That is an opinion editorial by Mark Maraia, an entrepreneur, creator of “Rainmaking Made Easy” and a Bitcoiner.

“What Is Your Relationship To Cash?”

I’d argue that’s a extra intimate query for a lot of than “Are you fortunately married?”

I’m certain most readers have by no means thought deeply about their relationship to cash. These raised with a shortage mindset won’t ever have sufficient. That is normally discovered from mother and father and household at a really younger age. Additionally it is bolstered by fiat. In case you are shedding 7.7% of your buying energy yearly, you’re more likely to foment a mindset of shortage. These raised with or those that cultivated an abundance mindset had been programmed otherwise. Both means, your mindset round and about cash is in the end a alternative; you may alter or rewrite this system. For some individuals, that is simple. For others, it’s almost unimaginable. And there are individuals who have loads of cash, however nonetheless aren’t blissful.

In our trendy world, there are various who consider that cash is important to life. There are some who go overboard and idolize cash. They worship making it and so they worship the individuals who make a number of it. When you’ve got or earn ample quantities of cash, rely your blessings. A person or lady who has few wants lives extra freely and abundantly than the remaining.

Most of us have a particular — typically invisible or unexamined — relationship to cash. For some, it provides them their complete cause for being on this world, whereas for others it’s a way to an finish. As we observe occasions like Prime Minister Justin Trudeau’s freezing of Canadian truckers’ financial institution accounts or Biden’s theft of Russian reserves, we begin to notice some chilling realities concerning the nature of cash. Should you don’t have bodily possession of the financial asset, all you’ve got is an IOU, and that IOU may be very tenuous if the ruling authorities determine your phrases or actions don’t comport with their worldview. Normally, the IOU is from the financial institution or credit score union the place you’ve got deposited “your” cash. The one factor is: It’s not “your” cash as soon as it’s deposited into the financial institution.

Bitcoiners are fond of claiming, “Not your keys, not your cash.” What many individuals who aren’t Bitcoiners don’t cease to think about is that the cash of their checking account isn’t actually theirs. Zoltan Pozsar, international head of short-term rate of interest technique at Credit score Suisse, makes the case that we’ve entered a brand new period of Bretton Woods III, which entails inside cash and out of doors cash and claims that commodities will underlie worldwide financial affairs. Inside cash is cash which has a intermediary, reminiscent of a financial institution. All the cash that you simply maintain is basically an IOU. Outdoors cash is cash that’s outdoors of the banking system. It can’t be taken from you thru denying you entry to an account, nor can they inflate it away.

Cash you earn for the work you do is proof of labor. Should you’re lucky, you earn greater than you want for on a regular basis dwelling. Within the paper cash period, that meant you traded your valuable time, labor and life vitality for inexperienced paper strips and little steel disks. Right now you commerce your valuable time, labor and life vitality for pixels on a pc display screen. When seen via that lens, one begins to appreciate that cash is only a image. If all we’ve got is an IOU with a financial institution, every kind of mischief is feasible from governments and banks. This may increasingly embrace bailouts, bail-ins and outright theft. That is deeply troubling. Our reliance on state-issued currencies means our wealth could be confiscated with a keystroke or the stroke of a pen.

The query on the outset could be additional damaged down into two crucial and private questions:

What Is Your Relationship To The U.S. Greenback?

I grew up very lucky. I lived in a house that at all times had meals on the desk, a roof over our heads and the privilege of not having to ever fear about cash. A basic middle-class upbringing via highschool. I went to a public college and a personal faculty, the place I paid for half my schooling and labored as an expert as soon as I bought out of faculty.

I used to be so lucky to develop up by no means actually pondering a lot about cash. It was low on my checklist of priorities and stays that option to this present day. I hardly ever fearful about having sufficient and usually took cash without any consideration. Sure, within the early days of my profession, I lived paycheck-to-paycheck, however I had financial savings — modest although they had been — and oldsters who had been a monetary backstop. A household banker of final resort, because it had been.

That upbringing was each a blessing and a curse. Why a curse? As a result of I by no means gave cash a lot thought. Except for the unstated values my mother and father modeled, I used to be by no means taught about cash, our banking system or our monetary system. These of us dwelling within the U.S. benefit from the extra privilege of getting the world’s reserve foreign money in our pocket. That privilege is one most People take without any consideration.

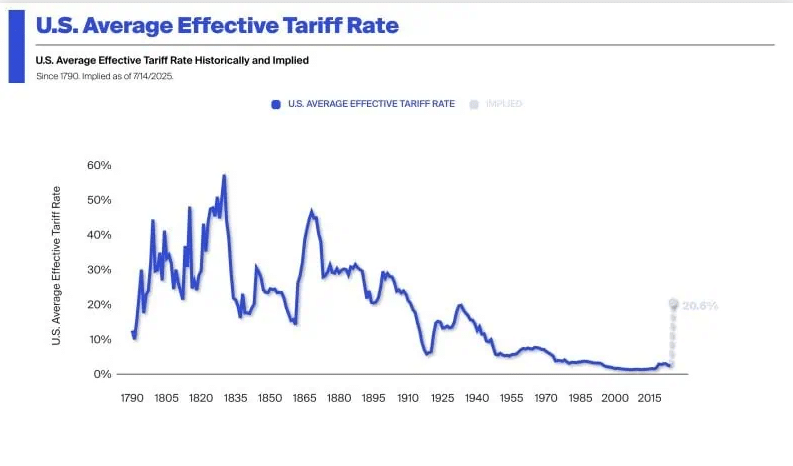

Whereas the U.S. greenback right now continues to be thought of the world’s strongest foreign money, it’s now not a dependable retailer of worth. Even probably the most privileged individuals start to take discover after watching the Federal Reserve and our authorities put absurd quantities of cash into circulation.

All People alive right now grew up with the greenback because the world’s reserve foreign money. To most, meaning nothing. Most of us can in all probability bear in mind the primary time somebody handed us a $5 invoice or another denomination after we had been younger and we felt a rush and thought. “Wow, I’m wealthy!”

Do you’ve got sturdy emotions of pleasure over the U.S. and its founding beliefs? Might that affect the way you see the greenback? Do you’ve got emotions of disgrace over the perpetually wars we’ve fought since Vietnam? Whereas it might appear irrelevant, these emotions will dramatically affect your relationship to the nation’s foreign money.

Are you a cash supervisor in a hedge fund? Are you a millennial? Are you a boomer? Are you a enterprise capitalist? Every will form your relationship with the world’s most fascinating fiat foreign money. Do you see your checking account or entry to capital as a supply of security, a supply of safety or a supply of energy? Do you see having a checking account as a privilege? These are all symbols. The vast majority of individuals on the earth are unbanked. As we’re studying in 2022, these symbols are shedding their luster and are extremely illusory.

Enter a brand new child on the block that was quietly introduced into existence on January 3, 2009.

What Is Your Relationship To Bitcoin?

An enormous share of individuals within the Western world are dismissive of it. Like all new expertise, we discover it exhausting to belief one thing we don’t perceive. Till we’ve got no alternative. Canadian truckers weren’t fascinated by bitcoin till they wanted to be. I consider we’ve got now entered a interval through which the transgressions of the fiat system depart us with no alternative however to be taught extra about bitcoin.

It is a visitor submit by Mark Maraia. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.