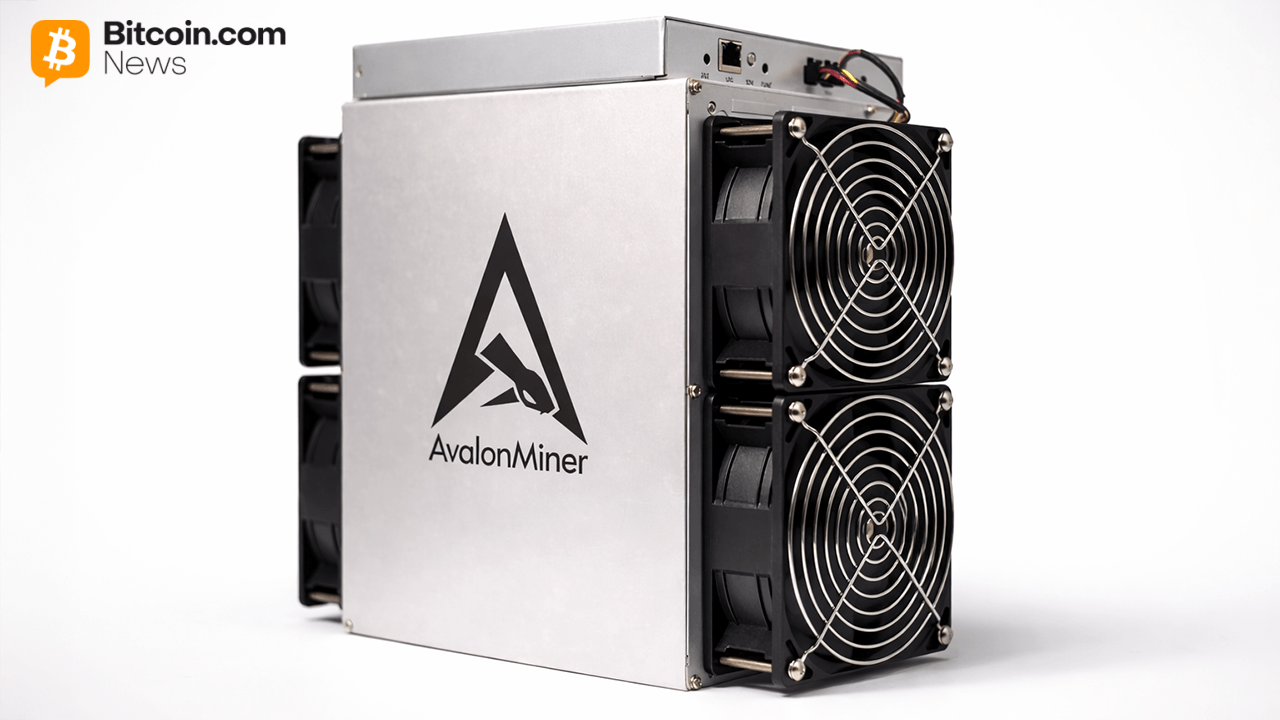

Bitcoin miner Canaan reported a fall within the third-quarter outcomes with income seeing a fall of 25.8% from the year-ago quarter.

Non-GAAP internet earnings for the quarter was $23.4 million, a lower of 71.7% from the identical interval in 2021. The corporate’s income for Q3 2022 was $137.5 million.

Nevertheless, mining income in Q3 2022 was $8.7 million, representing a rise of 1,002.7% versus Q3 2021.

Chairman and CEO Nangeng Zhang stated:

“The unfavourable market dynamics have considerably hindered bitcoin miners’ revenues and money flows. As miners are pressured to chop their demand for computing energy, we needed to modify down our promoting worth in response”

In the identical vein, CFO James Jin Cheng asserts that the market circumstances are anticipated to proceed deteriorating within the subsequent two quarters due to bitcoin’s downward trajectory, rising vitality costs, and miners underneath growing money strain.

Canaan will, nonetheless, tighten its money administration to seize extra alternatives when the market recovers, says Cheng.

Plans for Growth

The corporate plans to broaden regardless of Canaan’s newest monetary report exhibiting a downward pattern. Canaan will proceed to broaden its analysis and improvement tasks and mining operations worldwide. Zhang stated:

“[A]s a part of our ongoing effort to strengthen our analysis and improvement capabilities, we’re increasing our Singapore headquarters with promising native analysis and improvement abilities to assist help our enterprise on a world scale. As well as, now we have expanded our mining enterprise by tapping into the U.S. to optimize the allocation of our mining machines. “

Nevertheless, Zhang maintains that they’re dealing with a really difficult trade interval because the “bitcoin worth is sinking to lows the market has not seen in two years.”