The U.S. central financial institution’s Federal Open Market Committee (FOMC) convened on Wednesday and raised the federal funds price by 50 foundation factors (bps). The 0.5 share level rise follows the 4 consecutive three-quarters of some extent will increase codified throughout the previous couple of months. The FOMC’s price hike follows the current U.S. inflation report which indicated that shopper costs fell to 7.1%, which was decrease than expectations.

Fed Raises Federal Funds Charge by 50bps, Central Financial institution Expects Extra Will increase Going Ahead

Following the buyer value index (CPI) report printed on Tuesday, members of the U.S. Federal Reserve met on Wednesday and introduced a 50bps price hike. The December enhance is smaller than the final 4 three-quarters of some extent (75bps) price will increase.

“The committee seeks to attain most employment and inflation on the price of two p.c over the longer run,” the FOMC mentioned. “In help of those targets, the committee determined to lift the goal vary for the federal funds price to 4-1/4 to 4-1/2 p.c.” The Fed is projecting an extra 75bps hike within the federal funds price by the top of subsequent 12 months.

The information follows Tuesday’s CPI information that rose lower than anticipated as metrics present the inflation price in November was up 7.1% from a 12 months in the past. Core CPI jumped 0.2% on the month, the U.S. Bureau of Labor Statistics (BLS) famous. “During the last 12 months, the all objects index elevated 7.1 p.c earlier than seasonal adjustment,” the BLS CPI report particulars. The FOMC report notes that the Fed will proceed to observe “incoming data for the financial outlook.”

“As well as, the committee will proceed decreasing its holdings of Treasury securities and company debt and company mortgage-backed securities, as described within the Plans for Decreasing the Measurement of the Federal Reserve’s Steadiness Sheet that have been issued in Could,” the FOMC members disclosed. “The committee is strongly dedicated to returning inflation to its 2 p.c goal,” the FOMC added. After the speed hike and the financial institution signaled extra will increase might be enacted, fairness markets and treasured steel costs tumbled.

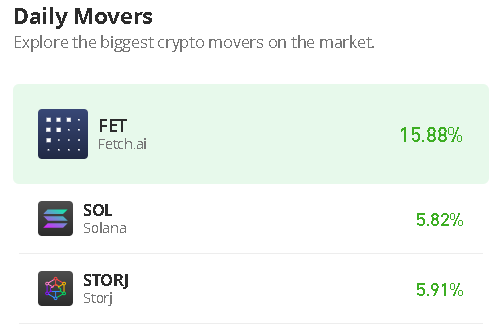

Crypto costs dropped too, and the worth of bitcoin (BTC) fell beneath the $18K zone after the FOMC assertion. The Fed has codified numerous price hikes this 12 months with one half share level leap and 4 three-quarters of some extent hikes, making it a grand complete of 5 federal funds price will increase in 2022.

On the finish of November, Federal Reserve chairman Jerome Powell hinted throughout a speech on the Brookings Establishment in Washington that easing up on the speed hikes very properly may occur in December. Powell has confronted political stress in regard to the speed hikes and Tesla’s Elon Musk has warned in opposition to the aggressive hikes in current instances.

“We have now extra work to do,” Powell instructed reporters on Wednesday afternoon, and he additional famous that “inflation dangers are to the upside.”

What do you concentrate on the Federal Reserve’s price hike on Wednesday? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.