The beneath is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

On-Chain Information Tendencies

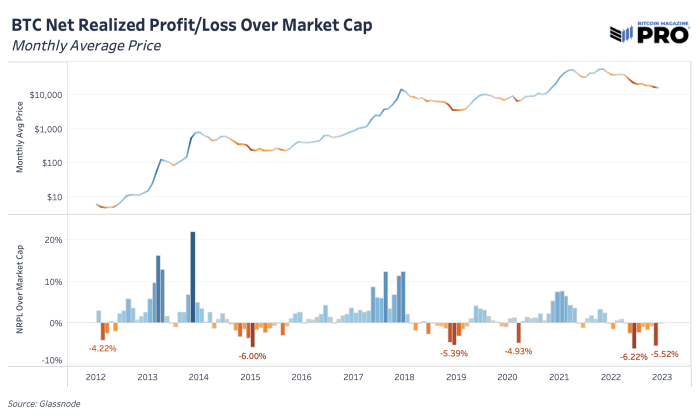

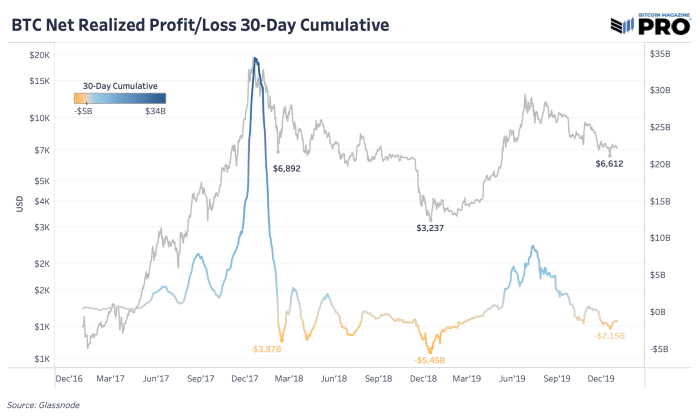

November was a painful month. By on-chain realized revenue and loss information, we will see that this was true for a lot of forced-sellers of bitcoin. Earlier than any bitcoin worth backside, an indicator signal that you just need to see is prolonged durations of pressured promoting, capitulation and rise in realized losses. One approach to view that is by wanting on the sum of realized revenue and loss for every month relative to bitcoin’s complete market cap. We noticed these backside indicators in November 2022, and equally within the July 2022 Terra/LUNA crash, March 2020 COVID concern and December 2018 cycle backside capitulation occasions.

Wanting on the 2018 cycle, the tip was marked by extra realized losses, though this was a lot completely different with the pressured liquidations and cascades of personal stability sheet leverage and paper bitcoin unwinding that we noticed this yr.

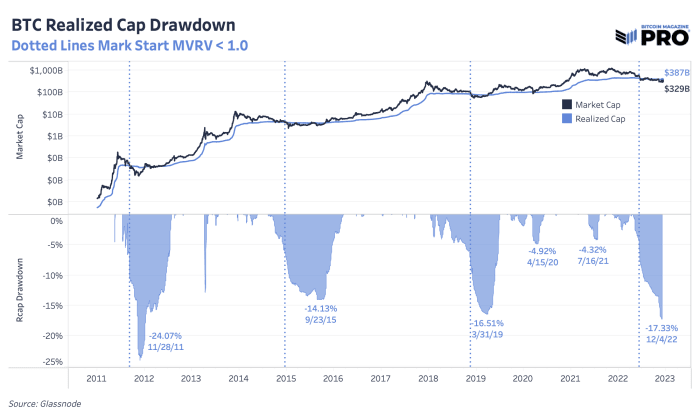

We’ve talked in regards to the present drawdown in bitcoin’s worth and the way that compares to earlier cycles many instances over the previous few months. One other manner to take a look at cyclical drawdowns is to concentrate on bitcoin’s realized market capitalization — the common value foundation of the community which tracks the most recent worth the place every UTXO moved final. With worth being extra risky, realized worth is a extra steady view of bitcoin’s progress and capital inflows. The realized market capitalization is now down 17.33% which is considerably increased than 2015 and 2018 cycles of 14.13% and 16.51%, respectively.

As for period, we’re 176 complete days into the value being beneath bitcoin’s realized worth. These aren’t consecutive days as worth can briefly go above realized worth, however worth traits beneath realized worth in bear market durations. For context, traits in 2018 had been short-lived at round 134 days and the traits in 2014-15 lasted 384 days.

On one hand, bitcoin’s realized market capitalization has taken a major hit within the earlier spherical of capitulation. That’s a promising bottom-like signal. However, there’s a case to be made that worth being beneath realized worth may simply final one other six months from historic cycles and the shortage of capitulation in fairness markets continues to be a significant headwind and concern.

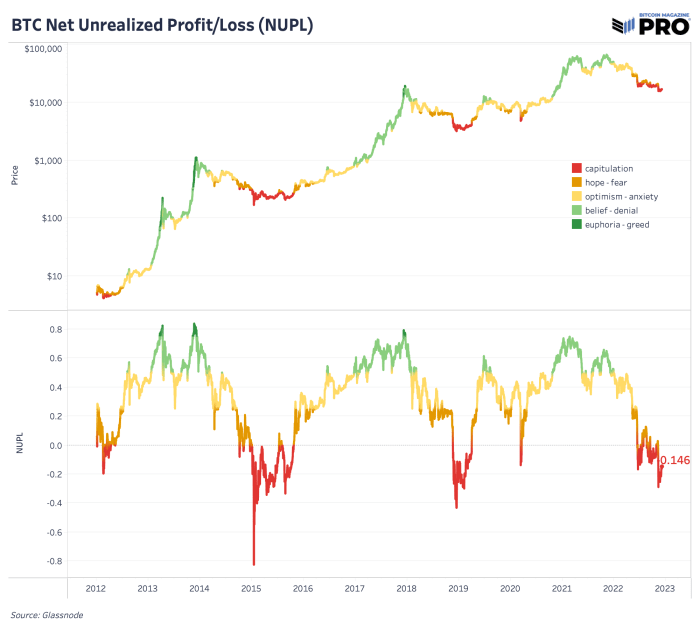

As per the net-unrealized-profit/loss (NUPL) ratio, we’re firmly within the capitulation part. NUPL will be calculated by subtracting the realized cap from market cap and dividing the outcome by the market cap, as described on this article authored by By Tuur Demeester, Tamás Blummer and Michiel Lescrauwaet.

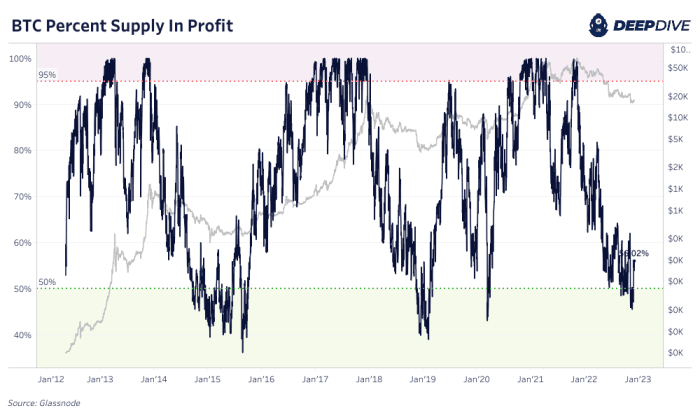

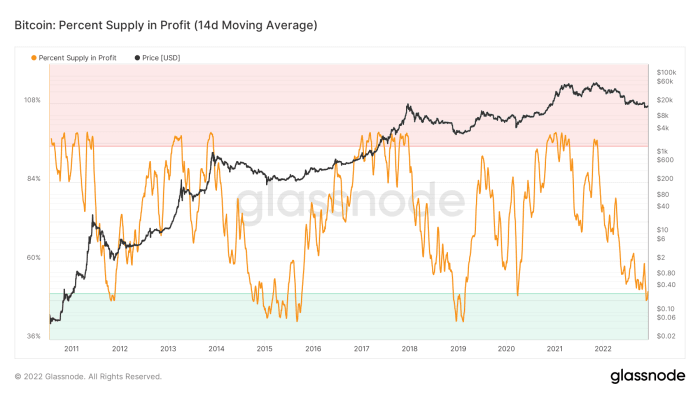

There is no such thing as a denying it: For bitcoin-native cycles, we’re firmly within the capitulation part. At present, solely 56% of circulating provide was final moved on-chain in revenue. On a two-week transferring common foundation, below 50% provide was final moved above the present trade fee, which is one thing that has solely ever occurred within the depths of earlier bear-market lows.

When pondering of the bitcoin trade fee, the numerator facet of the equation is traditionally low-cost. The Bitcoin community continues to supply a block roughly each 10 minutes in an unabated trend, as hash fee ticks increased and because the ledger gives an immutable settlement layer for international worth. The hypothesis, leverage and fraud of the earlier cycle is washing to shore and bitcoin continues to trade arms.

Bitcoin is objectively low-cost relative to its all time historical past and adoption phases. The actual query over the fast future is the denominator. We’ve talked at size in regards to the international liquidity cycle and its present monitor. Regardless of being traditionally low-cost, bitcoin isn’t proof against a sudden strengthening within the greenback as a result of nothing really is. Change charges are relative and if the greenback is squeezing increased, then every part else will subsequently fall — no less than momentarily. As at all times, place sizing and time choice is vital for all.

As for the catalyst for a surge increased within the greenback denominator of the bitcoin trade fee (BTC/USD), there are 80 trillion attainable catalysts…