The expansion of Bitcoin and crypto exchanges through the years displays the trade’s evolution. Exchanges have been probably the most essential companies supporting the blockchain and crypto protocols. As well as, the exchanges, led by the highest figures within the trade, home many of the iconic manufacturers within the crypto ecosystem.

For the reason that early days of Bitcoin until now, crypto exchanges have developed and grown in some ways, gaining customers’ belief. Nevertheless, issues have turned bitter throughout the twinkle of an eye fixed, and customers have misplaced religion in crypto exchanges. The FTX collapse has unfold its contagion throughout the crypto house, pulling most crypto exchanges down.

Bitcoin Data Highest Change Outflow Since 2018

This week recorded a large outflow of Bitcoin from crypto exchanges after the collapse of FTX. Latest information from Glassnode reveals that Bitcoin flows out of exchanges rapidly. In keeping with the report, customers and buyers have withdrawn all Bitcoins that flowed into exchanges since 2018.

For the reason that FTX insolvency, primarily because of asset mismanagement, the demand for self-custody and spot-driven BTC markets has elevated. This motion has by no means been recorded in all earlier bear markets that Bitcoin has survived.

Bitcoin wasn’t the one asset that recorded large withdrawals. Stablecoins equivalent to BUSD and USDC additionally recorded large outflow from exchanges within the final seven days. On-chain information reveals that a lot of the outgoing stablecoins have been transferring into self-custody wallets. Santiment’s information confirmed this report.

In keeping with Santiment, there was a relentless influx of stablecoins equivalent to USDC, BUSD, and USDT into the crypto market in early 2022. As well as, the info instructed that new buyers had been shopping for belongings as the costs declined.

The stablecoins market cap rose to $134.07 billion, with the influx of cash on the identical time BTC peaked. Nevertheless, issues have modified for the reason that fed’s rate of interest hike in June.

Moreover, the stablecoins market has been recording large holdings reshuffle after Binance revealed its plans to transform USDC to BUSD.

Self-Custody Is The Method To Go: Santiment Report

Santiment highlighted that the current disaster teaches everybody to embrace self-custody. The market has discovered, mirrored within the elevated outflow of USDC and BUSD from exchanges.

A number of crypto corporations and buyers are dealing with the warmth from the FTX downfall. For instance, Crypto enterprise capital agency Multicoin Capital misplaced almost $1 billion in belongings held on FTX. The extent of harm within the crypto house and the large outflow of belongings and worth declines has left questions on everybody’s minds. Many are questioning if crypto remains to be alive or useless.

There may nonetheless be hope for the reason that crypto house has survived comparable blows. The Mt.Gox collapse is one occasion that left a cascade impact on the crypto trade. The Terra collapse additionally had the same affect on crypto.

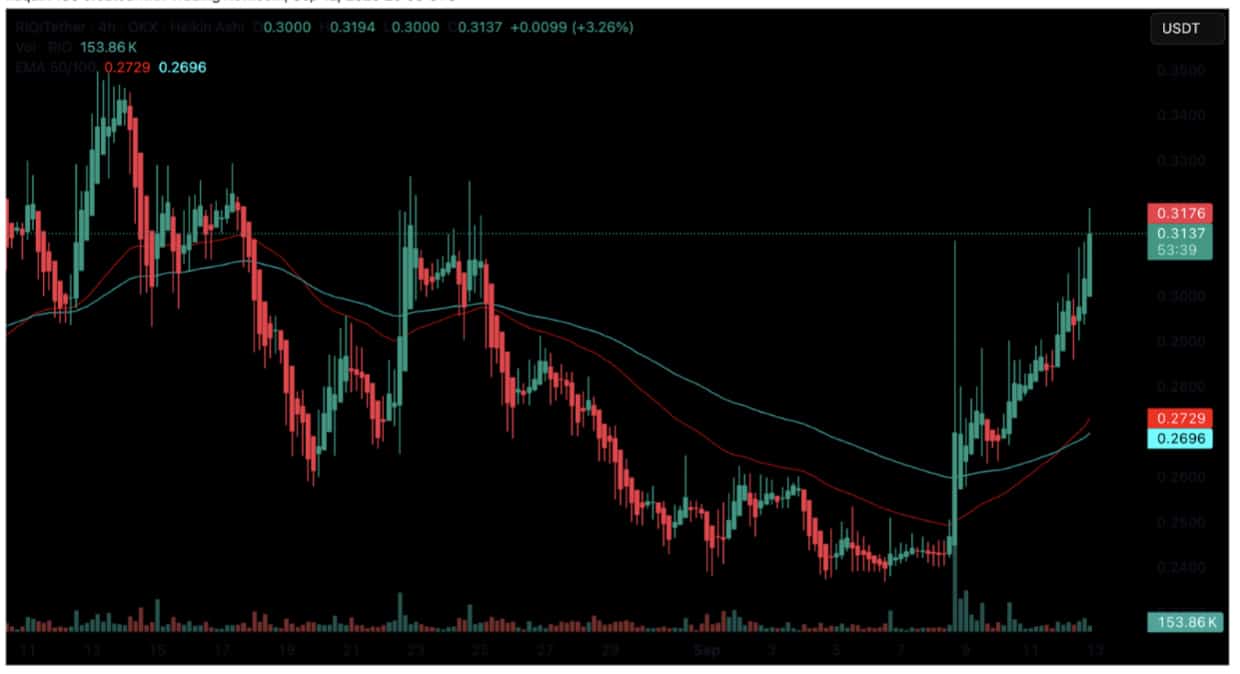

Featured picture from Pixabay, chart from TradingView.com