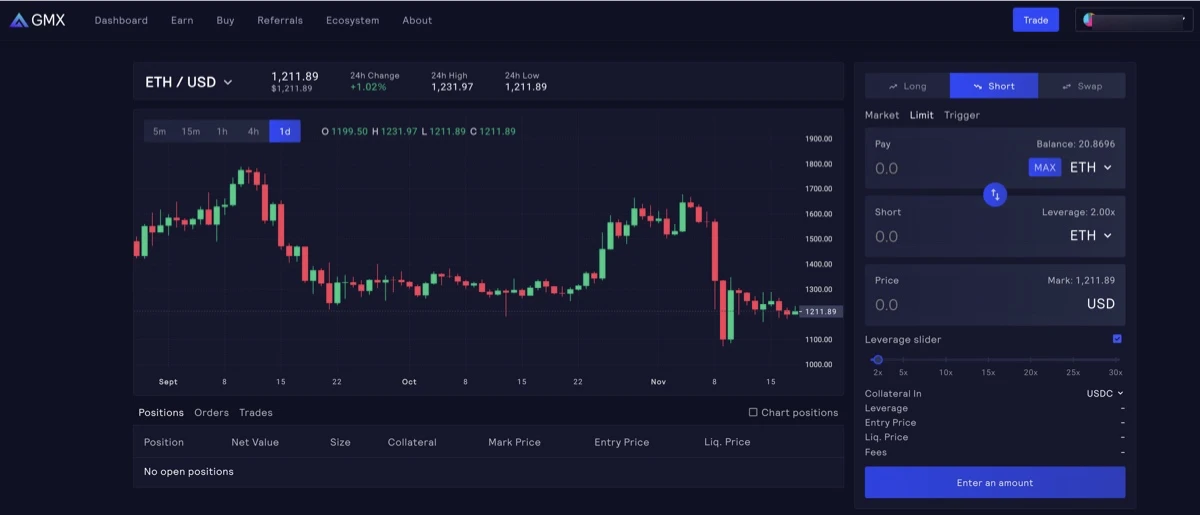

2. GMX Trade

After the FTX downfall, many crypto merchants moved to decentralized platforms for buying and selling. GMX turned out to be a kind of dex’s that’s gaining recognition among the many crypto merchants. It is a spot and perpetual buying and selling platform the place you should have custody of your token.

You can too do leverage buying and selling as much as 30x, and the GMX platform works on Arbitrum one chain (a scaling resolution for Ethereum) or AVAX C chain. There’s a GMX referral code, “FOMO,” that you should use to save lots of 5% on buying and selling charges eternally.

3. ParaSwap

Paraswap is likely one of the main DEX aggregators within the DeFi Ecosystem. It aggregates a number of decentralized exchanges in a single place, which helps in offering a aggressive worth to a Crypto purchaser.

Along with the above, Paraswap can also be supported by its in-house liquidity pool known as ParaSwapPool. Thus, rising the liquidity of the entire ecosystem.

ParaSwap doesn’t cost any transaction payment for purchasing or promoting crypto tokens. Which means for commerce, solely the community’s relevant gasoline payment is payable by the dealer.

Nevertheless, that is solely the case when a transaction is processed by way of ParaSwap.io. If a commerce is completed by way of a third-party service, then such a 3rd social gathering (for instance, an built-in pockets akin to Ledger) could cost a further payment on the commerce.

Following is the record of blockchain networks and wallets supported by ParaSwap:

| Supported Networks | Supported Wallets |

|---|---|

| Ethereum Polygon (earlier generally known as Matic) Binance Good Chain (BSC) |

Metamask Pockets Join Coinbase Pockets BSC (Binance Good Chain) Pockets Ledger Trezor |

You may refer ParaSwap’s commerce statistics right here.

4. Uniswap

Uniswap is the preferred decentralized alternate within the Ethereum ecosystem. Utilizing Uniswap, you’ll be able to convert any ERC20 token to another ERC20 token.

Because of the large recognition of Uniswap, it has additionally grow to be the primary alternative of place for a lot of new Ethereum primarily based undertaking launchpads. Learn: Uniswap alternate – Every thing a newbie must know

Additional, here’s a video that explains every thing you could find out about Uniswap.

On Uniswap you can too earn a living by changing into a liquidity supplier. It is a nice strategy to earn passive revenue out of your crypto holding. Not solely this, the platform additionally often rewards the liquidity suppliers with its in-house tokens UNI. The method is called Liquidity Mining. Learn: Liquidity Swimming pools Information for Rookies.

Uniswap at the moment has two lively variations V2 and V3. The buying and selling payment on UniswapV2 is mounted, i.e., 0.3% of the transaction worth. Nevertheless, UniswapV3 has a variable payment construction of 0.05%, 0.3%, and 1%. This variable payment is set by the liquidity suppliers of a particular liquidity pool. Along with the buying and selling payment, a dealer must pay for the community’s gasoline payment.

Following is the record of wallets supported by Uniswap:

- Metamask

- Pockets Join

- Coinbase Pockets

- Fortmatic

- Portis

You may confer with Uniswap’s commerce statistics right here.

5. QuickSwap

QuickSwap is the subsequent era DEX primarily based on Ethereum and developed on Polygon Community (beforehand generally known as Matic), the layer two protocol of Ethereum Community. Thus, you’ll be able to switch ERC20 tokens with nearly zero gasoline price and at a breakneck pace.

Because of the monumental alternatives in Liquidity Mining and Yield Farming, a number of purposes have been constructed on Ethereum. This has led to extreme congestion on the Ethereum Community, which additional led to an increase in gasoline charges.

Layer 2 resolution like QuickSwap supplies all of the options of an Ethereum primarily based software. The distinction is that the gasoline charges on layer 2 are nearly negligible, and the transaction is processed at a really excessive pace. Due to this fact, QuickSwap is an easy, quick, and cost-effective alternate to purchase crypto property in a decentralized ecosystem.

QuickSwap fees a buying and selling payment of 0.3% of the transaction worth on all trades. Just like the Uniswap, you’ll be able to grow to be a liquidity supplier on QuickSwap and earn passive revenue in your crypto property. QuickSwap pays rewards within the type of a share within the buying and selling payment and liquidity mining (i.e., the platform rewards the liquidity supplier with its in-house token known as QUICK).

Following is the record of wallets supported by Uniswap:

- Metamask

- Pockets Join

- Coinbase Pockets

You may refer QuickSwap’s commerce statistics right here.

6. 1Inch Trade

1Inchexchange is a well-liked aggregator of decentralized exchanges. It affords a swap function, restrict order function, and likewise yield farming function. You may join your pockets to 1inchexchange and begin utilizing the platform with out offering any private data.

In August 2020, 1Inch acquired its seed funding value $2.8 Million from Binance Labs. Additional, in December 2020, it raised $12 Million from Pantera Capital.

The platform has higher liquidity from a person DEX because it fetches liquidity from a number of DEXs accessible available in the market. Along with this, it supplies probably the most aggressive worth available in the market. It merely divides a purchase order and fulfills it from varied accessible DEXs and liquidity swimming pools.

The platform makes use of a mechanism known as Chi token to cut back the price of ETH Fuel at the moment over the roof. The platform is likely one of the hottest DEX’s proper now and one thing you need to be utilizing. 1Inch additionally affords a cell app, which makes it simpler for anybody to swap tokens with the consolation of a smartphone.

1Inch doesn’t cost any buying and selling, deposit, or withdrawal payment. Nevertheless, the DEXs from which an order is fulfilled would cost their due payment.

Following is the record of blockchain networks and wallets supported by 1Inch Trade:

| Supported Networks | Supported Wallets |

|---|---|

| Ethereum Polygon (earlier generally known as Matic) Binance Good Chain (BSC) |

Metamask Pockets Join Coinbase Pockets BSC (Binance Good Chain) Pockets Ledger Trezor 1Inch Pockets Join Portis MEW Fortmatic Authereum Torus Bitski Arkane FunFair Pockets |

You may refer 1Inch Trade’s commerce statistics right here.

7. SushiSwap

SushiSwap is a DEX that’s developed on the Ethereum community. It’s an extension of Uniswap, which cannot solely be used for buying and selling in crypto property, however these crypto-assets might be lent, staked, and farmed. Additional, SushiSwap prolonged itself to a number of different blockchain networks, thus rising the variety of crypto property supported by the platform.

Learn: What’s Staking in Crypto

The buying and selling payment on Sushiswap is 0.3% of the transaction worth. The catch right here is that the entire transaction payment isn’t distributed to the liquidity suppliers, however 0.25% is distributed to them, and the remainder 0.05% is distributed to the SUSHI token holders. SUSHI is the in-house governance token of SushiSwap. Along with buying and selling payment share, liquidity suppliers additionally SUSHI tokens rewards, that are additional rewarded by a share within the buying and selling payment.

Options of SushiSwap alternate might be listed as follows:

- Swap

- Liquidity Swimming pools

- Staking LP Tokens

- Reward Distribution

Following is the record of blockchain networks and wallets supported by SushiSwap Trade:

| Supported Networks | Supported Wallets |

|---|---|

| Ethereum Polygon (earlier generally known as Matic) Binance Good Chain (BSC) Fantom HECO xDai Concord Avalanche OKExChain |

Metamask Pockets Join Coinbase Pockets BSC (Binance Good Chain) Pockets Ledger Trezor 1Inch Pockets Join Portis MEW Fortmatic Authereum Torus Bitski Arkane FunFair Pockets |

Additional, the next is the record of wallets supported by SushiSwap:

- Metamask

- Pockets Join

- Coinbase Pockets

- Fortmatic

- Portis

- Lattice

- Torus

You may confer with SushiSwap’s commerce statistics right here.

8. PancakeSwap

PancakeSwap is the DEX developed on the Binance Good Chain (BSC). Actually, it’s the preferred undertaking on the Binance Good Chain, which affords many nice options. You may swap tokens (BEP20 tokens), grow to be a liquidity supplier, or stake your LP tokens to farm new tokens.

When Ethereum gasoline payment is skyrocketing, BSC is one other resolution for environment friendly and inexpensive transactions. The buying and selling payment on PancakeSwap is 0.2% of the transaction worth. Along with this, the dealer would want to pay the respective community payment.

Pancakeswap additionally affords a local token known as “CAKE” which has a number of use instances. Additional, the worth of CAKE has appreciated considerably in current instances.

Following is the record of wallets supported by PancakeSwap:

- Metamask

- Pockets Join

- Belief Pockets

- Binance Chain Pockets

- Safepal Pockets

- Math Pockets

- Token Pocket

You may refer PancakeSwap’s commerce statistics right here.

9. Curve.fi

Curve Finance is one other Ethereum primarily based DEX within the prime charts by way of buying and selling quantity. The platform has just lately built-in with Fantom and Polygon, which leads to quick and cost-efficient transactions.

Along with swaps, crypto-asset holders can earn a living by offering liquidity to the platform’s Curve Swimming pools.

The platform could be very upfront in regards to the dangers a consumer is uncovered to whereas utilizing the platform. Additional, the platform’s code has already been audited twice.

The buying and selling payment on the platform is 0.04% of the transaction worth. Additional, Curve Finance focuses extra on minimizing slippage. Due to this fact, many of the buying and selling quantity consists of the commerce of stablecoins.

The platform has an in-house governance token CRV that’s used to make Curve an entire Decentralised Autonomous Organisation (DAO).

Following is the record of blockchain networks and wallets supported by Curve Finance:

| Supported Networks | Supported Wallets |

|---|---|

| Ethereum Fantom Polygon |

Metamask Ledger Trezor Pockets Join WalletLink Portis Fortmatic Authereum Torus Lattice Opera |

You may refer Curve.Finance commerce statistics right here.

10. Raydium

This one is my favourite amongst the Finest Decentralised Exchanges. Raydium is a part of the Solana ecosystem and can be utilized to swap Solana ecosystem tokens in a decentralized method. You may join your favourite Solana pockets, and from right here on you can begin swapping your tokens.

The fantastic thing about this platform is that it supplies on-chain liquidity to a central order ebook. Which means customers can see the order stream and liquidity of the entire ecosystem and never simply their respective pool.

The buying and selling payment charged by the platform is 0.25% of the transaction worth. Out of this, 0.22% is distributed as rewards to liquidity suppliers, and the stability 0.03% is distributed as rewards for staking RAY token (in-house governance token of Raydium).

Additional, the buying and selling view interface permits a consumer to see charts and set a restrict order. Thus, offering nearly all options of a primary centralized alternate.

You can too grow to be a liquidity supplier and earn transaction charges from each swap in your pool. It is a nice strategy to earn passive revenue. You can too stake Raydium token (RAY) on Raydium governance to earn a good-looking staking reward.

Following is the record of wallets supported by Raydium:

- Ledger

- Sollet Extension

- Solong

- MathWallet

- Phantom

- Blocto

- Sollet

- Solflare

- Bonfida

You may refer Raydium commerce statistics right here.

11. Balancer

Balancer is an Ethereum-based DEX the place you’ll be able to swap your ERC20 tokens or deposit them into the liquidity swimming pools to earn passive revenue on them. The buying and selling payment on Balancer is variable and relies on which liquidity pool is getting used for the commerce.

Though Balancer is predicated on Ethereum, it has inventive methods of saving gasoline charges for a consumer. Each dealer earns BAL tokens (the in-house governance token of Balancer) on each commerce. Thus, lowering the efficient transaction price of the commerce.

Additional, attributable to excessive liquidity on the platform, slippage is diminished to the minimal.

Following is the record of wallets supported by Balancer:

- Metamask

- Pockets Join

- Coinbase Pockets

- Portis

- Fortmatic

- Torus

You may refer Balancer commerce statistics right here.

12. Bancor

Bancor is a DEX that lets you swap tokens on Ethereum and EOS blockchain. A consumer can earn passive revenue by offering liquidity to the liquidity swimming pools. Additional, he can borrow funds primarily based on his liquidity place within the pool.

Bancor is the primary DEX that has resolved the issue of Impermanent Loss and has benefited the liquidity suppliers. The buying and selling payment on Bancor is variable and relies on which liquidity pool is getting used for the commerce.

Following is the record of blockchain networks and wallets supported by Bancor Trade:

| Supported Networks | Supported Wallets |

|---|---|

| Ethereum EOS |

Metamask Ledger Trezor Coinbase Pockets Pockets Join Fortmatic Authereum Torus Lattice Opera |

Following is the record of wallets supported by Bancor:

You may refer Bancor commerce statistics right here.

13. THORSwap

THORSwap is a DEX constructed on Thorchain, which is a decentralized cross-chain protocol on Cosmos Community.

All of the exchanges mentioned above present a consumer with a really environment friendly strategy to commerce crypto tokens in a decentralized ecosystem. However, these exchanges can solely swap between tokens throughout the similar community. For instance, an ERC20 token might be swapped with one other ERC20 token solely.

The cross-chain swap was not potential earlier than THORSwap launched it. This implies which you can swap tokens throughout the totally different blockchains. For instance, you’ll be able to swap BTC with ETH.

Thus, THORSwap is the primary multichain DEX. That is the explanation that I couldn’t maintain this alternate out of my Finest Decentralised Exchanges record.

The issue with a multichain swap is that you’d be paying a number of gasoline charges. For instance, to swap BTC with ETH, you’ll pay the ETH gasoline payment, BTC gasoline payment, and Thorchain gasoline payment.

Apart from this, you’ll be able to present liquidity to the platform and earn passive revenue as a reward. The buying and selling payment charged by THORSwap is variable and might be higher understood right here.

Following is the record of blockchain networks and wallets supported by THORSwap Trade:

| Supported Networks | Supported Wallets |

|---|---|

| Ethereum Bitcoin Bitcoin Money Litecoin Binance Chain |

Pockets Join Metamask XDeFi Pockets Ledger |

You may confer with THORSwap commerce statistics right here.

Upcoming decentralized exchanges on various blockchain:

2022 noticed the most important inflow of latest blockchains and new AMM and decentralized exchanges.

Listed here are among the notable blockchain and their decentralised exchanges. They provide some wonderful alternatives for liquidity mining and funding. Do your analysis and make that life-changing cash:

Conclusion: Prime Decentralized exchanges (Crypto Dex)

Nevertheless, regardless of their present state, the way forward for decentralized exchanges appears promising.

Listed here are FAQs associated to Decentralized exchanges:

What’s a Decentralized Trade?

A Decentralized Trade, also referred to as DEX, is a peer-to-peer cryptocurrency alternate that doesn’t want any middleman. Nevertheless, there might be some intermediaries to make sure the safety and transparency of the transaction.

These exchanges don’t maintain the id of the customers. Additional, they don’t management the custody of the customer’s funds.

Is a DEX possible for smaller transactions?

Usually, No, as a DEX transaction would price you a buying and selling payment and the blockchain community’s gasoline payment, which might be substantial. Due to this fact, typically, for those who do a cost-benefit evaluation, a low-value transaction wouldn’t be possible.

Nevertheless, many DEXs are adopting layer 2 blockchain options to the excessive gasoline payment, presumably making these transactions possible as much as a particular restrict.

What’s the buying and selling payment on DEXs?

Transaction on a DEX typically has a buying and selling payment charged as a service payment for exchanging property.

A DEX fulfills a purchase or promote order from an ecosystem of liquidity swimming pools. Liquidity suppliers deposit their funds to those swimming pools to offer liquidity to a DEX. Part of the buying and selling payment is mostly paid to those Liquidity Suppliers as a reward.

To know extra about Liquidity Swimming pools and Liquidity Suppliers, confer with our Information for Liquidity Swimming pools.

Can I take advantage of Ledger Pockets with decentralized exchanges?

Sure, you should use your Ledger Pockets on many of the DEXs. Additional, just lately ParaSwap alternate has been built-in with the Ledger Reside software. This implies which you can entry the alternate from Ledger Reside solely.

Now it’s time to hear from you: Which DEX do you employ? Did I miss any important DEX with good liquidity? Lastly, what do you consider the way forward for DEX?

Let me know your ideas and feedback within the feedback part under.

Listed here are some extra articles from CoinSutra for you: