You’ll usually hear phrases like “bull” and “bear” thrown round in numerous contexts to explain the state of economic markets. In easiest phrases, a bull market is when market circumstances are favorable, whereas a bear market is simply the alternative. However what makes a bull or bear market? Is crypto in a bear market proper now? And what’s with all of the animal names? We’ve received solutions forward.

On this article

What are bull and bear markets?

Technically talking, a bull or a bear market happens when asset costs stay both elevated or depressed, respectively, over a chronic time frame. It’s usually not thought of a by-the-books bull or bear market except the upswing or downswing is 20% or extra.

Origins of names

Even in case you’ve heard the phrases one million instances, you’ll have by no means actually thought of how bull or bear markets received their mammalian monikers.

Bull market

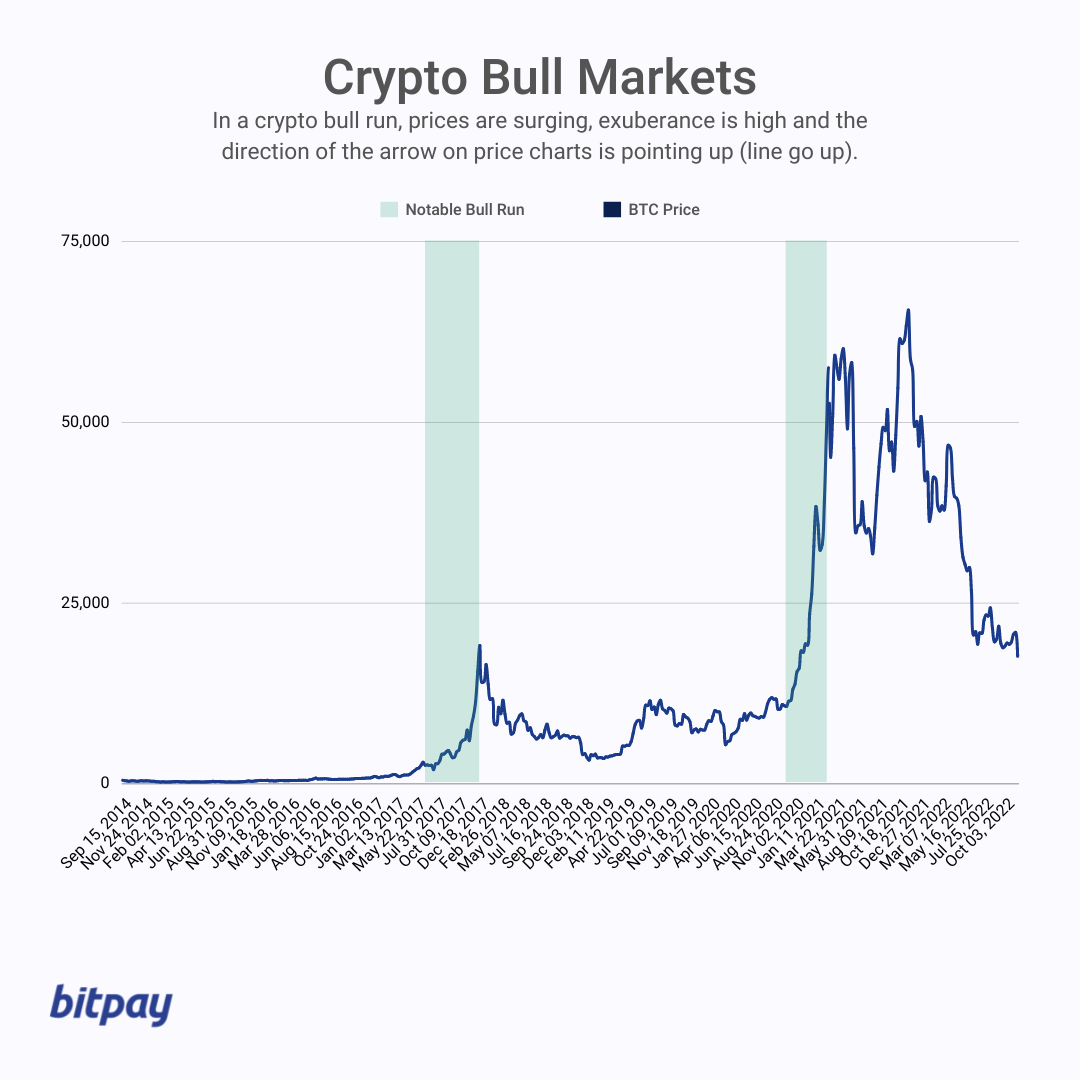

The expression “bull market” is assumed to originate from the upward movement a bull’s horns make because it costs and assaults. In a crypto bull run, costs are surging, exuberance is excessive and the course of the arrow on value charts is pointing up (line go up). The time period is so entrenched on this planet of finance there’s even an enormous bronze bull statue that’s been prominently displayed in Manhattan’s Monetary District since 1989. On the Bitcoin 2022 convention in Miami, a equally sized robotic-looking bull statue made its debut as a nod to the unique whereas additionally signifying one thing of a altering of the guard in world finance.

Bear market

A bear market, alternatively, is believed to be so named for the downward movement a bear makes with its claws whereas hanging. One other main principle on the time period’s origin dates again to a sixteenth century proverb admonishing, “don’t promote the bearskin earlier than you’ve caught the bear”. By early 18th-century England, the time period “bearskin” was used as shorthand for speculative inventory shopping for, which we name short-selling right now.

What’s a bear market in crypto?

In a crypto bear market, buyers are fearful. Confidence is low, and each costs and demand are sinking. No one likes a bear market, however it may possibly additionally current shopping for alternatives as soon as the mud settles. After costs discover their backside, investor curiosity tends to pique as soon as once more with a scramble for belongings they now contemplate undervalued. For this reason a significant crypto bull run has traditionally adopted every main bear market in current historical past.

What does “bearish” imply in crypto?

“Bearish” sentiment in crypto investing not solely means the newbies and paper arms are lengthy gone, however even the die-hard HODLers are beginning to sweat. A bear market is characterised by a basic lack of investor confidence and a pessimistic angle about asset costs. Costs plummet as demand slips, and once-popular cash or initiatives can turn out to be digital ghost cities as their person base hibernates for the downturn.

Indicators of a bear market

In a crypto bear market, you’ll possible see a number of of the next:

- Costs dropping over a chronic interval

- Demand for belongings falling

- Low investor confidence

- Enhance in hyperbolic media studies about “crypto meltdowns” or “crypto armageddon”

- Neophytes fleeing the market

- Dangerous information sends costs spiraling downwards

- Excellent news does little to cease the bleeding

Causes of bear markets

If optimism is the foreign money of a bull market, concern is the authorized tender in a bear market. Bear markets may be triggered by any variety of issues, from world upheaval like wars or the pandemic, to authorities crypto bans or hints from regulators about an impending crackdown. Crypto market cycles are sometimes pushed by hype, so when dangerous information or damaging sentiment begins to snowball, it may possibly have a cascading impact that sends costs considerably decrease, and quick.

Notable crypto bear runs

What goes up should finally come down, so it stands to cause the 2 most memorable crypto bear runs instantly adopted the most important bull runs in crypto market historical past.

After 2017’s then-unprecedented yearlong spike in crypto costs, the worldwide cryptocurrency market shed greater than 60% of its worth by February 2018, kicking off our first official crypto winter. Costs remained comparatively regular for the subsequent few years till the crypto bull run in 2021, which once more lasted for many of the yr. And you already know what occurred after that. As of November 2022, the cryptocurrency market cap is down almost 70% from its all-time highs notched in late 2021.

Is crypto in a bear market proper now?

There are faint rays of optimism starting to emerge, however by any technical measure or clear-eyed evaluation of issues, the crypto market may be very a lot certainly within the throes of a quite cranky bear market. Costs stay considerably decrease than highs seen in 2021 after a steep decline all through 2022.

Investing methods/alternatives in bear market

Though bear market investing may be dangerous, there are additionally pockets of alternative to be discovered as costs discover their backside. Some bear market methods buyers leverage when investing in a bear market embrace:

- “Purchase the dip”, the basic crypto rallying cry encouraging customers to purchase cash whose costs are depressed (however fastidiously contemplate your danger tolerance earlier than doing so)

- Leverage a dollar-cost averaging (DCA) crypto technique

- Transfer holdings to a much less risky crypto asset to climate the storm, similar to stablecoins

- Promote your holdings on the first main indicators of a downturn with the hope of shopping for again in at a lower cost later (although this might require timing the market, which doesn’t exist)

- Grit your tooth and cease your portfolio till market circumstances enhance

Securely purchase, swap, retailer and spend crypto by way of all market circumstances

What’s a bull market in crypto?

Throughout a crypto bull run, corks are popping, Lambos are being purchased left and proper and we’re all strapped on a rocketship headed straight for the moon. At the least, that’s the way it can really feel. Inventory costs have a tendency to maneuver loads slower than crypto costs, so whereas a 20% leap in an organization’s share value over a number of weeks or months is large information in conventional finance, a crypto bull run may very well be one thing like a 50% improve in mere days.

What does “bullish” imply in crypto?

In crypto investing, the time period “bullish” refers to optimistic investor sentiment about digital belongings, with such buyers generally referred to as “bulls”. Bullish buyers are normally including to their present positions with the expectation the ahead momentum will proceed. Confidence is excessive, and may be infectious, which may have the impact of propelling a bull market even additional.

Indicators of a bull market

A crypto bull market may be recognized by a lot of completely different traits:

- Sustained rising costs

- Steadily rising demand for belongings

- An uptick of media studies about market upswings

- Excessive ranges of investor confidence

- Floods of latest buyers taking part in markets

- Dangerous information has little affect on costs

- Excellent news sends costs sharply upward

Causes of bull markets

The first explanation for a bull market is investor optimism that the worth of an asset or belongings will rise, incomes them a revenue. However there are a number of different elements at play, some inner, some exterior. For example, a usually strong economic system marked by low unemployment and robust gross home product (GDP) progress is fertile soil for a bull market to take root.

As a more recent asset class that’s in some ways distinct from conventional investments, the causes of a crypto bull market are considerably completely different. For example, celebrities tweeting about numerous crypto initiatives they’re supporting has been recognized to kick off crypto bull runs. Reveals of confidence from the normal finance world, like Goldman Sachs’ oft-repeated $100,000 Bitcoin prediction, is one other drive that may put upward stress on digital asset costs. A serious monetary establishment launching a brand new crypto product like an exchange-traded fund (ETF) or a crypto belief also can sign optimistic momentum and spark further investor curiosity.

Notable crypto bull runs

We don’t need to look very far to the previous to see two epic current crypto bull runs.

In 2017, cryptocurrency had its first actual breakout second. The worth of Bitcoin surged from $1,000 in January to over $17,700 by the tip of the yr. It was a time when even your grandmother began asking you about cryptocurrency.

In 2021, within the midst of the so-called “all the things rally” the place investing was on straightforward mode, the cryptocurrency market skilled one other stratospheric run-up in costs. Firstly of the yr, the entire crypto market cap was roughly $772 billion. By Thanksgiving it had climbed to only shy of $3 trillion, a virtually fourfold improve in lower than a yr.

Investing methods for bull markets

A yr like 2021 most likely gained’t come round once more anytime quickly, when you might just about throw a dart at an inventory of investable belongings and more than likely flip a revenue. Nevertheless, there will definitely be extra bull markets in our future. Listed here are some methods for taking full benefit.

- Purchase early within the run, as that’s the place you could have the best probability to earn ROI

- Take income if the market begins to pattern bearish

- Set a stop-loss order to guard your good points, however make sure to depart sufficient of a buffer to climate short-lived value spikes to keep away from prematurely triggering the order

- Preserve your wits about you. No bull run is ceaselessly, so don’t make investments just like the gravy practice won’t ever finish

Wrap up on bears and bulls

Market timing is nearly at all times a idiot’s errand, so predicting the start or finish of a bull or bear market is equally futile. That’s very true in crypto, the place asset costs are extra susceptible to large up and down swings over brief durations of time. The chilly, exhausting reality is bull and bear markets are a reality of nature relating to investing. Studying to acknowledge them early on and making the suitable strikes can assist ease the sting when the bears are in cost, or flip a tidy revenue when the bulls run the present.