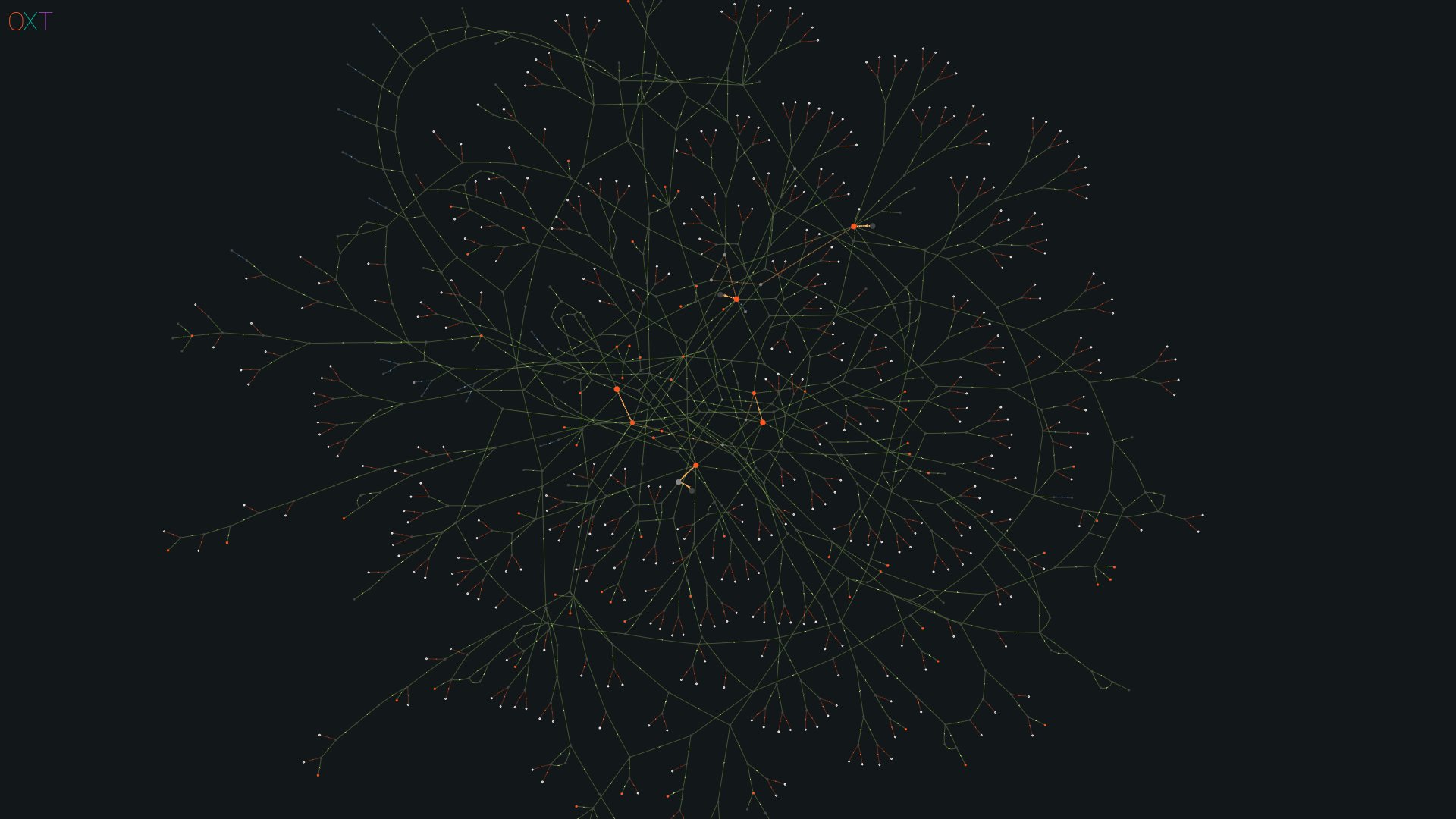

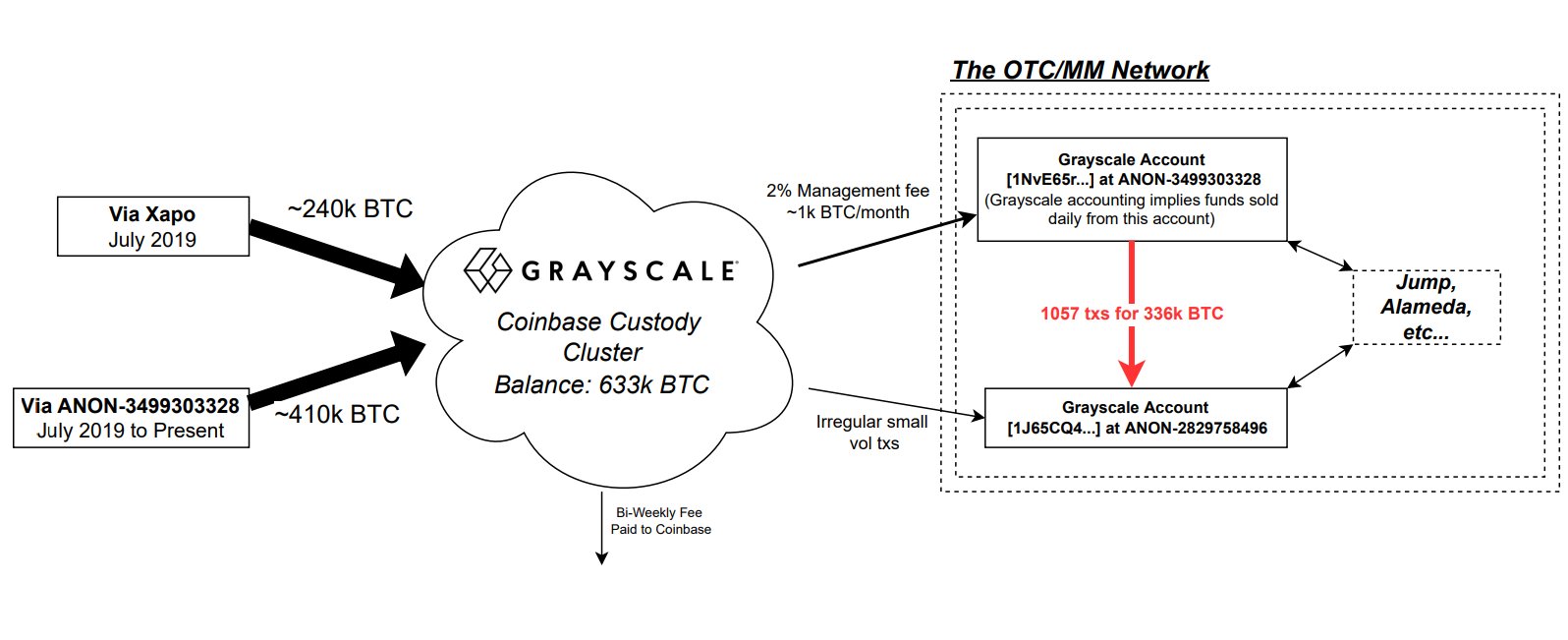

After Grayscale Investments shared info regarding the firm’s product holdings, folks questioned why the agency wouldn’t share the general public addresses related to the crypto property it holds. Nevertheless, on Nov. 23, OXT researcher Ergo revealed a Twitter thread that includes onchain forensics that verify Coinbase Custody holds a stability of 633K bitcoin that possible belongs to the Grayscale Bitcoin Belief (GBTC).

OXT Researcher Verifies Grayscale’s Bitcoin Holdings

5 days in the past, Bitcoin.com Information reported on Grayscale disclosing info tied to the security and safety of the corporate’s digital property. Grayscale’s statements had been meant to guarantee the general public that the corporate’s cryptocurrencies are “protected and safe” after the FTX collapse.

The digital asset fund supervisor detailed that the entire firm’s digital property are saved with Coinbase Custody Belief Firm. On the Grayscale web site, the agency says Coinbase Custody is a certified custodian beneath New York banking legal guidelines and the funds are saved in “chilly storage.”

The one factor Grayscale didn’t disclose is the corporate’s digital asset addresses and it did point out why it selected to not share the wallets. Grayscale defined that it has by no means publicly disclosed onchain addresses to most of the people “resulting from safety issues.” The declare was criticized and mocked, however Grayscale mentioned that it understood the non-disclosure could be “a disappointment to some.”

Regardless of Grayscale’s non-disclosure, the OXT researcher (oxt.me) Ergo defined that it began a community-led effort to create transparency round GBTC holdings. “Now we have taken steps to ID possible GBTC addresses and balances primarily based on public data and blockchain forensics,” Ergo said on Nov. 20.

Leveraging an article from Coindesk, heuristics, and publicly identified bitcoin addresses related to the custodian Xapo, that day, Ergo “attributed 432 addresses holding 317,705 BTC to possible GBTC custody exercise.”

The researcher found no less than 50% of the GBTC holdings and added: “extra work is important to ID the remaining addresses.” By 2:49 p.m. (ET) on Nov. 23, Ergo mentioned the extra work was completed in a Twitter thread known as: “The Grayscale G(BTC) Cash Half 2” Ergo tweeted:

On this evaluation, we use extra [onchain] forensics to CONFIRM the approximate 633K BTC stability held by G(BTC) at Coinbase Custody.

Ergo’s abstract notes that after discovering the primary 50% of bitcoins related to Grayscale’s BTC, the group needed to ‘scan the blockchain’ for added addresses becoming the profile of these present in Half 1.

Ergo additional leaves impartial analysts with info on the heuristics used and the bitcoin addresses compiled for the search. “Clearly no heuristic or set of heuristics are good, and this evaluation definitely contains false positives and negatives,” Ergo remarked. “However our result’s virtually an identical to the G(BTC) self-reported holdings.”

Within the Twitter thread, Ergo says that it doesn’t know why Grayscale determined to not share the corporate’s BTC addresses. Ergo mentioned the group initially thought Coinbase Custody could have a non-disclosure coverage. However after studying some info revealed by Coinbase, Ergo said “it appears clear that Coinbase Custody is keen to reveal addresses.”

A number of individuals complimented Ergo’s Twitter thread and evaluation of the GBTC cash. Moreover, the information follows Coinbase CEO Brian Armstrong explaining that as of Sept. 30, Coinbase holds 2 million bitcoin.

What do you consider Ergo’s onchain evaluation of GBTC’s bitcoin horde? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Ergo BTC, Grayscale emblem,

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss precipitated or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.