A number one digital property supervisor is discovering that institutional traders are pouring bigger quantities of capital into quick crypto funding merchandise than beforehand seen earlier than.

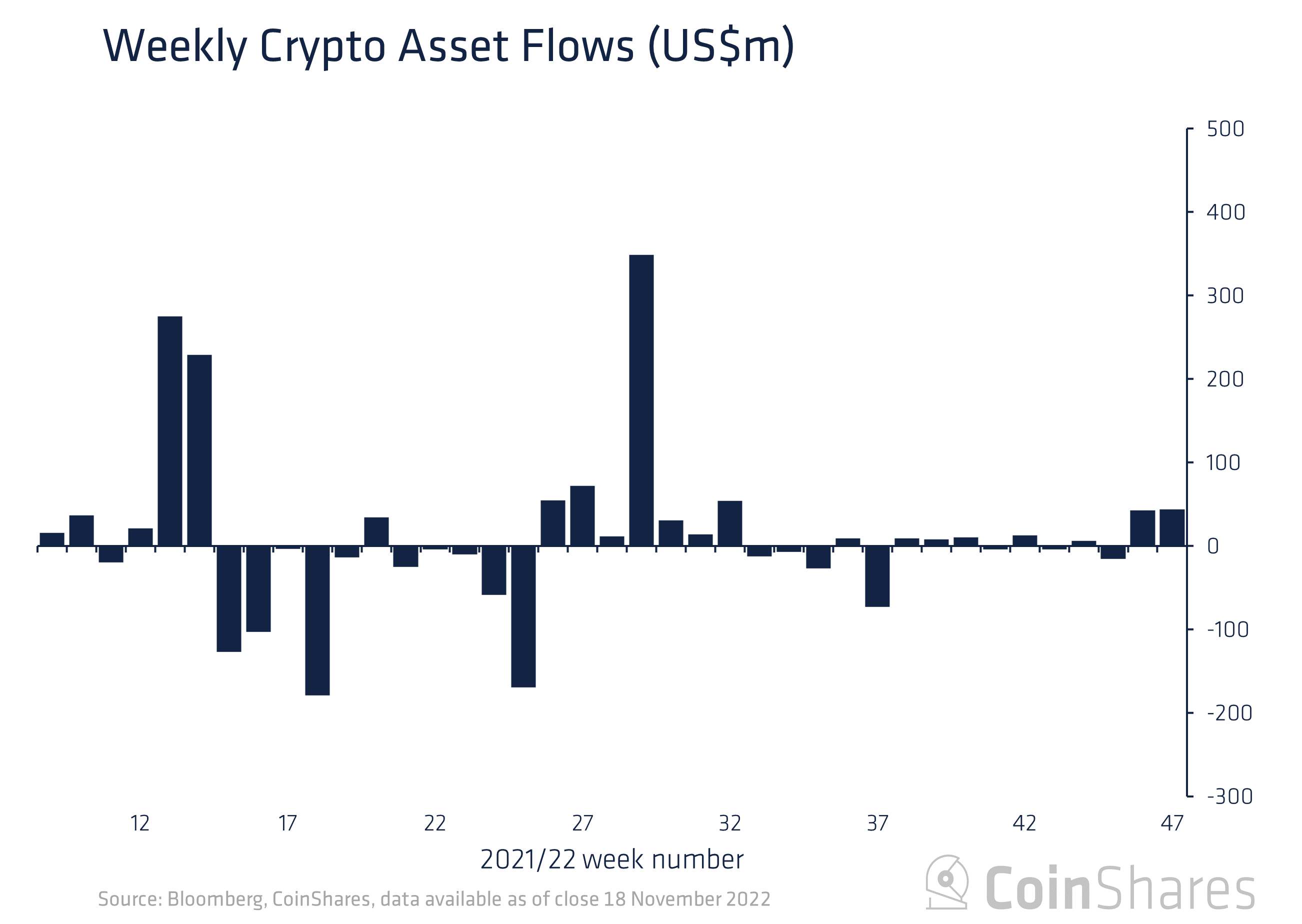

In its newest Digital Asset Fund Flows Weekly report, CoinShares says crypto funding merchandise noticed most inflows heading towards quick funding merchandise final week.

“Brief funding product inflows represented 75% of the entire inflows suggesting on combination sentiment was deeply unfavourable for the asset class, whereas whole AuM is now on the lowest level in 2 years at $22 billion.”

CoinShares finds that Bitcoin (BTC) quick funding merchandise noticed inflows throughout all areas, although it doesn’t essentially indicate investor sentiment is united.

“Regionally, inflows into quick funding merchandise had been seen in each the US and Europe though some quick merchandise noticed outflows implying opinion is split amongst traders as as to whether the market has reached its lows.”

BTC funding autos comprised a lot of the inflowing capital amongst lengthy merchandise, gaining $14.3 million final week, in keeping with the report.

“Bitcoin noticed inflows totaling $14 million, however when offset by the inflows into quick funding merchandise the web flows had been a unfavourable $4.3 million. AuM on short-Bitcoin is now at $173 million, near the excessive of $186 million.”

Lengthy Ethereum (ETH) funding merchandise noticed minor outflows. Quite the opposite, short-ETH merchandise noticed related inflows to BTC.

“Ethereum noticed minor outflows totaling $0.8 million though it additionally noticed the biggest inflows on document into short-Ethereum funding merchandise totaling $14 million. This unfavourable sentiment is probably going a results of renewed uncertainty over the Shanghai replace, which is able to permit the withdrawal of staking property, and the hacked FTX ETH property which sum to ~$280 million.”

All altcoin long-products noticed outflows final week. Solana (SOL) misplaced $3.3 million, Binance Coin (BNB) dropped $0.6 million, XRP suffered $1.4 million in outflows and Polygon (MATIC) misplaced $200,000. Multi-asset funding autos, these investing in a couple of digital asset, noticed inflows of $2.8 million.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses you might incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/Susanitah/Vladimir Kazakov