FTX’s fall from grace this week culminated within the firm submitting for Chapter 11 chapter on Nov. 11. The submitting contains all 130 firms underneath the umbrella, in addition to the buying and selling agency Alameda.

On asserting the information, Sam Bankman-Fried resigned from his place as CEO. John Ray, who oversaw Enron following its accounting scandal in 2007, took cost following SBF’s resignation.

Commenting on the chapter, Ray mentioned the Chapter 11 submitting would supply reduction and permit for a radical evaluation of the scenario to maximise recoveries for all stakeholders.

Chapter 11 filings allow an organization to proceed buying and selling and are often carried out in enterprise restructuring circumstances.

A ‘full failure’

Ray filed the Chapter 11 Petitions and First Day Pleadings with the Chapter Courtroom of Delaware on Nov. 17.

Having gone by means of FTX’s books, Ray blasted the earlier firm administration, saying he has by no means come throughout “such a whole failure of company controls and such a whole absence of reliable financial data.”

Specifically, he identified compromised programs integrity, defective regulatory oversight overseas, and focus of management within the fingers of a really small group – all of which have been inexperienced and incapable of working an operation the dimensions of FTX.

Ray mentioned:

“The FTX Group didn’t preserve centralized management of its money. Money administration procedural failures included the absence of an correct record of financial institution accounts and account signatories, in addition to inadequate consideration to the creditworthiness of banking companions around the globe. Below my course, the Debtors are establishing a centralized money administration system with correct controls and reporting mechanisms.”

The aftermath

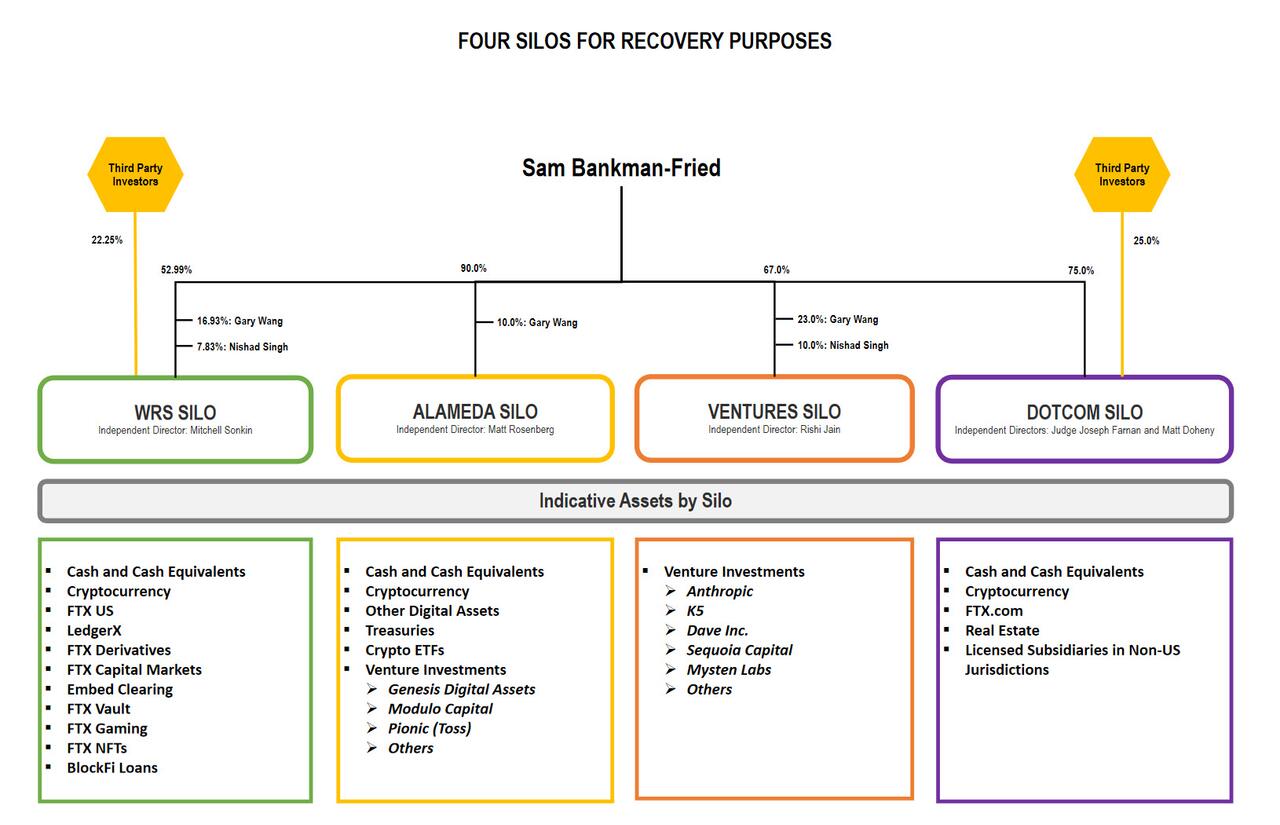

The companies have been divided into 4 teams or silos to handle the chapter course of. For every Silo, Ray included an unaudited steadiness sheet as of Sep. 30, 2022. A abstract is as follows:

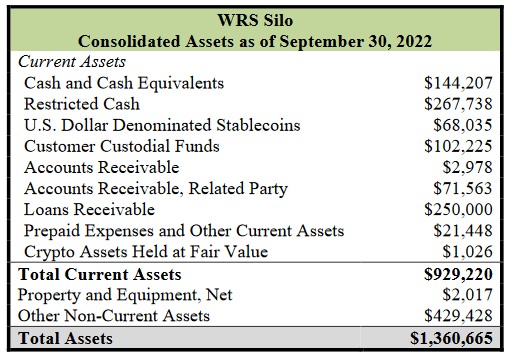

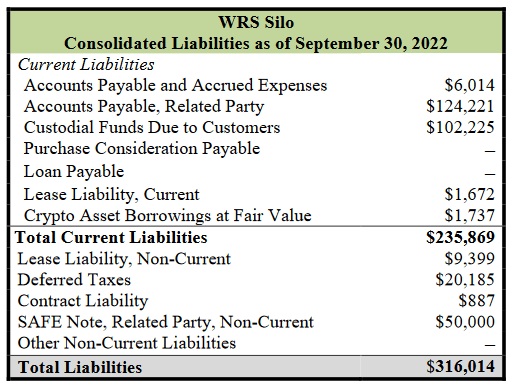

West Realm Shires Inc. Silo (WRS) contains FTX U.S., LedgerX, FTX US Derivatives, FTX U.S. Capital Markets and Embed Clearing, amongst different entities.

- The steadiness sheet confirmed $1.36 billion in Complete Belongings, of which $929.2 million is said to Present Belongings. Complete Liabilities are $316 million, with $235.9 million in Present Liabilities.

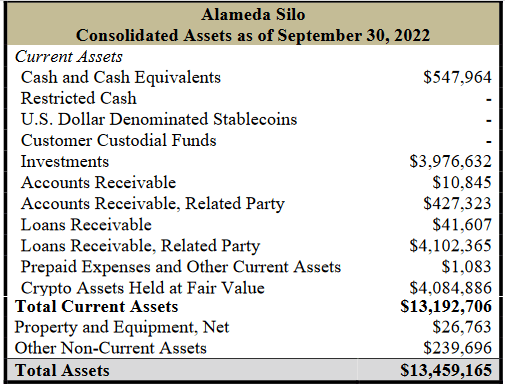

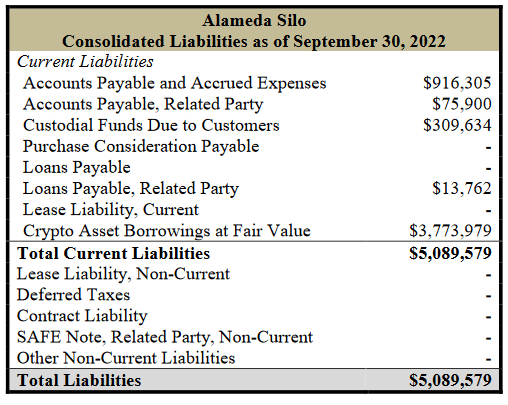

Alameda Silo refers to entities specializing in quantitative buying and selling funds; it contains Alameda Analysis LLC and debtors based mostly in Delaware, Korea, Japan, the British Virgin Islands, Antigua, Hong Kong, Singapore, Seychelles, the Cayman Islands, the Bahamas, Australia, Panama, Turkey, and Nigeria.

- The steadiness sheet confirmed $13.5 billion in Complete Belongings, of which $13.2 billion are Present Belongings. Complete Liabilities are $5.09 billion, all of that are present.

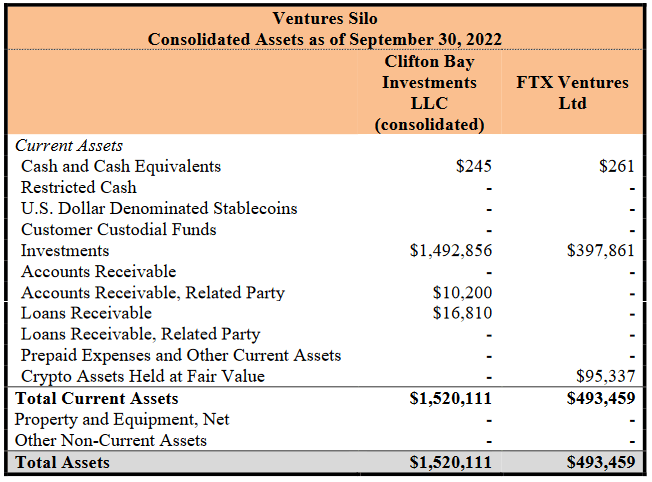

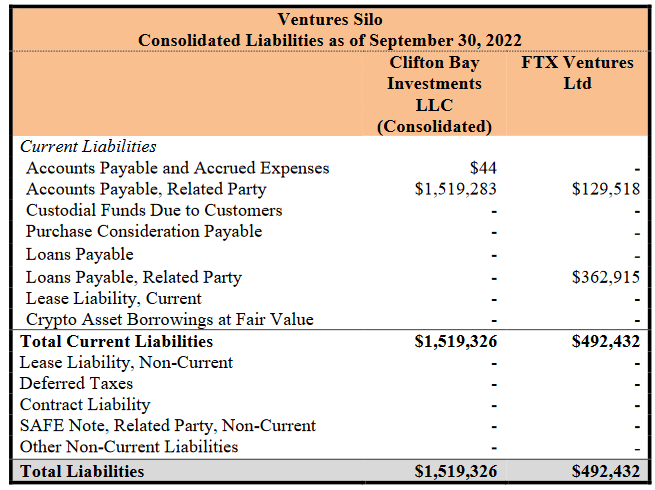

Ventures Silo firms relate to non-public funding entities, together with Clifton Bay Investments, LLC, Clifton Bay Investments Ltd., FTX Ventures Ltd., and Island Bay Ventures Inc, amongst different entities.

- The mixed steadiness sheet of Clifton Bay Investments LLC and FTX Ventures Ltd confirmed $2.014 billion in Complete Belongings, of which all are present. Likewise, whole Liabilities are available in at $2.012 billion, which is present.

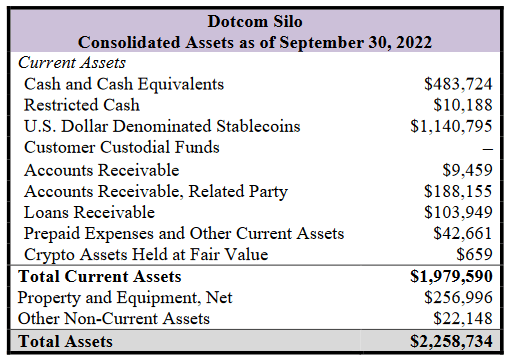

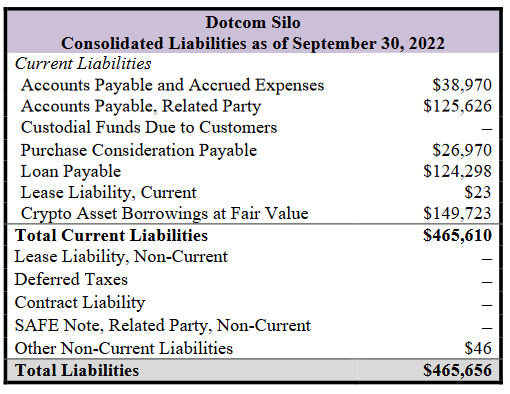

Dotcom Silo holds particular market licenses and registrations and contains the FTX digital buying and selling platform and trade.

- The steadiness sheet confirmed $2.259 billion in Complete Belongings, of which $1.98 billion is Present Belongings. Complete Liabilities are $466 million, and all however $46,000 is present.

In every case, present belongings exceed whole liabilities. Nonetheless, given the improper company controls earlier than his arrival, Ray mentioned he did “not believe” in any of the monetary statements.

Ray mentioned the FTX Group of firms did not maintain centralized management of its money, which means there isn’t any record of financial institution accounts to confirm money balances. Equally, firm controls have been poor, with no money administration programs or using correct reporting mechanisms.

Ray mentioned the audit agency for the WRS Silo was Armanino LLP, noting that he’s “professionally acquainted with the agency. He famous, nonetheless, that he was not acquainted with the audit agency for the Dotcom Silo, Prager Metis, which touts itself as “the first-ever CPA agency to formally open its Metaverse headquarters within the metaverse platform Decentraland.”

The CEO mentioned:

“I’ve substantial issues as to the data offered in these audited monetary statements, particularly with respect to the Dotcom Silo. As a sensible matter, I don’t imagine it acceptable for stakeholders or the Courtroom to depend on the audited monetary statements as a dependable indication of the monetary circumstances of those Silos.”

Unchecked loans; firm funds used to purchase homes

The chapter submitting additionally revealed that Sam Bankman-Fried acquired $1 billion in private loans from Alameda Analysis.

Additionally, Alameda gave a $543 million mortgage to FTX director of engineering Nishad Singh. The agency additionally gave Ryan Salame, the co-CEO of FTX, a $55 million mortgage.

In an obvious disregard for company course of, Ray claimed,

“Company funds of the FTX Group have been used to buy properties and different private gadgets for workers and advisors.”

The properties have been based mostly within the Bahamas, and the brand new CEO acknowledged that “no documentation” is current to establish the purchases as loans. On the similar time, the actual property was registered within the private names of the staff and advisors.

The place are the digital belongings and different investments

Bewilderingly, Ray additional depicted a chaotic strategy to bookkeeping and safety. SBF and Co-Founder Gary Wang “managed entry to digital belongings of the primary companies within the FTX Group.” The interior practices have been described as “unacceptable” by Ray. A gaggle e mail account was used because the “root person to entry confidential personal keys” in a exceptional instance of improper safety hygiene.

There was no common cadence to the “reconciliation of positions on the blockchain,” whereas software program was used to “conceal the misuse of buyer funds.” Ray particularly highlighted the “secret exemption of Alameda” from particular documentation to stop funds from being liquidated with out handbook intervention.

New wallets are allegedly nonetheless being found. One such chilly pockets incorporates roughly $740 million, however the FTX group of firms isn’t but positive of the origin of the funds. Additional, it’s unclear whether or not the funds needs to be cut up amongst a number of entities inside the FTX Group.

At current, Ray confirmed that $372 million was transferred with out authorization after submitting the chapter petition, whereas $300 million in FTT tokens was additionally minted after the deadline. As well as, the FTX firms imagine there are different crypto wallets that SBF and the previous management crew haven’t but disclosed.

Forensic analysts have been employed to seek for lacking funds and try and hint transactions to hyperlink crypto belongings. Ray commented that the analysts may uncover “what could also be very substantial transfers of firm property. Courtroom help was talked about as a possible course to resolve the difficulty.

Ray acknowledged the overview of the investigation in its present state.

“It’s my view based mostly on the data obtained to this point, that most of the workers of the FTX Group, together with a few of its senior executives, weren’t conscious of the shortfalls or potential

commingling digital belongings.”

The brand new CEO believes that “present and former workers” will be the “most damage” by the failure of FTX and SBF’s alleged actions.

Astonishingly, Ray claimed that the main firms associated to Alameda and FTX Ventures “didn’t maintain full books and data of their investments and actions.” A steadiness sheet is being finalized for the affected firms from “the bottom-up” by means of money data.

No paper path

A scarcity of data for SBF’s essential selections was described as considered one of “probably the most pervasive failures” by the appearing CEO. Communication purposes utilized by SBF have been set to “auto-delete” messages, and workers have been inspired to do the identical.

In a seemingly primary job, Ray detailed that the businesses, now, “are writing issues down.”

The crew concerned within the chapter procedures contains former administrators of the SEC and CFTC, together with members of the Cybercrime Unit of the U.S. Legal professional’s Workplace. “Dozens of regulators” have been contacted by Ray and his employees as he posited a necessity for transparency.

SBF’s present function

Ray took the chance to state that SBF “doesn’t converse for them” concerning the FTX firms concerned within the chapter course of. He additional confirmed that SBF is presently within the Bahamas and described his communication as “erratic and deceptive.”

Restoration

Ray famous that attributable to these money administration failures, actual money positions are usually not identified right now. Nonetheless, the businesses are working with turnaround consultants Alvarez & Marsal to resolve this example.

Any funds situated by the FTX group of firms can be “deposited into monetary establishments in the USA.” Every “silo” of funds can be segmented in order that Ray’s crew can allocate “prices throughout the assorted Silos and Debtors.”

A Money Administration Movement can be filed “promptly” to element how money can be managed going ahead.