The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Powell’s Speech And Contracting ISM PMI

We wish to zoom out and revisit the broader macroeconomic image and analyze a few of the newest information that got here out this week, which is able to closely affect the market route over the subsequent few months.

After Jerome Powell’s Brooking Establishment speech, it’s clear that markets are chomping on the bit to maneuver greater with any attainable Federal Reserve narrative and pivot situation. There’s over hedging, quick squeezes, choices market dynamics and compelled shopping for. That is past our experience to say precisely why markets are exploding with volatility on any given information level or new Powell speech. Nonetheless, these kinds of occasions and market actions have practically at all times been an indication of unhealthy and heightened risky swings in bear markets. Regardless of extra discuss from Powell with nothing new actually stated, markets perceived the speech as extra “dovish” along with his commentary across the concern of overdoing fee hikes. But, if that is one other bear market rally taking form for the most important indices, we appear to be near that rally turning over but once more.

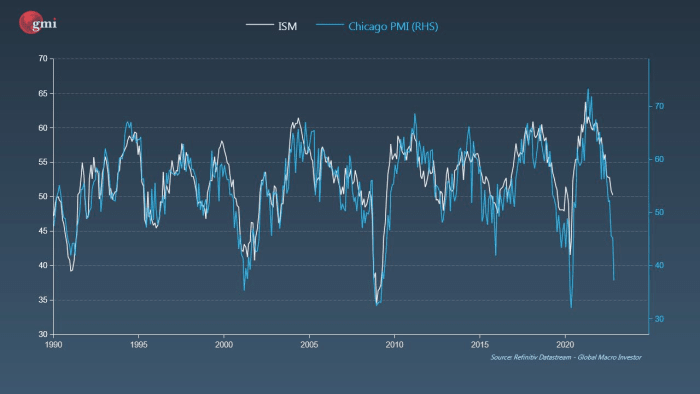

What can also be regarding and anticipated to proceed, is the development of financial contraction as advised by the information from the ISM manufacturing index (PMI). At the moment’s newest launch reveals a print of 49.0 beneath market expectations of 49.7. New orders are contracting, the backlog of orders are contracting and costs are reducing. By all measures and survey responses, these are the indicators of demand softening, situations worsening and the economic system shifting into extra cautious territory. The ISM PMI information extremely correlates to the much less impactful Chicago PMI information which simply printed contraction lows just like 2000, 2008 and 2020. That is the signal of an financial recession beginning within the manufacturing sector.

Supply: GMI, Julien Bittel

What does financial contraction imply for monetary markets? It’s usually dangerous information when there’s a sustained contraction development of ISM PMI beneath 50 and even beneath 40s taking part in out. It appears we’re within the early levels of a bigger contraction development taking part in out: The despair section of the market.

The precise query for the bitcoin and macro relationship is now: Was this industry-leverage wipeout and capitulation occasion sufficient promoting to mute the potential likelihood and results of an fairness bear market meltdown? Will bitcoin flatline and kind a backside if equities are to comply with related previous bear market drawdown paths?

We’ve nonetheless but to see an actual blowout in inventory market volatility which has at all times impacted bitcoin. It’s been a core a part of our thesis this yr that bitcoin will comply with conventional fairness markets to the draw back.

The magnitude of the long-duration debt in actual phrases was, and nonetheless is, the most important story right here.

Moreover, what does this imply going ahead for asset valuations?