That is an opinion editorial by Stanislav Kozlovski, a software program engineer and macroeconomic researcher.

Many Bitcoiners have heard of Bitcoin’s “lack of scalability” — it is among the most typical critiques waged in opposition to the challenge by each gluttonous cryptocurrency opponents and incumbent institution actors.

Some oldtimers might keep in mind the heated, bathed-in-controversy Blocksize Wars of 2015 to 2017 which, aided by trade insiders, most shallowly aimed to make Bitcoin scale to extra transactions by growing the utmost block dimension and by doing so, nearly set precedent and altered Bitcoin’s future course endlessly.

Each of those points will in the end show to be left on the incorrect facet of historical past. On this piece, we’re going to present how the Lightning Community addresses Bitcoin’s scalability issues and undoubtedly proves that the small-block resolution was in the end the correct one.

Base Layer Limitations And Decisions

Earlier than we perceive what the Lightning Community is fixing, we should always first perceive what the inherent drawback is. Merely put: You can’t scale a blockchain to validate your entire world’s transactions in a decentralized approach.

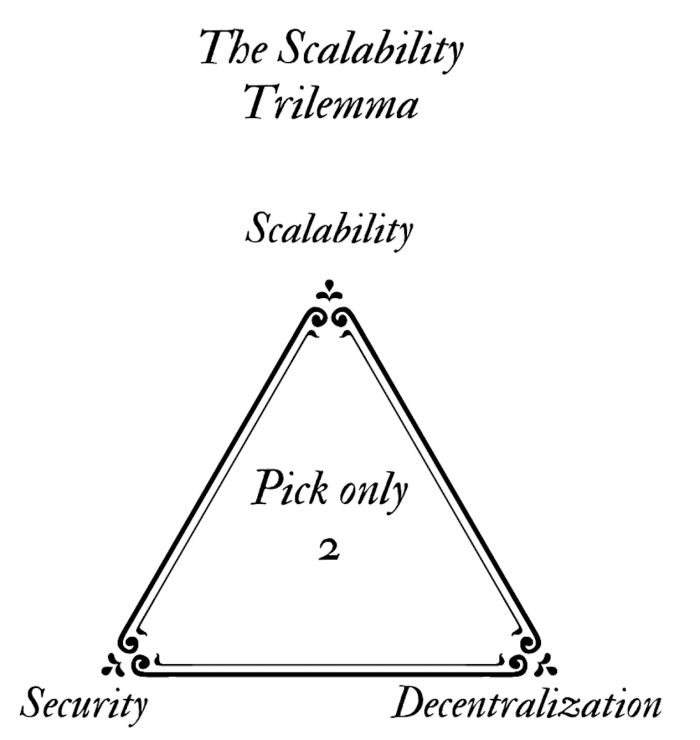

Blockchains endure from an inherent limitation which forces them to commerce off between three qualities — one high quality of their system has to go for the opposite two. As pictured above, a blockchain can solely reliably have two of those three qualities:

- Decentralized: not managed by any single social gathering or a small variety of elites

- Scalable: scale to a enough variety of transactions

- Safe: not be simple to assault and break its invariants

It’s price noting that each one of those traits sit on separate, complicated spectrums. For instance, you don’t turn out to be “safe” over a sure threshold, it is rather depending on the use case and many alternative traits.

Bitcoin is sluggish for a purpose. It explicitly picked to optimize the “safety” and “decentralization” sections of the trilemma, leaving “scalability” (transactions per second) on the sideline.

The important thing realization is that, very similar to at present’s web and monetary system, it’s extra optimum to comprise the entire system of separate layers, the place every layer optimizes for and is used for various issues.

Bitcoin, the bottom layer, is a globally-replicated public ledger — each transaction is broadcast to each participant within the community. It’s evident that one can not virtually scale such a ledger to accommodate your entire world’s rising transaction fee. Aside from being impractical and privateness damaging, its drawbacks vastly outweigh its insignificant advantages.

Again within the day, there was a serious civil battle between the net neighborhood in what Bitcoin ought to do to extend its transaction throughput capability. There may be main, infuriating controversy on this story and is largely what formed Bitcoin to stay what it’s at present — a grassroots, bottom-up motion the place the typical folks (plebs), in mixture with each other, dictate the principles of the community.

“The Blocksize Battle” by Jonathan Bier illustrates the battle between the decentralized community supporters wanting what’s greatest for the long-term viability of the community and the greed and propaganda perpetuated by main gamers and companies to additional their very own power-gaining and profit-seeking agendas.

Lengthy story quick, Bitcoin was forked right into a failed fork named “Bitcoin Money.”

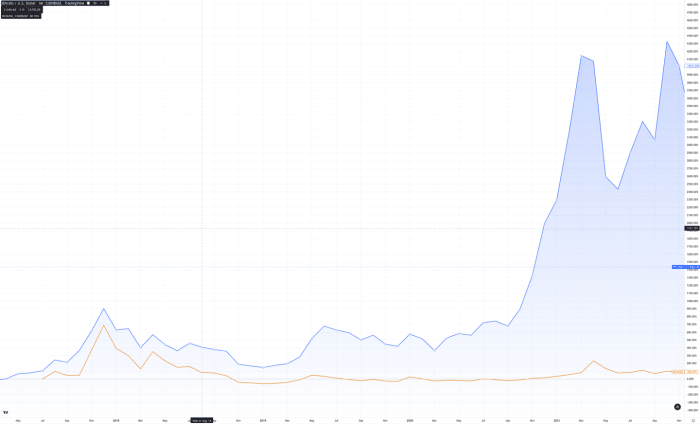

Bitcoin (blue) value in comparison with Bitcoin Money (orange). The fork may be seen in the beginning of the chart. Supply: tradingview.com.

The little man ultimately gained — Bitcoin didn’t rush any unhealthy design decisions that might come to compromise its decentralization, safety or censorship resistance. The choice was successfully made to scale Bitcoin via layers, introducing second layers that work individually from Bitcoin and checkpoint their state to the principle, slower-but-more-secure community.

In stark distinction, the evidently-unsuccessful fork Bitcoin Money sacrificed all hopes of decentralization by growing its block dimension to 32 megabytes, 32 instances greater than Bitcoin, for a mere most of fifty funds per second on the bottom chain.

Block Dimension

Every Bitcoin block has a cap on its dimension and this denotes the higher sure on what number of transactions can exist within a block. If demand grows to outpace the quantity of transactions a block can have, the block turns into full and transactions get left unconfirmed within the mempool. Customers start to outbid one another through the adjustable transaction charge so as to have their transaction be included by the miners, who’re incentivized to decide on the highest-paying transactions.

A naive resolution to this may be to easily enhance the block dimension restrict — that’s, permit extra transactions to be included in a block. The destructive negative effects of this are adequately subtle that even intellectuals like Elon Musk make the error of suggesting it.

Rising the block dimension has second-order results which lower the decentralization of the community. Because the block dimension grows, the price to run a node within the community will increase.

In Bitcoin, every node has to retailer and validate every transaction. Additional, mentioned transaction must be propagated to the node’s friends, which multiplies the community’s bandwidth necessities for supporting extra transactions. The extra transactions, the extra the community’s processing (CPU) and storage (disk) necessities develop for every node. As a result of working a node yields no monetary advantages, the motivation to run one disproportionately decreases the extra expensive it’s.

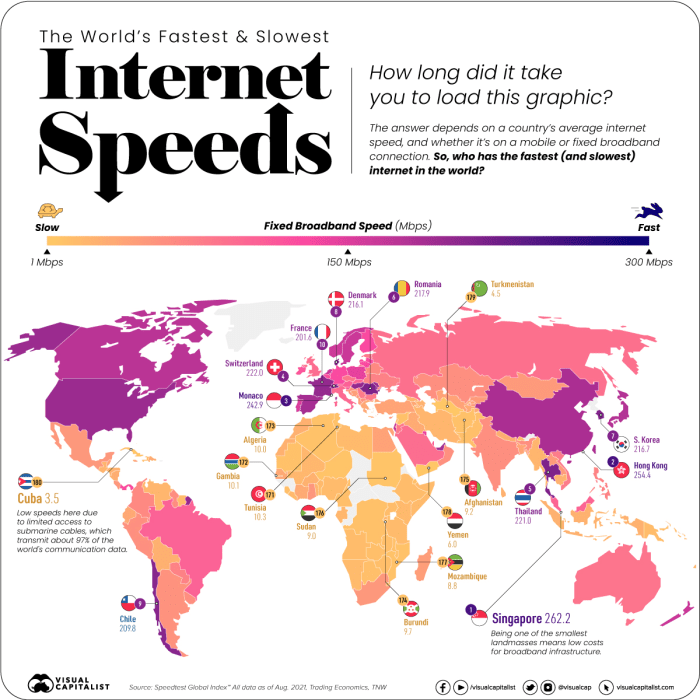

To place it into numbers, if Bitcoin is to ever scale to Visa’s purported peak capability ranges (24,000 transactions per second) a node would wish 48 megabytes per second simply to obtain the transactions over the community. The next is a map displaying the typical web velocity on the planet:

As you’ll be able to see, an enormous a part of the world’s common velocity would exclude them from the flexibility to run a node beneath these situations. Notice that common velocity implies that many are even decrease than mentioned threshold. Moreover, it doesn’t account for the truth that a person would produce other makes use of for his or her bandwidth — few selfless folks would dedicate 50% of their web bandwidth for a Bitcoin node.

Extra importantly, the quantity of information this may generate would make it unimaginable for anyone to virtually retailer it — it could lead to 518 gigabytes of information per day, or 190 terabytes of information a 12 months.

Additional, spinning up a brand new node would require one to obtain all of those petabytes of information and confirm every signature — each of which might make it so {that a} new node would take a very long time (years) to spin up.

And to make issues worse, 24,000 transactions per second doesn’t make for a very distinctive international funds community in and of itself. Visa isn’t the one funds community on the planet, and the world is rising extra interconnected each day.

Lightning Community 101

The Lightning Community is a separate, second-layer community that works on prime of the principle Bitcoin community. Merely mentioned, it batches Bitcoin transactions.

To entry it, it’s essential to run your personal node or use someone else’s. The community has two ideas price understanding for the needs right here:

- A Lightning node: separate software program that communicates with one another and constitutes a brand new peer-to-peer community.

- Channels: a connection opened between two Lightning nodes, permitting for funds to movement between them.

A channel is actually a Bitcoin base layer transaction, anchoring the channel to the safe chain.

As soon as two nodes open a channel between each other, funds begin flowing between them. Every subsequent fee modifies the channel’s state, cryptographically revoking the outdated one and checkpointing the brand new one in reminiscence and on disk of each nodes, however critically, to not the bottom chain.

Channels can and in my view ideally ought to keep open for a very long time (e.g., a 12 months or extra). If the nodes ever determine to shut down their channel, their newest steadiness after all of the off-chain funds is restored to their authentic wallets. That is cryptographically-secured by hashed timelocked contracts (HTLC) and digital signatures, which we gained’t get into element for the needs of this text.

This enables one to batch billions of funds into two on-chain transactions — one for opening the channel and one for closing it. As soon as a fee is full, it’s indeniable what the newest steadiness is between all events (assuming nodes redundantly retailer their channel checkpoints).

Critically, one needn’t be straight linked to a different social gathering so as to pay them — channels can be utilized by different nodes within the community so as to enhance their reachability. In different phrases, if Alice is linked to Bob and Bob is linked to Caroline, Alice and Caroline can seamlessly pay one another via Bob.

Lightning Scalability

As we’ll now show, the Lightning Community already scales to help 16,264 transactions a second at present and due to this fact solves the scalability drawback whereas preserving all the advantages Bitcoin has to supply — permissionlessness, shortage, person sovereignty, portability, verifiability, decentralization and censorship resistance.

For a fee to make its approach via the community, it sometimes has to undergo a number of fee channels. To reply what number of funds the community can do in a second, we have to perceive what number of a mean channel helps.

Statistics present that the typical fee goes via round three channels.

The benchmark numbers we’ll use for this evaluation have per-node throughput capability, not per-channel. Subsequently, we’ll inaccurately assume that every node has only one channel. The default LND node is claimed to have the ability to do 33 funds per second with an honest machine (8 vCPUs, 32 GB reminiscence) in keeping with the benchmark.

With 16,266 nodes within the community (as of November 2022), assuming every fee has to undergo three channels (4 nodes), the community ought to be capable of obtain round 134,194 funds per second.

That’s, every fee has to undergo a gaggle of 4 nodes, and there are 4,066 such distinctive teams within the community. Assuming every node can do 33 funds a second, we multiply 4,066 by 33 to succeed in 134,194.

Now, to be life like: Not each node is working a machine just like the one within the benchmark — many are merely working on a Raspberry Pi. Fortunately, it doesn’t take a lot to have the ability to beat the present fee methods.

Lightning Vs. Conventional Funds

Discovering genuine numbers concerning the peak capability of conventional fee methods is difficult, so we’ll depend on their common fee fee all through the 2021 monetary 12 months. We’ll evaluate that to the theoretical capability of Lightning, as a result of conversely, getting the typical fee of funds in Lightning is unimaginable attributable to its non-public nature, and can also be not revealing of functionality as a result of the demand for Lightning funds remains to be comparatively low. This comparability will give us an thought of what number of funds a Lighting node must be able to routing so as to out-compete conventional finance.

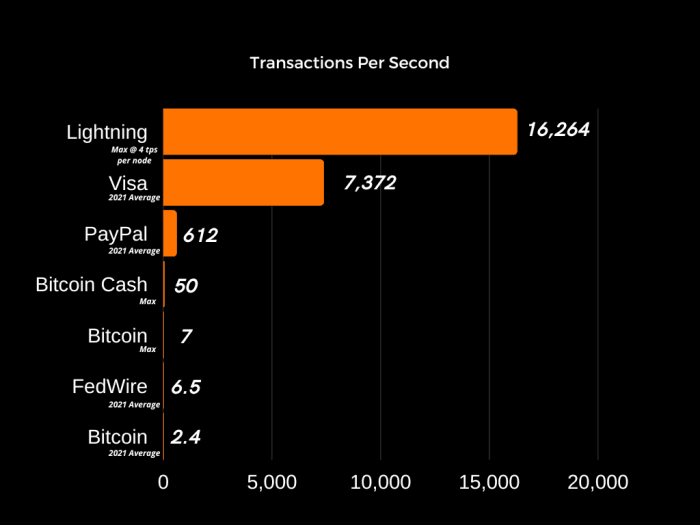

Visa noticed 165 billion funds in 2021, PayPal noticed 19.3 billion funds throughout its complete platform and FedWire noticed 204 million. Respectively, these quantity to 7,372, 612 and 6.5 funds per second on common for 2021. To place into perspective, Bitcoin did 2.44 funds per second in 2021 and scales as much as a most of seven per second.

The numbers are promising — it takes every Lightning node to be able to doing simply 4 funds a second so as to beat the present fee networks by at the least two instances. At that fee, 4,066 distinctive four-node teams can obtain 16,264 funds per second — 2.2 instances that of the biggest competitor, Visa.

To make issues worse for conventional fee networks, the typical Lightning transaction charge is 13 instances much less that of Visa — 0.1% in comparison with 1.29%.

It’s price remembering that one might all the time proceed to scale the Lightning Community by creating new nodes. Since it’s peer to see, its scalability is theoretically limitless so long as nodes within the community develop.

Additional, the aforementioned benchmark by Bottlepay makes the case that there are not any actual technical blockers for Lightning node implementations to ultimately attain 1,000 funds per second. At such a quantity, the community’s present throughput can be nearer to 4 million per second, to not point out what it could be with a rise within the variety of nodes.

And lastly, it’s price remembering that the Lightning Community remains to be very a lot immature software program and has a good quantity of future optimizations to be finished, each within the protocol and its implementations. Sources when it comes to builders are the one short-term constraint to growing scalability, which has rightfully come second to extra essential issues like reliability.

To provide a way of the progress there, River Monetary not too long ago shared that its fee success fee is 98.7% at a mean dimension of $46, which is astonishingly higher than the earliest publicly-available information it might discover from 2018, the place $5 transactions had been failing 48% of the time.

Conclusion

On this piece, we uncovered all the destructive drawbacks of scaling the Bitcoin blockchain via growing the bottom layer’s block dimension, most notably severely compromising its decentralization and in the end failing to attain its purpose of reaching the immense scalability wanted for the calls for a world funds community has and can proceed to more and more have sooner or later.

We confirmed that the Lightning Community, as a second-layer resolution, most elegantly solves the scalability drawback by each preserving all of Bitcoin’s advantages whereas on the similar time scaling it approach past what any base-layer options promise.

This can be a visitor publish by Stanislav Kozlovski. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.